Hawaii Merchandise Return Sheet

Description

How to fill out Merchandise Return Sheet?

You can spend countless hours online searching for the official document template that aligns with the federal and state regulations you require.

US Legal Forms offers a multitude of official documents that can be reviewed by professionals.

You can conveniently download or print the Hawaii Merchandise Return Sheet from our platform.

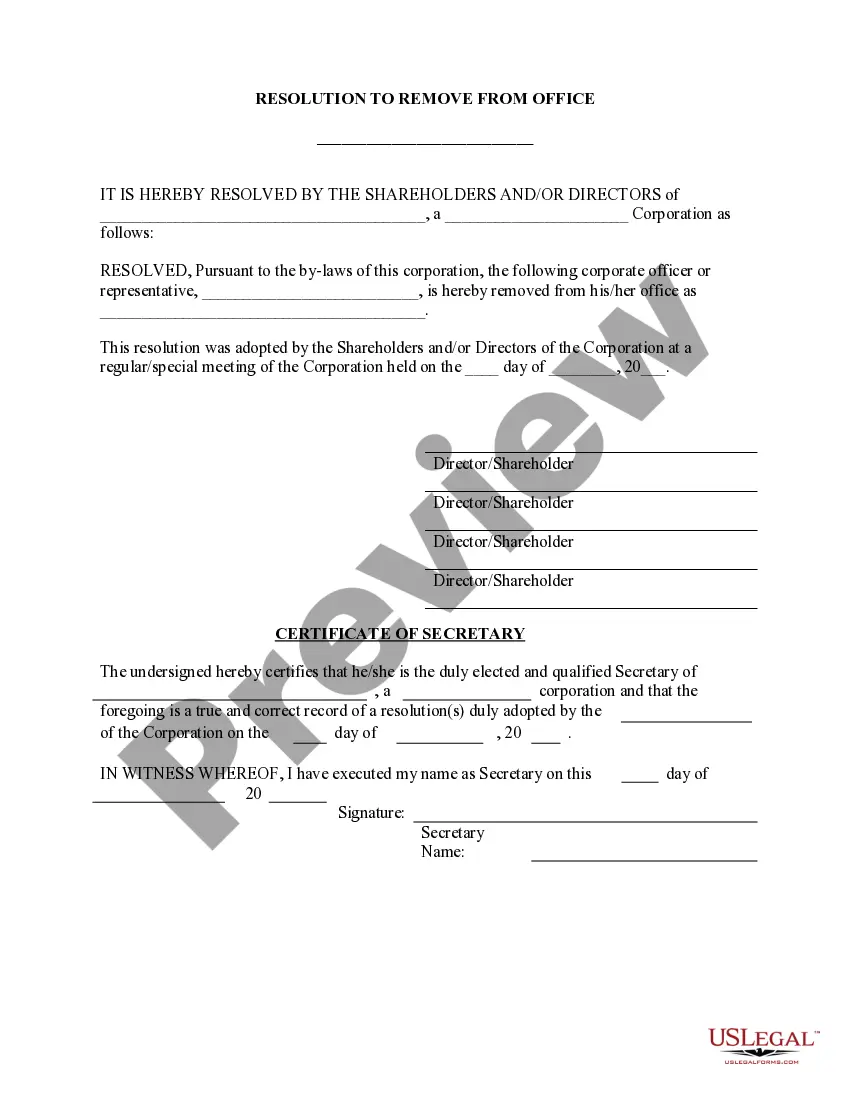

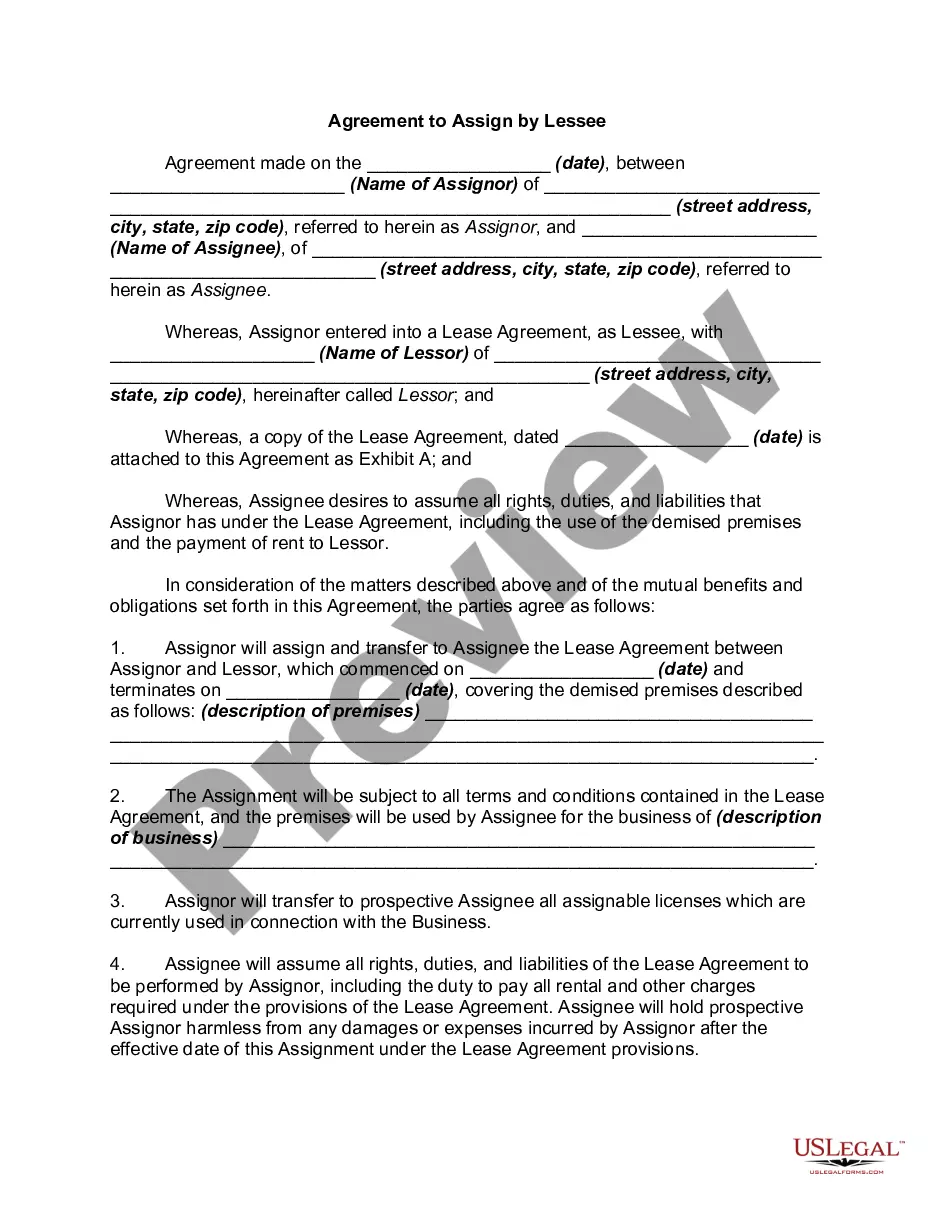

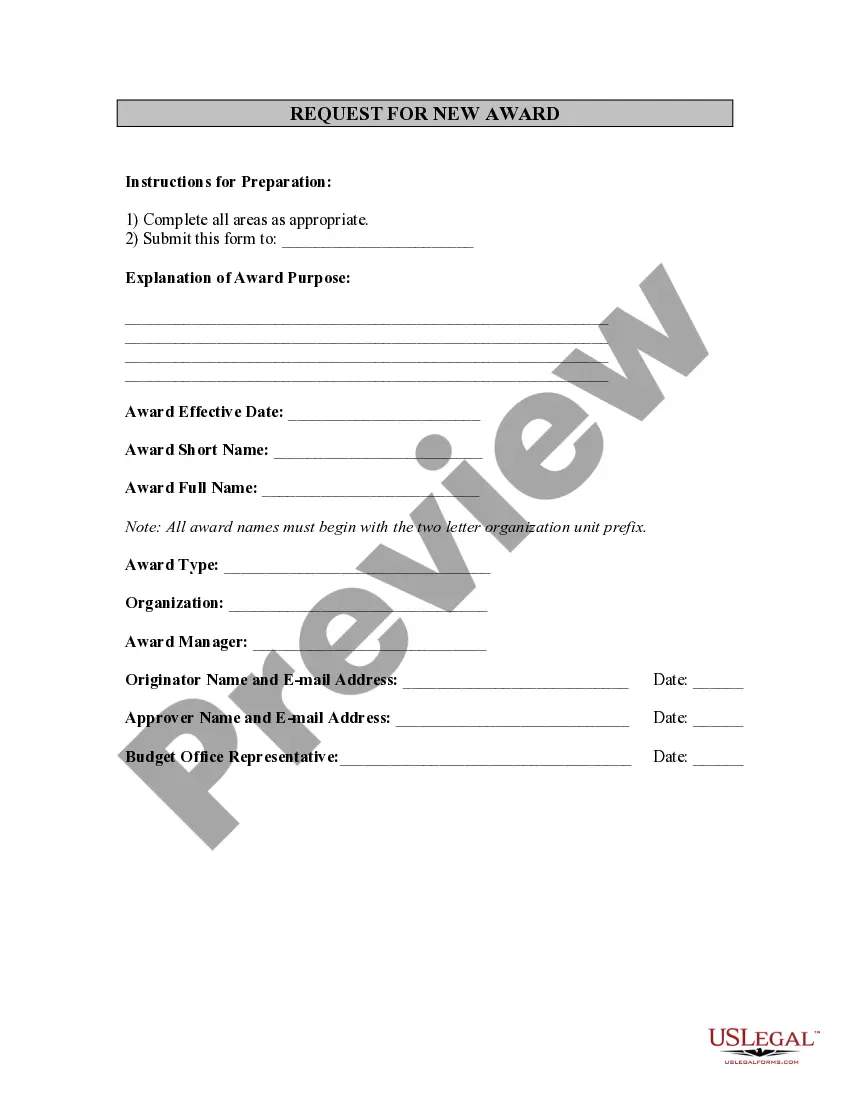

Read the form description to confirm you have chosen the right form. If available, make use of the Preview button to view the document template simultaneously.

- If you have an account with US Legal Forms, you may Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Hawaii Merchandise Return Sheet.

- Every official document template you purchase belongs to you permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/town of choice.

Form popularity

FAQ

Form G-45 is due on or before the 20th day of the calendar month following the end of the filing period. For example, if your filing period ends on January 31st, then your return will be due on February 20th. Form G-49 is due on or before the 20th day of the fourth month following the close of the tax year.

Complete Form BB-1, State of Hawaii Basic Business Application, and select GE One-Time Event to register for a one-time event. Use Form G-45, Periodic General Excise/ Use Tax Return, to report and pay the tax due from your one-time event.

What is the difference between the G-45 and the G-49 Forms? The G-45 is the 'periodic' form which is filed either monthly, quarterly, or semiannually. The G-49 is the annual or so called "reconciliation" form which is filed annually.

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

You have the following options to pay your tax:Send e-payment through state website.Mail in a check. You need to attach Payment Voucher (Form N-200V) Hawaii Department of Taxation. P. O. Box 1530. Honolulu, Hawaii 96806-1530.

Corporation - A request for an automatic 6-month extension of time to file a Hawaii Corporate Income Tax Return (Form N-30) must be submitted on Form N-301 Application for Automatic Extension of Time to File Hawaii Return for a Corporation, Partnership, Trust, or REMIC, by the original due date of the return.

On your check or money order. Mail to: HAWAII DEPARTMENT OF TAXATION, P. O. BOX 1425, HONOLULU, HI 96806-1425 or file and pay electronically at hitax.hawaii.gov.

File your general excise and use tax returns with: Hawaii Department of Taxation P.O. Box 1425 Honolulu, HI 96806-1425. The general excise tax is a tax imposed on the gross income you receive from any business activ- ity you have in Hawaii.

PURPOSE OF FORM Use this form to: 1. Register for various tax licenses and permits with the Department of Taxation (DOTAX) and to obtain a corresponding Hawaii Tax Identification Number (Hawaii Tax I.D. No.).