Hawaii Exemption Statement

Description

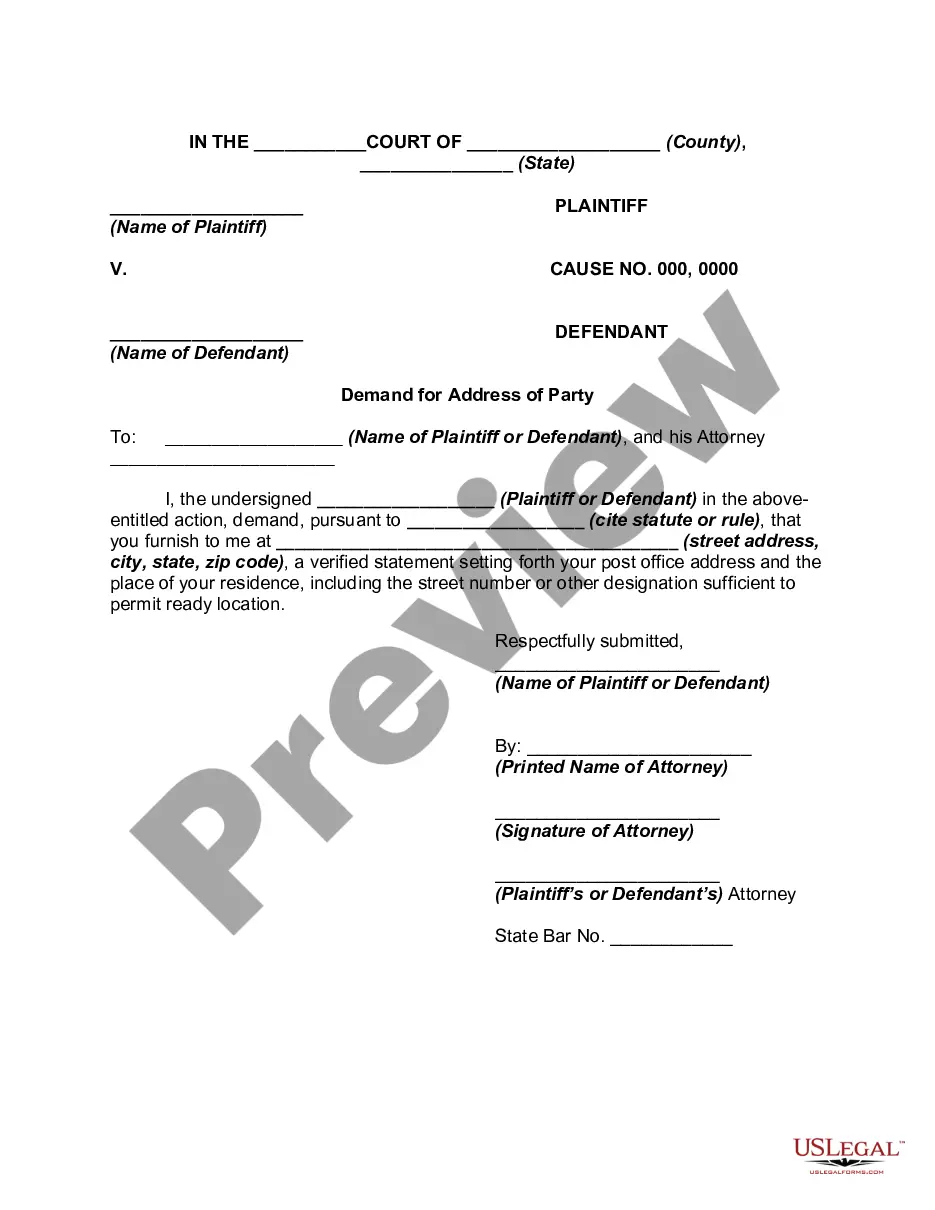

How to fill out Exemption Statement?

If you want to complete, obtain, or print lawful file templates, use US Legal Forms, the most important selection of lawful forms, that can be found on-line. Use the site`s basic and handy look for to get the documents you need. Different templates for organization and personal purposes are categorized by groups and states, or search phrases. Use US Legal Forms to get the Hawaii Exemption Statement - Texas in just a few mouse clicks.

If you are previously a US Legal Forms customer, log in to the account and then click the Download button to have the Hawaii Exemption Statement - Texas. You can even gain access to forms you earlier downloaded within the My Forms tab of the account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the proper city/land.

- Step 2. Make use of the Review solution to check out the form`s articles. Do not overlook to see the outline.

- Step 3. If you are unsatisfied with all the form, use the Lookup industry towards the top of the monitor to get other types of your lawful form design.

- Step 4. Upon having identified the shape you need, click on the Get now button. Pick the costs prepare you prefer and add your accreditations to register for an account.

- Step 5. Approach the financial transaction. You may use your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Select the format of your lawful form and obtain it on your own product.

- Step 7. Complete, modify and print or indication the Hawaii Exemption Statement - Texas.

Every lawful file design you get is yours for a long time. You might have acces to each and every form you downloaded with your acccount. Click on the My Forms segment and choose a form to print or obtain yet again.

Compete and obtain, and print the Hawaii Exemption Statement - Texas with US Legal Forms. There are many specialist and express-specific forms you can utilize for your personal organization or personal demands.

Form popularity

FAQ

Exemptions from property tax require applications in most circumstances. Applications for property tax exemptions are filed with the appraisal district in which the property is located. The general deadline for filing an exemption application is before May 1.

Generally, tax exemptions reduce the taxable income on a return. There are many kinds of tax exemptions; however, personal exemptions are included on nearly every individual return filed in the U.S. You can claim a personal exemption for yourself unless someone else can claim you as a dependent.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption ? Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

A Hawaii Resident is an individual that is domiciled in Hawaii or an individual that resides in Hawaii for other than temporary purpose. An individual domiciled outside Hawaii is considered a Hawaii resident if they spend more than 200 days in Hawaii during the tax year.

Once filed and granted, a claim for home exemption does not have to be re- filed annually as long as all requirements continue to be met. Through the Real Property Tax Office, the Director of Finance may request a new claim for home exemption to be completed.

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption ? Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

Under Hawaii tax laws? You do not need to apply with us to be exempt from Hawaii income tax. Certain organizations (see table below for a sample listing) that are exempt from federal income tax are automatically exempt from Hawaii income tax. No separate Hawaii application is required.

When can a taxpayer claim personal exemptions? To claim a personal exemption, the taxpayer must be able to answer ?no? to the intake question, ?Can anyone claim you or your spouse as a dependent?? This applies even if another taxpayer does not actually claim the taxpayer as a dependent.