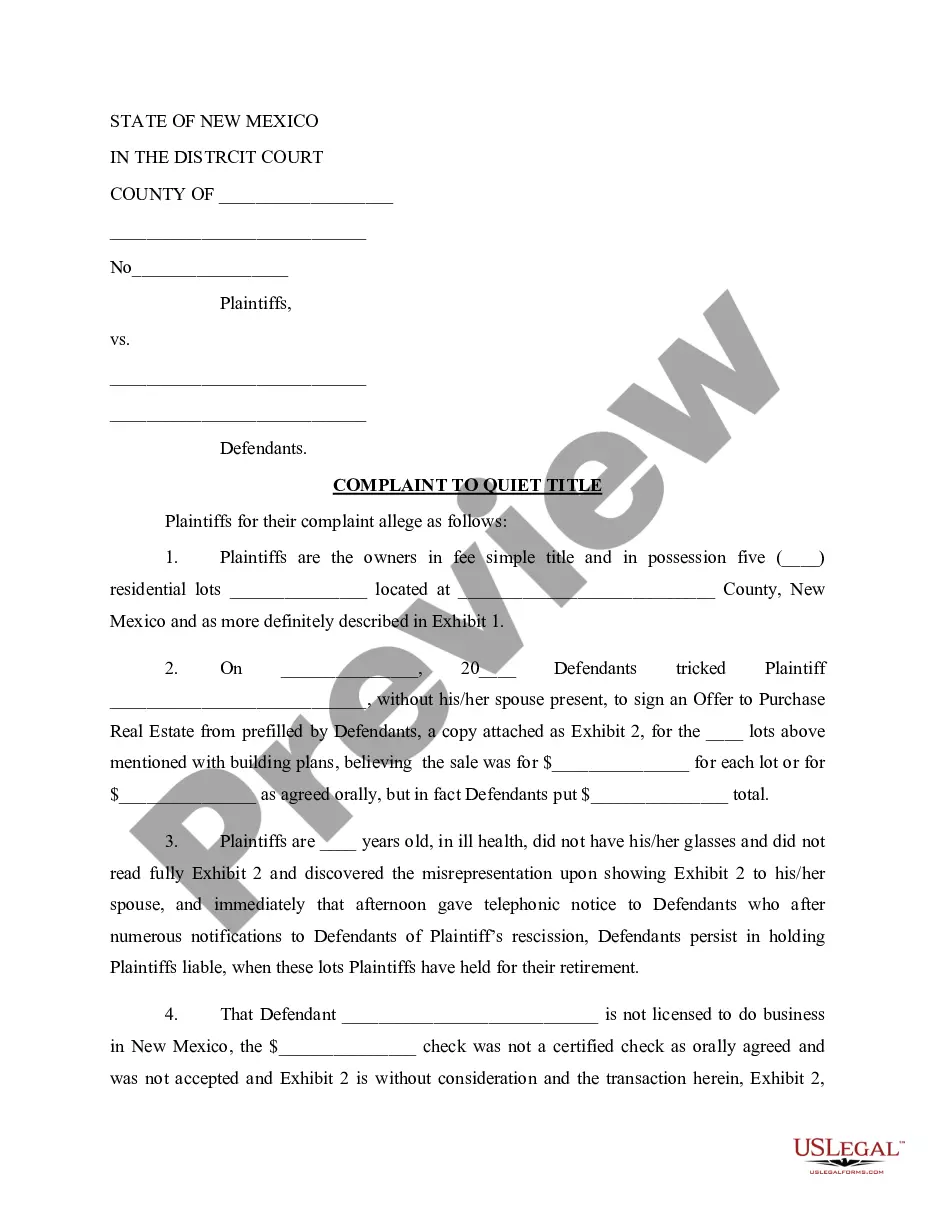

Hawaii Letter to Board of Directors regarding recapitalization proposal

Description

How to fill out Letter To Board Of Directors Regarding Recapitalization Proposal?

US Legal Forms - one of many largest libraries of legitimate forms in the States - delivers a wide range of legitimate papers layouts you are able to download or print. While using internet site, you can find a large number of forms for enterprise and person uses, categorized by classes, says, or keywords.You can find the latest variations of forms like the Hawaii Letter to Board of Directors regarding recapitalization proposal in seconds.

If you have a monthly subscription, log in and download Hawaii Letter to Board of Directors regarding recapitalization proposal in the US Legal Forms local library. The Acquire button will show up on each kind you perspective. You have access to all formerly delivered electronically forms inside the My Forms tab of your respective profile.

In order to use US Legal Forms initially, allow me to share basic directions to obtain began:

- Ensure you have selected the proper kind to your town/area. Click the Preview button to examine the form`s content. Browse the kind information to actually have selected the appropriate kind.

- In case the kind doesn`t satisfy your demands, utilize the Lookup area towards the top of the display screen to get the one who does.

- In case you are content with the form, confirm your choice by simply clicking the Get now button. Then, pick the costs prepare you favor and provide your credentials to register on an profile.

- Approach the financial transaction. Utilize your bank card or PayPal profile to perform the financial transaction.

- Find the formatting and download the form on your device.

- Make adjustments. Fill up, revise and print and indication the delivered electronically Hawaii Letter to Board of Directors regarding recapitalization proposal.

Each design you included in your bank account does not have an expiration time and is the one you have for a long time. So, if you would like download or print one more copy, just check out the My Forms portion and click about the kind you will need.

Gain access to the Hawaii Letter to Board of Directors regarding recapitalization proposal with US Legal Forms, probably the most comprehensive local library of legitimate papers layouts. Use a large number of skilled and condition-certain layouts that satisfy your business or person requires and demands.

Form popularity

FAQ

Plan your proposal Introduction. Problem Statement. Goals & outcomes. Methodology. Expected results. Budget. Conclusion. How to Write a Proposal and Get What You Want (Free Templates) process.st ? how-to-write-a-proposal process.st ? how-to-write-a-proposal

How to write a proposal letter Introduce yourself and provide background information. State your purpose for the proposal. Define your goals and objectives. Highlight what sets you apart. Briefly discuss the budget and how funds will be used. Finish with a call to action and request a follow-up.

Just like any other formal letter, a proposal letter follows a structure that begins with your company details and ends with a formal salutation. Your professional proposal letter may include: Your company name, address and contact details. The date the proposal was written and sent. How to Write Professional Proposal Letter for Your Business ... Visme ? blog ? proposal-letter Visme ? blog ? proposal-letter

How to write a project proposal Write an executive summary. The executive summary serves as the introduction to your project proposal. ... Explain the project background. ... Present a solution. ... Define project deliverables and goals. ... List what resources you need. ... State your conclusion. ... Know your audience. ... Be persuasive. How to Write a Project Proposal [2023] - Asana asana.com ? resources ? project-proposal asana.com ? resources ? project-proposal

Common sections include an introduction, problem statement, objectives, methodology, timeline, deliverables, pricing, and terms and conditions. Customize these sections based on the nature of your work and the requirements of your clients. 3. Write the content: Start your proposal with an eye catching title page.