Hawaii Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan

Description

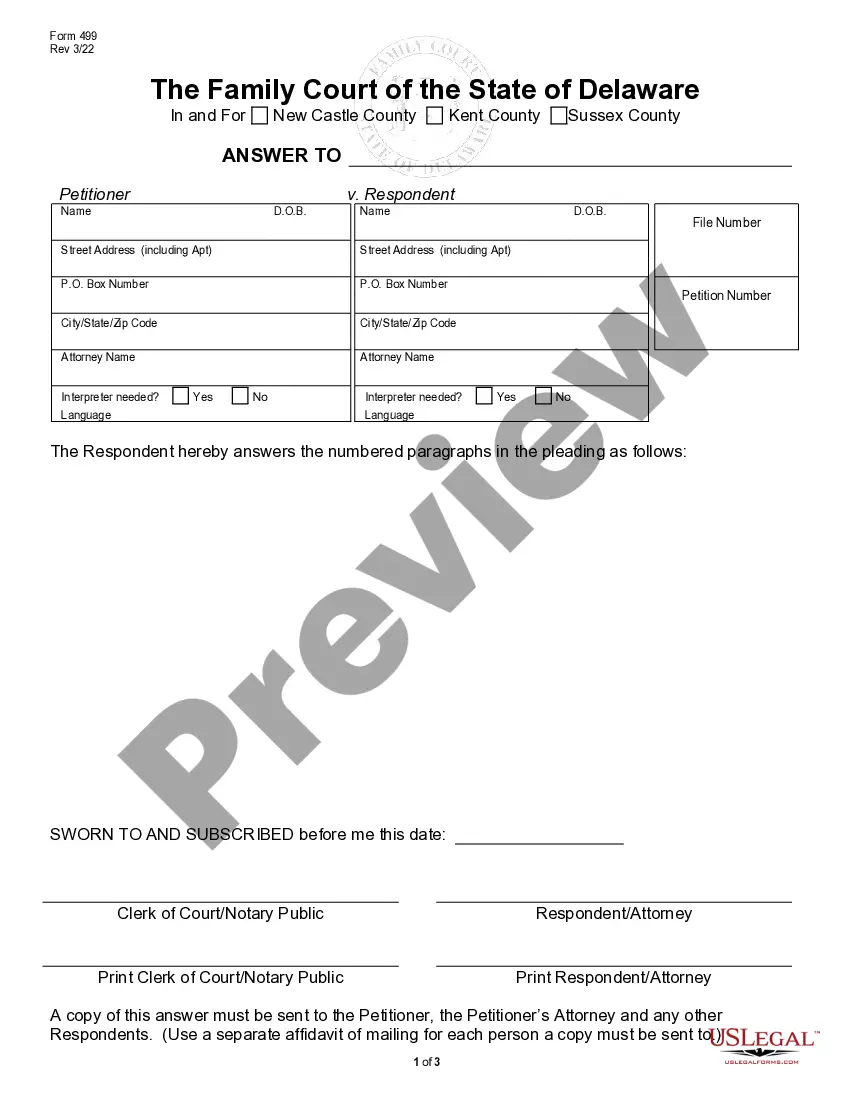

How to fill out Adoption Of Nonemployee Directors Deferred Compensation Plan With Copy Of Plan?

Are you presently within a placement that you need papers for sometimes business or individual purposes nearly every time? There are plenty of lawful papers layouts available online, but discovering types you can rely on isn`t easy. US Legal Forms gives 1000s of kind layouts, much like the Hawaii Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan, that are published to satisfy federal and state demands.

If you are currently acquainted with US Legal Forms website and also have a merchant account, simply log in. Next, it is possible to obtain the Hawaii Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan format.

Should you not provide an profile and want to start using US Legal Forms, follow these steps:

- Get the kind you want and ensure it is for that correct area/area.

- Make use of the Preview switch to review the form.

- Read the description to actually have selected the right kind.

- In case the kind isn`t what you`re looking for, use the Lookup industry to get the kind that meets your needs and demands.

- Whenever you discover the correct kind, click on Buy now.

- Opt for the prices prepare you desire, fill out the desired information to make your bank account, and purchase an order with your PayPal or charge card.

- Pick a hassle-free file formatting and obtain your duplicate.

Locate all of the papers layouts you possess bought in the My Forms menu. You can aquire a more duplicate of Hawaii Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan any time, if possible. Just click on the necessary kind to obtain or print the papers format.

Use US Legal Forms, the most substantial assortment of lawful types, in order to save time as well as prevent blunders. The service gives professionally made lawful papers layouts that can be used for an array of purposes. Generate a merchant account on US Legal Forms and initiate generating your life a little easier.

Form popularity

FAQ

Deferring income to retirement might help avoid high state income taxes (ex: California, New York, etc) if you're planning to move to a low-tax state. The biggest risk of deferred compensation plans is they're not guaranteed; if your company goes bankrupt, you might receive none of the income you deferred.

In general, deferred compensation plans allow the participant to defer income today and withdraw it at some point in the future (usually upon retirement) when taxable income is likely to be lower. Like 401(k) plans, participants must elect how to invest their contributions.

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

One of the options available to you when you set up your deferred compensation plan is to name beneficiaries. Naming beneficiaries on your plan is essentially the same process as naming beneficiaries in a 401(k) plan or other retirement plan.

The Bottom Line. If you have a qualified plan and have passed the vesting period, your deferred compensation is yours, even if you quit with no notice on very bad terms. If you have a non-qualified plan, you may have to forfeit all of your deferred compensation by quitting depending on your plan's specific terms.