Hawaii Business Reducibility Checklist: A Comprehensive Guide for Maximum Tax Benefits The Hawaii Business Reducibility Checklist serves as an essential tool for business owners in Hawaii to ensure they are taking full advantage of deductible expenses for tax purposes. This detailed guide outlines various deductible expenses that can help reduce a business's tax liability and maximize their financial benefits. Keywords: Hawaii, Business Reducibility Checklist, comprehensive guide, tax benefits, deductible expenses, tax liability, financial benefits. Different Types of Hawaii Business Reducibility Checklists: 1. General Business Expenses Reducibility Checklist: — This checklist includes various common business expenses that are generally considered deductible. It covers a wide range of costs such as rent, utilities, insurance, office supplies, advertising, employee wages, and benefits. Keywords: general business expenses, deductible, office supplies, advertising, employee wages, benefits. 2. Mortgage Interest Reducibility Checklist: — For businesses operating in Hawaii that have mortgages on their properties, this checklist focuses on mortgage interest as a deductible expense. It provides guidelines on calculating and documenting mortgage interest payments to ensure proper deduction during tax filings. Keywords: mortgage interest, deductible expense, property, tax filings. 3. Vehicle and Transportation Reducibility Checklist: — Specifically designed for businesses that heavily rely on vehicles or transportation services, this checklist outlines deductible expenses related to vehicles such as fuel, maintenance, repairs, insurance, and leasing costs. It helps business owners understand and leverage the deductions available in this domain. Keywords: vehicle expenses, transportation services, deductible expenses, fuel, maintenance, repairs, insurance. 4. Business Travel Reducibility Checklist: — Ideal for businesses that frequently engage in travel for meetings, conferences, or client visits, this checklist assists in identifying deductible expenses associated with business travel. It covers expenses like airfare, accommodation, meals, transportation, and conference fees. Keywords: business travel, deductible expenses, meetings, conferences, client visits, airfare, accommodation, meals. 5. Home Office Reducibility Checklist: — With the rise of remote work and home-based businesses, this checklist aids entrepreneurs who operate their ventures from home. It highlights deductible expenses related to home offices, including utilities, mortgage interest, property taxes, repairs, internet bills, and office equipment. Keywords: home office, remote work, home-based businesses, deductible expenses, utilities, mortgage interest, property taxes, internet bills. By utilizing these various Hawaii Business Reducibility Checklists, business owners can ensure they are fully capitalizing on the myriad of deductible expenses available to them. It is important to consult with an experienced tax professional or accountant to accurately apply these checklists to individual business circumstances and comply with Hawaii's specific tax regulations.

Hawaii Business Deductibility Checklist

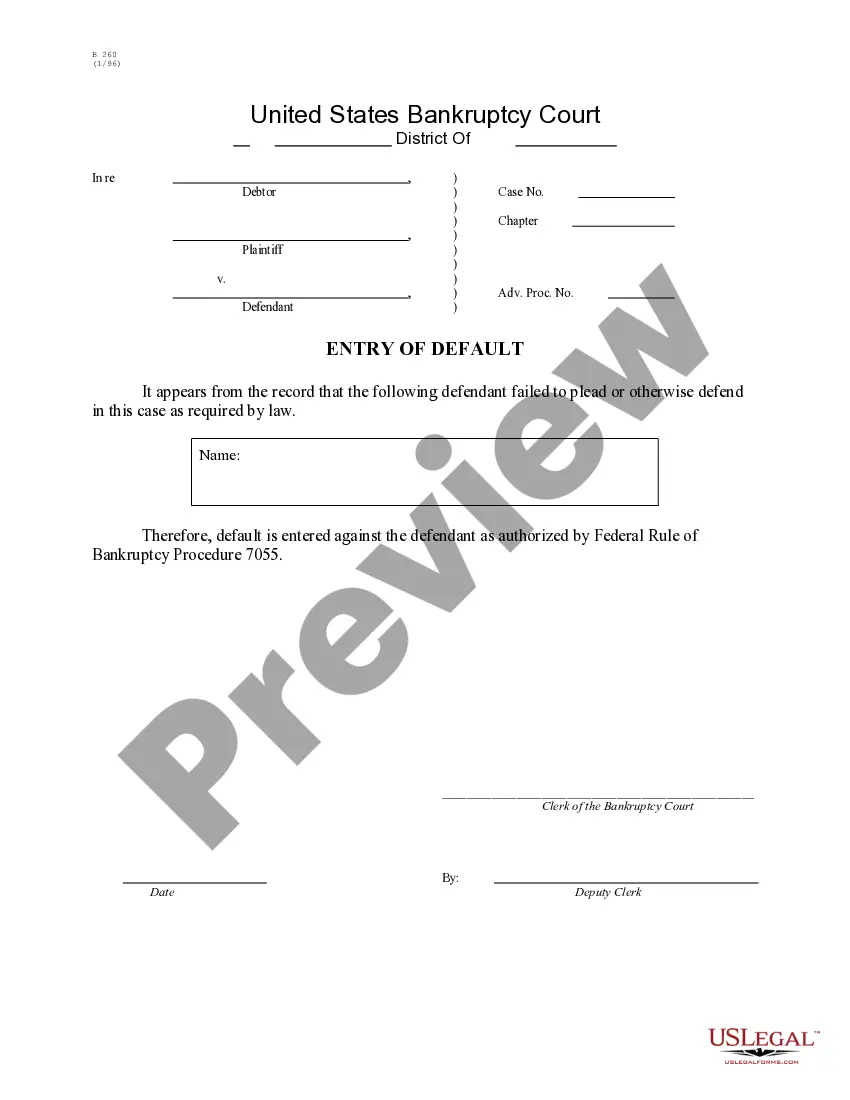

Description

How to fill out Hawaii Business Deductibility Checklist?

US Legal Forms - among the most significant libraries of authorized kinds in the United States - delivers a wide range of authorized file templates you can acquire or print out. Making use of the web site, you can get a large number of kinds for business and individual functions, categorized by groups, states, or search phrases.You can find the most up-to-date models of kinds just like the Hawaii Business Deductibility Checklist in seconds.

If you already possess a membership, log in and acquire Hawaii Business Deductibility Checklist from your US Legal Forms collection. The Obtain key will show up on every single develop you perspective. You get access to all in the past acquired kinds within the My Forms tab of the bank account.

In order to use US Legal Forms the very first time, here are straightforward instructions to help you get started out:

- Be sure you have picked the proper develop to your area/region. Click the Preview key to examine the form`s content. Look at the develop outline to actually have selected the right develop.

- In case the develop does not suit your needs, take advantage of the Look for discipline on top of the display to get the one that does.

- Should you be pleased with the form, confirm your decision by clicking on the Buy now key. Then, pick the pricing plan you like and give your accreditations to sign up for an bank account.

- Approach the transaction. Make use of your bank card or PayPal bank account to perform the transaction.

- Choose the formatting and acquire the form in your device.

- Make changes. Load, modify and print out and indication the acquired Hawaii Business Deductibility Checklist.

Each and every format you included in your bank account does not have an expiry day and is your own property forever. So, in order to acquire or print out one more copy, just visit the My Forms section and click in the develop you want.

Obtain access to the Hawaii Business Deductibility Checklist with US Legal Forms, the most extensive collection of authorized file templates. Use a large number of specialist and status-specific templates that fulfill your business or individual demands and needs.