Hawaii Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement

Description

How to fill out Hawaii Registration For Offer Sale Of Franchise Or Supplemental Report To Registration Statement?

Choosing the best legitimate papers format can be a battle. Naturally, there are plenty of web templates available on the net, but how do you discover the legitimate form you want? Utilize the US Legal Forms internet site. The services delivers a large number of web templates, like the Hawaii Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement, that you can use for company and private requirements. All of the varieties are checked by pros and satisfy federal and state requirements.

Should you be previously authorized, log in to the bank account and then click the Download button to find the Hawaii Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement. Use your bank account to appear throughout the legitimate varieties you have acquired earlier. Proceed to the My Forms tab of your own bank account and acquire one more backup from the papers you want.

Should you be a whole new user of US Legal Forms, allow me to share basic guidelines for you to adhere to:

- Very first, make certain you have selected the correct form to your metropolis/state. You are able to look over the shape while using Review button and look at the shape explanation to make sure it is the best for you.

- When the form does not satisfy your expectations, make use of the Seach field to discover the appropriate form.

- When you are sure that the shape is suitable, go through the Purchase now button to find the form.

- Select the costs plan you desire and enter the necessary information and facts. Design your bank account and buy the order making use of your PayPal bank account or Visa or Mastercard.

- Select the document formatting and download the legitimate papers format to the gadget.

- Total, edit and produce and indicator the attained Hawaii Hawaii Registration for Offer Sale of Franchise or Supplemental Report to Registration Statement.

US Legal Forms is the most significant local library of legitimate varieties for which you can discover numerous papers web templates. Utilize the company to download skillfully-manufactured files that adhere to state requirements.

Form popularity

FAQ

An organizer may be an individual, business entity, business trust, estate, trust, association, joint venture, government, governmental subdivision or agency, or any other legal or commercial entity. Hawaii LLC Members: Hawaii LLCs require 1 or more members. There is no residence or age requirement.

Hawaii LLC Formation Filing Fee: $51 You can file online, by mail, email, fax, or in person. Hawaii charges $50 to file, and adds a $1 State Archive Preservation Fee for a total filing cost of $51.

Every business operating in Hawaii must have a State Tax Identification Number. The form to file is called Form BB-1 Basic Business Application, and the registration fee is $20. You can file online through Hawaii Business Express, or you can file the form by mail.

File Hawaii Certificate of Formation Agency:Hawaii Business Registration Division (BREG)Agency Fee:$51 + optional $25 expedite feeTurnaround:~7-14 business days by mail. ~3-5 business days by fax, in-person, or online. ~1-3 business days if you file online and pay the $25 expedite fee.4 more rows

Corporations, LLCs and partnerships registered in the State of Hawaii are required to file annual reports/statements with DCCA Business Registration Division. The annual report/statement provides the public with information on the registered business entity, and it does not include financial information.

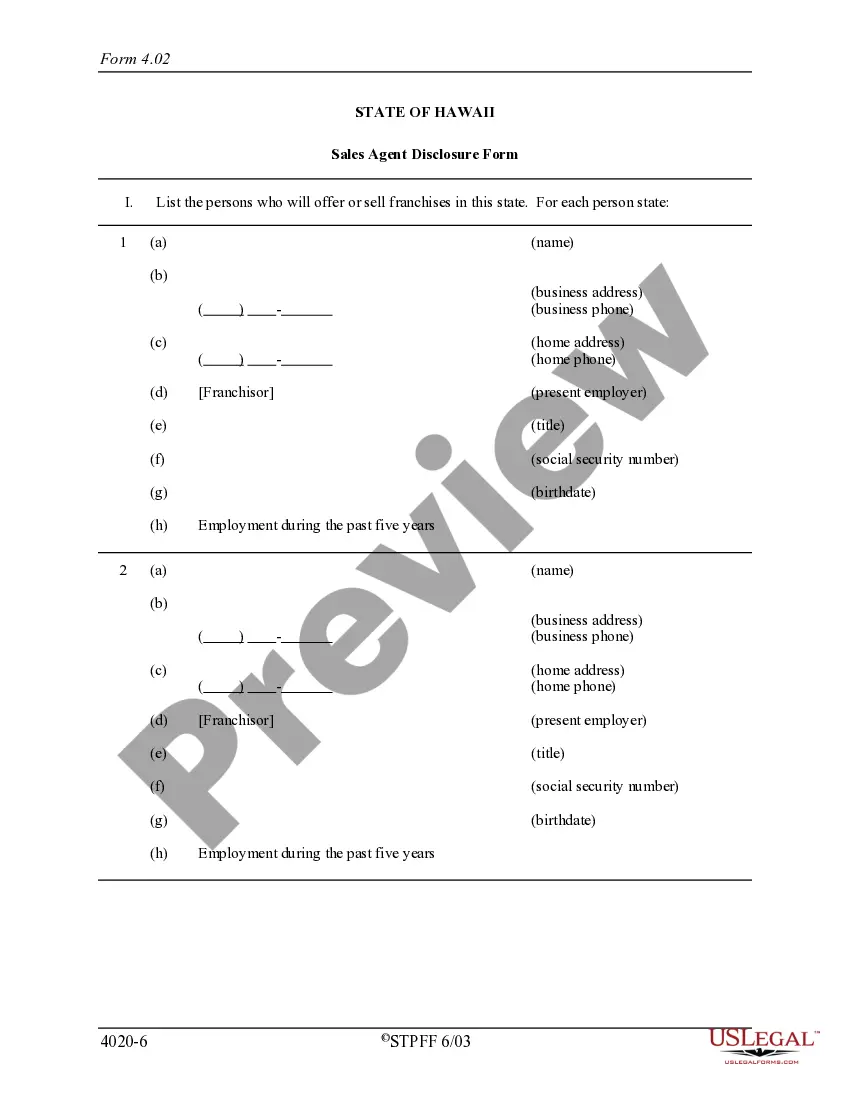

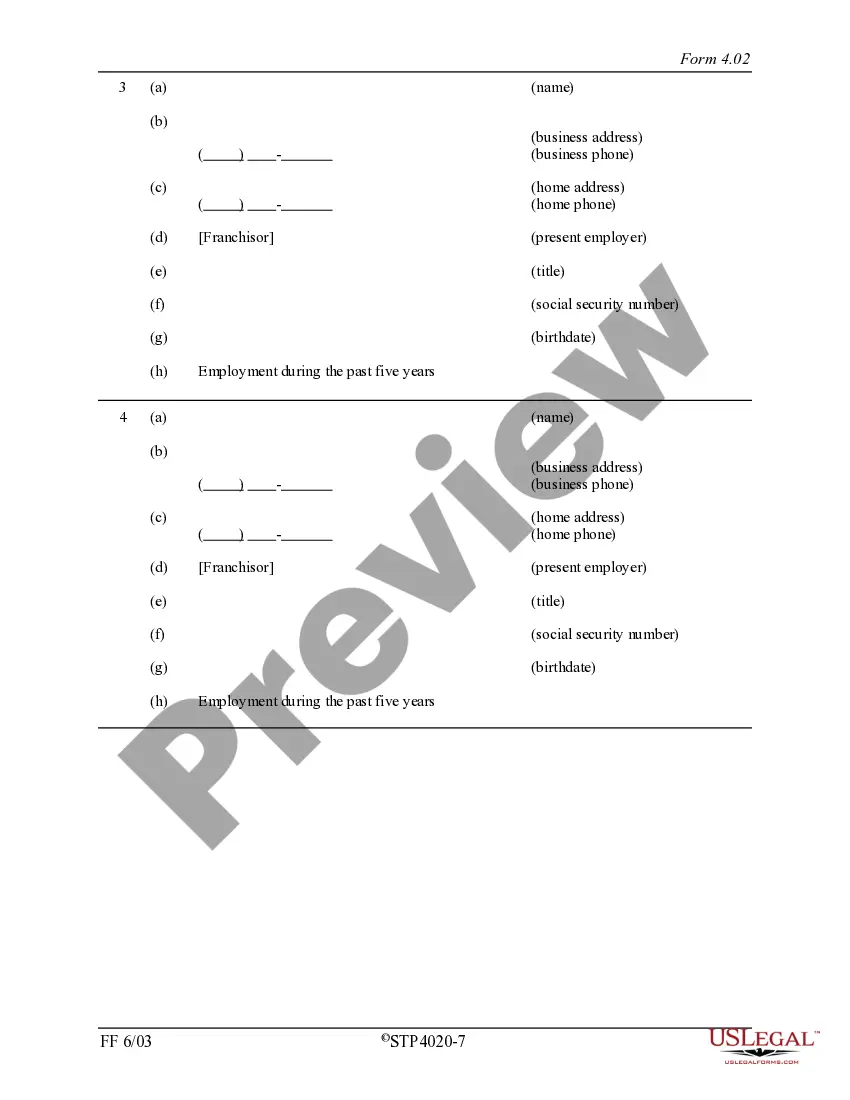

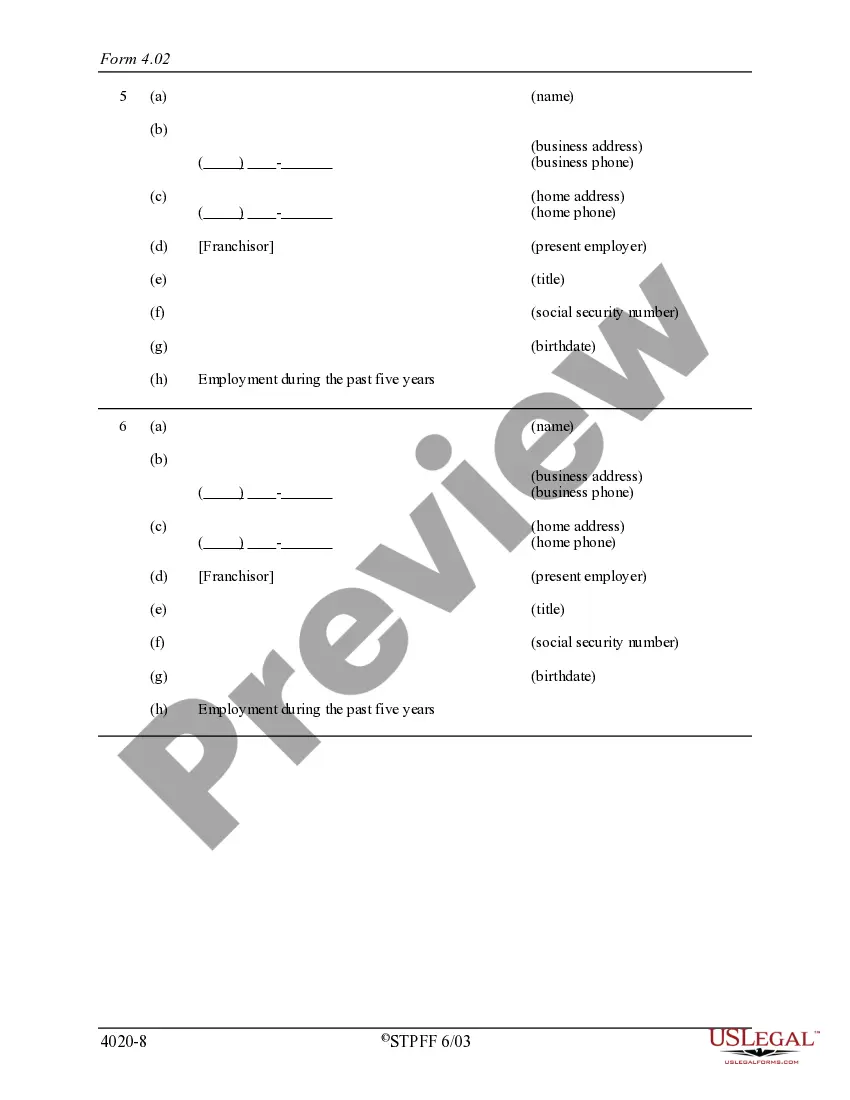

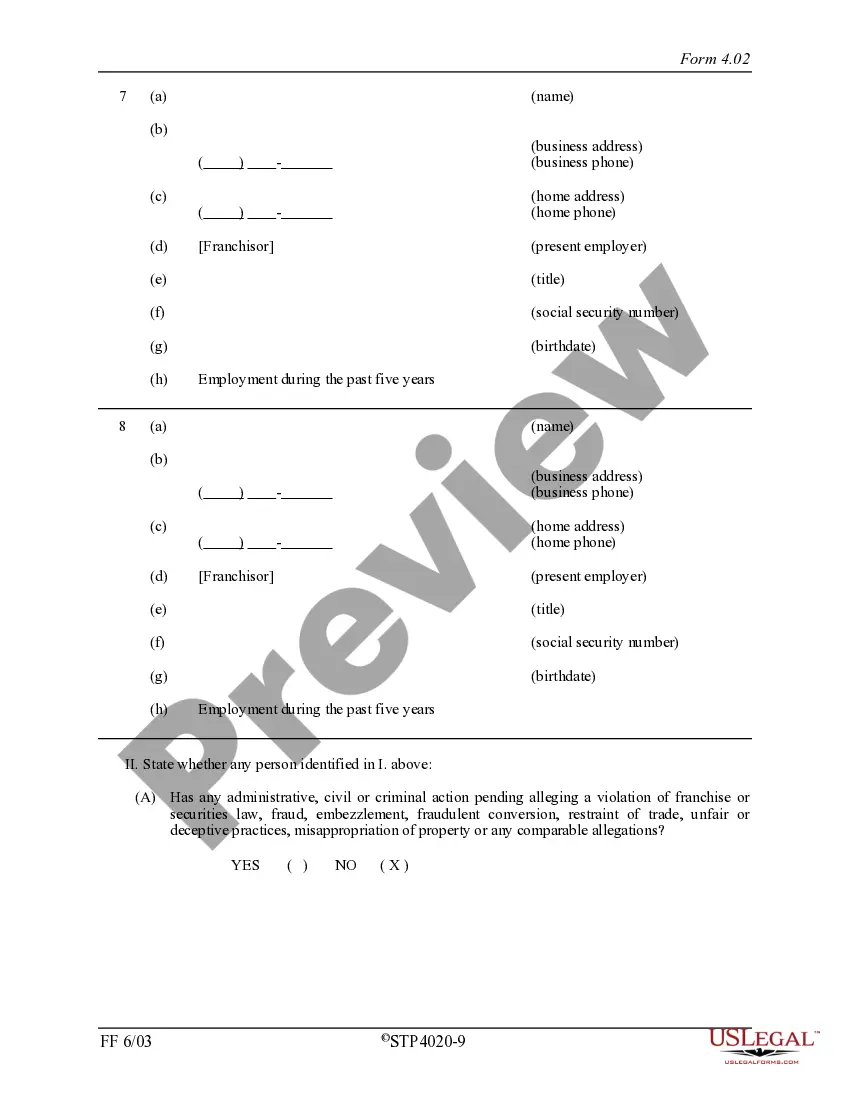

Hawaii is a franchise registration state. Before you offer or sell a franchise in Hawaii you must register your Franchise Disclosure Document (FDD) with the Business Registration Division of the Hawaii State Dept. of Commerce and Consumer Affairs.

In Hawaii, all business registrations are filed with the State of Hawaii Department of Commerce and Consumer Affairs, Business Registration Division. Our business registration forms are simple to fill out and only require enough information to fulfill Hawaii's statutory filing requirements.

Corporations, LLCs, and LLPs are required to pay $15 to file an annual report. Nonprofits, general partnerships, LPs, and LLPs must pay a mere $5 to submit their report. If you do not file your report on time, the state of Hawaii will assess a $10 late fee, unless you are a nonprofit.