Hawaii Employee Stock Ownership Trust Agreement

Description

How to fill out Employee Stock Ownership Trust Agreement?

It is possible to devote time online attempting to find the legal papers format that suits the federal and state specifications you need. US Legal Forms gives a huge number of legal forms that happen to be evaluated by experts. You can actually acquire or print the Hawaii Employee Stock Ownership Trust Agreement from your service.

If you currently have a US Legal Forms bank account, you may log in and then click the Acquire key. After that, you may full, edit, print, or signal the Hawaii Employee Stock Ownership Trust Agreement. Every legal papers format you purchase is the one you have forever. To acquire another copy of any obtained kind, go to the My Forms tab and then click the related key.

If you use the US Legal Forms website initially, stick to the basic directions under:

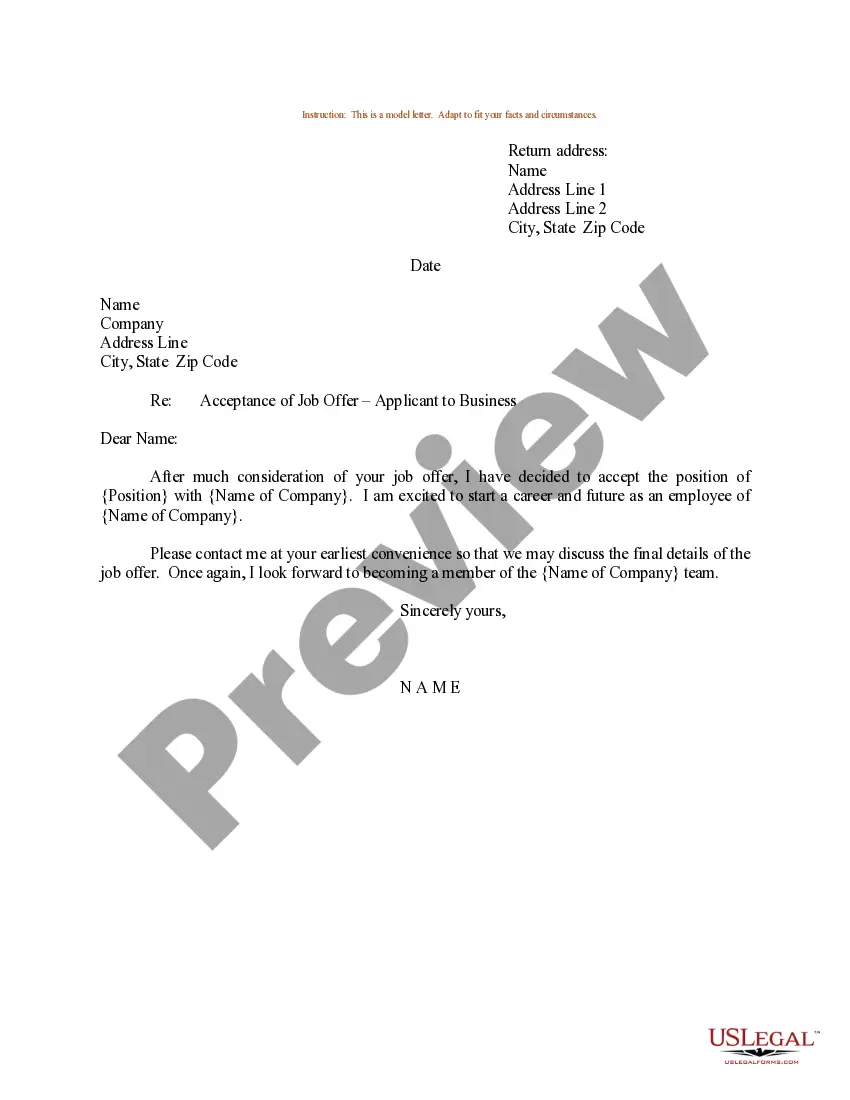

- Very first, be sure that you have chosen the best papers format for that area/metropolis of your choosing. Browse the kind outline to ensure you have selected the right kind. If readily available, use the Preview key to appear from the papers format also.

- If you would like locate another model of your kind, use the Look for discipline to get the format that fits your needs and specifications.

- When you have discovered the format you desire, click Purchase now to proceed.

- Select the pricing program you desire, enter your qualifications, and register for a free account on US Legal Forms.

- Full the purchase. You can use your Visa or Mastercard or PayPal bank account to fund the legal kind.

- Select the format of your papers and acquire it for your gadget.

- Make alterations for your papers if necessary. It is possible to full, edit and signal and print Hawaii Employee Stock Ownership Trust Agreement.

Acquire and print a huge number of papers templates while using US Legal Forms site, which offers the biggest assortment of legal forms. Use professional and express-specific templates to take on your organization or person requirements.

Form popularity

FAQ

The rule of thumb is to create a 10% ESOP pool, and most Startups use this pool over two to four years. Suppose you are among the top five to six early hires in the company, and you are offered 0.5% equity through ESOPs. In that case, you can negotiate for 1% equity as fair compensation.

Under federal tax law, owners of closely held companies can defer and possibly avoid tax on the gains made when selling stock to an ESOP?when the following conditions are met: The ESOP company is a C corporation at the time of the sale. The ESOP owns at least 30 percent of the company immediately after the sale. What is an ESOP? The ESOP Association ? articles ? what-is-an... The ESOP Association ? articles ? what-is-an...

An employee share ownership trust (ESOT) is a stock program that allows for the acquisition of a company's shares by its employees. An ESOT works through a profit-sharing scheme and a trust that acquires the shares. Employees and the company can benefit through tax incentives by using an ESOT. Employee Share Ownership Trust (ESOT): What it is, How it Works investopedia.com ? terms ? employeeshareo... investopedia.com ? terms ? employeeshareo...

Amounts rolled over from an ESOP are not taxed as your income, if the rollover is made within 60 days of the ESOP distribution. You can transfer the distribution to an individual retirement account (IRA), an individual retirement annuity, or to another employer's qualified retirement plan.

Each eligible ESOP participant (?Eligible Participant?) must be provided the opportunity to diversify up to 25% of his or her company stock account each year over a five year period, then increasing to 50% during the sixth and final year.

The ESOP owns at least 30 percent of the company immediately after the sale. (The sale of stock by two or more shareholders counts toward this 30 percent requirement). The sale proceeds are re-invested in U.S. domestic corporation stocks and bonds within a set time period.

ESOPs must follow rules about which employees participate in the plan and on what terms, while EOTs offer great flexibility. Employee ownership can also be set up without creating a trust. See our pages on equity compensation plans and on other kinds of employee ownership options, including direct share ownership. An Introduction to Employee Ownership Trusts | NCEO nceo.org ? article ? introduction-employee-... nceo.org ? article ? introduction-employee-...

An ESOP is an employee benefit program under which employer stock is transferred to individual employee accounts within a tax-exempt trust. The Employee Ownership Trust: An ESOP Alternative - EOT Advisors eotadvisors.com ? the-employee-ownership-trust-e... eotadvisors.com ? the-employee-ownership-trust-e...