Hawaii Private Trust Company (PTC) is a special type of trust company that is established in the state of Hawaii. A private trust company is a legal entity that is formed specifically to provide trust services, managing and administering assets placed in trusts for beneficiaries. These companies are typically set up by individuals, families, or business owners who wish to have more control and flexibility over their wealth management and estate planning. Hawaii Private Trust Companies offer several advantages, including the ability to customize and tailor trust services to meet the specific needs of the granter and beneficiaries. These companies act as fiduciaries, managing assets, making investment decisions, and distributing income or principal according to the terms and objectives set forth in the trust agreements. The Hawaii Department of Commerce and Consumer Affairs regulates the establishment and operation of private trust companies in Hawaii. To establish an PTC, one needs to meet certain criteria such as maintaining a physical presence in Hawaii, having at least one qualified trustee, and meeting minimum capitalization requirements. There are different types of Hawaii Private Trust Companies available to individuals, families, and business entities. These include: 1. Single-Family Private Trust Company: This type of PTC is established by a single family to manage and administer their wealth and assets. It enables families to have more control over their estate and ensure smooth wealth transfer from one generation to the next. 2. Multi-Family Private Trust Company: This variant of PTC is formed by multiple families pooling their resources to create a shared trust administration structure. It allows these families to achieve economies of scale and cost efficiencies while maintaining their individual identities. 3. Corporate Private Trust Company: This type of PTC is established by a business entity, such as a corporation or limited liability company (LLC), to manage and administer assets held in trusts for business purposes. It allows businesses to separate their strategic assets from operational assets, ensuring efficient management and protection of wealth. In conclusion, Hawaii Private Trust Companies provide specialized trust services, offering individuals, families, and businesses the opportunity to have more control over their assets and estate planning. Whether it is a single-family, multi-family, or corporate private trust company, these entities offer customized wealth management solutions to meet the unique needs of their clients.

Hawaii Private Trust Company

Description

How to fill out Hawaii Private Trust Company?

Are you in the placement where you need to have papers for either business or individual purposes almost every day time? There are a lot of authorized papers web templates available on the Internet, but discovering versions you can rely on is not easy. US Legal Forms gives a huge number of type web templates, like the Hawaii Private Trust Company, which can be published in order to meet state and federal requirements.

In case you are presently knowledgeable about US Legal Forms web site and have your account, basically log in. Following that, you may download the Hawaii Private Trust Company web template.

If you do not have an profile and want to start using US Legal Forms, adopt these measures:

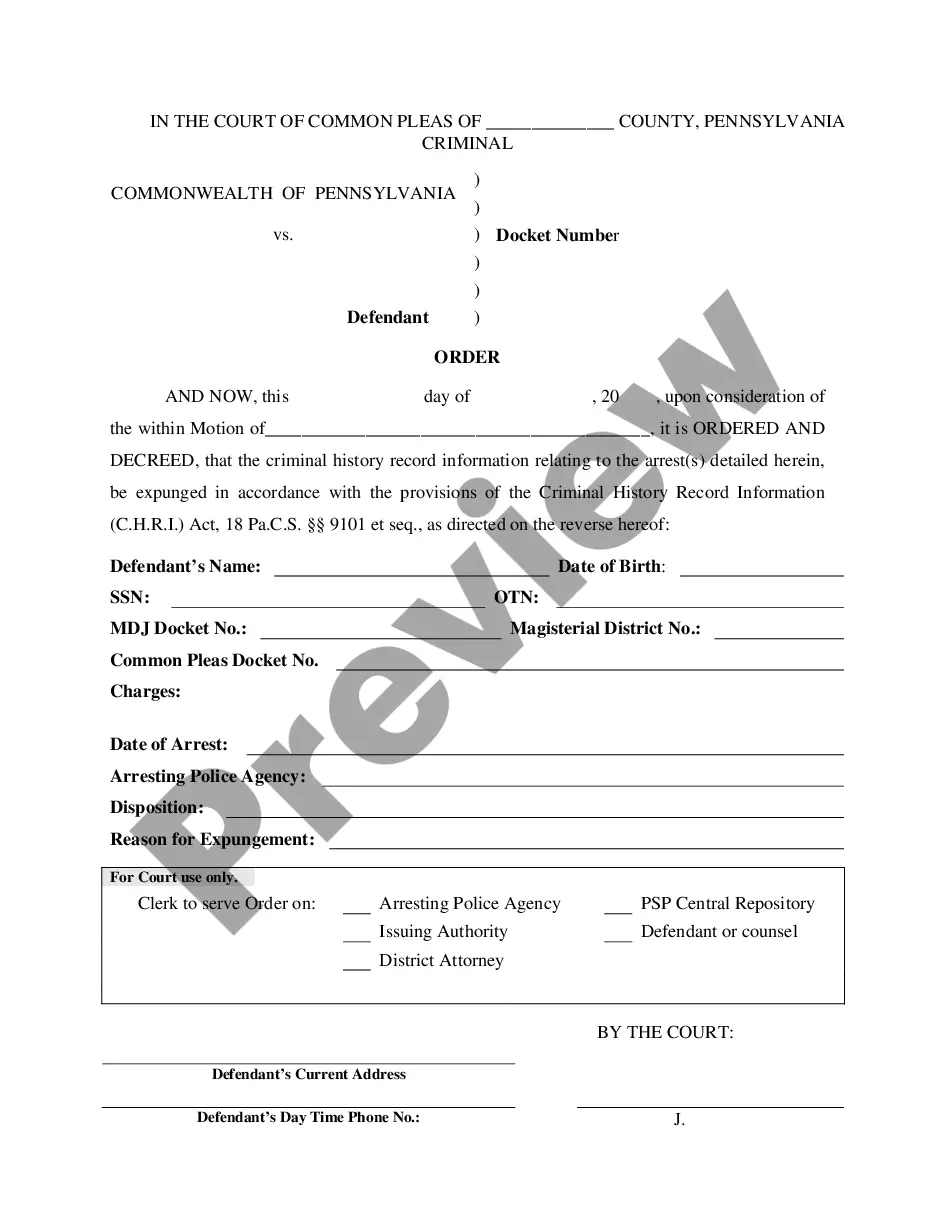

- Find the type you want and ensure it is for the appropriate area/county.

- Make use of the Preview key to examine the form.

- See the outline to actually have chosen the right type.

- In the event the type is not what you`re looking for, make use of the Search discipline to get the type that fits your needs and requirements.

- Once you find the appropriate type, just click Purchase now.

- Choose the costs prepare you want, submit the specified information to make your money, and pay money for the transaction using your PayPal or charge card.

- Select a convenient file formatting and download your duplicate.

Discover all of the papers web templates you possess purchased in the My Forms menu. You may get a further duplicate of Hawaii Private Trust Company anytime, if needed. Just click the necessary type to download or print the papers web template.

Use US Legal Forms, the most extensive selection of authorized forms, to save lots of some time and steer clear of blunders. The services gives professionally manufactured authorized papers web templates which you can use for an array of purposes. Make your account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

For now, note that the top states for perpetual trusts are Alaska, Delaware, Nevada, and South Dakota. These states all allow perpetual trusts and don't assess state income taxes on these trusts....Which States Allow Perpetual Trusts?Alaska.Delaware.District of Columbia.Hawaii.Idaho.Illinois.Kentucky.Maine.More items...

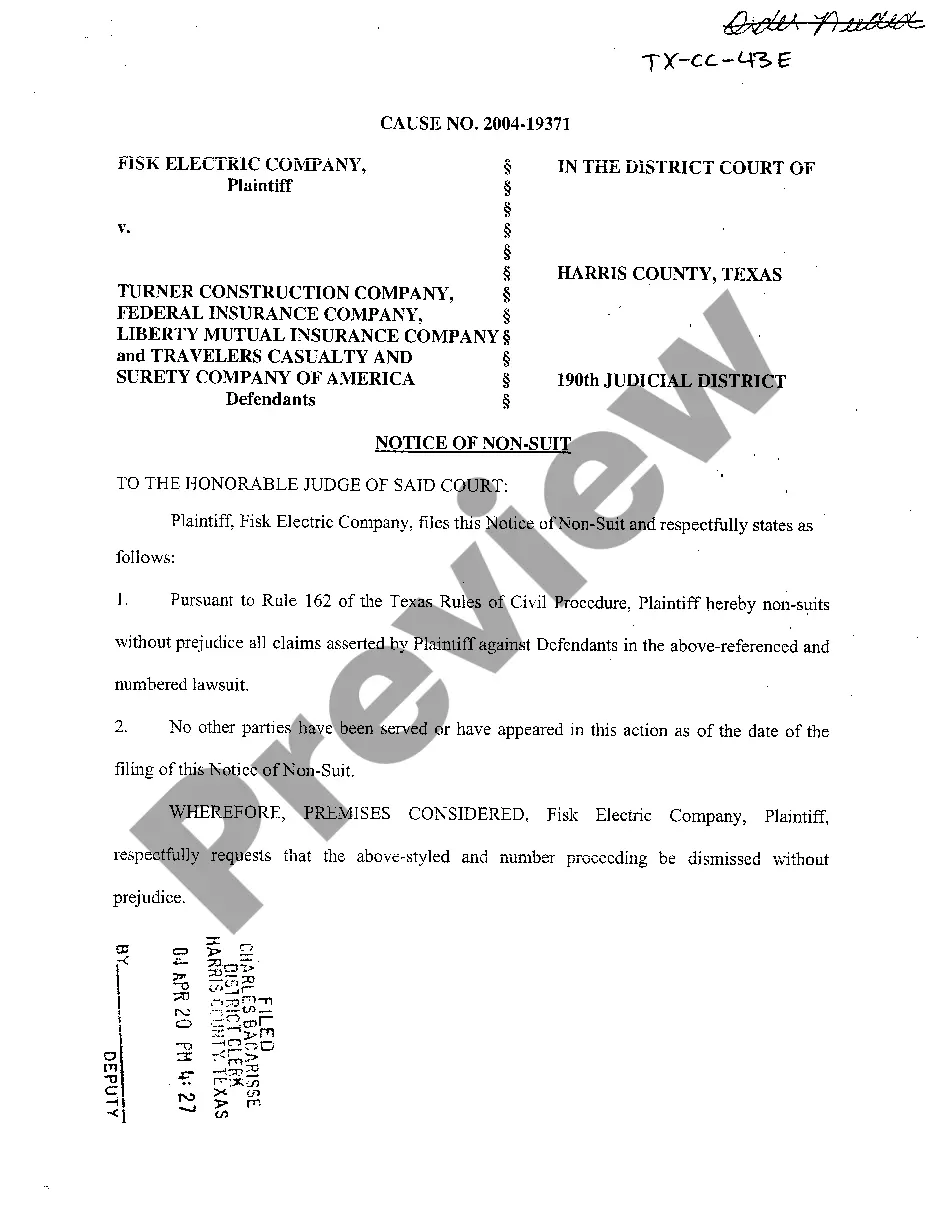

States that recognize regulated private trust companies include:Alabama.Colorado.Delaware.Massachusetts.Nevada.New Hampshire.Pennsylvania.South Dakota.More items...

Private Trust Companies (PTCs) are established with the sole purpose of acting as corporate trustee to a trust or a number of trusts, created by a settlor or individuals connected to the settlor described in the trust instrument creating the private trust.

Some of the larger trust companies are Northern Trust, Bessemer Trust, and U.S. Trust, which is now part of Bank of America Corporation. These trusts generally charge their fees based on a percentage of assets, ranging from 0.25% to 2.0%, depending on the size of the trust.

A Private Trust Company (PTC) is often created to be the trustee of one or more (typically) family trusts, but is not run as a commercial trust company. PTCs are popular with ultra-high net worth families who want to retain significant control over trustee decision-making.

Private trust companies are designed to preserve ownership of family wealth, which may include business assets, real estate, alternative assets such as hedge funds or private equity. These assets are managed by the trustee in accordance with the wishes of the family.

Simply put, a trust company is a corporation authorized to act as trustee or in other fiduciary capacities. It is somewhat of a historical accident that corporate trustees are regulated as banking institutions, but a trust company does not necessarily have to be a "bank" in the normal sense of the term.

According to independent rankings, the top states with the best trust laws are South Dakota trust law and Nevada in the US.

Plus, because trusts are private arrangements, they're a great way to plan the future ownership of any family business interests while keeping your financial affairs under wraps.

Because trust companies are subject to regulation substantially similar to that applicable to banks, they enjoy many of the same exemptions from securities and other laws.