Hawaii Sample Self-Employed Independent Contractor Agreement - for ongoing relationship

Description

How to fill out Sample Self-Employed Independent Contractor Agreement - For Ongoing Relationship?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of documents for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of documents such as the Hawaii Sample Self-Employed Independent Contractor Agreement - for ongoing relationship in just a few minutes.

If you already have a monthly subscription, Log In and download the Hawaii Sample Self-Employed Independent Contractor Agreement - for ongoing relationship from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously saved documents in the My documents section of your account.

Complete the transaction. Use your Visa, MasterCard, or PayPal account to finalize the payment.

Select the format and download the document to your device. Make alterations. Fill in, modify, and print/sign the saved Hawaii Sample Self-Employed Independent Contractor Agreement - for ongoing relationship. Each template you add to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the document you desire.

- Ensure you have selected the correct document for your locale/region.

- Click the Preview button to review the content of the document.

- Check the description of the document to confirm you have chosen the correct one.

- If the document does not meet your requirements, use the Search box at the top of the screen to find the right one.

- When you are satisfied with the document, confirm your selection by clicking the Get now button.

- Then, choose your preferred pricing plan and provide your details to register for the account.

Form popularity

FAQ

Such a partner who devotes time and energy in the conduct of the trade of business of the partnership, or in providing services to the partnership as an independent contractor, is a self- employed individual rather than a common law employee.

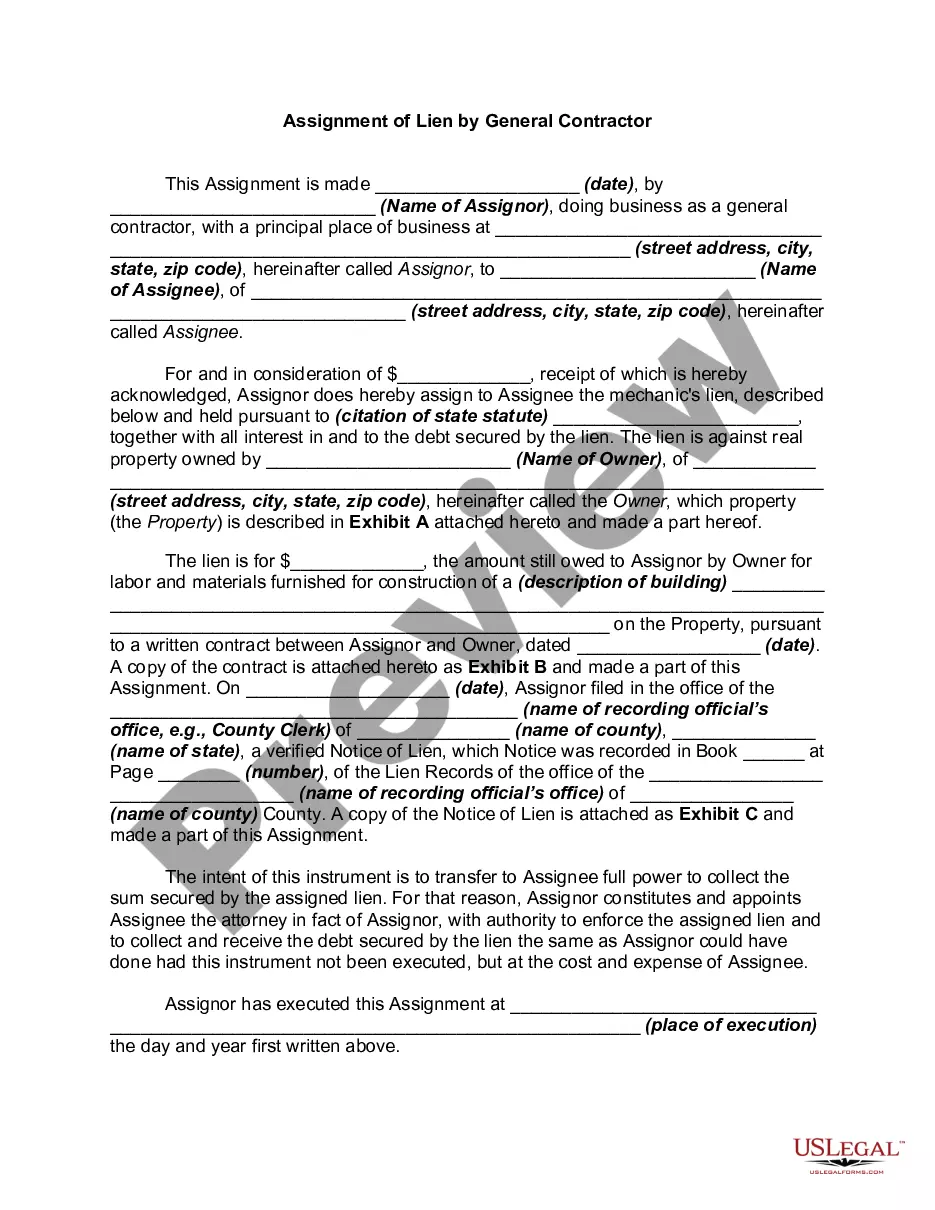

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

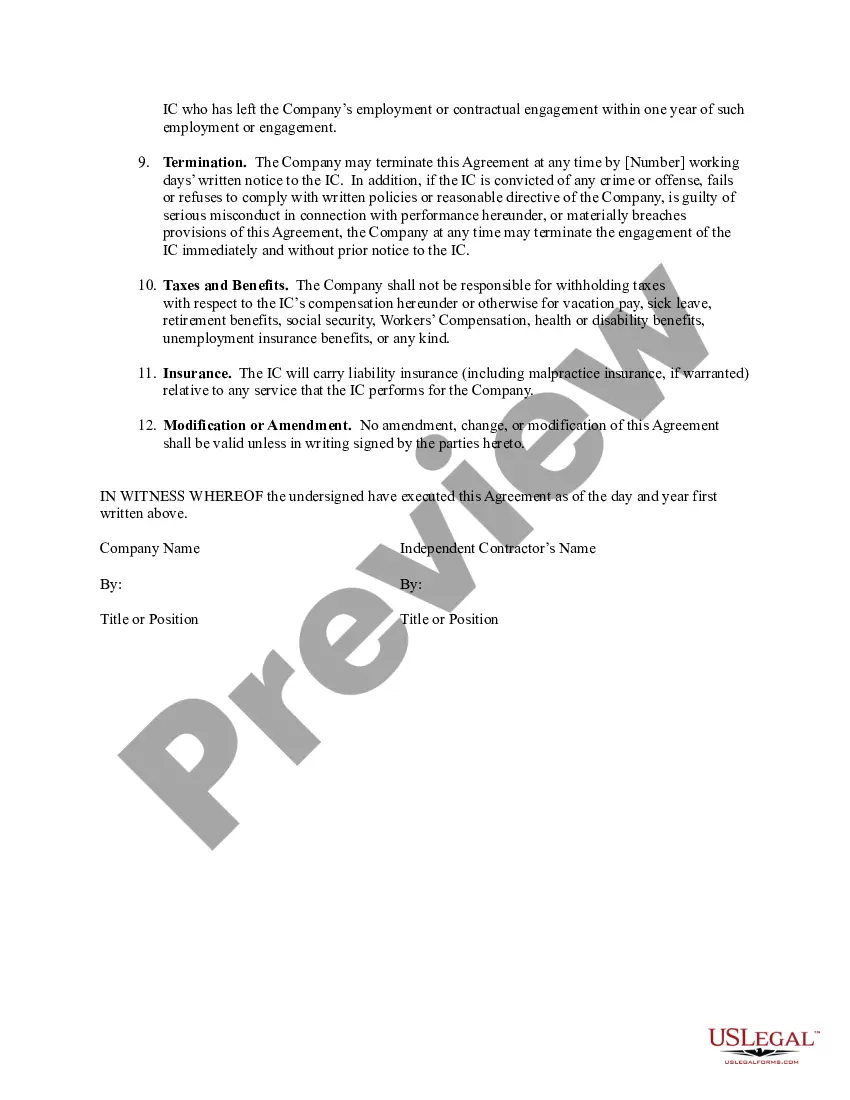

If your independent contractor agreement contains a provision that allows the parties to terminate the relationship at any time, revise the agreement to include a notice provision with at least some kind of a notice period required for termination of the contract.

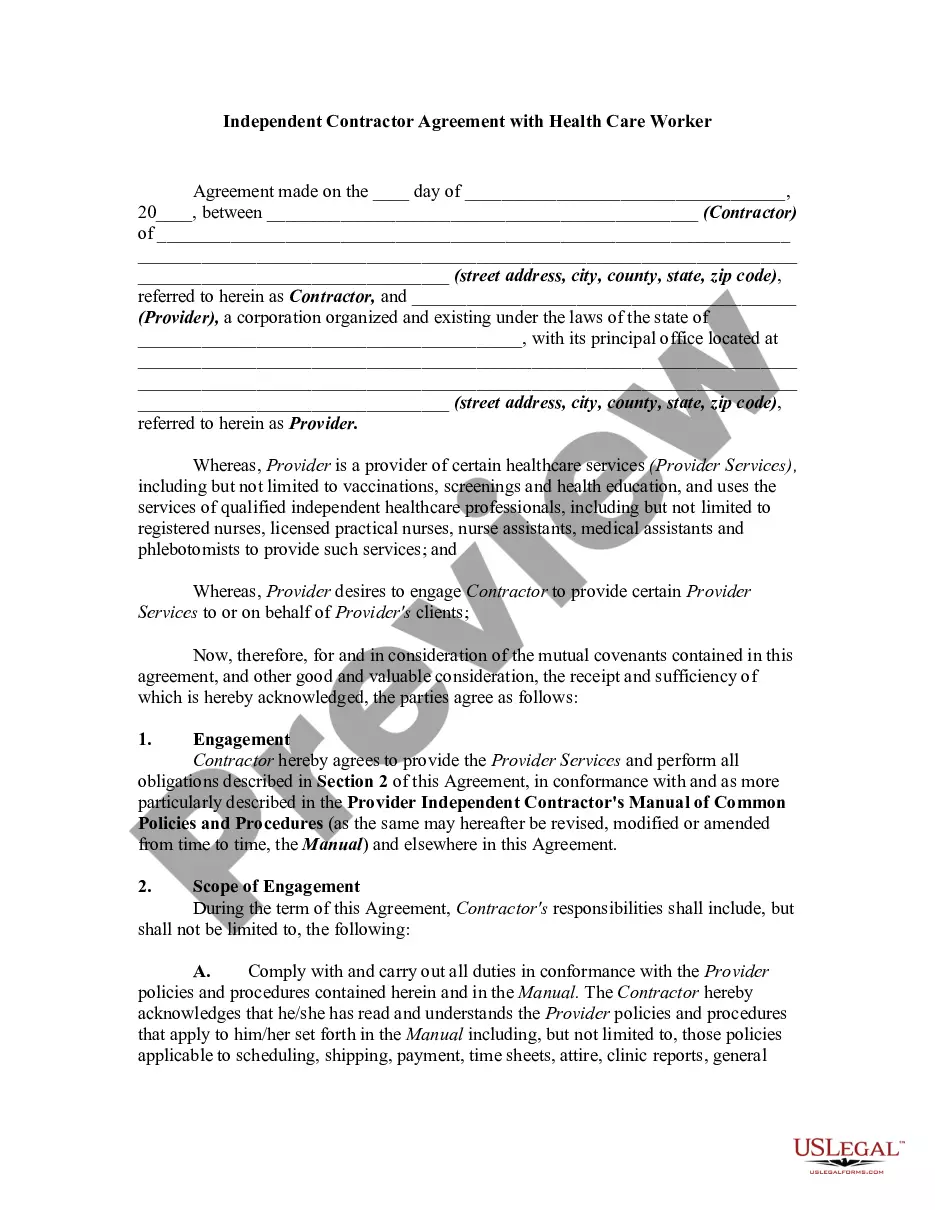

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Partners in a partnership (including certain members of a limited liability company (LLC)) are considered to be self-employed, not employees, when performing services for the partnership.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The fixed, periodic compensation of a partner (often referred to as guaranteed payments or the partner's draw) is therefore self-employment income rather than employee wages. A partner's salary is reported to the partner on a Schedule K-1 as a guaranteed payment rather than on a Form W-2.

Yes. The contractor should receive a 1099 form if the LLC is treated as a partnership as well as a single-member LLC (disregarded entity).

Second, as an independent contractor, your spouse will have to pay his or her own self-employment taxes since you will not be doing payroll taxes as if he or she were an employee.