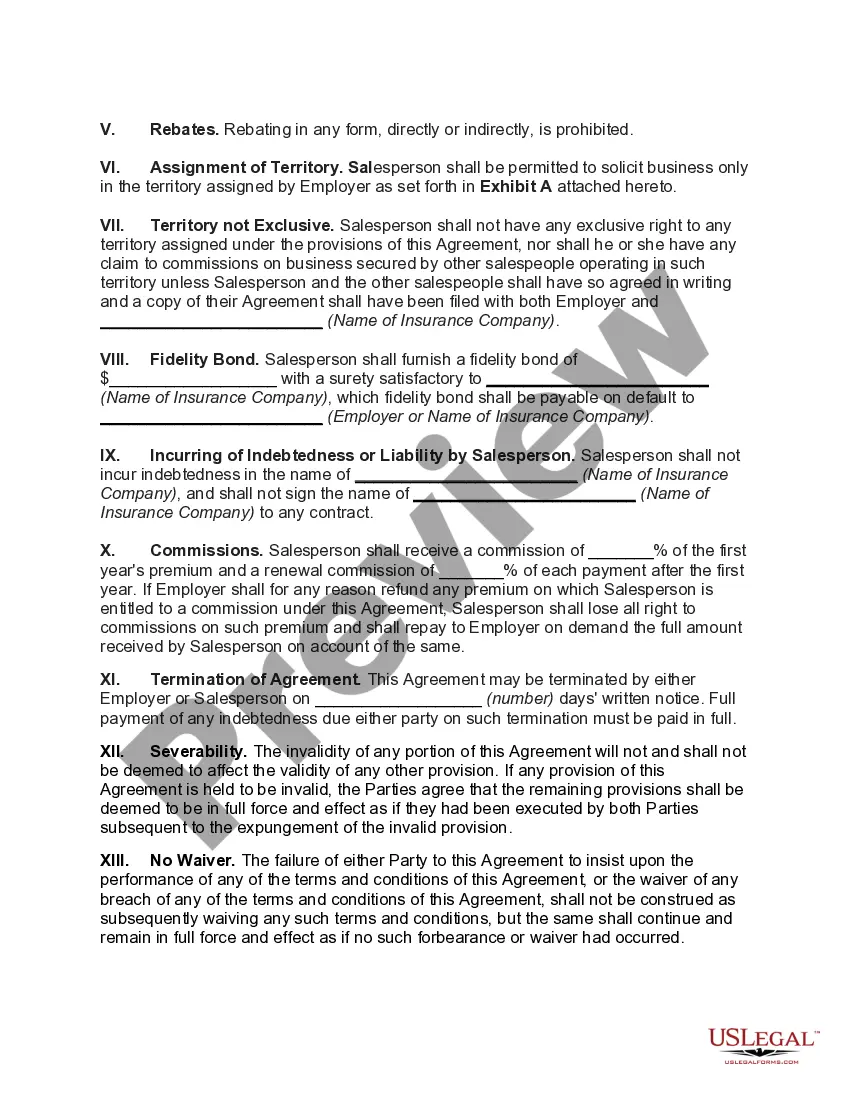

Description: A Hawaii Employment Agreement between a General Agent and a Salesperson, specifically for the Sale of Insurance, is a legally binding contract that outlines the terms and conditions of employment between the employer and the employee. This agreement establishes clear guidelines and obligations for both parties involved in the insurance industry. Keywords: Hawaii Employment Agreement, General Agent, Salesperson, Insurance, Terms and Conditions, Obligations, Guidelines, Employer, Employee. There are different types of Hawaii Employment Agreements between a General Agent and a Salesperson in the Sale of Insurance, which may include: 1. Commission-Based Agreement: This type of agreement typically compensates the salesperson based on a percentage of the insurance premiums sold. The terms and conditions regarding commission rates, commission structure, and payment terms will be clearly defined in this agreement. 2. Non-Compete Agreement: This agreement may be added to protect the interests of the insurance agency. It restricts the salesperson from working for a competing insurance company or agency during and after the employment term. This helps ensure the general agent's client base remains exclusive and prevents the salesperson from accessing or sharing sensitive information with competitors. 3. Exclusive Agency Agreement: In an exclusive agency agreement, the salesperson is given the exclusive rights to sell the general agent's insurance products within a specific territory. This type of agreement guarantees a certain level of commitment from both parties, and the salesperson may be required to meet specific sales targets or performance expectations. 4. Independent Contractor Agreement: Although not an employment agreement in the traditional sense, this type of agreement is commonly used in the insurance industry. It establishes a relationship between the general agent and salesperson as independent contractors, outlining the terms of collaboration and compensation structure, with the salesperson being responsible for their taxes and benefits. 5. Training Agreement: This agreement outlines the training provided by the general agent to the salesperson. It specifies the type and duration of training, any associated costs, and expectations for the salesperson to successfully complete the training program. This agreement helps ensure the salesperson is well-equipped and knowledgeable about the insurance products they will be selling. In conclusion, a Hawaii Employment Agreement between a General Agent and a Salesperson in the Sale of Insurance is a crucial tool to establish a clear understanding of the employment relationship. Different types of agreements may exist to address specific aspects, such as compensation, competition, exclusivity, contractor status, or training. It is essential for both the employer and employee to carefully review and understand the terms and conditions outlined in the agreement before signing it.

Hawaii Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance

Description

How to fill out Hawaii Employment Agreement Between General Agent As Employer And Salesperson - Sale Of Insurance?

US Legal Forms - one of many most significant libraries of legal forms in America - gives a wide array of legal papers themes you can obtain or print. While using website, you may get a huge number of forms for company and specific purposes, categorized by types, states, or keywords and phrases.You can find the latest versions of forms just like the Hawaii Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance within minutes.

If you have a monthly subscription, log in and obtain Hawaii Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance from your US Legal Forms library. The Down load option can look on each develop you perspective. You get access to all previously acquired forms from the My Forms tab of the account.

If you want to use US Legal Forms for the first time, listed below are simple directions to get you started:

- Ensure you have picked out the best develop for the city/county. Click the Review option to analyze the form`s content. Look at the develop description to actually have chosen the correct develop.

- If the develop doesn`t match your needs, utilize the Research area near the top of the display to find the one who does.

- If you are satisfied with the form, verify your option by simply clicking the Buy now option. Then, pick the costs plan you prefer and supply your qualifications to sign up for the account.

- Approach the financial transaction. Make use of your charge card or PayPal account to complete the financial transaction.

- Select the structure and obtain the form in your system.

- Make adjustments. Load, edit and print and signal the acquired Hawaii Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance.

Every single format you included in your money lacks an expiry day and is also the one you have permanently. So, if you wish to obtain or print an additional backup, just visit the My Forms area and click around the develop you need.

Gain access to the Hawaii Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance with US Legal Forms, probably the most comprehensive library of legal papers themes. Use a huge number of skilled and state-particular themes that satisfy your organization or specific requirements and needs.