Hawaii Purchasing Cost Estimate is a detailed analysis that helps individuals, businesses, or organizations gauge the potential expenses involved in purchasing real estate or various goods and services in Hawaii. This estimation is crucial for making informed financial decisions and ensuring a smooth purchasing process. By utilizing relevant keywords, here is a detailed description explaining what a Hawaii Purchasing Cost Estimate entails: Keywords: Hawaii, purchasing cost estimate, real estate, expenses, financial decisions, goods and services. Description: A Hawaii Purchasing Cost Estimate is an essential tool used to determine the overall expenses associated with purchasing real estate, products, or services across the Hawaiian Islands. With a unique state-specific context, this estimation helps potential buyers thoroughly understand the financial aspects and make informed decisions regarding their purchase. When it comes to real estate, a Hawaii Purchasing Cost Estimate factors in various elements such as the property's purchase price, closing costs, including escrow fees, title insurance, appraisal fees, and potential property taxes. Additionally, it considers the costs associated with home inspections, homeowner's insurance, and potential maintenance or renovation costs. It is important to note that Hawaii offers several types of Purchasing Cost Estimates, catering to different needs and preferences of buyers. These may include: 1. Residential Purchasing Cost Estimate: This estimate focuses on purchasing residential properties such as houses, condos, or townhouses. It takes into account both one-time expenses like the purchase price and closing costs, as well as recurring costs, including property taxes and monthly mortgage payments. 2. Commercial Purchasing Cost Estimate: Aimed at individuals or organizations looking to buy commercial properties like office spaces, retail stores, or warehouses, this estimate evaluates the unique expenses involved. It factors in factors such as property size, location, renovation costs, potential leasing arrangements, property management fees, and ongoing operational costs. 3. Goods and Services Purchasing Cost Estimate: Apart from real estate, this estimate focuses on estimating expenses related to purchasing various goods and services in Hawaii. It covers aspects such as price comparison of different suppliers, shipping costs, import duties, taxes, and other additional charges that may apply. In conclusion, a Hawaii Purchasing Cost Estimate provides a comprehensive breakdown of the expenses associated with purchasing real estate or goods and services. Whether it is residential or commercial properties, or estimates focused on goods and services procurement, it offers valuable insights and helps individuals and businesses plan their finances accordingly.

Hawaii Purchasing Cost Estimate

Description

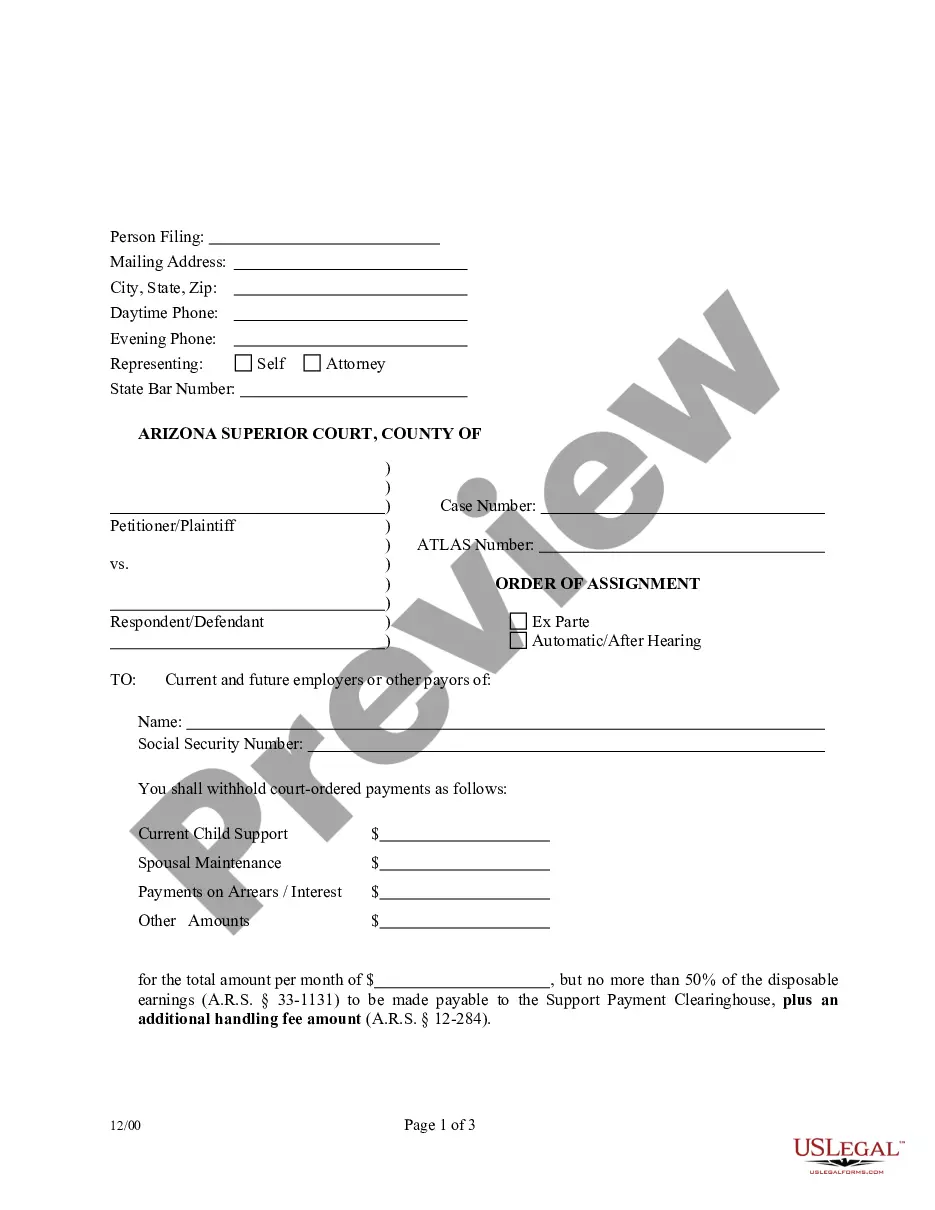

How to fill out Hawaii Purchasing Cost Estimate?

Choosing the right lawful record template can be quite a struggle. Obviously, there are a variety of templates accessible on the Internet, but how do you discover the lawful kind you require? Use the US Legal Forms internet site. The service offers thousands of templates, including the Hawaii Purchasing Cost Estimate, which you can use for company and personal requirements. Each of the forms are checked by pros and meet state and federal needs.

When you are already listed, log in for your account and click the Acquire key to obtain the Hawaii Purchasing Cost Estimate. Make use of your account to check with the lawful forms you possess ordered in the past. Check out the My Forms tab of your respective account and acquire one more version in the record you require.

When you are a whole new customer of US Legal Forms, listed here are straightforward instructions for you to comply with:

- First, make certain you have chosen the right kind for the town/state. You can check out the shape utilizing the Preview key and read the shape description to make certain this is basically the best for you.

- In case the kind will not meet your preferences, take advantage of the Seach discipline to get the proper kind.

- When you are certain the shape is proper, click on the Get now key to obtain the kind.

- Opt for the pricing plan you want and type in the essential information and facts. Build your account and purchase your order with your PayPal account or credit card.

- Opt for the file file format and acquire the lawful record template for your device.

- Comprehensive, modify and produce and indication the acquired Hawaii Purchasing Cost Estimate.

US Legal Forms is definitely the greatest collection of lawful forms for which you will find different record templates. Use the service to acquire expertly-produced files that comply with status needs.