Hawaii Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors

Description

How to fill out Sample Common Shares Purchase Agreement Between Visible Genetics, Inc. And Investors?

If you need to total, download, or printing legitimate record web templates, use US Legal Forms, the biggest collection of legitimate forms, which can be found on the web. Take advantage of the site`s simple and easy practical look for to discover the files you require. Different web templates for organization and individual functions are categorized by types and claims, or key phrases. Use US Legal Forms to discover the Hawaii Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors with a few click throughs.

Should you be presently a US Legal Forms consumer, log in to your profile and click the Acquire option to get the Hawaii Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors. You may also access forms you previously delivered electronically in the My Forms tab of your own profile.

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the shape for that appropriate area/country.

- Step 2. Use the Review solution to look through the form`s content material. Never forget to see the outline.

- Step 3. Should you be unsatisfied together with the type, utilize the Look for discipline near the top of the display screen to find other variations of the legitimate type format.

- Step 4. After you have identified the shape you require, click on the Acquire now option. Opt for the costs prepare you choose and add your references to sign up for an profile.

- Step 5. Process the deal. You may use your Мisa or Ьastercard or PayPal profile to finish the deal.

- Step 6. Pick the format of the legitimate type and download it in your device.

- Step 7. Complete, edit and printing or indicator the Hawaii Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors.

Each and every legitimate record format you get is your own property for a long time. You possess acces to each type you delivered electronically in your acccount. Click the My Forms section and select a type to printing or download once more.

Contend and download, and printing the Hawaii Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors with US Legal Forms. There are many skilled and state-certain forms you can utilize for your organization or individual requirements.

Form popularity

FAQ

At exchange, the parties sign or execute the formal documentation, including the share purchase agreement. At completion, the requisite formalities to complete and implement the transaction are undertaken.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

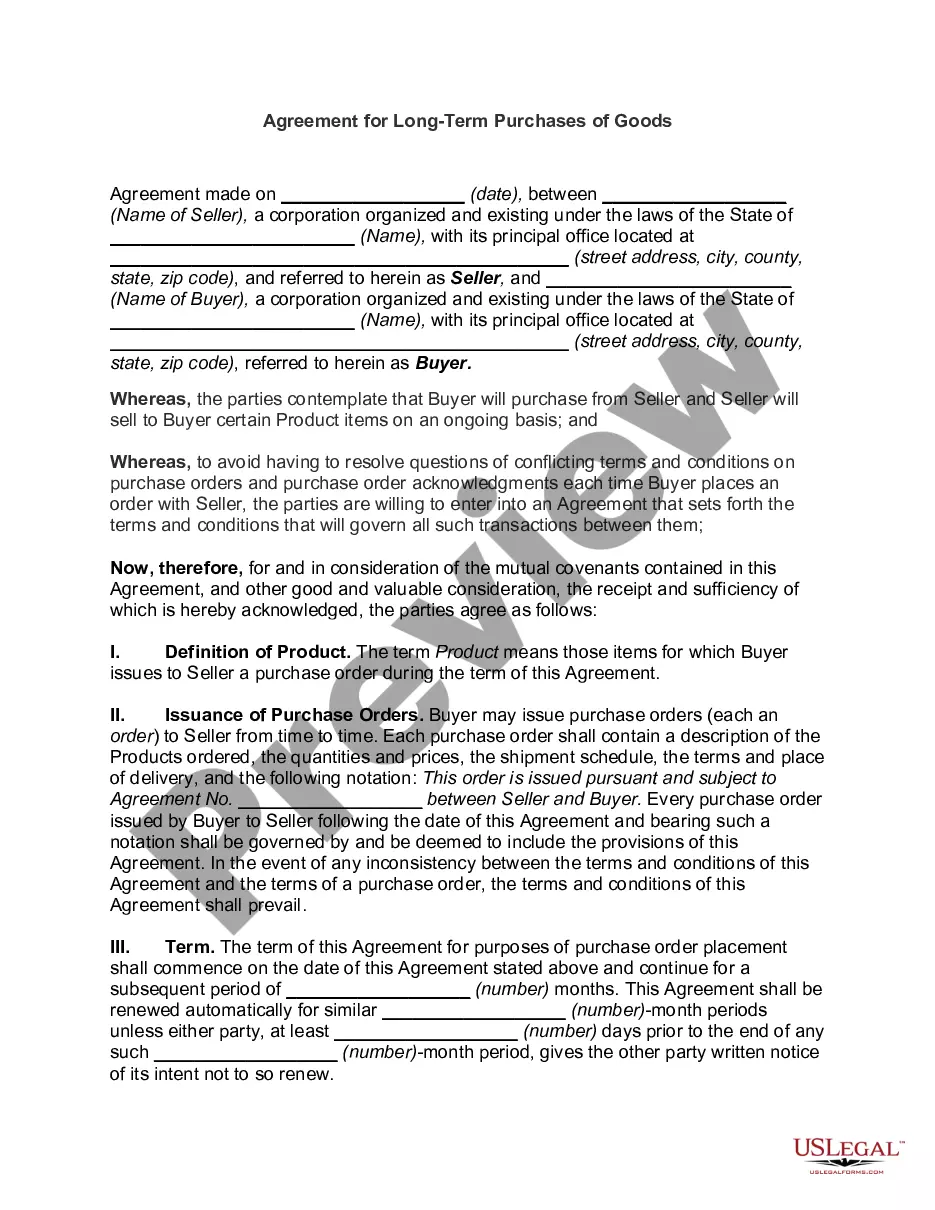

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

The agreement is exchanged and signed by both parties, payment completed and share ownership is transferred to the buyer. However, delays to completion may occur if either party has to meet certain obligations, such as: Consent of other shareholders to the transaction.

To file a share purchase agreement, it is necessary to review it once and then get the signature done by both the parties as well as the signatures of the witnesses. Copies of the agreement shall be made for a company, purchaser, and seller. The issue of certificate only after the payment.