The Hawaii Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment is a legally binding document that outlines the process of terminating a partnership in the state of Hawaii. This agreement sets forth the terms and conditions by which partners agree to dissolve their partnership, settle any remaining obligations, and determine the distribution of assets and liabilities. Partnerships may decide to dissolve for various reasons, such as retirement, disagreement among partners, or the fulfillment of the partnership's objectives. However, to ensure a smooth and fair dissolution, it is crucial to have a comprehensive agreement in place. The Hawaii Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment serves this purpose, offering clear guidelines and protection for all parties involved. There are several types of Hawaii Agreements to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment, depending on the specific circumstances and desired outcomes. These may include: 1. Termination by Mutual Agreement: This type of agreement is reached when all partners unanimously agree to dissolve the partnership. The agreement will outline the steps involved in winding up the partnership affairs, settling debts, and distributing assets. 2. Dissolution due to Retirement: If one or more partners wish to retire from the partnership, a specific agreement tailored to retirement may be necessary. This agreement will stipulate the method of payment for the retiring partner's share of the partnership assets and liabilities. 3. Dissolution due to Dispute or Unresolved Issues: In cases where partners cannot agree on major decisions or face unresolved conflicts within the partnership, a dissolution agreement can provide a structured framework for the fair division of assets and liabilities. 4. Dissolution upon Completion of Specific Objectives: If a partnership was formed for a specific purpose or project and its objectives have been achieved, a dissolution agreement can be crafted to wind up the partnership and allocate remaining resources efficiently. The Hawaii Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment typically includes essential clauses, such as: 1. Effective Date: Specifies the date when the dissolution agreement becomes effective. 2. Partnership Assets and Liabilities: Outlines the process of identifying and valuing assets and liabilities of the partnership. 3. Settlement: Describes the terms and conditions for settling any outstanding debts, financial obligations, and legal claims against the partnership. 4. Distribution of Assets: States the agreed-upon method for distributing the remaining assets among the partners, including any lump sum payments involved. 5. Tax Obligations: Addresses the tax implications of the partnership dissolution, ensuring that each partner assumes responsibility for their share of tax liabilities. 6. Confidentiality and Non-Compete: May include provisions to protect the partners' confidential information and restrict them from engaging in competing activities after the dissolution. The Hawaii Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment is a critical legal document that provides a framework for the fair and amicable dissolution of partnerships in Hawaii. By outlining the process, settling all financial matters, and ensuring proper asset distribution, this agreement helps partners move forward and transition into new ventures smoothly.

Hawaii Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment

Description

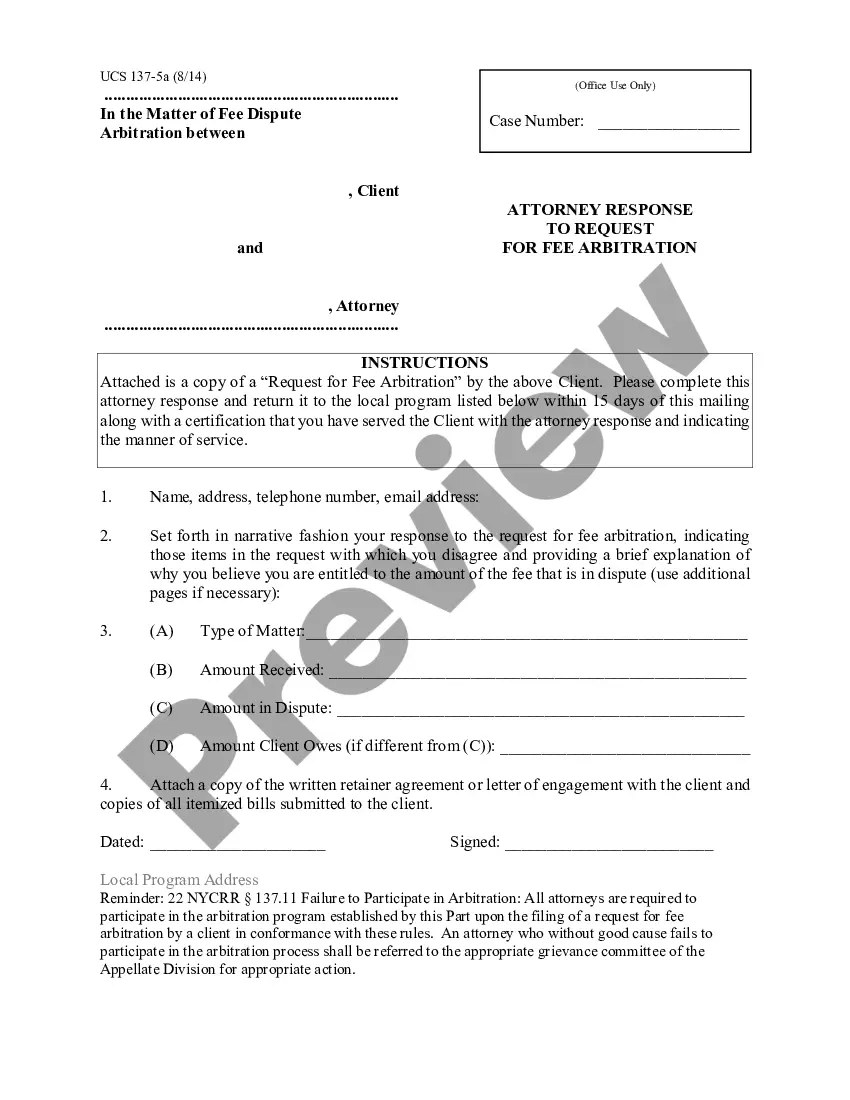

How to fill out Hawaii Agreement To Dissolve And Wind Up Partnership With Settlement And Lump Sum Payment?

Are you currently in a situation that you need paperwork for either organization or personal uses almost every time? There are a variety of legitimate file layouts available on the Internet, but locating types you can trust isn`t straightforward. US Legal Forms gives a huge number of type layouts, like the Hawaii Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment, that happen to be written to fulfill state and federal demands.

In case you are presently knowledgeable about US Legal Forms web site and possess an account, just log in. Next, you are able to download the Hawaii Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment web template.

If you do not offer an bank account and need to begin using US Legal Forms, abide by these steps:

- Obtain the type you want and ensure it is for that proper area/county.

- Utilize the Preview key to analyze the shape.

- Look at the outline to ensure that you have selected the appropriate type.

- In case the type isn`t what you`re looking for, use the Look for area to obtain the type that meets your requirements and demands.

- When you find the proper type, simply click Acquire now.

- Pick the rates plan you need, fill out the necessary information and facts to create your bank account, and pay for the transaction utilizing your PayPal or credit card.

- Decide on a handy data file format and download your copy.

Get every one of the file layouts you have bought in the My Forms food list. You can aquire a extra copy of Hawaii Agreement to Dissolve and Wind up Partnership with Settlement and Lump Sum Payment at any time, if possible. Just click on the necessary type to download or produce the file web template.

Use US Legal Forms, one of the most extensive variety of legitimate forms, to save time and stay away from blunders. The services gives professionally made legitimate file layouts that you can use for a range of uses. Produce an account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

The distribution of payments of the Company in the process of winding-up shall be made in the following order: (i) All known debts and liabilities of the Company, excluding debts and liabilities to Members who are creditors of the Company; (ii) All known debts and liabilities of the Company owed to Members who are

Generally, however, the liquidators of a partnership pay non-partner creditors first, followed by partners who are also creditors of the partnership. If any assets remain after satisfying these obligations, then partners who have contributed capital to the partnership are entitled to their capital contributions.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

Generally, however, the liquidators of a partnership pay non-partner creditors first, followed by partners who are also creditors of the partnership. If any assets remain after satisfying these obligations, then partners who have contributed capital to the partnership are entitled to their capital contributions.

Debt to parties, account of capital of each partner, advances given by partners, residue to be divided amongst partners in profit sharing ratio.