The Hawaii Self-Employed Independent Contractor Agreement is a legally binding document that outlines the terms and conditions between a self-employed individual, known as an independent contractor, and a client or business who hires their services. This agreement defines the working relationship and expectations of both parties and ensures that the independent contractor is treated as a separate entity from an employee. In Hawaii, there are various types of Self-Employed Independent Contractor Agreements that cater to different industries and arrangements. Some of these variations may include: 1. General Self-Employed Independent Contractor Agreement: This type of agreement is applicable across various industries and covers the basic working relationship between the independent contractor and the hiring client. It outlines the scope of work, payment terms, work schedule, and any specific conditions or requirements both parties need to adhere to. 2. Hawaii Construction Independent Contractor Agreement: For the construction industry, this agreement focuses on the specific regulations and requirements unique to construction projects in Hawaii. It may include provisions related to safety protocols, permits, licenses, and project milestones specific to the construction industry. 3. Hawaii Freelance Independent Contractor Agreement: This agreement is tailored for freelancers who provide creative services, such as graphic design, writing, or photography. It may include provisions related to intellectual property rights, revisions, copyrights, and ownership of the created work. 4. Hawaii Consulting Independent Contractor Agreement: For professionals offering consulting services, such as business or financial consultants, this agreement outlines the scope of consultancy, confidentiality clauses, payment terms, and the client's obligations during the consulting engagement. 5. Hawaii Non-Disclosure Independent Contractor Agreement: This type of agreement is used when an independent contractor requires access to sensitive or proprietary information of the hiring client. It ensures that the independent contractor maintains confidentiality and does not disclose any confidential information to others. In summary, the Hawaii Self-Employed Independent Contractor Agreement is a crucial legal document that establishes the working relationship between a self-employed individual and their client. With various types of agreements tailor-made for specific industries and circumstances, it is essential to choose the appropriate agreement type that aligns with the nature of the work being performed.

Independent Contractor Agreement Hawaii

Description

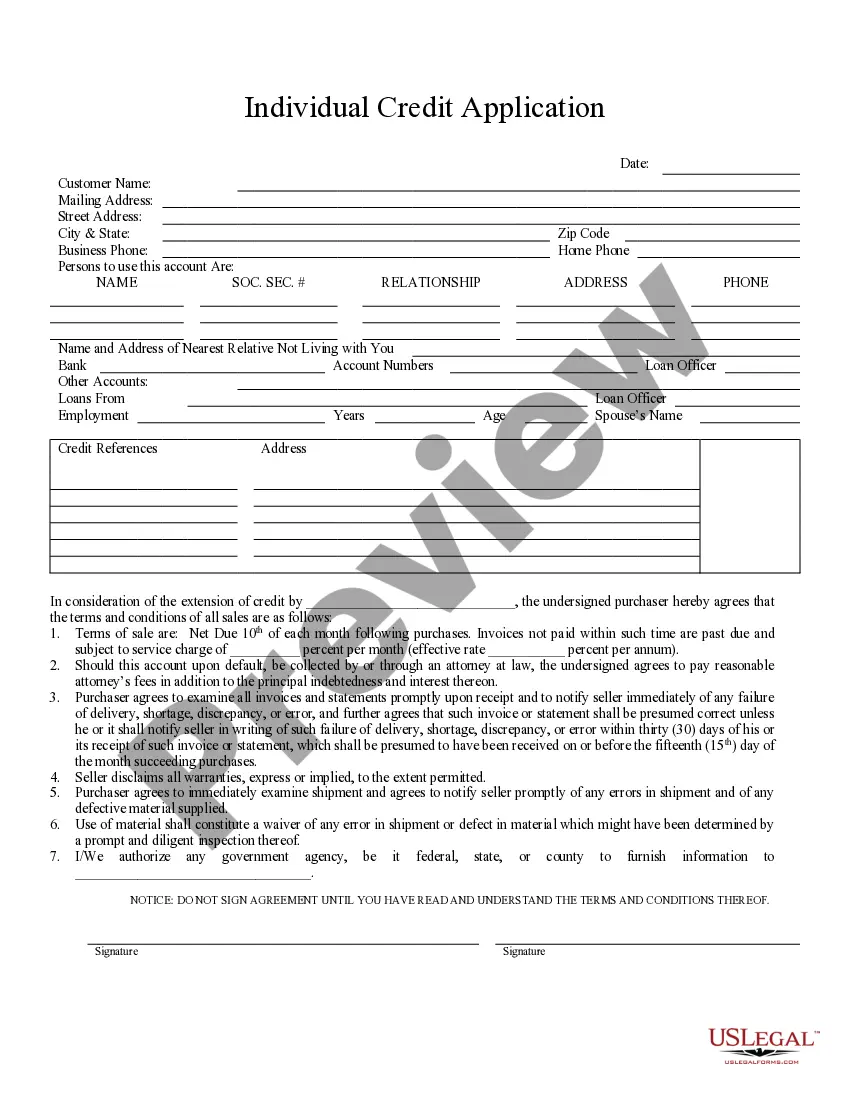

How to fill out Hawaii Self-Employed Independent Contractor Agreement?

It is possible to invest time on the Internet searching for the lawful file format that suits the federal and state requirements you will need. US Legal Forms supplies 1000s of lawful forms that happen to be examined by pros. You can easily download or print out the Hawaii Self-Employed Independent Contractor Agreement from the services.

If you currently have a US Legal Forms bank account, you are able to log in and then click the Down load key. Next, you are able to comprehensive, change, print out, or sign the Hawaii Self-Employed Independent Contractor Agreement. Each and every lawful file format you get is your own forever. To get one more backup of any acquired form, go to the My Forms tab and then click the related key.

If you work with the US Legal Forms website the first time, keep to the easy instructions listed below:

- Initially, make sure that you have chosen the right file format to the region/city of your choice. Read the form explanation to make sure you have chosen the appropriate form. If readily available, make use of the Review key to appear from the file format as well.

- In order to find one more model of the form, make use of the Search area to find the format that meets your requirements and requirements.

- Once you have located the format you want, simply click Get now to carry on.

- Pick the prices strategy you want, type in your qualifications, and sign up for an account on US Legal Forms.

- Total the purchase. You should use your charge card or PayPal bank account to pay for the lawful form.

- Pick the structure of the file and download it for your product.

- Make alterations for your file if necessary. It is possible to comprehensive, change and sign and print out Hawaii Self-Employed Independent Contractor Agreement.

Down load and print out 1000s of file web templates utilizing the US Legal Forms site, that provides the biggest variety of lawful forms. Use specialist and status-distinct web templates to tackle your small business or person demands.

Form popularity

FAQ

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

General Business License Hawaii Several types of businesses are licensed in Hawaii County, such as auctioneers, firearm sales, dance halls, pawnbrokers, and second-hand dealers. Home-based businesses will need to complete a Home Occupation Declaration from the County of Hawaii Planning Department.

Any business, whether it's a small business, self-employed, independent contractor, or freelancer, must obtain a general excise license and pay the tax. Businesses headquartered in another state but with a physical presence in Hawaii also have to pay the GET.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Unlike some other states, Hawaii doesn't have a required general business license for all businesses. However, some businesses may be required to obtain permits from state agencies. For example, a business may need a permit related to the environment or health and safety issued by the Department of Health.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.