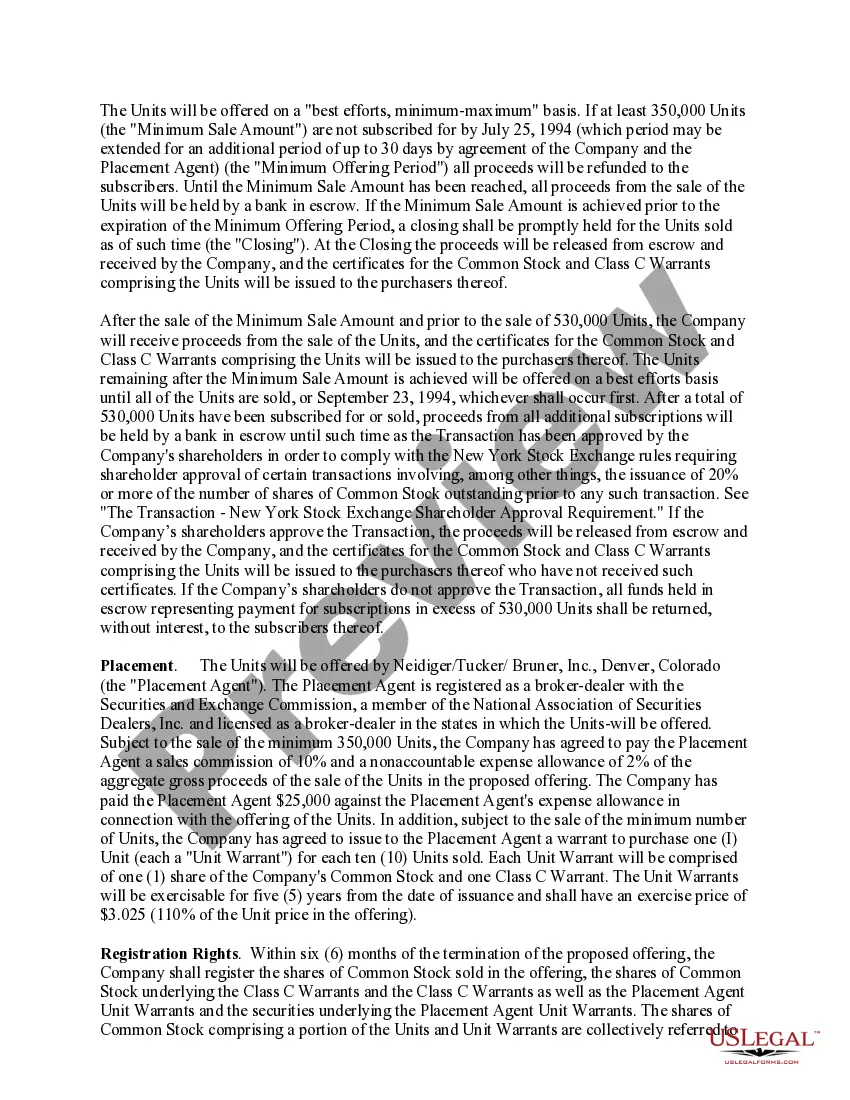

Hawaii Proxy Statement of Electronic Associates, Inc. with appendix

Description

How to fill out Proxy Statement Of Electronic Associates, Inc. With Appendix?

US Legal Forms - one of many largest libraries of lawful types in the USA - offers a wide array of lawful papers themes you are able to obtain or print out. Utilizing the site, you will get a large number of types for organization and person uses, categorized by groups, suggests, or keywords.You can find the newest variations of types such as the Hawaii Proxy Statement of Electronic Associates, Inc. with appendix within minutes.

If you currently have a monthly subscription, log in and obtain Hawaii Proxy Statement of Electronic Associates, Inc. with appendix from your US Legal Forms catalogue. The Acquire option can look on each develop you see. You have access to all previously delivered electronically types within the My Forms tab of the accounts.

If you would like use US Legal Forms the very first time, allow me to share basic directions to help you get started out:

- Be sure to have picked out the correct develop for your personal city/county. Click the Preview option to check the form`s content material. See the develop description to actually have selected the proper develop.

- When the develop doesn`t match your requirements, take advantage of the Research discipline near the top of the monitor to find the one who does.

- When you are pleased with the shape, confirm your option by simply clicking the Get now option. Then, opt for the pricing program you favor and offer your references to sign up for an accounts.

- Approach the deal. Use your credit card or PayPal accounts to perform the deal.

- Pick the structure and obtain the shape in your gadget.

- Make adjustments. Fill out, edit and print out and indication the delivered electronically Hawaii Proxy Statement of Electronic Associates, Inc. with appendix.

Each and every format you put into your bank account lacks an expiry time and is also your own eternally. So, in order to obtain or print out yet another copy, just go to the My Forms segment and then click on the develop you require.

Get access to the Hawaii Proxy Statement of Electronic Associates, Inc. with appendix with US Legal Forms, the most considerable catalogue of lawful papers themes. Use a large number of specialist and express-distinct themes that meet up with your company or person needs and requirements.

Form popularity

FAQ

Proxy statements describe matters up for shareholder vote, and include management and executive compensation information if the shareholders are voting for the election of directors.

A proxy statement also details the compensation packages of a company's CEO, its chief financial officer and its three other highest paid executives. The compensation is broken down by salary, bonuses, stock options, pension benefits and more.

A company is required to file its proxy statements with the SEC no later than the date proxy materials are first sent or given to shareholders. You can see this filing by using the SEC's database, known as EDGAR. Enter the company's name here and select the appropriate company to view its SEC filings.

Proxy statements are intended for shareholders with voting rights, while annual reports are for anyone following the company. This may be shareholders, including potential investors, regulators, financial institutions and more.

"In the annual proxy statement, a company must disclose information concerning the amount and type of compensation paid to its chief executive officer, chief financial officer and the three other most highly compensated executive officers A company also must disclose the criteria used in reaching executive compensation ...

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make.

Companies use mailed notices to direct shareholders to publicly accessible websites where they can find proxy statements. The SEC also makes proxy statements available through its EDGAR database. Most retail investors, however, learn about the availability of proxy statements through an email from their brokerage firm.

The SEC's new rule requires companies to disclose the relationship between executive compensation and the company's financial performance, including information on the company's total shareholder return and the performance of the company's peers.