Hawaii Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.

Description

How to fill out Plan Of Merger Between Ichargeit.Com, Inc. And Ichargeit.Com, Inc.?

It is possible to devote hrs on-line trying to find the legal record format which fits the federal and state requirements you will need. US Legal Forms gives a large number of legal kinds which can be analyzed by pros. It is possible to acquire or printing the Hawaii Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc. from my support.

If you have a US Legal Forms profile, it is possible to log in and click the Down load option. Following that, it is possible to comprehensive, modify, printing, or sign the Hawaii Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.. Each and every legal record format you get is your own property for a long time. To have an additional backup for any obtained type, go to the My Forms tab and click the related option.

If you use the US Legal Forms website initially, adhere to the easy directions below:

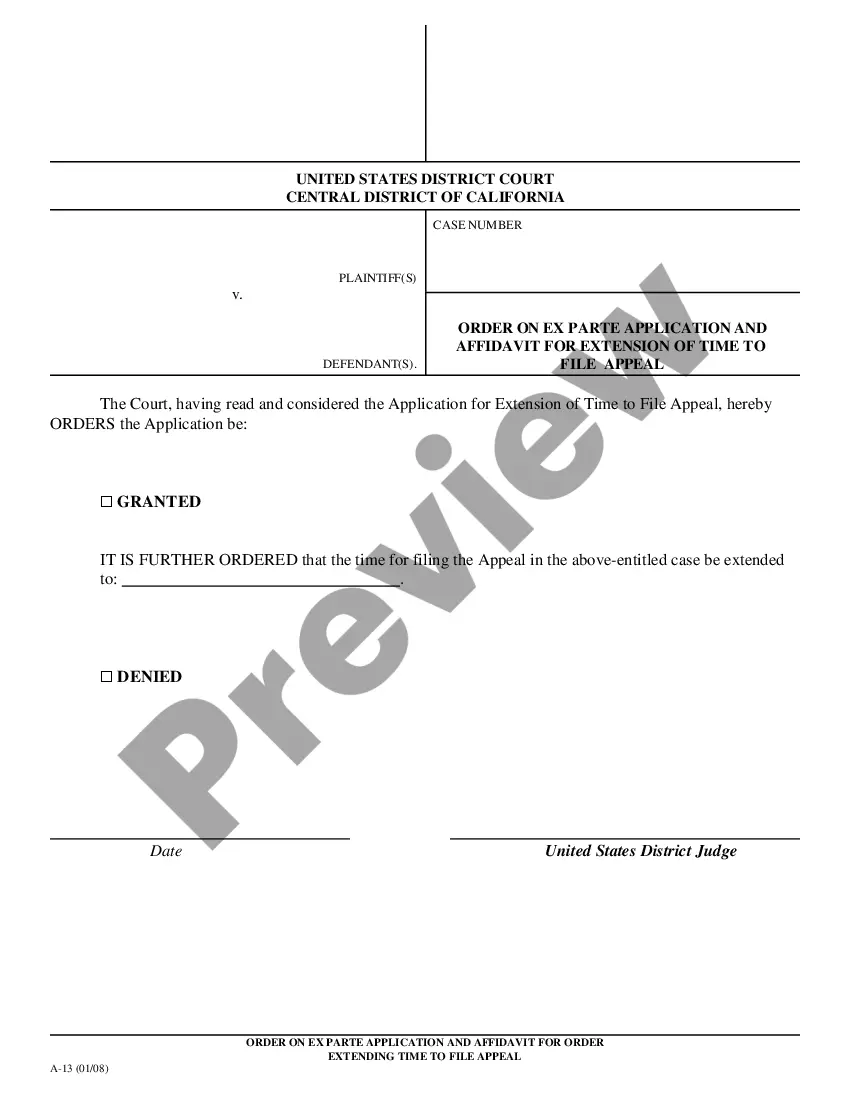

- Initial, ensure that you have selected the proper record format for your state/city of your liking. Read the type explanation to make sure you have selected the appropriate type. If available, take advantage of the Preview option to check from the record format at the same time.

- If you want to discover an additional edition of your type, take advantage of the Lookup area to find the format that meets your requirements and requirements.

- Once you have identified the format you would like, click Acquire now to continue.

- Choose the rates program you would like, key in your accreditations, and sign up for an account on US Legal Forms.

- Full the deal. You should use your Visa or Mastercard or PayPal profile to fund the legal type.

- Choose the format of your record and acquire it to your gadget.

- Make changes to your record if required. It is possible to comprehensive, modify and sign and printing Hawaii Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc..

Down load and printing a large number of record templates while using US Legal Forms website, which offers the largest selection of legal kinds. Use professional and express-certain templates to tackle your small business or person requires.