Hawaii Travel Expense Reimbursement Form

Description

How to fill out Travel Expense Reimbursement Form?

Finding the appropriate legal documents template can be a challenge.

Clearly, there are numerous templates accessible online, but how do you locate the legal form that you require.

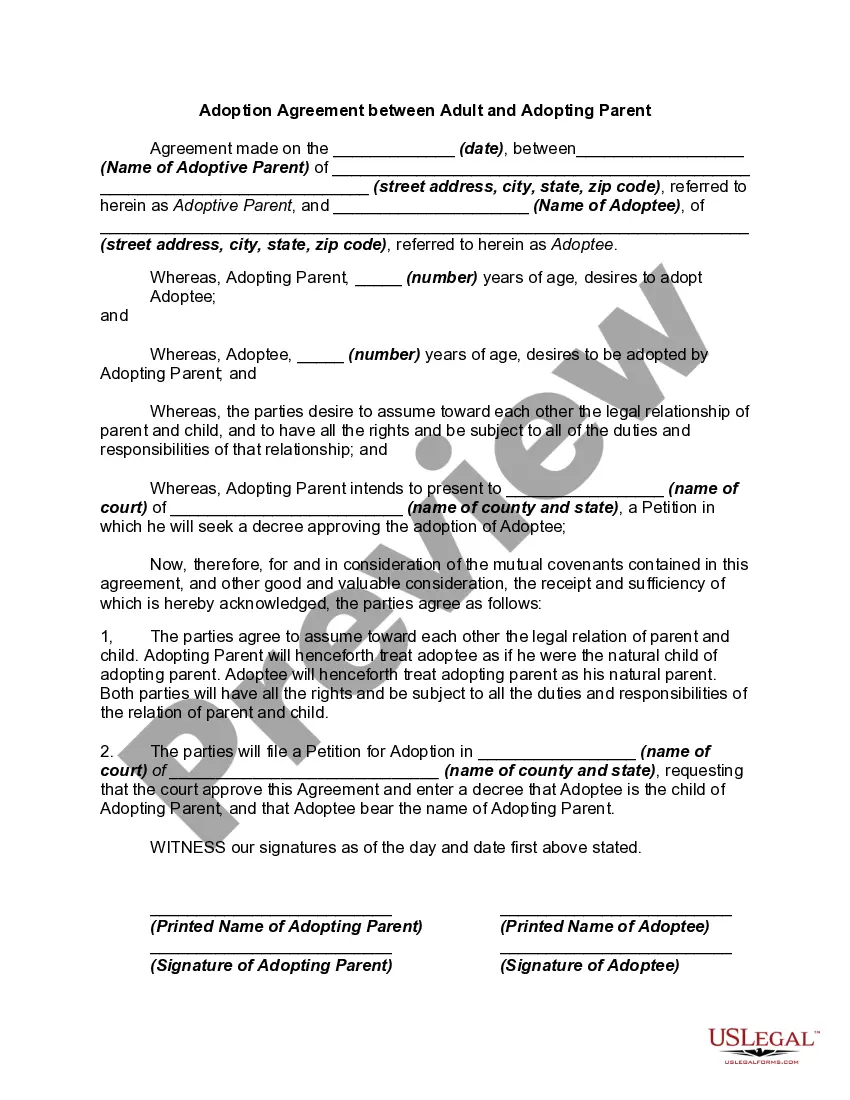

Utilize the US Legal Forms website. The service provides thousands of templates, including the Hawaii Travel Expense Reimbursement Form, which can be utilized for business and personal purposes.

First, ensure you have selected the correct form for your city/state. You can preview the template using the Preview button and review the outline to make sure this is suitable for you. If the form does not meet your requirements, utilize the Search field to find the correct form. Once you are certain that the form is appropriate, click on the Buy now button to obtain the document. Choose the payment plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Hawaii Travel Expense Reimbursement Form. US Legal Forms is the largest collection of legal forms where you will find a multitude of document templates. Use the service to acquire professionally created documents that adhere to state regulations.

- All the forms are verified by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to access the Hawaii Travel Expense Reimbursement Form.

- Use your account to browse through the legal forms you have downloaded before.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

A: The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses are generally reimbursable expenses.

Companies spend around 10% of their revenue on business travel-related expenses. This was reported in the New York Journal and given how significant the percentage is, it's critical that companies are strategic about managing their business travel expenditure.

Travel reimbursement is the way employers pay their employees back for expenses they have incurred during business-related travel. Such expenses can range from airfare to mileage, event registration, parking, and meals. Depending on your travel policy, employees may need to pay for these first.

The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses from employee wages under an accountable plan; or (2) employers can consider all payments to employees as wages under a non-accountable

57.5 cents per mile for business miles (58 cents in 2019) 17 cents per mile driven for medical or moving purposes (20 cents in 2019) 14 cents per mile driven in service of charitable organizations.

I want to state that I visited (Location) for (Personal/ Professional work). This visit was done on // (Date). Therefore, I request you to kindly reimburse the amount of the expense of (Amount) which I spent.

Examples of travel expenses include airfare and lodging, transport services, cost of meals and tips, use of communications devices. Travel expenses incurred while on an indefinite work assignment, which lasts more than one year according to the IRS, are not deductible for tax purposes.

The cost of work-related travel, including transportation, lodging, meals, and entertainment that meet the criteria outlined in IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses, are generally reimbursable expenses.

Travel expenses, and reimbursement of employees' travel expenses, are considered a legitimate business expense that can be deducted from a company's income taxes. For this reason, it can be advantageous to both employers and employees to have a reimbursement policy for travel expenses.