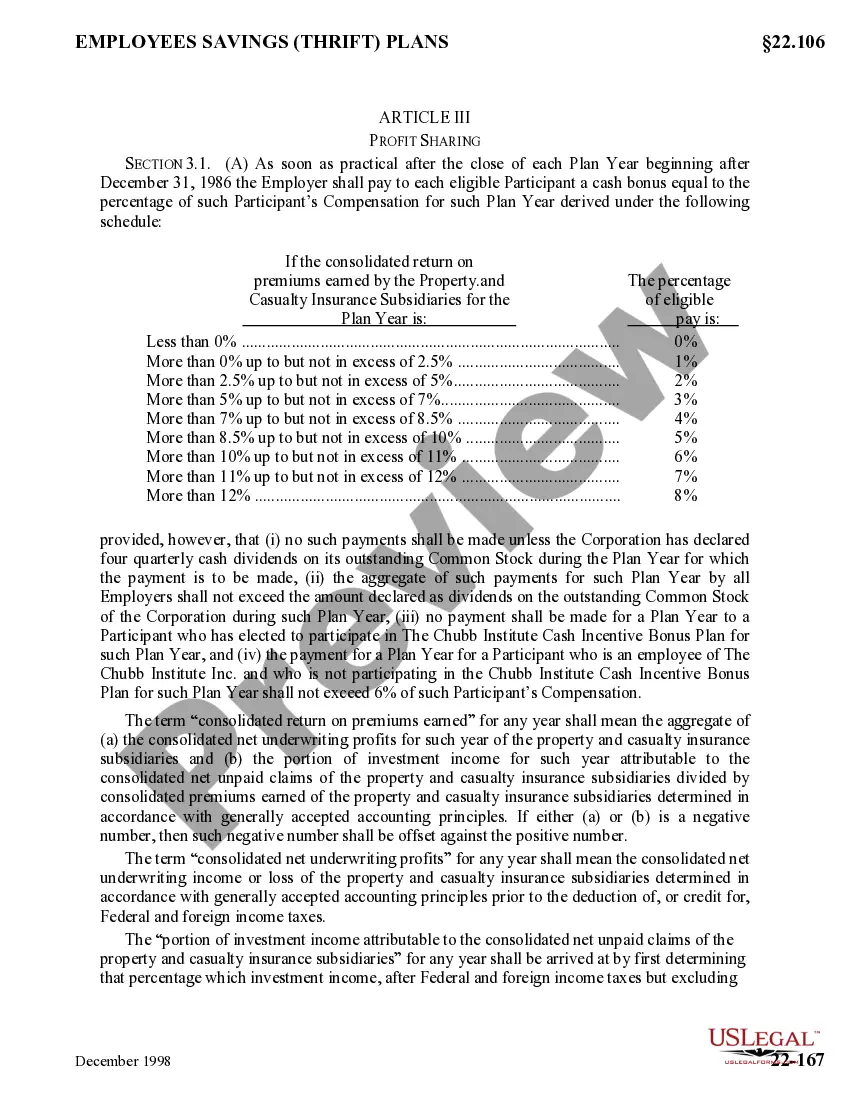

Hawaii Profit Sharing Plan is a retirement benefit program offered by employers in the state of Hawaii. It allows employees to share in the profits of the company and save for their retirement simultaneously. This plan is designed to motivate and reward employees for their hard work and dedication by providing them with a portion of the company's profits. The Hawaii Profit Sharing Plan works by allocating a percentage of the company's annual profits to the employees' accounts based on certain predetermined criteria. These criteria can be determined by the employer or may be outlined in the plan documents. The amount allocated to each employee's account is often based on their salary or the number of years they have been employed with the company. One of the primary benefits of the Hawaii Profit Sharing Plan is that it provides a tax-advantaged way for employees to save for retirement. Contributions made by the employer are typically tax-deductible, and the growth of investments within the plan is tax-deferred until the funds are withdrawn during retirement. The funds contributed to the Hawaii Profit Sharing Plan are usually invested in a wide range of investment options such as stocks, bonds, mutual funds, or a combination of these. Employees have the opportunity to choose the investment options that best align with their risk tolerance and investment goals. Different types of Hawaii Profit Sharing Plans may include: 1. Traditional Profit Sharing Plan: This is the most common type, where the employer contributes a portion of the company's profits to employees' retirement accounts. 2. 401(k) Profit Sharing Plan: This plan combines features of a traditional 401(k) plan with profit sharing. Employees can make their own pre-tax contributions to the plan, and the employer can also make profit-sharing contributions. 3. Defined Contribution Profit Sharing Plan: In this type of plan, the employer determines the amount of contributions made to employees' retirement accounts based on a predetermined formula, such as a percentage of salary or company profits. 4. New Comparability Plan: This plan allows employers to allocate different contribution levels to different groups of employees based on factors such as job position or length of service. It provides flexibility in designing a plan that suits the company's financial goals. In conclusion, the Hawaii Profit Sharing Plan is a retirement benefit program that enables employees to share in the profitability of their company and save for their future. With various types of plans available, employers in Hawaii can choose the one that best fits their business structure and goals, ensuring employees' long-term financial security.

Hawaii Profit Sharing Plan

Description

How to fill out Hawaii Profit Sharing Plan?

Are you in a situation in which you need to have files for either company or person uses just about every day? There are plenty of authorized papers layouts available on the net, but locating kinds you can depend on isn`t simple. US Legal Forms gives 1000s of kind layouts, just like the Hawaii Profit Sharing Plan, which can be created to meet federal and state needs.

When you are currently familiar with US Legal Forms website and also have a merchant account, simply log in. Following that, you are able to obtain the Hawaii Profit Sharing Plan design.

Should you not have an accounts and want to begin using US Legal Forms, abide by these steps:

- Obtain the kind you will need and make sure it is to the proper area/county.

- Utilize the Preview switch to review the shape.

- Look at the outline to actually have chosen the proper kind.

- When the kind isn`t what you`re seeking, use the Research area to discover the kind that meets your needs and needs.

- If you find the proper kind, simply click Buy now.

- Pick the prices program you desire, fill out the necessary information to make your money, and purchase the transaction using your PayPal or bank card.

- Decide on a hassle-free file formatting and obtain your duplicate.

Discover each of the papers layouts you possess purchased in the My Forms menus. You may get a more duplicate of Hawaii Profit Sharing Plan anytime, if required. Just click the required kind to obtain or print the papers design.

Use US Legal Forms, one of the most considerable assortment of authorized types, to save lots of time and avoid blunders. The service gives professionally created authorized papers layouts that can be used for a selection of uses. Make a merchant account on US Legal Forms and initiate creating your life a little easier.