Hawaii Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company

Description

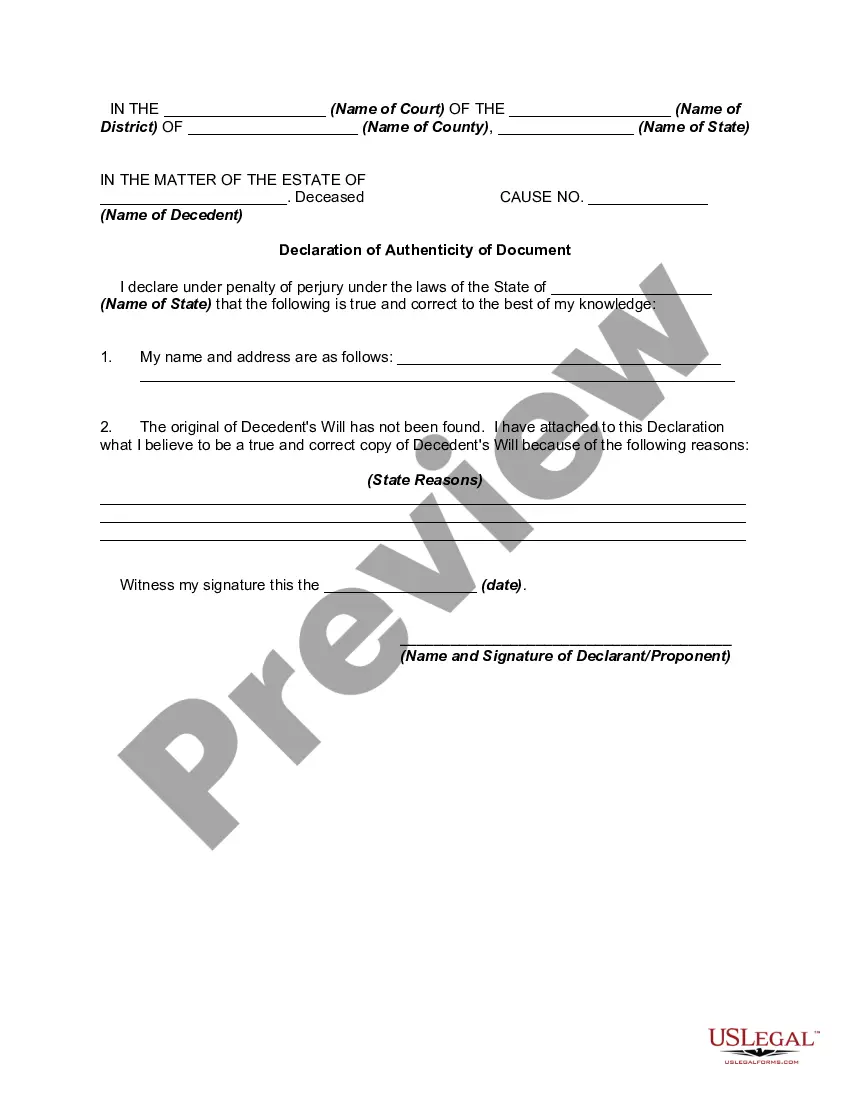

How to fill out Amendment To Trust Agreement Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Company?

You may invest hrs on-line searching for the legal file web template that suits the state and federal needs you want. US Legal Forms offers a huge number of legal kinds that are evaluated by specialists. You can actually download or print out the Hawaii Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company from our service.

If you currently have a US Legal Forms accounts, you may log in and click the Download key. Following that, you may complete, change, print out, or indication the Hawaii Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company. Each legal file web template you purchase is your own permanently. To obtain another version of the acquired develop, go to the My Forms tab and click the corresponding key.

If you use the US Legal Forms web site the very first time, keep to the basic guidelines listed below:

- Very first, be sure that you have chosen the right file web template to the area/city that you pick. Look at the develop information to make sure you have picked the appropriate develop. If offered, use the Preview key to search through the file web template too.

- If you would like locate another model of the develop, use the Lookup field to obtain the web template that meets your requirements and needs.

- Upon having found the web template you want, click on Purchase now to proceed.

- Pick the rates program you want, type your qualifications, and sign up for an account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal accounts to cover the legal develop.

- Pick the format of the file and download it to your product.

- Make modifications to your file if possible. You may complete, change and indication and print out Hawaii Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company.

Download and print out a huge number of file templates utilizing the US Legal Forms Internet site, which offers the biggest variety of legal kinds. Use professional and condition-particular templates to deal with your small business or specific requirements.

Form popularity

FAQ

Amending a Living Trust in California Nearly all trust documents can be amended. However, some are easier to amend than others. In the case of a revocable living trust, amendments usually take on the form of additional documents written after the original trust document has been signed and notarized.

A trust amendment is a legal document that changes specific provisions of a revocable living trust but leaves all of the other provisions unchanged, while a restatement of a trust?which is also known as a complete restatement or an amendment and complete restatement?completely replaces and supersedes all of the ...

This is by far one of the easiest ways to modify your irrevocable trust in the state of California. In the event that not all parties of the trust can provide their written consent, probate code §15404(b) can allow all the parties consenting to petition the court to modify your termination of the trust.

California's Legal Framework for Dissolving an Irrevocable Trust. California's Probate Code allows for the modification and termination of trusts when: The trust is revocable by the settlor. All beneficiaries of an irrevocable trust consent to modification or termination of the trust.

Amending a Living Trust in California These amendments do not need to be notarized to count, but they do need to be witnessed and signed, or at least created holographically (in the grantor's handwriting, with the grantor's signature).

It's important to know what you want to change and where in your trust document this information lives (such as the article number you're amending). Fill out the amendment form. Complete the entire form. It's important to be clear and detailed in describing your changes.