A Hawaii Self-Employed Independent Contractor Consulting Agreement is a comprehensive legal document that establishes the terms and conditions between a self-employed independent contractor and a client for consulting services in the state of Hawaii. This agreement outlines the rights, responsibilities, and obligations of both parties to ensure a fair and mutually beneficial business relationship. Keywords: Hawaii, self-employed, independent contractor, consulting agreement, detailed There are several types of Hawaii Self-Employed Independent Contractor Consulting Agreements, each tailored to specific consulting services. Here are a few examples: 1. Professional Consulting Agreement: This type of agreement is commonly used for consulting services provided by professionals such as lawyers, engineers, accountants, or IT experts. It outlines the scope of work, payment terms, non-disclosure clauses, intellectual property rights, and termination procedures. 2. Marketing Consulting Agreement: Specifically designed for marketing consultants, this agreement details the services to be rendered, including market research, strategy development, branding, advertising, and social media management. It addresses compensation arrangements, deadlines, confidentiality, and any specific deliverables. 3. Financial Consulting Agreement: Catering to financial advisors or consultants, this agreement focuses on financial analysis, investment planning, tax advice, and accounting services. It covers fee structures, responsibilities, conflict of interest, and confidentiality related to financial data. 4. Technology Consulting Agreement: Geared towards IT consultants or technology experts, this agreement centers around software development, systems integration, cybersecurity, data management, and infrastructure consulting. It addresses milestones, payment schedules, ownership of intellectual property, and confidentiality of sensitive information. 5. Human Resources Consulting Agreement: This type of agreement is customized for HR consultants assisting businesses with employee hiring, training and development, employee relations, and compliance with labor laws. It outlines project scope, compensation terms, deliverables, and confidentiality of personnel information. In conclusion, a Hawaii Self-Employed Independent Contractor Consulting Agreement is a detailed legal contract that clarifies the terms and conditions of a business relationship between a self-employed independent contractor and a client for consulting services. The type of agreement may vary based on the specific consulting field, such as professional, marketing, financial, technology, or human resources consulting.

Hawaii Self-Employed Independent Contractor Consulting Agreement - Detailed

Description

How to fill out Hawaii Self-Employed Independent Contractor Consulting Agreement - Detailed?

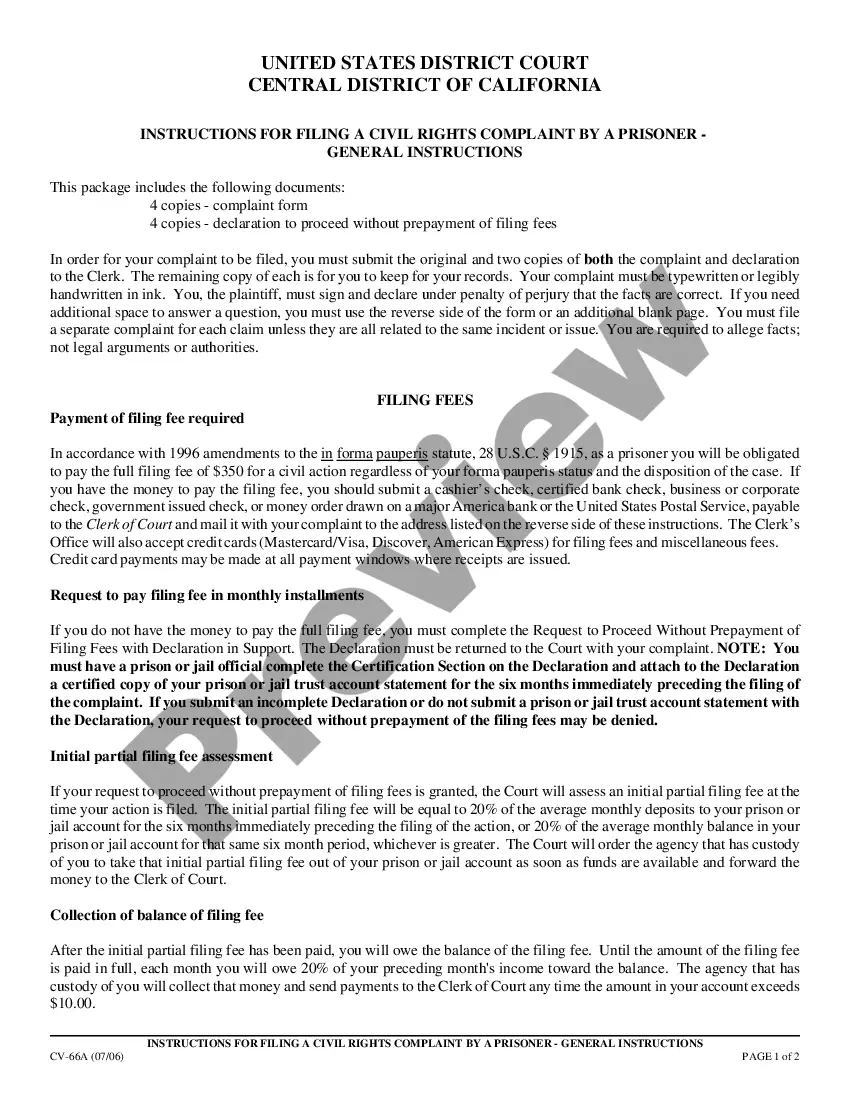

Are you presently inside a place where you need paperwork for both organization or person purposes nearly every working day? There are a lot of legal papers themes available online, but locating kinds you can rely on is not effortless. US Legal Forms gives thousands of type themes, such as the Hawaii Self-Employed Independent Contractor Consulting Agreement - Detailed, that happen to be created to satisfy federal and state specifications.

In case you are already knowledgeable about US Legal Forms internet site and have a merchant account, basically log in. After that, you can down load the Hawaii Self-Employed Independent Contractor Consulting Agreement - Detailed format.

If you do not offer an accounts and want to begin to use US Legal Forms, follow these steps:

- Obtain the type you require and make sure it is for your right city/region.

- Make use of the Preview option to analyze the shape.

- Browse the explanation to actually have selected the right type.

- When the type is not what you`re looking for, use the Lookup discipline to get the type that suits you and specifications.

- Whenever you get the right type, click Purchase now.

- Choose the rates strategy you desire, submit the desired information and facts to generate your bank account, and buy the order making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free file format and down load your copy.

Locate every one of the papers themes you may have purchased in the My Forms menus. You can obtain a extra copy of Hawaii Self-Employed Independent Contractor Consulting Agreement - Detailed at any time, if possible. Just click the necessary type to down load or print the papers format.

Use US Legal Forms, by far the most considerable variety of legal kinds, to save lots of efforts and prevent mistakes. The service gives professionally produced legal papers themes which you can use for a range of purposes. Produce a merchant account on US Legal Forms and initiate making your life a little easier.

Form popularity

FAQ

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

An independent contractor agreement between an individual independent contractor (a self-employed individual) and a client company for consulting or other services. This Standard Document is drafted in favor of the client company and is based on federal law.

Your consulting agreement should include:the commercial details of the specific project, including exactly what services you will provide;a clause outlining when and how much you should be paid;how you and your client will deal with pre-existing and new intellectual property;a dispute resolution process; and.More items...?

Here is the full list of the components to include in the document:Names of the parties involved.List of all the services the consultant will provide.List of the client's required contributions.Payment and compensation details.Deadlines and timeline details.Details about contract termination.More items...