Title: The Hawaii Plan of Merger: Merging the Strengths of WIT Capital Group, WIS Merger Corporation, and Sound view Technology Group Introduction: The Hawaii Plan of Merger refers to the comprehensive agreement between WIT Capital Group, Inc., WIS Merger Corporation, and Sound view Technology Group, Inc. that aims to integrate and leverage their respective expertise in the technology industry. This strategic merger aims to create a unified entity capable of providing enhanced financial services, robust technological solutions, and cutting-edge research to clients. Dive into the details of this transformative merger plan below. 1. Objectives of the Hawaii Plan of Merger: The Hawaii Plan of Merger is designed to achieve multiple objectives, such as: a. Synergies: By combining the strengths of WIT Capital Group, WIS Merger Corporation, and Sound view Technology Group, the merger aims to generate synergistic effects that will enable the new entity to offer an expanded range of services and products. b. Market Positioning: The merger aims to enhance the market positioning of the combining firms by creating a more significant presence in the technology sector, thereby attracting larger clientele and fostering growth opportunities. c. Financial Strength: By pooling resources, expertise, and operational efficiencies, the merger enhances the financial stability and growth potential of the resulting entity, enabling it to invest in R&D, acquisitions, and expansion plans. 2. Merger Types within the Hawaii Plan: The Hawaii Plan of Merger encompasses two primary types of mergers, each bringing its own distinct benefits: a. Horizontal Merger: This type of merger refers to the combination of WIT Capital Group, WIS Merger Corporation, and Sound view Technology Group, which all operate within the same industry. By merging horizontally, the firms aim to consolidate similar operations and capitalize on shared strengths, complementary services, and accumulated industry knowledge. b. Vertical Merger: Another aspect of the Hawaii Plan involves vertical integration, through the collaborative efforts of WIT Capital Group, WIS Merger Corporation, and Sound view Technology Group. This merger type seeks to integrate various stages of the supply chain, enhancing the overall operational efficiency of the firms involved. 3. Key Strategies and Execution: The Hawaii Plan of Merger utilizes various strategies to ensure a successful integration of WIT Capital Group, WIS Merger Corporation, and Sound view Technology Group: a. Talent Retention: The merger aims to retain key talent and top-performing employees, ensuring a smooth transition and maintaining continuity in operations. b. Streamlined Operations: The merging firms will work diligently to optimize processes, consolidate redundant functions, and eliminate inefficiencies to maximize productivity and cost-effectiveness. c. Cross-Selling and Upselling: By leveraging the combined client base, the entities involved can cross-sell and upsell their expanded range of services and products, contributing to increased revenue streams. d. Technological Integration: The merger incorporates a comprehensive technology integration plan, allowing for seamless transition and enabling the newly merged entity to harness the latest advancements in the technology sector. Conclusion: The Hawaii Plan of Merger underscores a transformative union that amalgamates the strengths, expertise, and resources of WIT Capital Group, WIS Merger Corporation, and Sound view Technology Group. Through this merger, the aim is to create a robust, competitive entity capable of delivering unparalleled financial services, cutting-edge technology solutions, and superior research capabilities. By capitalizing on synergistic effects, the merger paves the way for enhanced growth opportunities, increased market positioning, and long-term success within the technology industry.

Hawaii Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.

Description

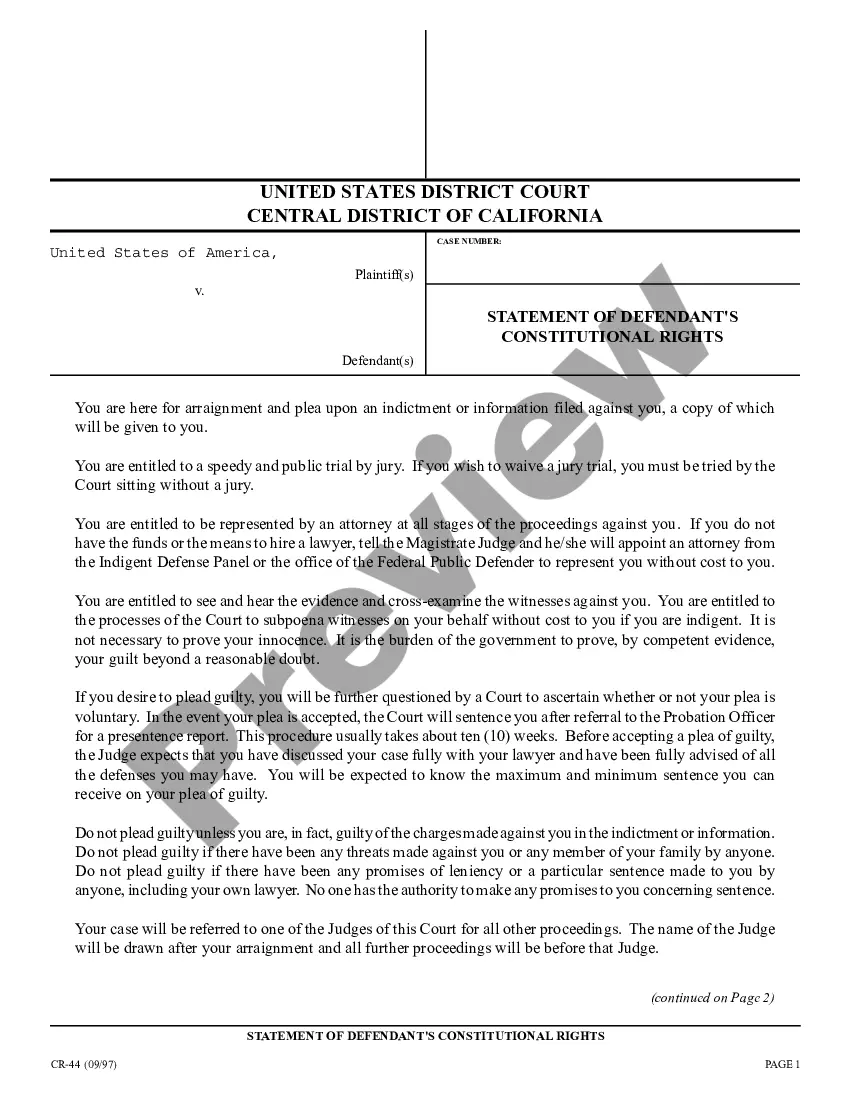

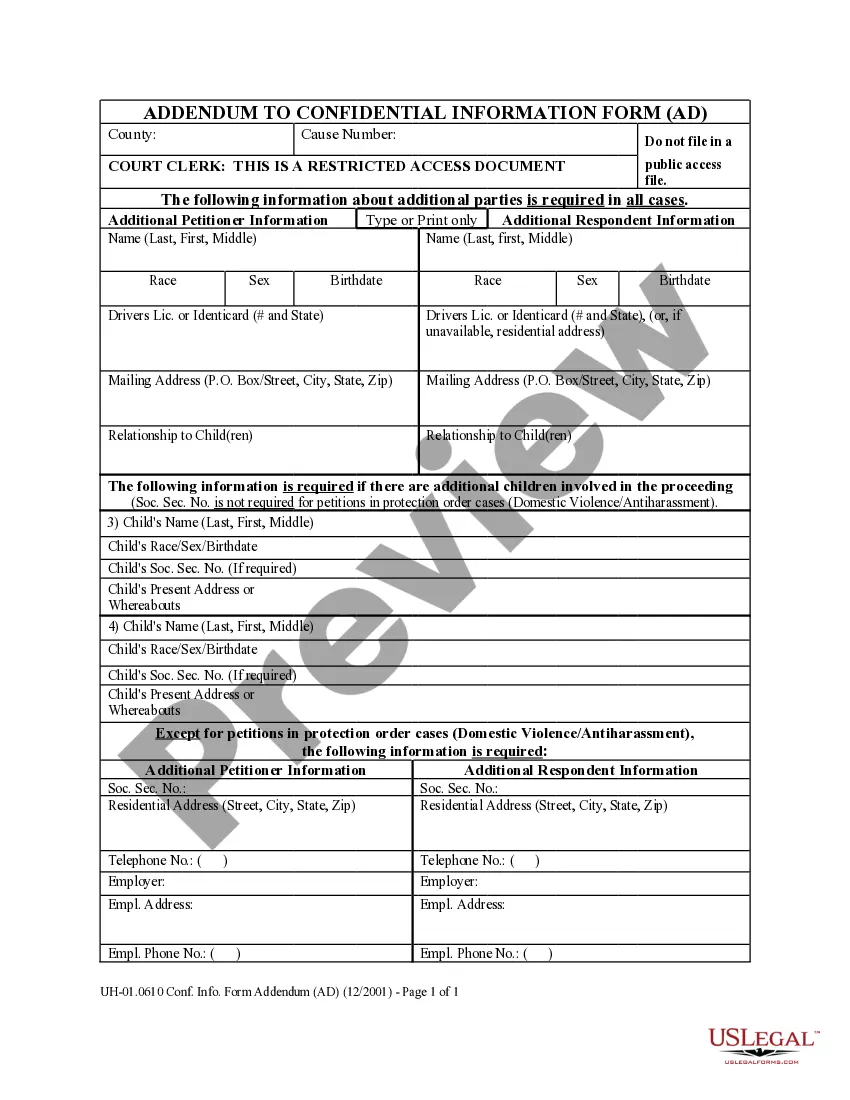

How to fill out Hawaii Plan Of Merger Between WIT Capital Group, Inc., WIS Merger Corporation And Soundview Technology Group, Inc.?

It is possible to commit time on-line searching for the authorized file design that fits the state and federal specifications you need. US Legal Forms provides a huge number of authorized kinds which are evaluated by specialists. You can actually obtain or printing the Hawaii Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc. from my assistance.

If you currently have a US Legal Forms profile, it is possible to log in and click on the Obtain option. Afterward, it is possible to full, edit, printing, or sign the Hawaii Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc.. Every authorized file design you purchase is your own property eternally. To obtain one more copy of any acquired form, proceed to the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms web site the first time, keep to the straightforward guidelines listed below:

- First, be sure that you have selected the best file design for that county/metropolis that you pick. Read the form explanation to make sure you have chosen the right form. If offered, use the Preview option to search from the file design at the same time.

- If you would like discover one more model of the form, use the Search discipline to obtain the design that fits your needs and specifications.

- After you have discovered the design you want, just click Purchase now to move forward.

- Select the rates prepare you want, type in your qualifications, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You may use your Visa or Mastercard or PayPal profile to purchase the authorized form.

- Select the format of the file and obtain it to your gadget.

- Make adjustments to your file if necessary. It is possible to full, edit and sign and printing Hawaii Plan of Merger between WIT Capital Group, Inc., WIS Merger Corporation and Soundview Technology Group, Inc..

Obtain and printing a huge number of file templates using the US Legal Forms Internet site, which offers the most important variety of authorized kinds. Use specialist and condition-certain templates to handle your small business or individual requires.