Hawaii Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

If you seek to be thorough, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site’s simple and convenient search to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After you have found the form you need, click the Purchase now option. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to find the Hawaii Pay in Lieu of Notice Guidelines in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to obtain the Hawaii Pay in Lieu of Notice Guidelines.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

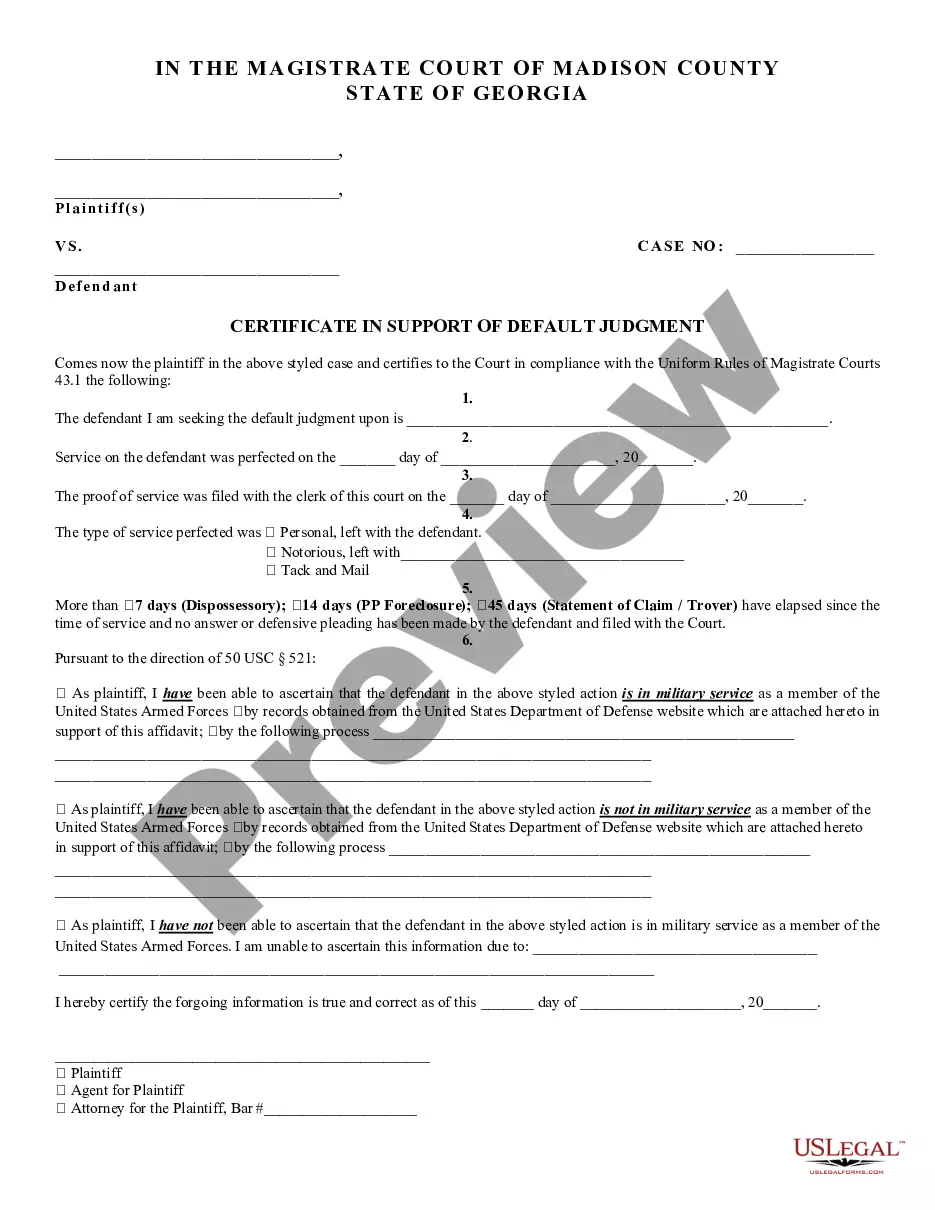

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find other templates in the legal form format.

Form popularity

FAQ

Payment in lieu of notice refers to compensation you receive when your employer ends your employment without providing the standard notice period. According to the Hawaii Pay in Lieu of Notice Guidelines, this payment serves as an alternative to the notice period typically required, allowing for a smoother transition for both parties. Understanding these guidelines ensures that you are aware of your rights and options if faced with sudden job termination. At US Legal Forms, you can find resources that help navigate these situations effectively.

Calculating payment in lieu of notice involves a few simple steps. First, identify the employee's regular pay rate and how many days of notice are required. Multiply the daily pay rate by the number of notice days to determine the total payment. Following the Hawaii Pay in Lieu of Notice Guidelines ensures you have calculated this amount correctly and fairly for the departing employee.

Yes, under the Hawaii Pay in Lieu of Notice Guidelines, payments made in lieu of notice are generally subject to superannuation contributions. Employers must include this payment in their calculations for superannuation to comply with state laws. This requirement helps ensure that employees receive their full benefits, supporting their future financial stability.

Payment in lieu of leave is a financial compensation for leave days that an employee did not take before their employment ends. Under the Hawaii Pay in Lieu of Notice Guidelines, this payment ensures that employees receive their entitled leave benefits, specifically if those days could not be used or transferred. It is crucial for employers to clearly outline this process in their policies to prevent misunderstandings.

To process a payment in lieu of notice under the Hawaii Pay in Lieu of Notice Guidelines, an employer should first determine the employee's regular pay rate and the notice period required. Then, calculate the total amount owed by multiplying the daily rate by the number of days that correspond to the notice period. Finally, include this amount in the employee's final paycheck, ensuring that all applicable deductions are made.

Wrongful termination in Hawaii refers to an employee being fired in violation of state or federal laws, or in breach of an employment contract. The Hawaii Pay in Lieu of Notice Guidelines highlight that employees who believe they were wrongfully terminated may have legal recourse. This includes situations where firing occurs due to discrimination or retaliation for exercising legal rights. For additional resources or legal advice, check out US Legal Forms.

Hawaii law does not mandate employees to provide two weeks’ notice before resigning. However, following the Hawaii Pay in Lieu of Notice Guidelines, it is generally considered a professional courtesy to do so. By providing notice, employees can promote goodwill with their employer and facilitate smoother transitions. If you need detailed templates or guidance on notice procedures, the US Legal Forms platform can assist you.

In Hawaii, employers are not legally required to pay out unused PTO upon termination unless specified in the employment agreement or company policy. Following the Hawaii Pay in Lieu of Notice Guidelines, employees are encouraged to review their contracts for any clauses related to PTO payouts. To ensure compliance, employers often establish clear policies regarding PTO to avoid disputes at termination. For more guidance on this matter, consider visiting US Legal Forms.

Processing payment in lieu of notice involves a few key steps. Begin by reviewing your employment agreement for relevant clauses regarding notice periods. Next, submit a formal request to your employer, along with any supporting documents. Following Hawaii Pay in Lieu of Notice Guidelines can streamline this process, and platforms like uslegalforms offer templates and advice to ensure you comply with legal requirements.

Payment in lieu of leave refers to compensation an employee receives instead of taking their entitled leave. According to the Hawaii Pay in Lieu of Notice Guidelines, this payment allows employees to receive their due wages when they cannot take time off. This concept ensures employees don't lose earnings when circumstances change. Understanding these guidelines can help you navigate your rights effectively.