Hawaii Employee Shareholder Escrow Agreement

Description

How to fill out Employee Shareholder Escrow Agreement?

Finding the right legitimate papers design might be a battle. Obviously, there are plenty of web templates available on the net, but how will you obtain the legitimate kind you need? Take advantage of the US Legal Forms web site. The support delivers thousands of web templates, including the Hawaii Employee Shareholder Escrow Agreement, that can be used for company and private requires. All of the varieties are checked out by professionals and meet federal and state specifications.

When you are presently listed, log in to the accounts and click the Download button to get the Hawaii Employee Shareholder Escrow Agreement. Make use of your accounts to search through the legitimate varieties you might have acquired earlier. Check out the My Forms tab of your own accounts and acquire one more copy in the papers you need.

When you are a whole new end user of US Legal Forms, allow me to share easy instructions so that you can follow:

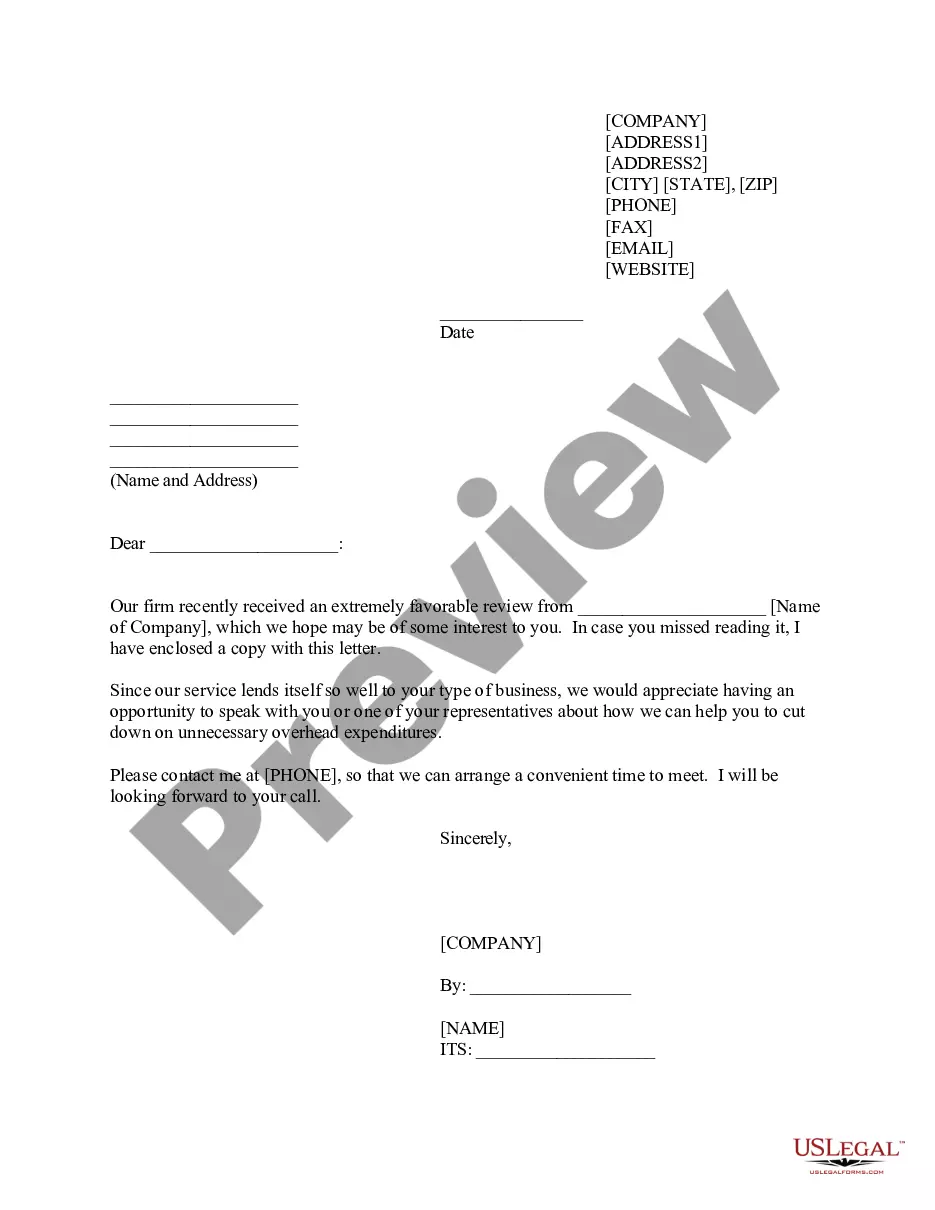

- Initially, make certain you have selected the right kind to your city/county. You can look over the shape while using Preview button and study the shape explanation to ensure this is basically the right one for you.

- When the kind does not meet your preferences, utilize the Seach field to discover the proper kind.

- Once you are certain that the shape is suitable, click the Buy now button to get the kind.

- Select the rates program you desire and enter in the needed information and facts. Make your accounts and buy the transaction using your PayPal accounts or bank card.

- Opt for the document file format and acquire the legitimate papers design to the gadget.

- Total, revise and printing and indicator the obtained Hawaii Employee Shareholder Escrow Agreement.

US Legal Forms will be the biggest library of legitimate varieties in which you will find a variety of papers web templates. Take advantage of the company to acquire appropriately-produced paperwork that follow status specifications.

Form popularity

FAQ

Which action CANNOT be performed by an escrow agent? Disburse funds as authorized by both principals.

In short, in Hawaii, the closing process generally is conducted through escrow. In Hawaii, escrow services are typically provided by title insurance companies, but escrow can also be done through trust companies, lenders, Hawaii attorneys, or Hawaii real estate brokers.

An escrow agent may be a bank, savings and loan, title insurance company, attorney, real estate broker, or an escrow company.

In Hawaii, the seller in a transaction typically has the most leverage and selects the title and escrow company they prefer via contract negotiations. If the seller doesn't have any preference, they are likely to accept a contract where the buyer makes the selection.

Typically, the role of the escrow agent will be played by representatives from a title company, mortgage lender, or an attorney, but it can depend on the laws and customs in your state.

Escrow instructions are written directions to an escrow agent which state the duties of the parties and the escrow holder. Note that an existing agent or an attorney of grantor or grantee cannot act as an escrow agent due to the conflict of interest in the duties.

An escrow agreement is a legal document outlining terms and conditions between parties as well as the responsibility of each. Agreements usually involve an independent third party called an escrow agent, who holds an asset until the contract's conditions are met.

As an escrow agent, the Bank will: 1) receive funds from the project owner or contractor, 2) deposit funds into a separate non-interest bearing account, 3) honor checks written against the account, 4) mail monthly account statements, and 5) provide on-line access to the necessary parties.