Title: Hawaii Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank — Overview and Types Introduction: A Hawaii Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is a legally binding document that authorizes a limited liability company (LLC) to obtain funding from a specific financial institution in order to finance its operations, investments, or other business-related purposes. This resolution outlines the essential details and terms of the agreement, providing clarity and consensus among the LLC members participating in the decision-making process. Let's explore the various types of resolutions commonly used in Hawaii when LLC members seek to borrow capital from a designated bank. 1. Ordinary Resolution: An ordinary resolution is typically used when the LLC intends to borrow a lesser amount of capital, which does not require significant alteration to the company's financial structure or operations. This type of resolution might involve day-to-day operational expenses or smaller investments that can be repaid within a shorter timeframe. 2. Special Resolution: A special resolution is necessary when the LLC intends to secure a substantial amount of capital, potentially resulting in significant changes to its financial structure or business operations. This resolution typically requires a higher majority vote or a specified quorum, ensuring that a significant majority of LLC members support the borrowing decision. 3. Emergency Resolution: An emergency resolution is employed when a sudden, unforeseen situation necessitates immediate capital. This could include instances of natural disasters, infrastructure failures, or sudden opportunities where rapid funding is required. Emergency resolutions bypass certain formalities, granting the LLC the power to borrow capital swiftly. 4. Capital Expansion Resolution: When an LLC plans to expand its business operations, undertake major investments, or acquire new assets, a capital expansion resolution is appropriate. This resolution allows the LLC to access capital for long-term financing needs, such as purchasing new equipment, expanding physical infrastructure, or enhancing existing product lines. 5. Investment Resolution: An investment resolution enables the LLC to secure capital in order to invest in external ventures or partnerships that align with its strategic goals. This resolution empowers the LLC members to authorize borrowing for the purpose of expanding the company's reach, diversifying revenue streams, or gaining a competitive edge in the market. Conclusion: Hawaii Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank encompasses various types of resolutions, each catering to distinct financing needs. Whether for day-to-day operational expenses, major investments, emergencies, capital expansion, or investment ventures, these resolutions ensure that LLC members follow proper procedures and act in the best interests of the company while securing the necessary funds. It is crucial for state-specific legal requirements and guidelines to be adhered to when drafting and executing these resolutions to maintain the LLC's legal compliance and protect the rights of its members.

Hawaii Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

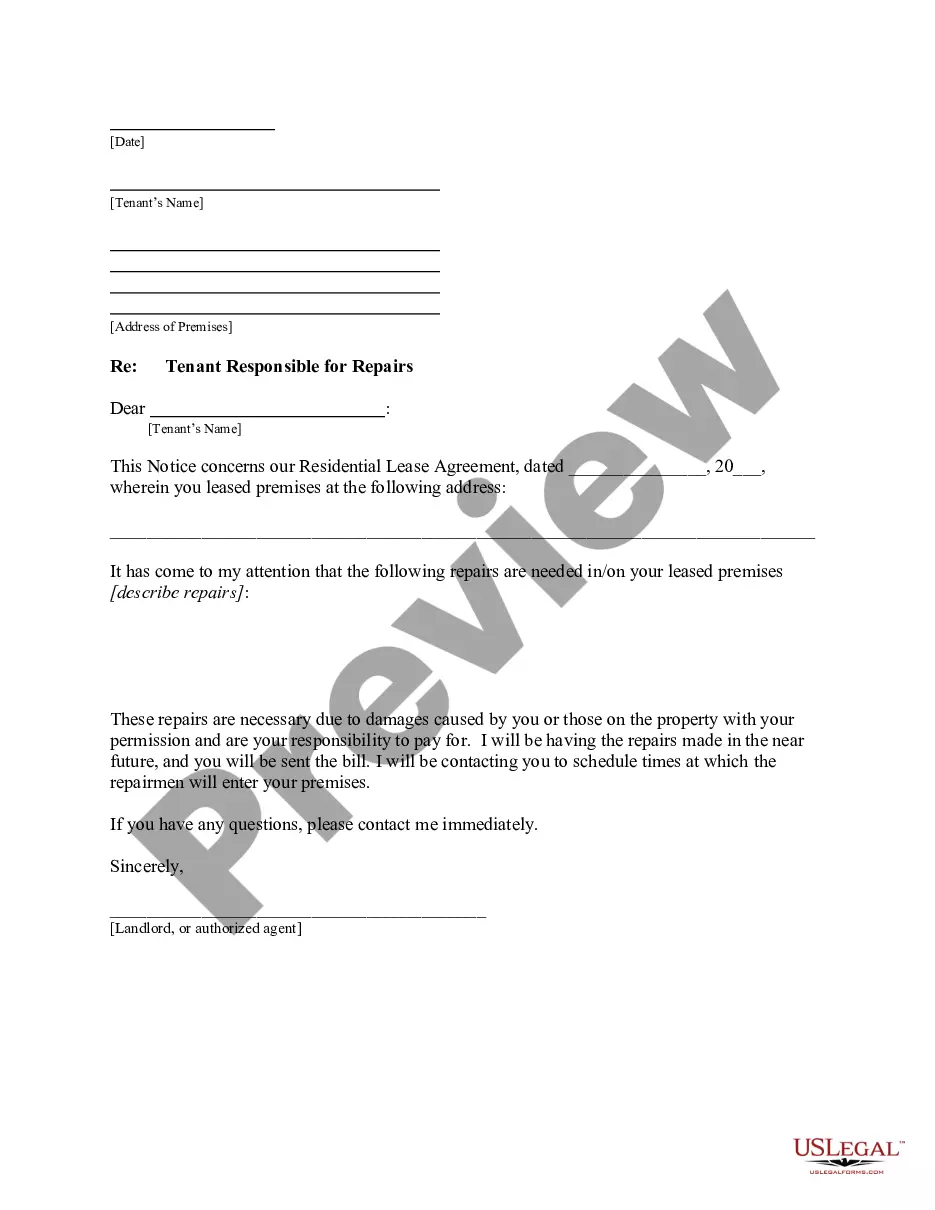

How to fill out Hawaii Resolution Of Meeting Of LLC Members To Borrow Capital From Designated Bank?

US Legal Forms - one of several greatest libraries of authorized varieties in the United States - delivers a variety of authorized record layouts it is possible to acquire or print out. While using internet site, you will get thousands of varieties for enterprise and individual purposes, categorized by groups, suggests, or keywords.You can get the most up-to-date versions of varieties much like the Hawaii Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank within minutes.

If you currently have a subscription, log in and acquire Hawaii Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank through the US Legal Forms library. The Acquire switch can look on each type you view. You have access to all formerly acquired varieties within the My Forms tab of the accounts.

If you would like use US Legal Forms the very first time, listed here are simple guidelines to help you began:

- Be sure you have picked out the best type to your area/region. Click the Review switch to analyze the form`s information. Browse the type description to ensure that you have chosen the right type.

- In the event the type does not satisfy your specifications, utilize the Lookup field near the top of the screen to obtain the the one that does.

- In case you are happy with the form, verify your selection by visiting the Buy now switch. Then, choose the pricing prepare you favor and supply your accreditations to sign up for an accounts.

- Process the transaction. Make use of bank card or PayPal accounts to finish the transaction.

- Select the file format and acquire the form in your system.

- Make modifications. Complete, change and print out and signal the acquired Hawaii Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

Every single web template you added to your bank account lacks an expiration day and it is the one you have forever. So, if you wish to acquire or print out one more duplicate, just go to the My Forms portion and click about the type you require.

Get access to the Hawaii Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank with US Legal Forms, one of the most extensive library of authorized record layouts. Use thousands of expert and status-distinct layouts that meet your company or individual demands and specifications.