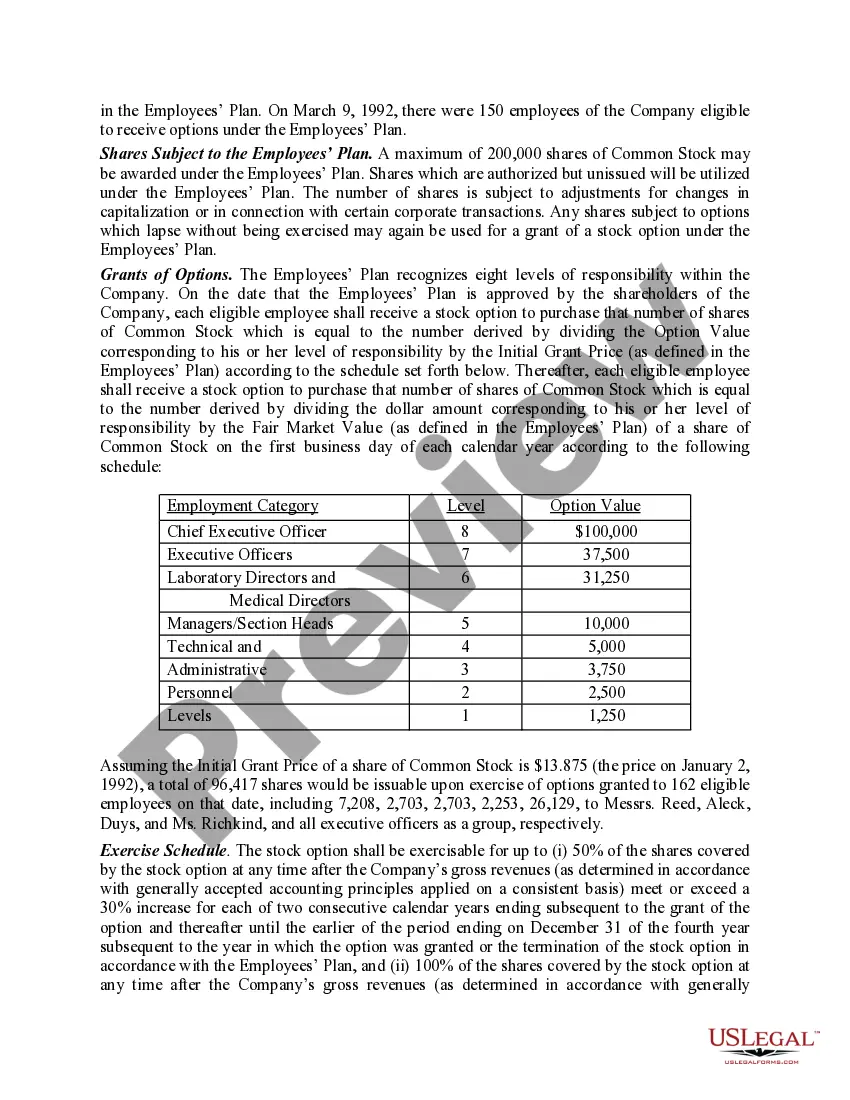

Title: Hawaii Proposal to Approve Adoption of Employees' Stock Option Plan: A Comprehensive Overview Keywords: Hawaii, Proposal, Approve, Adoption, Employees' Stock Option Plan Introduction: In this article, we will delve into the details of Hawaii's proposal to approve the adoption of an Employees' Stock Option Plan (ESOP). We will provide relevant information to help you understand the proposal's purpose, benefits, and types specific to Hawaii. 1. Understanding the Employees' Stock Option Plan (ESOP): The Employees' Stock Option Plan (ESOP) is a compensation strategy that allows employees to purchase or be granted shares of their company's stock. It is designed to align employees' interests with corporate performance, fostering an ownership mindset. 2. Hawaii's Proposal and Its Importance: The Hawaii Proposal aims to obtain legal approval for companies operating in the state to establish their own Sops. The proposal recognizes the numerous advantages that Sops offer both employers and employees, fostering long-term growth, retention, and financial well-being. 3. Benefits of the Employees' Stock Option Plan (ESOP): a) Employee Retention and Motivation: Sops help attract and retain talented employees, as stock options provide an additional incentive to contribute to a company's success. b) Company Growth: By offering stock options, companies can enable employees to share in their growth, which boosts morale and productivity. c) Wealth Creation for Employees: Sops can be a valuable tool in wealth creation, as employees can sell their shares at a future date, potentially benefiting from the company's appreciation. d) Tax Advantages: Sops often offer tax advantages for both employers and employees, making it a preferred method of compensation. 4. Types of Hawaii's Proposal to Approve Adoption of Employees' Stock Option Plan: a) Broad-Based ESOP: This type of plan is available to all eligible employees within the company, regardless of title or position. b) Executive-Only ESOP: Targeted towards top-level management, this plan offers stock options to executives and key personnel, aligning their interests with the overall success of the organization. c) Non-Qualified ESOP: This plan differs from traditional Sops in terms of tax regulations and eligibility requirements, providing more flexibility in terms of stock offering. d) Qualified ESOP: A qualified plan adheres to specific regulations outlined by the Internal Revenue Service (IRS), ensuring various tax advantages for both employers and employees. Conclusion: Hawaii's Proposal to Approve Adoption of Employees' Stock Option Plan holds significant potential for both employers and employees in the state. By implementing Sops, companies can motivate and retain talented individuals while fostering prosperity and wealth creation. The proposal encompasses different types of Sops, offering flexibility and catered options for various employee groups.

Hawaii Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Hawaii Proposal To Approve Adoption Of Employees' Stock Option Plan?

If you need to total, obtain, or produce authorized document layouts, use US Legal Forms, the greatest selection of authorized forms, which can be found online. Use the site`s easy and convenient look for to obtain the documents you need. Numerous layouts for company and individual purposes are sorted by groups and claims, or keywords. Use US Legal Forms to obtain the Hawaii Proposal to Approve Adoption of Employees' Stock Option Plan in just a few click throughs.

If you are presently a US Legal Forms client, log in in your profile and then click the Acquire switch to obtain the Hawaii Proposal to Approve Adoption of Employees' Stock Option Plan. You may also accessibility forms you in the past acquired from the My Forms tab of your own profile.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that correct town/nation.

- Step 2. Make use of the Preview option to check out the form`s information. Never neglect to read the information.

- Step 3. If you are unsatisfied with the develop, make use of the Research discipline towards the top of the screen to find other variations of the authorized develop web template.

- Step 4. When you have identified the form you need, click the Acquire now switch. Choose the costs plan you favor and add your credentials to register on an profile.

- Step 5. Procedure the financial transaction. You should use your bank card or PayPal profile to finish the financial transaction.

- Step 6. Select the formatting of the authorized develop and obtain it on your product.

- Step 7. Comprehensive, modify and produce or indication the Hawaii Proposal to Approve Adoption of Employees' Stock Option Plan.

Every single authorized document web template you purchase is your own forever. You might have acces to every develop you acquired within your acccount. Click on the My Forms section and decide on a develop to produce or obtain again.

Compete and obtain, and produce the Hawaii Proposal to Approve Adoption of Employees' Stock Option Plan with US Legal Forms. There are millions of skilled and express-particular forms you can utilize to your company or individual requires.