The Hawaii Severance Compensation Program is a comprehensive employee benefit program designed to provide financial support to workers who are terminated due to reasons beyond their control, such as layoffs, plant closures, or workforce reductions. This program ensures that employees receive a fair and equitable amount of compensation to assist them during the transition period between jobs. Under the Hawaii Severance Compensation Program, eligible employees are entitled to receive severance pay, which is a form of financial compensation provided by the employer upon termination of employment. Severance pay aims to ease the financial burden faced by employees who lose their jobs unexpectedly, giving them some financial stability as they search for new employment opportunities. The amount of severance pay can vary depending on several factors, including the length of employment, position within the company, and the organization's specific policies. Typically, severance pay is calculated based on a certain number of weeks or months' worth of salary, with some employers offering a fixed lump-sum amount. The Hawaii Severance Compensation Program also encompasses other forms of compensation, such as continuation of health insurance coverage. This benefit ensures that terminated employees can maintain their health insurance coverage for a specified period, providing them with access to medical services while they navigate the job market. It is important to note that while the Hawaii Severance Compensation Program establishes a general framework for severance benefits, the specific program details vary depending on the employer. Some companies may offer enhanced severance packages, including additional benefits or incentives to support employees during this challenging time. Different types of Hawaii Severance Compensation Programs can include: 1. Standard Severance Pay: This refers to the traditional severance package provided to eligible employees upon termination, typically based on years of service or salary. 2. Enhanced Severance Pay: Certain employers may opt to offer a more generous severance package to employees, providing additional financial assistance or benefits above the standard requirements. 3. Voluntary Severance Program: Some organizations may introduce voluntary severance programs, which offer employees the opportunity to leave the company voluntarily in exchange for a more lucrative severance package. This helps employers streamline their workforce and cut costs without resorting to layoffs. 4. Executive Severance Benefits: Executives and high-level employees may be entitled to specific severance packages tailored to their position, often including extended periods of severance pay, pension plans, stock options, or other executive benefits. In summary, the Hawaii Severance Compensation Program ensures that workers facing job loss receive fair and appropriate compensation. Different types of severance packages cater to the diverse needs of employees and can range from standard pay to enhanced benefits, reflecting the varying policies and practices of individual employers.

Hawaii Severance Compensation Program

Description

How to fill out Hawaii Severance Compensation Program?

Have you been in a placement that you require paperwork for possibly company or personal purposes virtually every working day? There are a lot of legitimate document layouts accessible on the Internet, but getting types you can trust is not easy. US Legal Forms offers thousands of type layouts, just like the Hawaii Severance Compensation Program, which are published to satisfy federal and state demands.

Should you be previously knowledgeable about US Legal Forms internet site and possess a free account, just log in. Afterward, you can download the Hawaii Severance Compensation Program format.

Should you not offer an bank account and want to begin to use US Legal Forms, abide by these steps:

- Discover the type you want and ensure it is for the appropriate town/county.

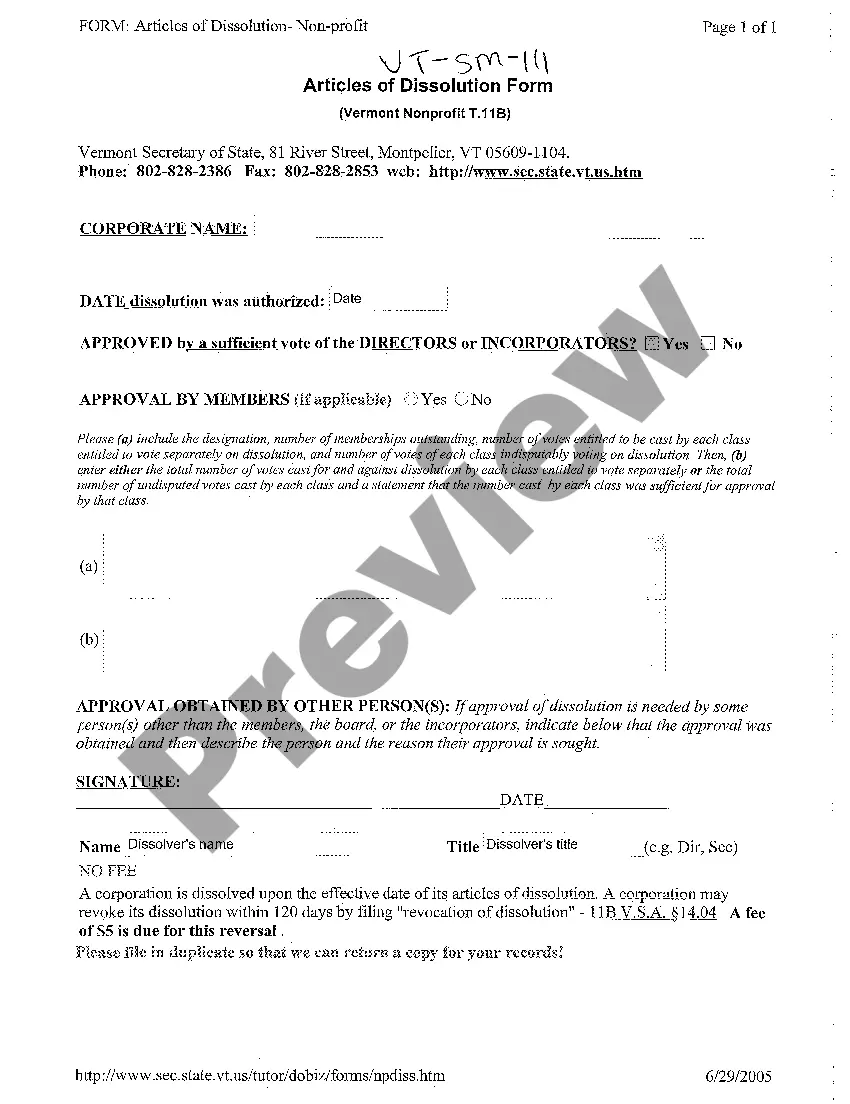

- Use the Preview option to examine the shape.

- Browse the description to ensure that you have chosen the right type.

- In case the type is not what you`re seeking, utilize the Lookup industry to obtain the type that suits you and demands.

- Once you discover the appropriate type, click Get now.

- Select the costs program you need, fill in the desired information and facts to generate your account, and pay money for an order using your PayPal or charge card.

- Pick a hassle-free file file format and download your backup.

Find every one of the document layouts you may have purchased in the My Forms food list. You can aquire a additional backup of Hawaii Severance Compensation Program at any time, if needed. Just click on the needed type to download or produce the document format.

Use US Legal Forms, one of the most extensive collection of legitimate varieties, in order to save time as well as steer clear of mistakes. The services offers expertly manufactured legitimate document layouts which you can use for a selection of purposes. Generate a free account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

The amount you can defer (including pre-tax and Roth contributions) to all your plans (not including 457(b) plans) is $22,500 in 2023 ($20,500 in 2022; $19,500 in 2020 and 2021; $19,000 in 2021).

Key Takeaways. Deferred compensation plans allow employees to withhold a certain amount of their salaries or wages for a specific purpose. Deferred compensation plans can be qualified or non-qualified. Qualified plans fall under the Employee Retirement Income Security Act and include 401(k)s and 403(b)s.

The State Deferred Compensation Plan (or ?Plan?) is a voluntary retirement savings plan, governed by Internal Revenue Code section 457(b), that helps set aside your pre-tax contributions through payroll deductions for future retirement needs.

Generally, under Haw. Rev. Stat. § 388-3, an employer must issue a final paycheck to a terminated employee immediately, or if immediate payment is not possible, no later than the next business day.

With a nonqualified deferred compensation (NQDC) plan, your employees can defer some of their pay until a later date. This type of deferred compensation plan typically pays out income after an employee leaves their job, like in retirement, for instance.

Benefits begin on the 8th day of illness or injury, following a seven consecutive day waiting period. A maximum of 26 weeks of paid benefits during a benefit year.

Your contributions are made on a pre-tax basis, and any earnings are tax-deferred. Taxes are due when money is distributed from the plan.

To be eligible for TDI benefits, an employee must have at least 14 weeks of Hawaii employment during each of which the employee was paid for 20 hours or more and earned not less than $400 in the 52 weeks preceding the first day of disability. The 14 weeks need not be consecutive nor with only one employer.