Title: Hawaii Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds Description: A Hawaii Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds is a legal document filed by a borrower or debtor in Hawaii, who disputes the bank's attempt to pursue further collection on a promissory note or debt obligation after applying the proceeds from a security or collateral. This detailed complaint serves as a legal tool, aimed at presenting a strong case against the actions taken by the bank. The complaint outlines the factual background of the case, including the original loan terms, the security or collateral provided, and the bank's actions after receiving the security proceeds. Keywords: 1. Hawaii Complaint: A formal legal document filed in a Hawaii court. 2. Action by Bank: Refers to the steps or measures taken by the lender, often a bank, in order to recover the debt owed. 3. Recover on Note: Relates to the bank's attempt to collect the remaining balance on a promissory note or loan agreement. 4. Application of Security Proceeds: Describes the process where the bank utilizes the funds obtained from the sale or application of the provided security or collateral. 5. Debtors' Rights: Pertains to the legal protections granted to debtors during debt collection practices. 6. Loan Agreement: The legally binding contract detailing the terms and conditions of the loan. 7. Collateral: The property or assets pledged by the borrower as a security for the loan. 8. Factual Background: Provides an overview of the key events and circumstances leading up to the dispute. 9. Legal Argument: Outlines the borrower's legal arguments and reasons why the bank's actions are improper or unjust. 10. Relief Sought: States the requested resolutions or outcomes the borrower seeks from the court. Types of Hawaii Complaints regarding Action by Bank to Recover on Note After Application of Security Proceeds: 1. Individual vs. Bank Complaint: Filed by an individual borrower against a bank or lending institution. 2. Business vs. Bank Complaint: Filed by a business entity against a bank or lending institution. 3. Mortgage Complaint: Specifically addressing issues related to a mortgage loan and the bank's actions after receiving security proceeds. 4. Consumer Complaint: When the borrower is a consumer, filed against the bank or lender in case of unfair practices or violations of consumer protection laws. 5. Disputed Security Proceeds Complaint: Pertains to cases where the borrower contests the bank's application of security proceeds. In conclusion, a Hawaii Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds is a legal document designed to challenge a bank's pursuit of additional debt collection after the application of security proceeds. By providing comprehensive details and raising relevant legal arguments, the complaint aims to protect the borrower's rights and seek appropriate remedies from the court.

Hawaii Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

How to fill out Hawaii Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

US Legal Forms - one of several largest libraries of legitimate forms in the States - provides a wide array of legitimate document themes you can download or print. Using the web site, you may get a huge number of forms for enterprise and person purposes, sorted by groups, claims, or keywords.You can find the newest variations of forms just like the Hawaii Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds in seconds.

If you have a membership, log in and download Hawaii Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds in the US Legal Forms local library. The Obtain option will appear on every form you view. You get access to all previously acquired forms inside the My Forms tab of your own accounts.

If you want to use US Legal Forms the first time, here are straightforward instructions to obtain started out:

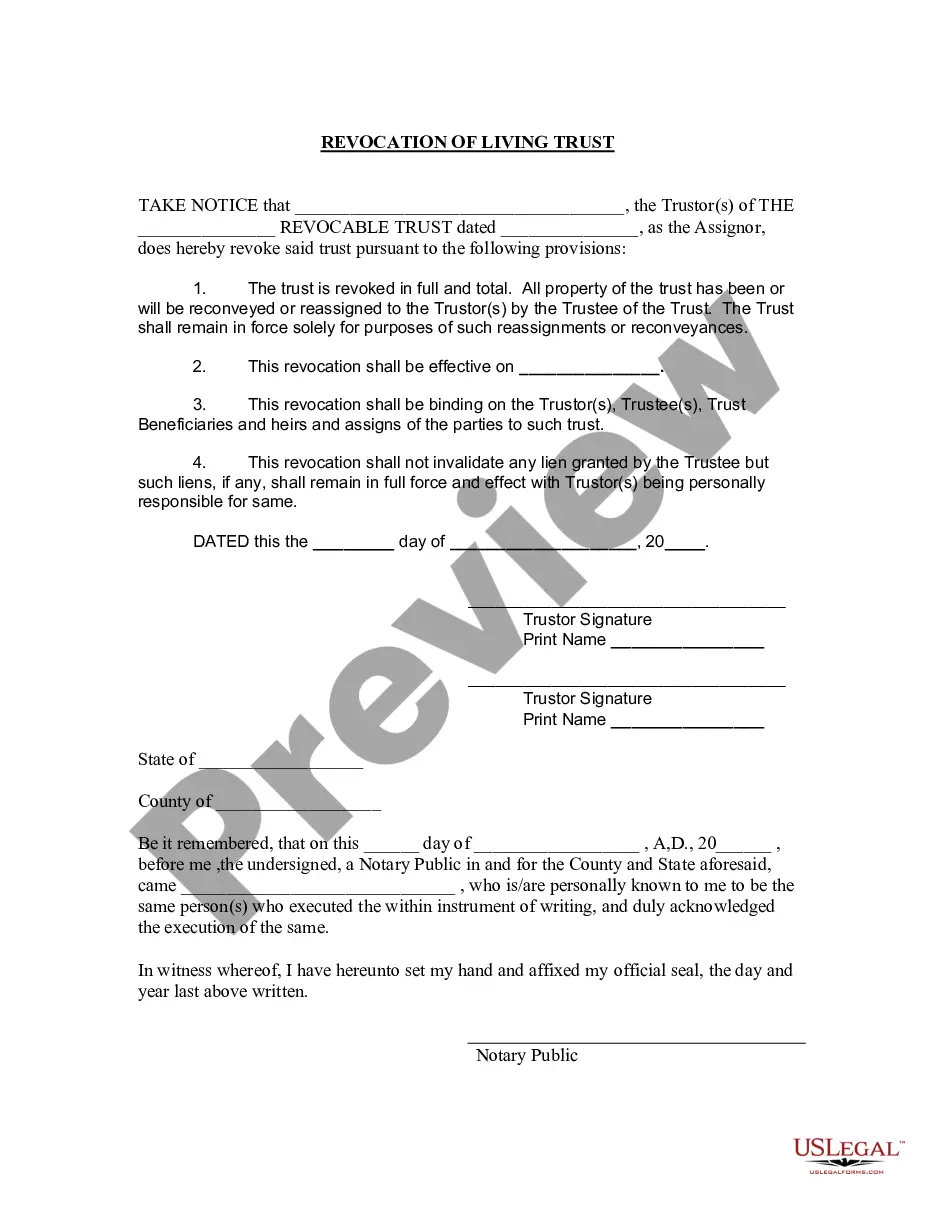

- Make sure you have chosen the proper form for your area/area. Click the Review option to examine the form`s information. Read the form description to ensure that you have selected the correct form.

- In case the form doesn`t suit your requirements, take advantage of the Lookup area at the top of the monitor to obtain the one which does.

- In case you are happy with the shape, confirm your choice by clicking on the Acquire now option. Then, opt for the costs plan you prefer and supply your credentials to register on an accounts.

- Process the deal. Use your credit card or PayPal accounts to perform the deal.

- Find the formatting and download the shape in your gadget.

- Make alterations. Fill up, revise and print and signal the acquired Hawaii Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

Every single web template you included in your account lacks an expiry day and is yours for a long time. So, if you would like download or print one more backup, just go to the My Forms segment and click in the form you need.

Get access to the Hawaii Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds with US Legal Forms, by far the most considerable local library of legitimate document themes. Use a huge number of professional and state-particular themes that meet up with your organization or person demands and requirements.

Form popularity

FAQ

You can file a complaint about your bank or lender with the Attorney General's Public Inquiry Unit. Complaints are used by the Attorney General's Office to get information about misconduct and to determine whether to investigate a company. However, we cannot give legal advice or provide legal assistance to individuals.

Check out 10 effective ways and online destinations to file complaints that a company will pay attention to. Go to the company website. ... Contact the Better Business Bureau. ... Contact the Federal Trade Commission (FTC). ... Check out the Ripoff Report. ... Email spam@uce.gov. ... Try Yelp. ... Post on Planet Feedback.

Where can I complain if I have a problem with my Bank? You can raise your grievance on the Digital Complaint Management System (CMS) Portal: .

Consistent with applicable law, we securely share complaints with other state and federal agencies to, among other things, facilitate: supervision activities, enforcement activities, and. monitor the market for consumer financial products and services.

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.

Federal Reserve Consumer Help will connect you with or forward your complaint to the appropriate federal regulator for the bank or institution involved in your complaint.

The FTC's Bureau of Consumer Protection stops unfair, deceptive and fraudulent business practices by collecting reports from consumers and conducting investigations, suing companies and people that break the law, developing rules to maintain a fair marketplace, and educating consumers and businesses about their rights ...

You can file a complaint about your bank or lender with the Attorney General's Public Inquiry Unit. Complaints are used by the Attorney General's Office to get information about misconduct and to determine whether to investigate a company. However, we cannot give legal advice or provide legal assistance to individuals.