Title: Hawaii Notice of Violation of Fair Debt Act — Improper Document Appearance Introduction: In Hawaii, the Fair Debt Collection Practices Act (FD CPA) safeguards consumers from unfair debt collection practices. A crucial aspect of this act is ensuring proper documentation standards are met. The Hawaii Notice of Violation of Fair Debt Act — Improper Document Appearance serves as a legal notification to collectors that their documents fail to meet the required standards, potentially rendering them invalid. This article will provide a detailed description of what this notice entails, its objectives, and other relevant information. Keywords: Hawaii, Notice of Violation, Fair Debt Collection Practices Act, FD CPA, improper document appearance, documentation standards, debt collectors, legal notification, consumer protection. Types of Hawaii Notice of Violation of Fair Debt Act — Improper Document Appearance: 1. Inadequate Document Formatting: This category encompasses notices where debt collection documents fail to meet proper formatting standards. It includes issues such as improper margins, font size, spacing, or insufficient readability. The Hawaii Notice of Violation is a means for consumers to address such discrepancies and protect their rights under the FD CPA. 2. Misleading or Unverified Information: This type of notice points out instances where debt collection documents contain false or misleading information. It highlights violations, such as incorrect balances, inaccurate debt ownership, or misleading statements meant to coerce or deceive consumers. The Hawaii Notice of Violation protects consumers from such deceptive practices. 3. False Representation of Legal Authority: Debt collectors must establish their legal authority when contacting consumers about debts. This notice addresses situations where collectors falsely claim or misrepresent their authority, creating a misleading impression of their ability to enforce collection actions. The Hawaii Notice of Violation ensures that consumers are aware of such violations and can challenge them accordingly. 4. Absence of Required Disclosures: Certain information should be clearly disclosed within debt collection documents to promote transparency and protect consumers' interests. This notice identifies cases where necessary disclosures, such as the debt collector's identity, the consumer's rights, or the debt's origin, are missing or insufficient. By alerting collectors to these violations, the Hawaii Notice of Violation empowers consumers to demand compliance with the FD CPA. Conclusion: The Hawaii Notice of Violation of Fair Debt Act — Improper Document Appearance plays a vital role in ensuring that debt collectors adhere to documentation standards outlined in the FD CPA. By issuing this notice in response to improper document appearance, consumers can hold debt collectors accountable for their actions, protecting their rights and fostering a fair and transparent debt collection process.

Hawaii Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

How to fill out Hawaii Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

US Legal Forms - among the largest libraries of legal types in the USA - gives an array of legal papers layouts you are able to acquire or produce. Using the website, you will get a large number of types for business and personal purposes, categorized by types, claims, or search phrases.You will find the newest types of types such as the Hawaii Notice of Violation of Fair Debt Act - Improper Document Appearance in seconds.

If you have a registration, log in and acquire Hawaii Notice of Violation of Fair Debt Act - Improper Document Appearance from your US Legal Forms catalogue. The Down load button will appear on every single kind you see. You gain access to all earlier downloaded types inside the My Forms tab of your profile.

In order to use US Legal Forms the first time, listed below are basic recommendations to obtain started:

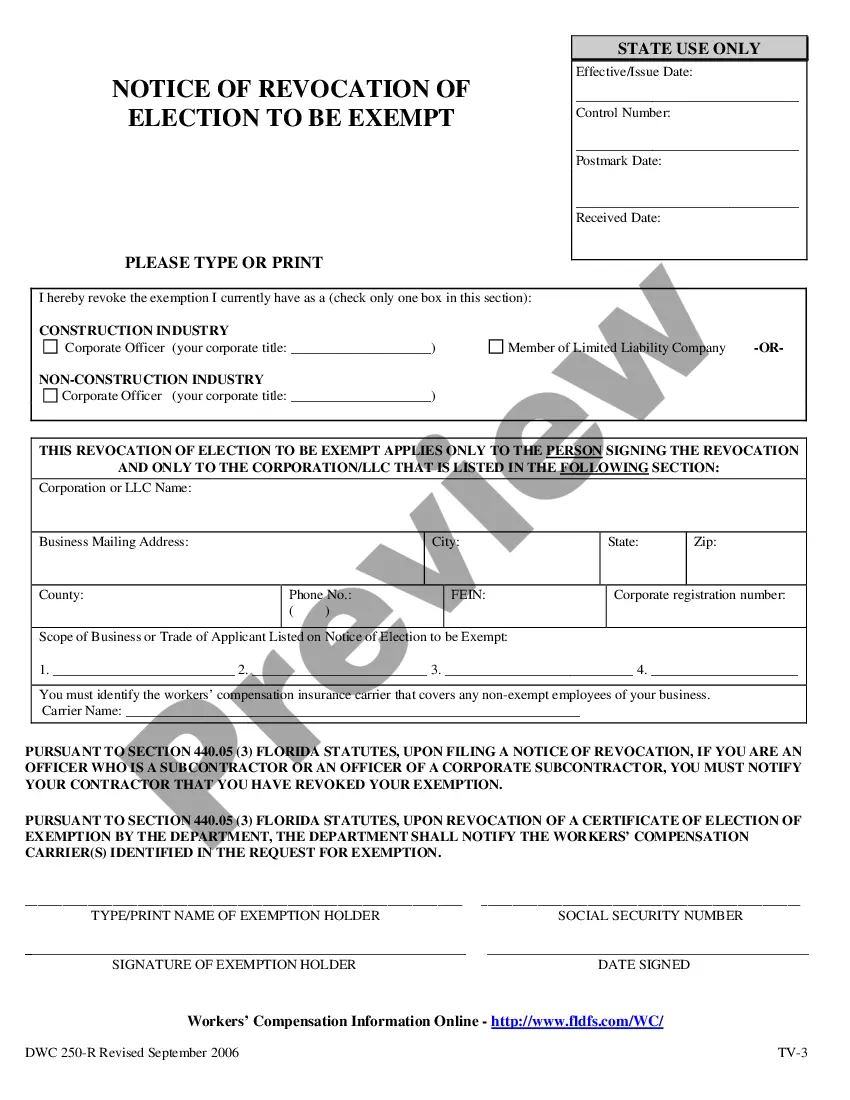

- Be sure to have picked out the right kind to your metropolis/area. Click on the Review button to examine the form`s information. Look at the kind information to actually have chosen the correct kind.

- When the kind doesn`t fit your needs, make use of the Lookup area towards the top of the display to get the the one that does.

- When you are pleased with the form, confirm your option by clicking on the Buy now button. Then, opt for the prices plan you prefer and supply your accreditations to sign up for an profile.

- Procedure the financial transaction. Use your bank card or PayPal profile to complete the financial transaction.

- Find the formatting and acquire the form on your gadget.

- Make changes. Fill up, modify and produce and sign the downloaded Hawaii Notice of Violation of Fair Debt Act - Improper Document Appearance.

Each and every design you included in your account lacks an expiration day which is the one you have for a long time. So, in order to acquire or produce an additional duplicate, just go to the My Forms area and click on around the kind you need.

Get access to the Hawaii Notice of Violation of Fair Debt Act - Improper Document Appearance with US Legal Forms, the most considerable catalogue of legal papers layouts. Use a large number of professional and state-certain layouts that satisfy your organization or personal demands and needs.

Form popularity

FAQ

A debt validation letter should include the name of your creditor and how much you owe, The letter will include information about when you need to pay the debt and how to dispute it.

Contact your creditors immediately; don't wait for them to contact you. Even if your payment history is less than perfect, you will still make better arrangements by being forthright. Explain your current situation. Tell them your family income is reduced and you are not able to keep up with your payments.

However, I feel that it is in our mutual interest for me to decline your generous offer. This has been a difficult decision for me, but I believe it is the appropriate one for my career at this time. I want to thank you for the time and consideration you have extended to me.

Refusal-to-pay letters are simple to write. The consumer only needs to send a letter to the debt collector stating something like ?I refuse to pay this debt? with the debt amount and account number listed for reference to eliminate confusion.

I enclose a copy of my financial statement. This shows income and expenses for me. You will see from this information that I am unable to make any offer of payment at the moment. I am making every effort to increase my income and will contact you again as soon as my financial circumstances improve.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by [phone/mail], on [date] and identified the debt as [any information they gave you about the debt]. I do not have any responsibility for the debt you're trying to collect.

The collection dispute letter to debt collectors should include the following information: Your details ? name, address, official email address, etc. Request for more information about the creditor. Amount of debt owed. A request note to not report the matter to the credit reporting agency until the matter is resolved.

However, they may file a lawsuit against you to collect the debt, and if the court orders you to appear or to provide certain information but you don't comply, a judge may issue a warrant for your arrest. In some cases, a judge may also issue a warrant if you don't comply with a court-ordered installment plan.