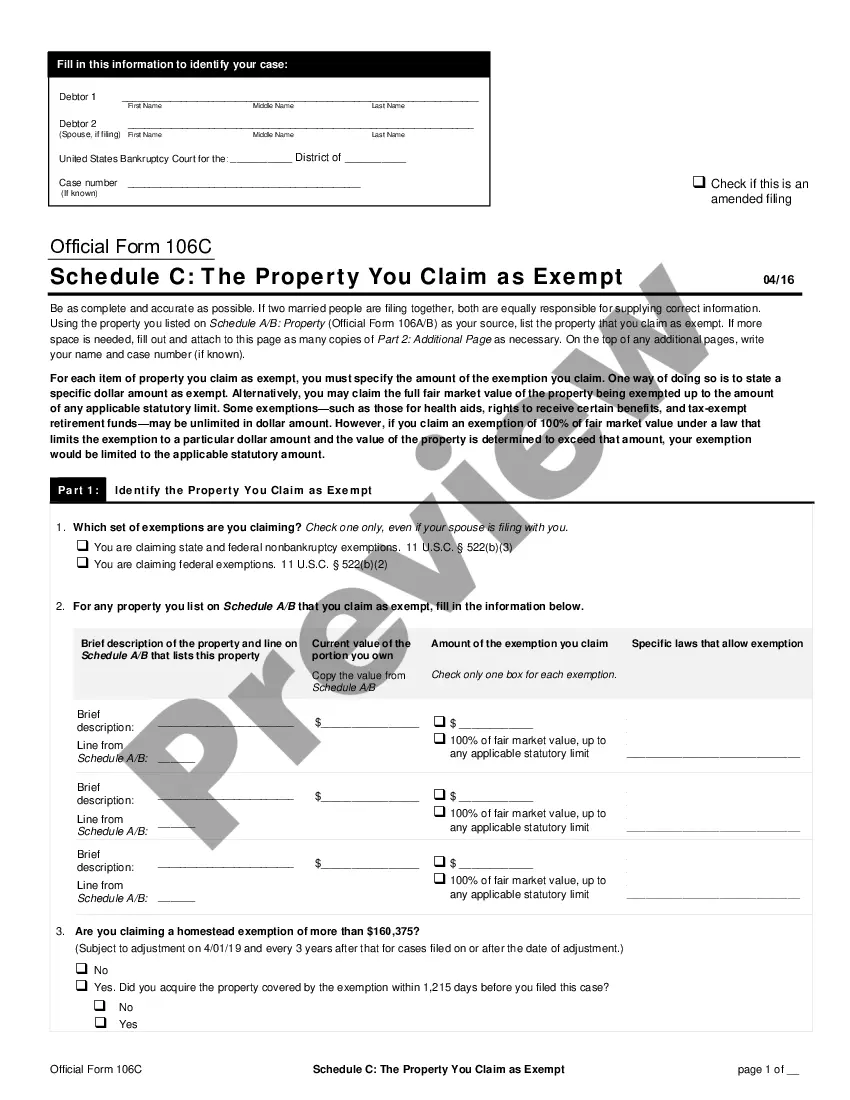

Hawaii Property Claimed as Exempt - Schedule C - Form 6C - Post 2005

Description

How to fill out Property Claimed As Exempt - Schedule C - Form 6C - Post 2005?

Are you in the place the place you need paperwork for sometimes organization or personal functions almost every time? There are plenty of authorized papers layouts available on the Internet, but locating versions you can trust is not simple. US Legal Forms gives 1000s of kind layouts, like the Hawaii Property Claimed as Exempt - Schedule C - Form 6C - Post 2005, that happen to be created in order to meet state and federal demands.

Should you be previously informed about US Legal Forms website and have a free account, just log in. After that, you can download the Hawaii Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 format.

Unless you provide an bank account and need to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you require and ensure it is for the right area/county.

- Make use of the Preview option to analyze the shape.

- See the outline to ensure that you have chosen the appropriate kind.

- If the kind is not what you are trying to find, utilize the Lookup area to get the kind that fits your needs and demands.

- When you find the right kind, just click Acquire now.

- Pick the costs prepare you want, complete the necessary information to produce your bank account, and pay money for your order with your PayPal or charge card.

- Decide on a hassle-free file structure and download your backup.

Discover every one of the papers layouts you have purchased in the My Forms food list. You can get a additional backup of Hawaii Property Claimed as Exempt - Schedule C - Form 6C - Post 2005 whenever, if possible. Just click the essential kind to download or produce the papers format.

Use US Legal Forms, one of the most substantial variety of authorized kinds, to conserve time and steer clear of faults. The support gives expertly created authorized papers layouts that can be used for a selection of functions. Generate a free account on US Legal Forms and initiate making your daily life a little easier.

Form popularity

FAQ

(Official Form 106C) lists the property that you believe you are entitled to keep. If you do not claim the property on this form, it will not be exempted, despite your rights under the law. Before filling out this form, you have to decide whether you will use your state exemptions or the federal exemptions.

§ 703.140(b)(3) An unlimited exemption is allowed in household goods and furnishings, clothes and shoes, appliances, books, animals, crops, or musical instruments, which are held primarily for personal, family, or household use, so long as no single item is worth more than $725.

In general, 704 exemptions protect many specific forms of property and provide for a homestead exemption, whereas 703 exemptions protect fewer forms of property but provide for a ?wild card? exemption where a specific dollar value can be spread out to exempt any property.

The Purpose of 704 Exemptions California 704 bankruptcy exemptions protect your property from creditor collection actions. Think of chapter 7 bankruptcy like this: in chapter 7 bankruptcy, you are putting all of your property and assets up for auction.

California 704 Motor Vehicle Exemption The motor vehicle exemption protects equity in your car, truck, motorcycle, or another vehicle. The System 1 vehicle exemption is $3,625 - 704.010.

There are two places in California state law that detail exemptions for vehicles in bankruptcy. The first, California's 703 bankruptcy exemption allows a debtor to file the following exemptions for vehicles in a Chapter 7 bankruptcy: A $3,525 exemption for the equity held in a personal vehicle.