Hawaii Purchase by Company of Its Stock: Explained in Detail When a company buys its own stock, it is known as a Hawaii Purchase. This strategic move allows companies to invest in themselves and acquire ownership of their own outstanding shares. This process involves buying shares directly from the market or through a tender offer, which provides an opportunity to gain control over a significant portion of the company's equity. Hawaii Purchase offers several benefits to a company, including increased control and flexibility. By repurchasing shares, the company can reduce the number of outstanding shares, effectively concentrating ownership and allowing existing shareholders to have a larger stake in the company. This action also signals to investors that the management believes the stock is undervalued, boosting market confidence in the company's future prospects. There are different types of Hawaii Purchases that companies can undertake based on their objectives and financial capabilities. Some of these variations include: 1. Open Market Purchases: This type involves buying shares from the open market using a broker. Companies can gradually accumulate shares, spreading out the purchases over an extended period, which reduces the impact on stock prices. 2. Tender Offers: A tender offer is a formal invitation by a company to its shareholders to offer their shares at a specific price within a designated time frame. Shareholders can voluntarily decide whether to sell their stock at the stated price or hold onto it. 3. Dutch Auction: In a Dutch auction, the company determines a price range within which shareholders can tender their shares. The company then assesses the amount of stock tendered and the corresponding prices to determine the lowest price at which to purchase the shares. 4. Private Negotiations: Companies can also negotiate with large shareholders or institutional investors to repurchase a significant portion of their stock through private transactions. This approach allows companies to buy back shares without affecting the market price or disclosing information publicly. Hawaii Purchase transactions need to comply with regulations set by securities commissions to protect investors from any potential stock market manipulation. Companies should also consider the financial impact of repurchasing their stock, as it utilizes capital that could otherwise be allocated to other investments, dividends, or debt reduction. In conclusion, a Hawaii Purchase by a company involves buying its own stock from the market or shareholders. It empowers companies to increase their ownership, enhance market confidence, and improve shareholder value. The type of Hawaii Purchase varies based on the company's strategy and financial position. Through open market purchases, tender offers, Dutch auctions, or private negotiations, companies can tailor their approach to best suit their objectives and the overall market conditions.

Hawaii Purchase by company of its stock

Description

How to fill out Hawaii Purchase By Company Of Its Stock?

Discovering the right lawful file format can be a have a problem. Needless to say, there are plenty of themes available on the net, but how do you obtain the lawful develop you need? Make use of the US Legal Forms web site. The support delivers a huge number of themes, such as the Hawaii Purchase by company of its stock, which you can use for organization and private demands. All the types are checked out by pros and fulfill federal and state needs.

When you are currently registered, log in to the account and then click the Download option to find the Hawaii Purchase by company of its stock. Utilize your account to check with the lawful types you have bought in the past. Check out the My Forms tab of your own account and have an additional version from the file you need.

When you are a new consumer of US Legal Forms, listed here are basic instructions so that you can adhere to:

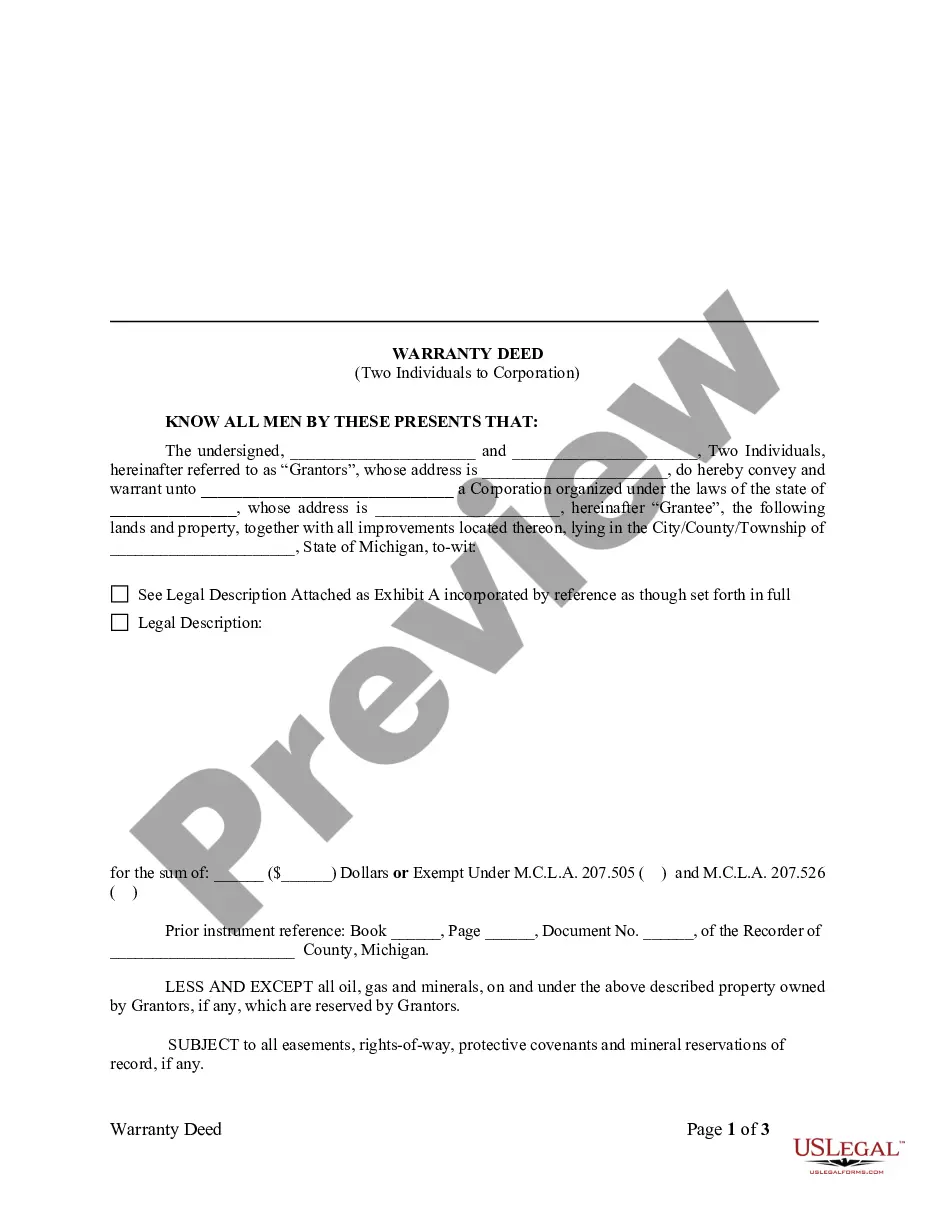

- Initial, make sure you have selected the correct develop for your personal town/state. You may look through the form making use of the Review option and study the form outline to guarantee this is basically the best for you.

- If the develop will not fulfill your needs, take advantage of the Seach industry to discover the proper develop.

- When you are sure that the form is acceptable, go through the Buy now option to find the develop.

- Pick the costs prepare you need and enter the needed information and facts. Build your account and pay for the transaction making use of your PayPal account or credit card.

- Choose the data file formatting and down load the lawful file format to the device.

- Full, modify and print out and indicator the received Hawaii Purchase by company of its stock.

US Legal Forms is definitely the most significant library of lawful types for which you can discover numerous file themes. Make use of the company to down load skillfully-made files that adhere to status needs.