The Hawaii Nonqualified Stock Option Agreement of Orion Network Systems, Inc. is a legal document that outlines the terms and conditions of granting nonqualified stock options to employees or certain individuals based in Hawaii. This agreement is specific to Orion Network Systems, Inc., a company operating in Hawaii, and it aims to provide employees with the opportunity to purchase company stock at a predetermined price within a defined timeframe. The nonqualified stock option agreement typically includes the following key details: 1. Purpose and Terms: The agreement starts by clarifying the purpose of the document, which is to grant nonqualified stock options to eligible employees and individuals. It highlights the terms and conditions that govern the exercise and transferability of these options. 2. Grant of Stock Options: This section outlines the exact number of stock options being granted to the employee or individual. It specifies the grant date and provides any restrictions or vesting schedule associated with the options. 3. Exercise Price: The agreement states the exercise price per share, which is the amount the option holder must pay to purchase the company's stock. The exercise price is usually set at a discount to the market price on the grant date. 4. Exercise Period: It details the duration within which the option holder can exercise their stock options. The exercise period may start from the grant date or other specified dates and can extend for a predetermined number of years. 5. Exercising Options: This section explains the procedure and requirements for exercising the stock options. It may include information about submitting a written notice to the company, payment methods, and any tax implications. 6. Termination of Options: The agreement describes the circumstances under which the stock options may terminate, such as upon the employee's voluntary termination, retirement, death, or disability. It may outline rules related to the transferability of options and provide details on what happens to exercised options upon termination. 7. Tax Considerations: This section briefly discusses the general tax implications associated with nonqualified stock options. However, it is important to consult a tax advisor to understand the specific tax consequences as they can vary based on individual circumstances and applicable tax laws. Different types of Hawaii Nonqualified Stock Option Agreements of Orion Network Systems, Inc. may exist based on various factors such as the roles and responsibilities of employees, their seniority levels, and the company's stock option policies. These agreements could have different terms, exercise periods, and vesting schedules depending on the specific circumstances of the individual's employment or position within the company.

Hawaii Nonqualified Stock Option Agreement of Orion Network Systems, Inc.

Description

How to fill out Hawaii Nonqualified Stock Option Agreement Of Orion Network Systems, Inc.?

Are you currently in the place in which you need files for possibly company or person functions almost every day? There are plenty of legitimate record themes available on the Internet, but discovering types you can rely on isn`t easy. US Legal Forms offers 1000s of form themes, just like the Hawaii Nonqualified Stock Option Agreement of Orion Network Systems, Inc., which can be written to fulfill federal and state requirements.

Should you be previously knowledgeable about US Legal Forms internet site and possess an account, simply log in. Following that, you may down load the Hawaii Nonqualified Stock Option Agreement of Orion Network Systems, Inc. web template.

If you do not have an profile and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is for that right town/area.

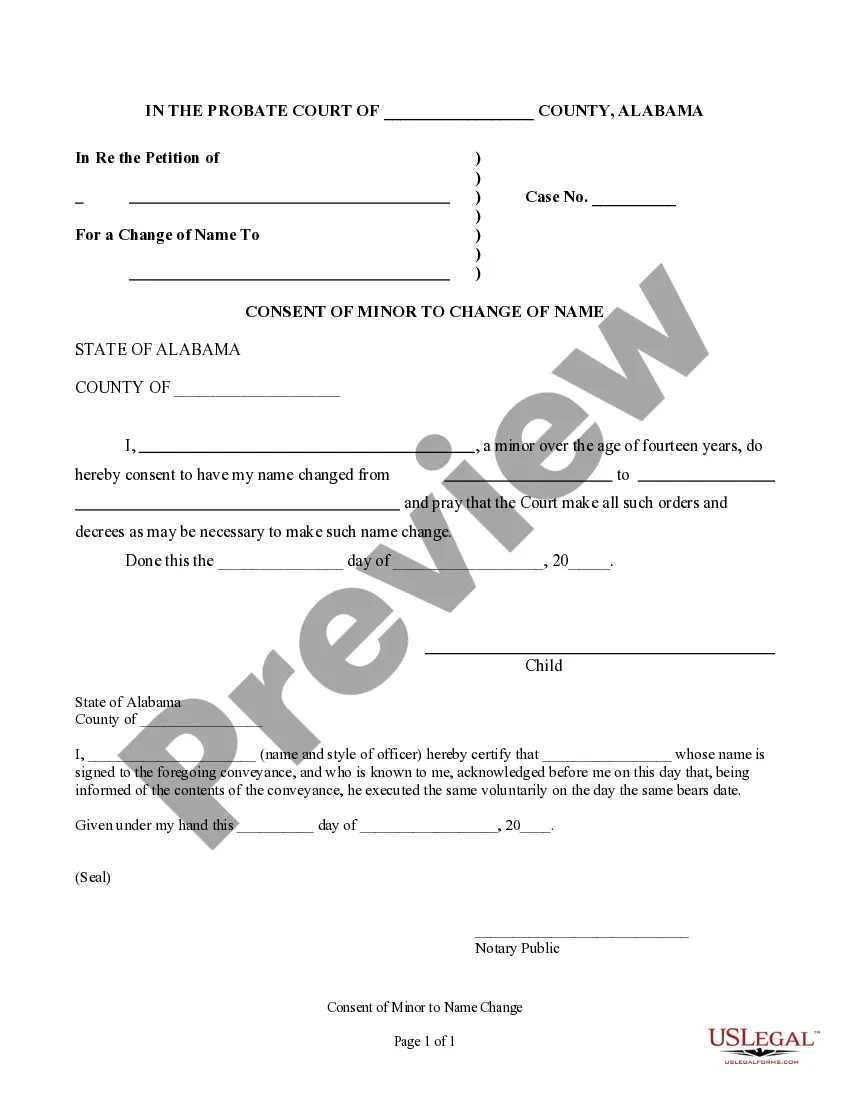

- Use the Preview key to review the shape.

- Look at the explanation to actually have selected the proper form.

- In the event the form isn`t what you are looking for, utilize the Search area to find the form that fits your needs and requirements.

- Whenever you get the right form, click Buy now.

- Select the rates plan you need, fill out the desired information to generate your bank account, and buy the order utilizing your PayPal or bank card.

- Pick a handy paper formatting and down load your copy.

Find every one of the record themes you might have purchased in the My Forms menus. You can aquire a more copy of Hawaii Nonqualified Stock Option Agreement of Orion Network Systems, Inc. anytime, if required. Just go through the necessary form to down load or print the record web template.

Use US Legal Forms, probably the most extensive variety of legitimate forms, to save lots of time as well as prevent blunders. The assistance offers skillfully made legitimate record themes which can be used for a variety of functions. Produce an account on US Legal Forms and start producing your lifestyle a little easier.