Hawaii Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan is a legal document that outlines the process and terms for transferring an individual's retirement plan from Motorola, Inc. Pension Plan to a retirement plan based in Hawaii. This agreement ensures a smooth transition of retirement benefits and aligns with Hawaii's specific laws and regulations. Keywords: Hawaii, retirement plan, transfer agreement, Motorola, Inc. Pension Plan, process, terms, transferring, individual, retirement benefits, Hawaii laws, regulations. Types of Hawaii Retirement Plan Transfer Agreements for the Motorola, Inc. Pension Plan: 1. Individual Retirement Plan Transfer Agreement: This type of agreement pertains to the transfer of an individual's retirement plan from the Motorola, Inc. Pension Plan to a specific retirement plan based in Hawaii. It outlines the necessary steps and conditions for the transfer. 2. Employee Retirement Plan Transfer Agreement: This agreement focuses on the transfer of retirement plans for multiple employees of Motorola, Inc. to Hawaii-based retirement plans. It addresses the process for transferring benefits for each employee, ensuring compliance with Hawaii's retirement plan regulations. 3. Lump-sum Retirement Plan Transfer Agreement: This agreement specifically deals with the transfer of a lump-sum retirement plan from Motorola, Inc. Pension Plan to a designated retirement plan in Hawaii. It outlines the terms and conditions for the transfer of funds in a lump-sum format. 4. Deferred Compensation Retirement Plan Transfer Agreement: This type of agreement is specifically relevant for employees who have a deferred compensation retirement plan with Motorola, Inc. It lays out the procedures for transferring the deferred compensation plan to a retirement plan in Hawaii, preserving the employee's future benefits. In each type of transfer agreement, the document will focus on the unique circumstances and requirements associated with transferring retirement funds from Motorola, Inc. Pension Plan to a retirement plan in Hawaii. The agreement will address key factors such as eligibility criteria, documentation needed, timelines, tax implications, and any specific provisions required by Hawaii's retirement plan regulations.

Hawaii Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan

Description

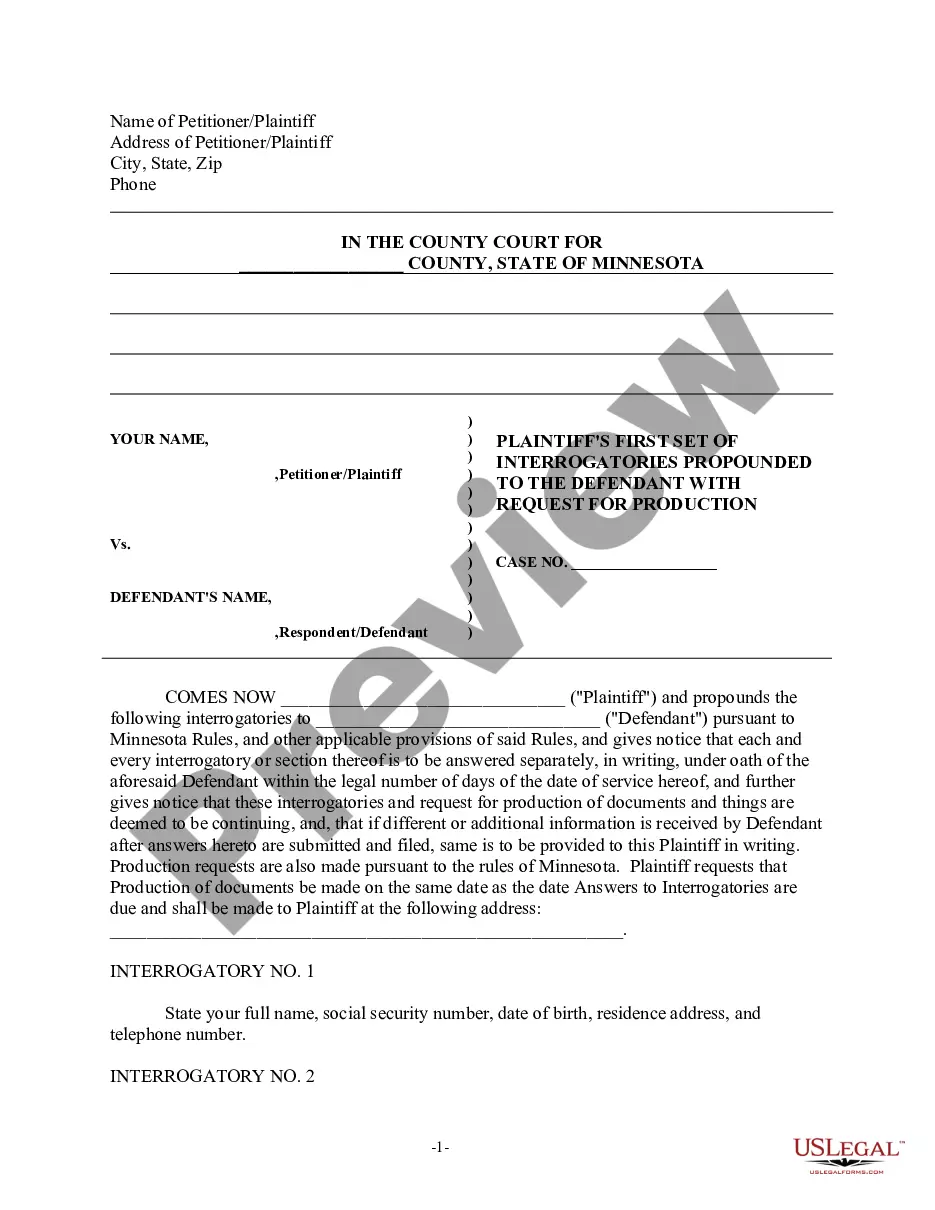

How to fill out Hawaii Retirement Plan Transfer Agreement For The Motorola, Inc. Pension Plan?

If you need to full, acquire, or printing lawful papers themes, use US Legal Forms, the most important variety of lawful forms, which can be found online. Use the site`s basic and convenient look for to discover the paperwork you need. A variety of themes for organization and personal purposes are categorized by classes and states, or key phrases. Use US Legal Forms to discover the Hawaii Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan in a number of click throughs.

In case you are already a US Legal Forms client, log in to your accounts and click the Down load key to get the Hawaii Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan. You may also entry forms you previously downloaded in the My Forms tab of your accounts.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape to the appropriate town/country.

- Step 2. Take advantage of the Review option to check out the form`s information. Never forget to see the outline.

- Step 3. In case you are unsatisfied with all the kind, utilize the Lookup field at the top of the display screen to locate other variations in the lawful kind web template.

- Step 4. Upon having identified the shape you need, select the Acquire now key. Choose the pricing plan you like and add your qualifications to register on an accounts.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal accounts to accomplish the transaction.

- Step 6. Find the format in the lawful kind and acquire it on your own product.

- Step 7. Comprehensive, revise and printing or indication the Hawaii Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan.

Each and every lawful papers web template you buy is the one you have eternally. You have acces to each kind you downloaded in your acccount. Click the My Forms area and choose a kind to printing or acquire once more.

Be competitive and acquire, and printing the Hawaii Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan with US Legal Forms. There are thousands of skilled and state-particular forms you may use for your personal organization or personal requires.

Form popularity

FAQ

What is the difference between a transfer and a rollover? A transfer is used to move funds from one institution to another without changing the account type. A direct rollover is used to move funds from an employer plan to another account type like an IRA, without having to pay taxes.

Failure to follow 401(k) transfer rules may result in extra penalties and taxes. For example, if you don't do a direct rollover and receive the funds from your previous employer's plan in the form of a check, a mandatory 20% withholding will apply.

When are penalty-free distributions from my 403(b) account available? Current IRS regulations allow withdrawals of 403(b) monies, without penalties, when you: Reach age 59½, Retire or separate from service during the year in which you reach age 55 or later,***

If you leave the Plan before Normal Retirement Date you will have the option to leave the accumulated fund in the Motorola Pension Plan or transfer to an alternative pension arrangement. If you leave the Company you cannot continue to contribute to the Motorola Pension Builder.

A 403(b) plan is an employer-sponsored retirement plan that's very similar to a 401(k) plan. The key difference is that 403(b) plans are offered by public schools, churches, and 501(c)(3) non-profit organizations. The 403(b) plan was originally created in 1958, but it's been expanded and adapted since then.

A qualified plan-to-plan transfer is the process of moving money from a qualified (as defined by IRS) pretax investment account/retirement plan to another qualified plan without incurring taxes or penalties on the money being transferred.