A Hawaii revocable letter of credit is a financial instrument commonly used in international trade transactions, providing a secure method of payment between the buyer and seller. This letter of credit guarantees the buyer's payment obligations and assures the seller that they will receive the agreed-upon funds. Hawaii, being a prominent global trade hub and a popular tourist destination, has its own specific regulations and requirements for revocable letters of credit. These letters of credit can be categorized into different types, depending on their specific attributes and functions. Below are some key types of Hawaii revocable letters of credit: 1. Commercial Revocable Letter of Credit: This type of letter of credit is commonly used in regular commercial transactions. It ensures that the seller will receive payment upon complying with the terms and conditions set forth in the letter of credit. The buyer and seller may negotiate the terms before the letter of credit is issued. 2. Standby Revocable Letter of Credit: A standby letter of credit serves as a backup measure in case the buyer is unable to fulfill their payment obligations. It typically acts as a safety net for the seller, guaranteeing payment if the buyer fails to make the required payments on time or defaults on their obligations. 3. Revolving Revocable Letter of Credit: In certain cases, a buyer may have an ongoing or recurring need to initiate multiple transactions with the same seller. A revolving letter of credit allows a specified amount to be reinstated once it has been utilized, providing the buyer with flexibility in their purchasing activities and ensuring continued payment security for the seller. 4. Confirmed Revocable Letter of Credit: In this type of letter of credit, a second bank, known as the confirming bank, adds its payment guarantee to the letter of credit. The confirming bank's involvement further strengthens the seller's confidence in receiving payment, as they have an additional party to seek payment from in case the issuing bank fails to fulfill its obligations. When dealing with a Hawaii revocable letter of credit, it is important for both buyers and sellers to familiarize themselves with the specific provisions, terms, and conditions outlined in the letter. Additionally, adherence to the regulations set forth by government authorities, financial institutions, and international trade practices is crucial to ensuring a smooth and successful trade transaction.

Hawaii Revocable Letter of Credit

Description

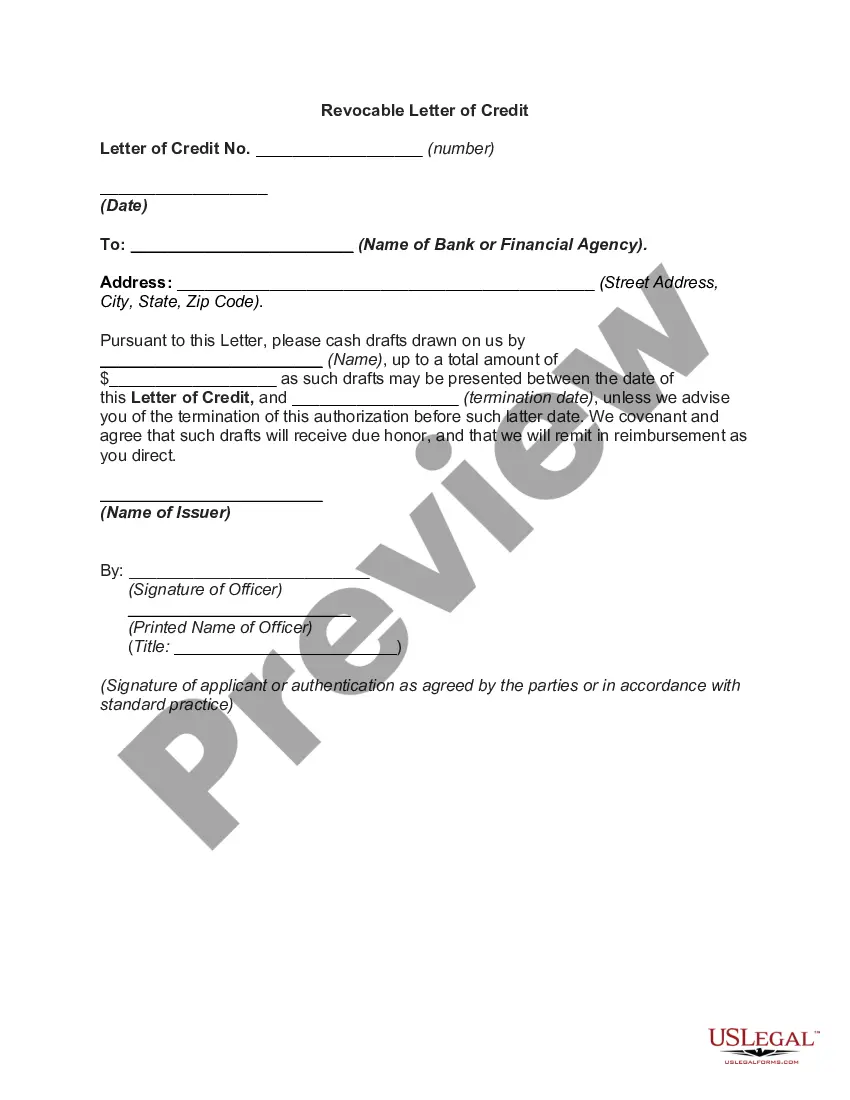

How to fill out Hawaii Revocable Letter Of Credit?

Have you been in the place that you will need documents for both enterprise or specific purposes virtually every day time? There are tons of authorized file web templates accessible on the Internet, but discovering ones you can rely is not easy. US Legal Forms offers a large number of develop web templates, like the Hawaii Revocable Letter of Credit, which can be written to satisfy federal and state requirements.

If you are currently knowledgeable about US Legal Forms web site and get an account, simply log in. Following that, you may down load the Hawaii Revocable Letter of Credit design.

Unless you come with an accounts and need to begin to use US Legal Forms, follow these steps:

- Discover the develop you require and ensure it is for the right town/state.

- Use the Review button to review the shape.

- Browse the information to actually have selected the right develop.

- In case the develop is not what you`re looking for, take advantage of the Look for discipline to obtain the develop that suits you and requirements.

- Whenever you find the right develop, click on Get now.

- Select the prices plan you want, complete the desired info to generate your bank account, and buy the transaction utilizing your PayPal or credit card.

- Select a convenient document structure and down load your version.

Discover each of the file web templates you possess purchased in the My Forms food selection. You can aquire a further version of Hawaii Revocable Letter of Credit anytime, if required. Just click on the needed develop to down load or printing the file design.

Use US Legal Forms, the most comprehensive assortment of authorized forms, to save lots of time as well as prevent errors. The service offers expertly made authorized file web templates that can be used for a variety of purposes. Make an account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

The types of letters of credit include a commercial letter of credit, a revolving letter of credit, a traveler's letter of credit, and a confirmed letter of credit.

Main types of LC Irrevocable LC. This LC cannot be cancelled or modified without consent of the beneficiary (Seller). ... Revocable LC. ... Stand-by LC. ... Confirmed LC. ... Unconfirmed LC. ... Transferable LC. ... Back-to-Back LC. ... Payment at Sight LC.

An Irrevocable Letter of Credit is one which cannot be cancelled or amended without the consent of all parties concerned. A Revolving Letter of Credit is one where, under terms and conditions thereof, the amount is renewed or reinstated without specific amendments to the credit being needed.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

A letter of credit may be irrevocable, which means that it cannot be changed unless both parties agree. Alternatively, it can be revocable, in which case either party may unilaterally make changes. A revocable letter of credit is inadvisable because it carries many risks for the exporter.

Current letter of credit rules, UCP 600, do not cover revocable letters of credit. This point is made clear in article 3 of UCP 600: A credit is irrevocable even if there is no indication to that effect.

A revocable LC is a credit, the terms and conditions of which can be amended/ cancelled by the Issuing Bank. This cancellation can be done without prior notice to the beneficiaries. An irrevocable credit is a credit, the terms and conditions of which can neither be amended nor cancelled.

An irrevocable letter of credit cannot be canceled, nor in any way modified, except with the explicit agreement of all parties involved: the buyer, the seller, and the issuing bank. For example, the issuing bank does not have the authority by itself to change any of the terms of an ILOC once it is issued.

A Letter of Credit is an arrangement whereby Bank acting at the request of a customer (Importer / Buyer), undertakes to pay for the goods / services, to a third party (Exporter / Beneficiary) by a given date, on documents being presented in compliance with the conditions laid down.