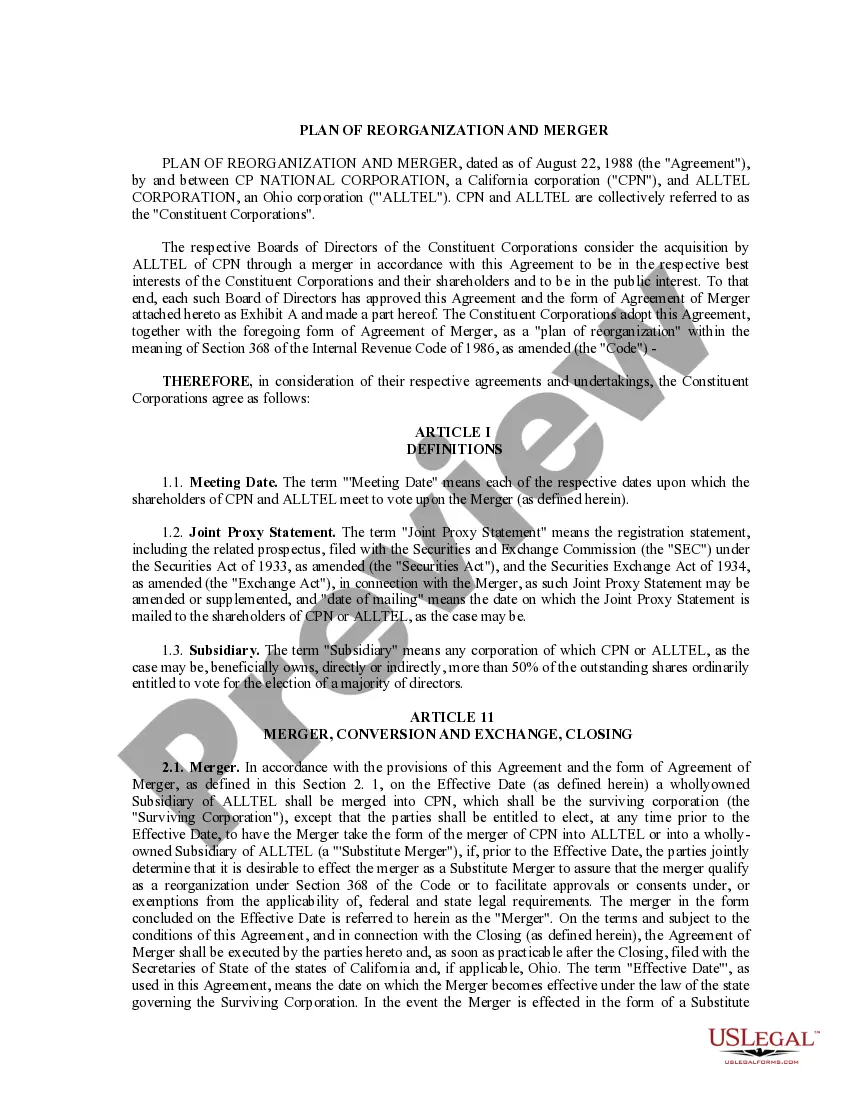

Hawaii Plan of Reorganization and Merger between CP National Corp. and Alltel Corp.

Description

How to fill out Plan Of Reorganization And Merger Between CP National Corp. And Alltel Corp.?

You are able to spend hours on-line trying to find the authorized file design that fits the state and federal specifications you will need. US Legal Forms provides 1000s of authorized forms that happen to be analyzed by professionals. It is possible to download or print out the Hawaii Plan of Reorganization and Merger between CP National Corp. and Alltel Corp. from our services.

If you already have a US Legal Forms bank account, you may log in and then click the Obtain key. Next, you may comprehensive, edit, print out, or indicator the Hawaii Plan of Reorganization and Merger between CP National Corp. and Alltel Corp.. Every single authorized file design you purchase is your own permanently. To acquire one more duplicate of the obtained form, proceed to the My Forms tab and then click the related key.

If you are using the US Legal Forms site for the first time, stick to the basic directions beneath:

- Very first, ensure that you have selected the correct file design for that region/metropolis of your choosing. See the form information to make sure you have picked the appropriate form. If offered, take advantage of the Preview key to search through the file design at the same time.

- If you want to get one more variation from the form, take advantage of the Lookup area to discover the design that meets your requirements and specifications.

- When you have located the design you want, just click Acquire now to proceed.

- Pick the pricing prepare you want, type in your accreditations, and sign up for your account on US Legal Forms.

- Total the purchase. You should use your credit card or PayPal bank account to fund the authorized form.

- Pick the file format from the file and download it to the gadget.

- Make adjustments to the file if required. You are able to comprehensive, edit and indicator and print out Hawaii Plan of Reorganization and Merger between CP National Corp. and Alltel Corp..

Obtain and print out 1000s of file layouts using the US Legal Forms Internet site, that offers the largest assortment of authorized forms. Use specialist and express-particular layouts to deal with your business or personal needs.