Hawaii Registration Rights Agreement regarding the purchase of convertible subordinated debentures

Description

How to fill out Registration Rights Agreement Regarding The Purchase Of Convertible Subordinated Debentures?

It is possible to spend several hours on the Internet attempting to find the authorized document web template which fits the state and federal requirements you require. US Legal Forms supplies a huge number of authorized forms that happen to be evaluated by pros. You can actually down load or print the Hawaii Registration Rights Agreement regarding the purchase of convertible subordinated debentures from the services.

If you already have a US Legal Forms accounts, you may log in and then click the Obtain switch. Afterward, you may total, edit, print, or signal the Hawaii Registration Rights Agreement regarding the purchase of convertible subordinated debentures. Each authorized document web template you buy is your own property eternally. To acquire an additional version for any purchased develop, go to the My Forms tab and then click the related switch.

If you use the US Legal Forms website for the first time, follow the easy guidelines beneath:

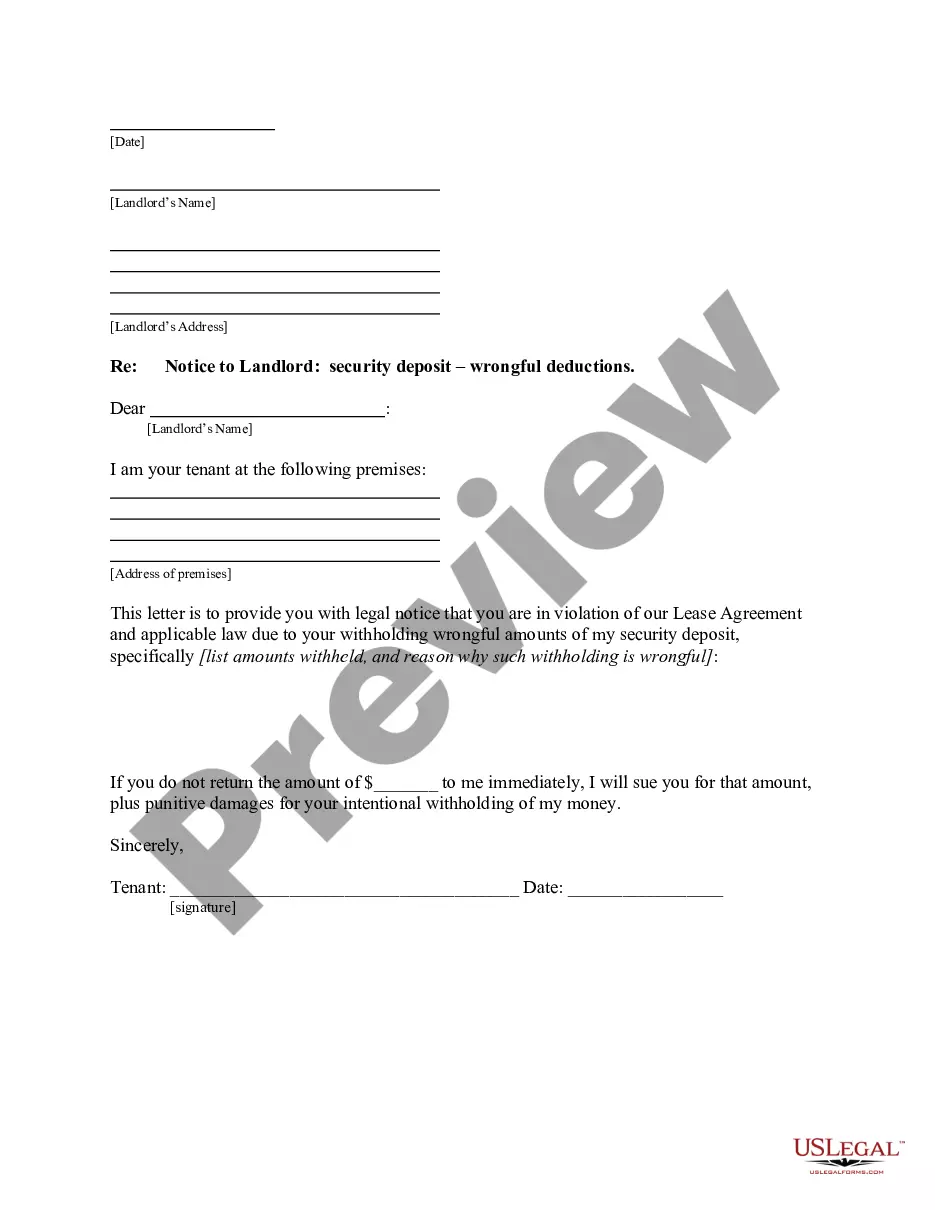

- Initially, be sure that you have chosen the correct document web template for your area/area that you pick. Read the develop outline to ensure you have picked the appropriate develop. If offered, make use of the Review switch to appear through the document web template as well.

- If you wish to locate an additional edition in the develop, make use of the Look for discipline to obtain the web template that suits you and requirements.

- Upon having located the web template you desire, simply click Acquire now to move forward.

- Select the prices plan you desire, enter your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You may use your charge card or PayPal accounts to purchase the authorized develop.

- Select the format in the document and down load it to your system.

- Make adjustments to your document if needed. It is possible to total, edit and signal and print Hawaii Registration Rights Agreement regarding the purchase of convertible subordinated debentures.

Obtain and print a huge number of document web templates making use of the US Legal Forms site, which offers the most important variety of authorized forms. Use skilled and status-specific web templates to tackle your company or specific requirements.

Form popularity

FAQ

Form 144 must be filed with the SEC by an affiliate as a notice of the proposed sale of securities when the amount to be sold under Rule 144 during any three-month period exceeds 5,000 shares or units or has an aggregate sales price in excess of $50,000.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

Section 144 of the Criminal Procedure Code (CrPC) of 1973 authorises the Executive Magistrate of any state or territory to issue an order to prohibit the assembly of four or more people in an area. ing to the law, every member of such 'unlawful assembly' can be booked for engaging in rioting.

If the seller complies with Rule 144, the sale will not violate the registration requirements of the Securities Act. Rule 144 imposes certain holding period, informational, volume, manner of sale and notice obligations in certain situations and for certain stockholders.

A registration right is a right entitling an investor who owns restricted stock to require that a company list the shares publicly so that the investor can sell them. Registration rights, if exercised, can force a privately-held company to become a publicly-traded company.

What Is Registration Right? A registration right is a right entitling an investor who owns restricted stock to require that a company list the shares publicly so that the investor can sell them. Registration rights, if exercised, can force a privately-held company to become a publicly-traded company.