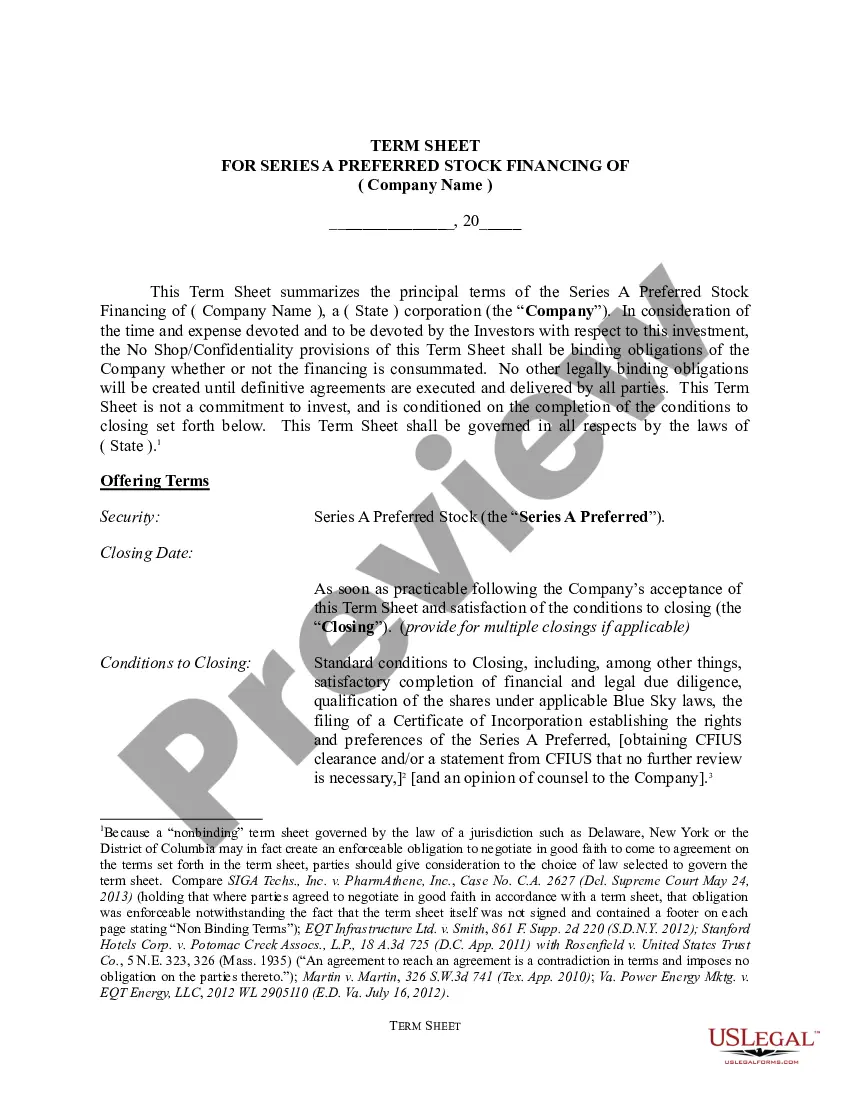

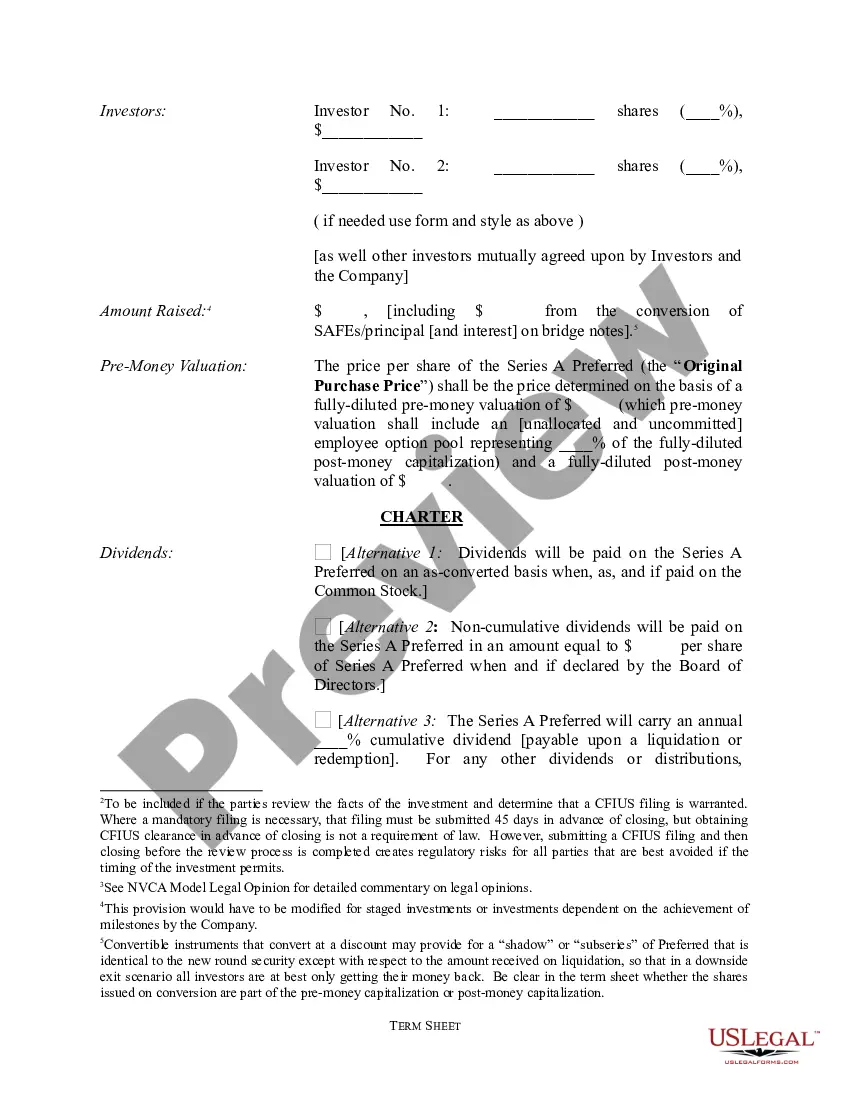

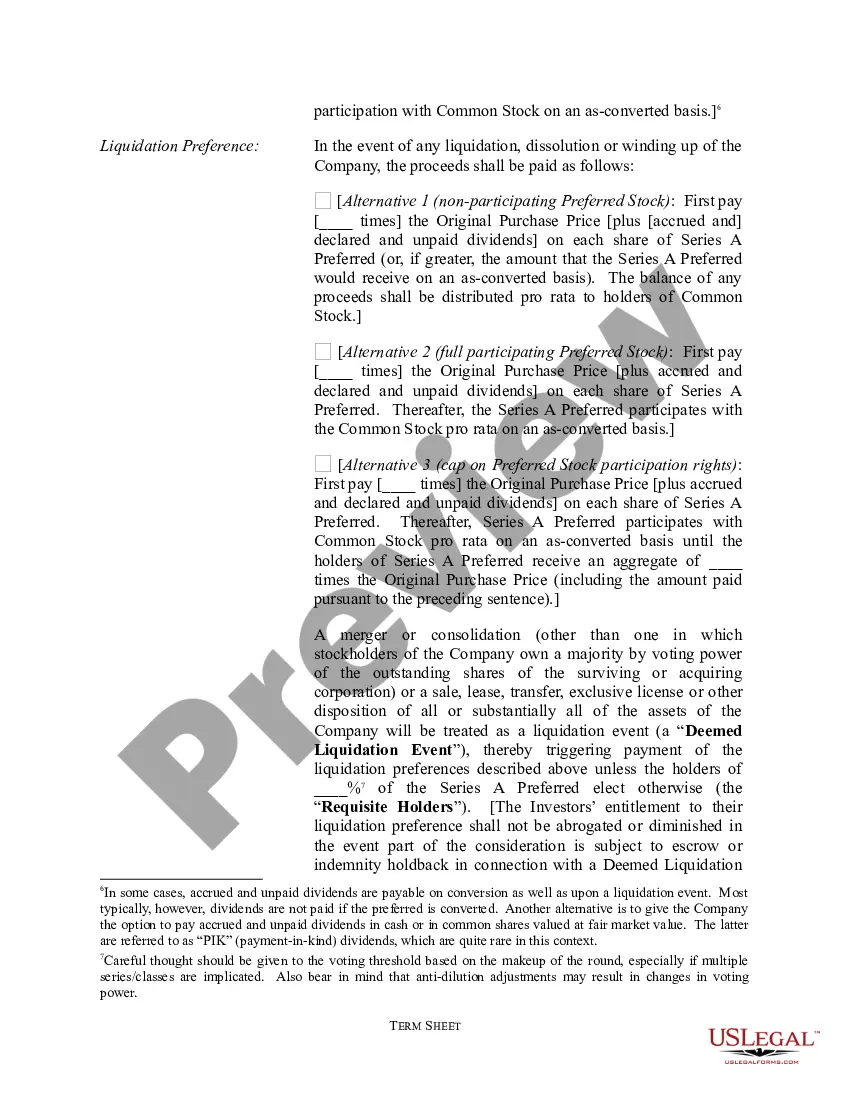

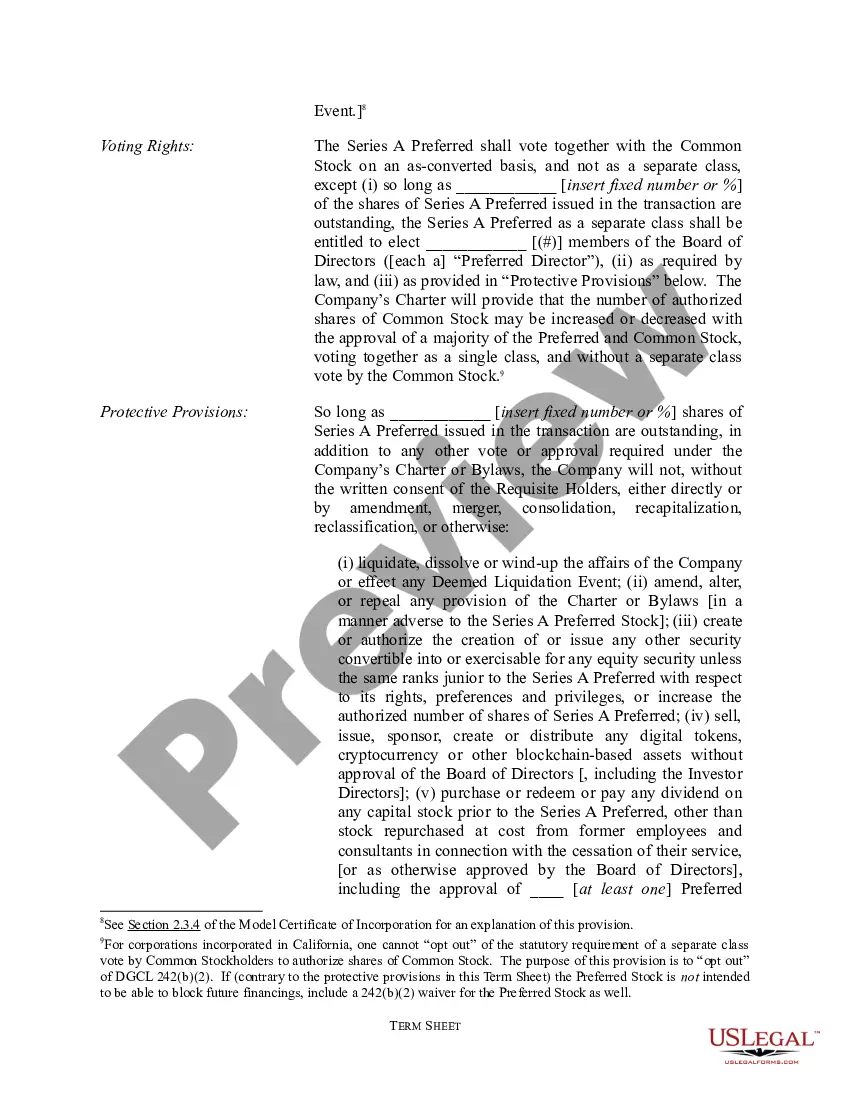

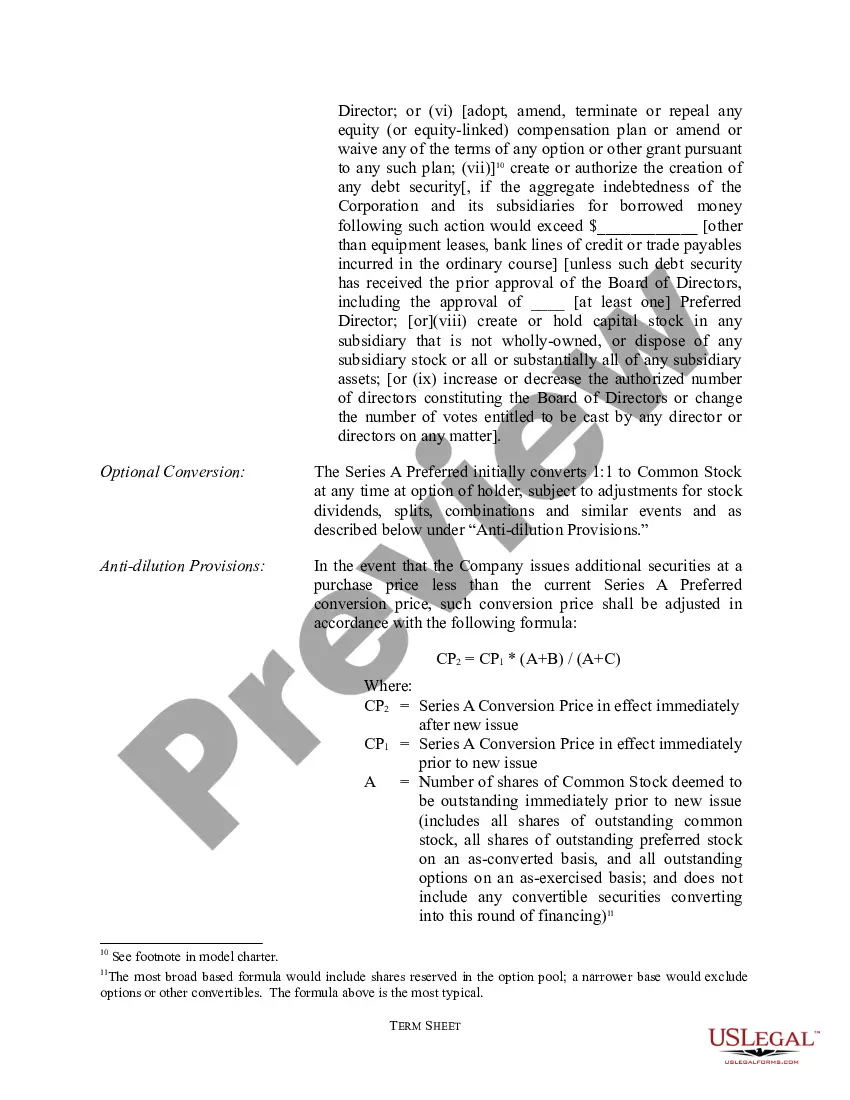

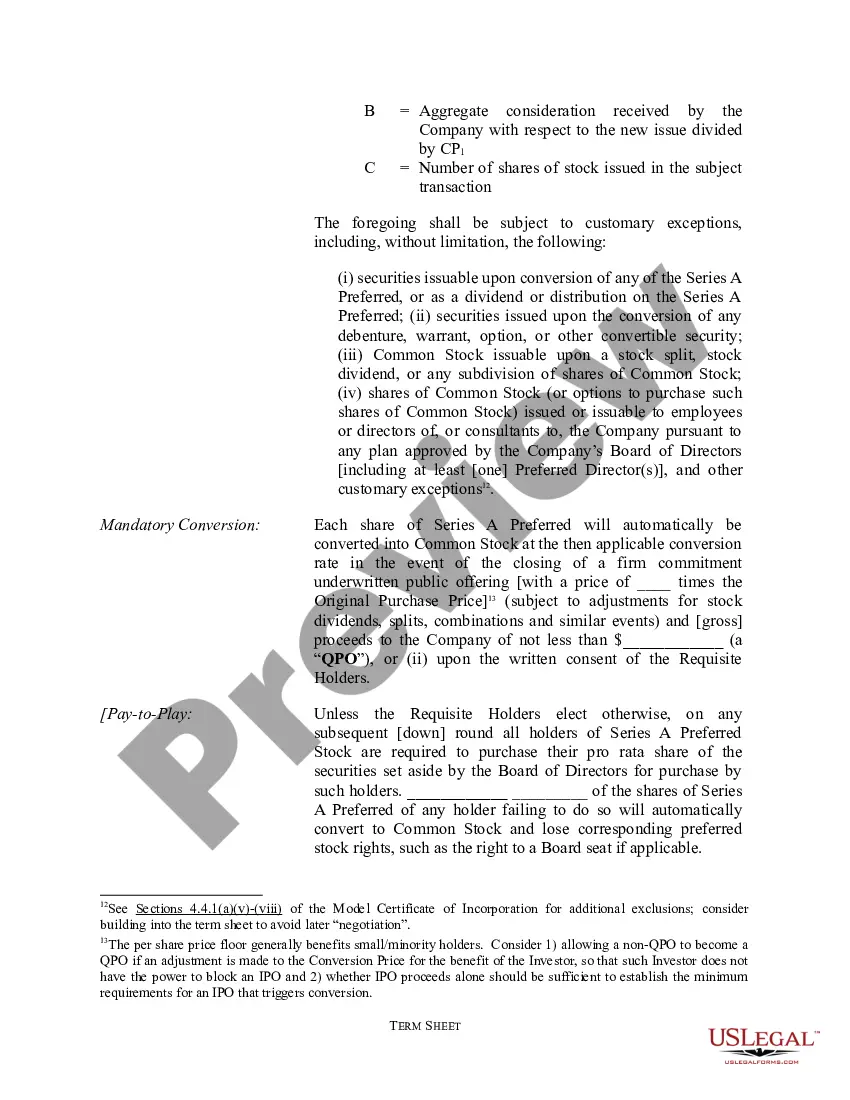

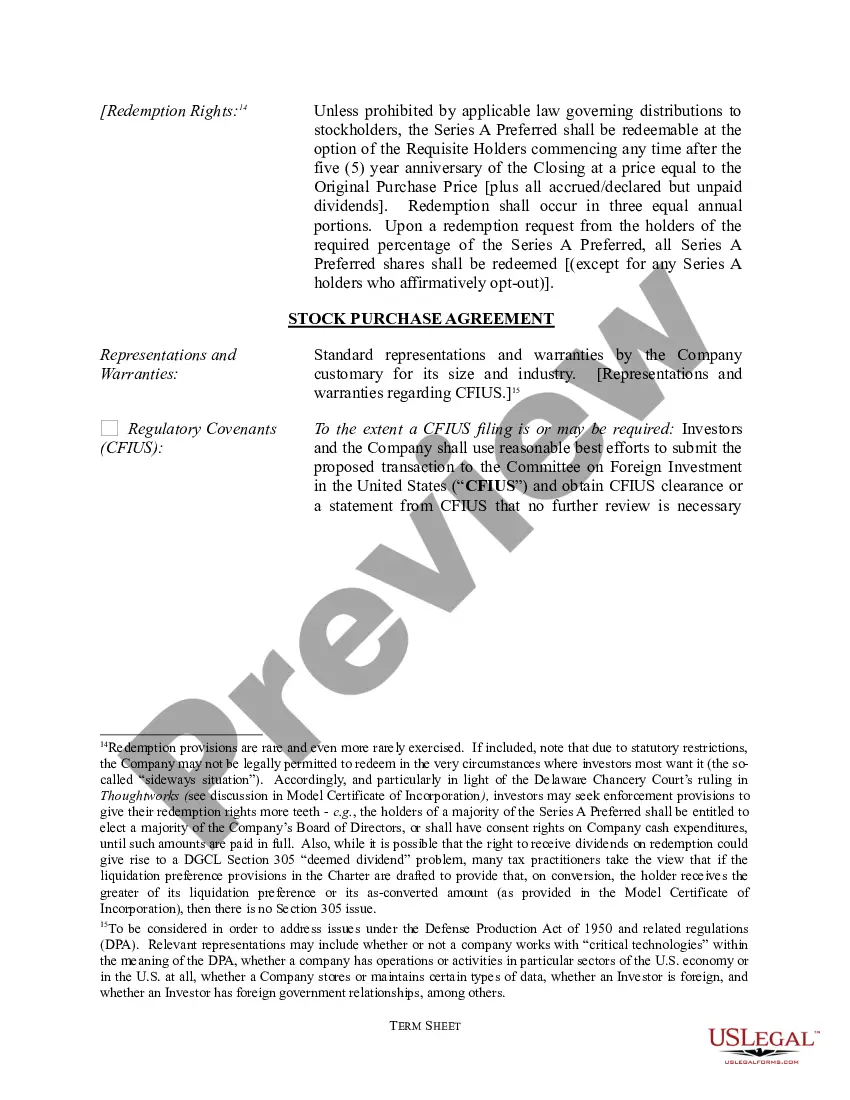

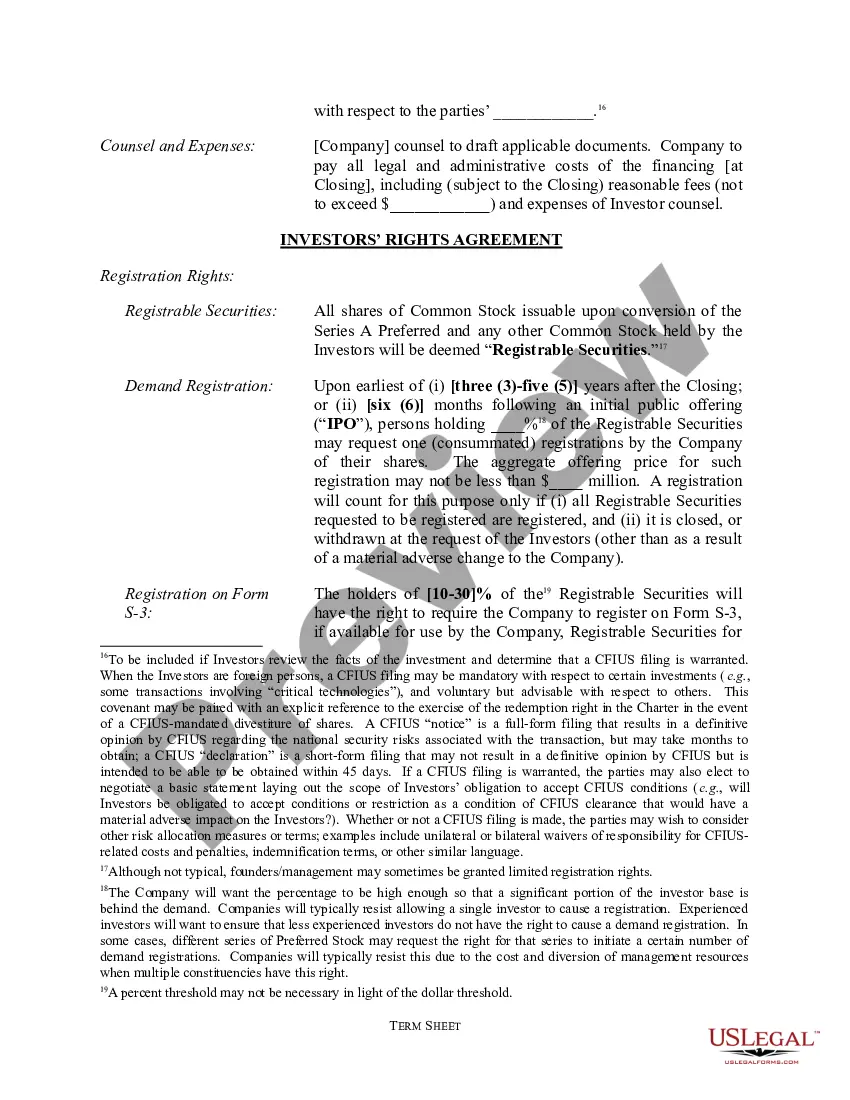

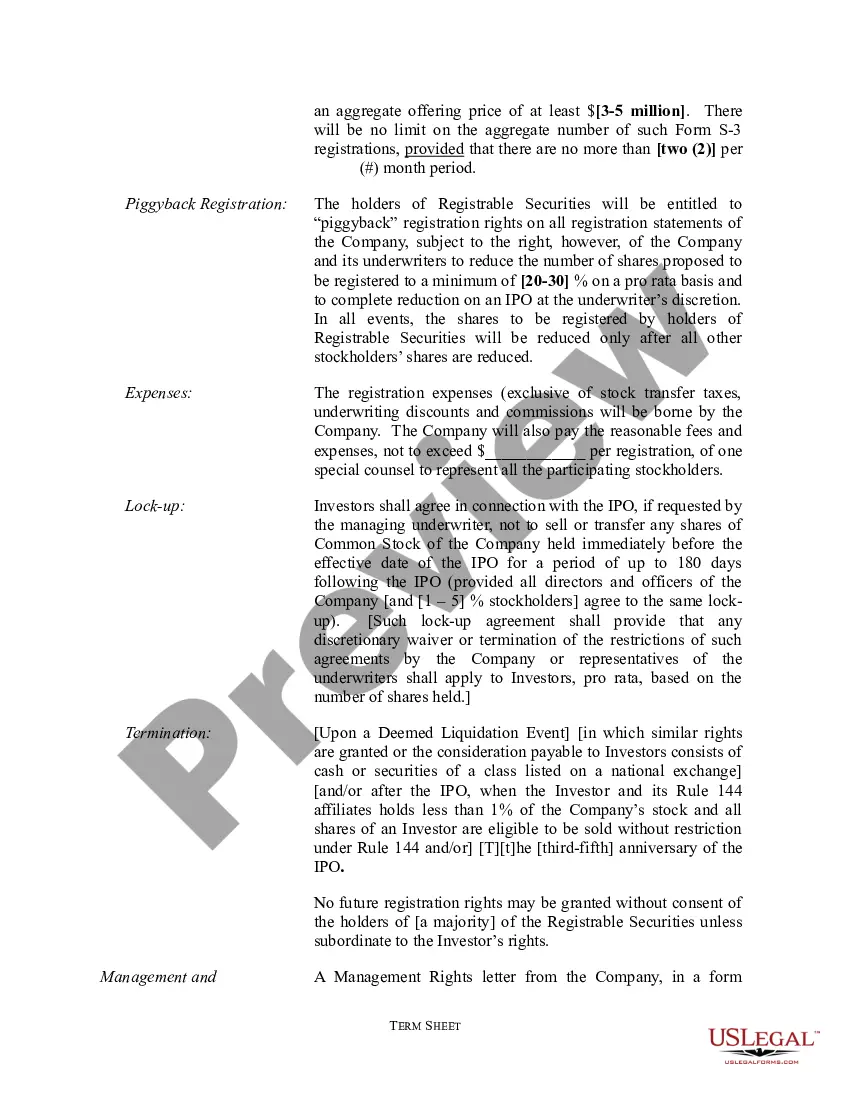

Hawaii Term Sheet — Series A Preferred Stock Financing is a financial agreement utilized by companies in Hawaii to raise capital for expansion, research and development, or other business needs. This form of financing involves selling shares of preferred stock to investors who provide funding and have certain privileges over common stockholders. The Series A Preferred Stock is the first round of financing in a company's journey towards growth. It signifies an early stage of investment and acts as a stepping stone for subsequent funding rounds. This financing option is often sought by startups and companies with promising potential, as it offers investors a higher level of security compared to common stock. The Hawaii Term Sheet for Series A Preferred Stock Financing typically outlines the terms and conditions of the investment, safeguarding the interests of both the company and the investors. Some key elements covered in this document include: 1. Valuation: The term sheet specifies the PRE and post-money valuation, providing a basis for determining the percentage of ownership the investors will acquire. 2. Investment Amount: This section outlines the total amount of funds the company aims to raise through the issuance of preferred stock. 3. Liquidation Preference: Series A Preferred Stockholders have a preference over common stockholders in the event of liquidation or sale of the company, ensuring they will be paid a certain multiple of their initial investment before other shareholders. 4. Dividends: The term sheet may include provisions regarding the payment of dividends to the Series A Preferred Stockholders. These dividends can be cumulative or non-cumulative, and the specific terms are negotiated between the company and the investors. 5. Conversion Rights: Investors may negotiate conversion rights, which allow them to convert their preferred stock into common stock, typically upon the occurrence of a specific event, such as an initial public offering (IPO). 6. Anti-Dilution Protection: The term sheet may incorporate anti-dilution provisions to protect the investors from dilution in the event of future stock issuance sat a lower valuation. 7. Board Representation: Investors may negotiate for a seat on the company's board of directors or observer rights to actively participate in the decision-making process. It is important to note that while the general structure and key elements of a Hawaii Term Sheet — Series A Preferred Stock Financing are often similar, specific terms may vary based on the negotiations between the company and the investors. Different variations or additional types may include customized provisions addressing specific needs or risks, such as investor rights, tag-along rights, forced redemption rights, or participation rights. In summary, Hawaii Term Sheet — Series A Preferred Stock Financing is an essential tool for companies seeking early-stage capital in Hawaii. It serves as a roadmap for investors and the company, ensuring clear terms and expectations for both parties involved in the financing agreement.

Hawaii Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Hawaii Term Sheet - Series A Preferred Stock Financing Of A Company?

If you need to comprehensive, obtain, or produce authorized document layouts, use US Legal Forms, the most important collection of authorized forms, which can be found on the Internet. Make use of the site`s simple and handy lookup to discover the papers you will need. A variety of layouts for company and person functions are sorted by categories and suggests, or search phrases. Use US Legal Forms to discover the Hawaii Term Sheet - Series A Preferred Stock Financing of a Company within a couple of clicks.

In case you are already a US Legal Forms client, log in in your bank account and click on the Download switch to find the Hawaii Term Sheet - Series A Preferred Stock Financing of a Company. You can even gain access to forms you earlier downloaded within the My Forms tab of your own bank account.

If you work with US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for that right metropolis/region.

- Step 2. Take advantage of the Review choice to examine the form`s articles. Do not overlook to read through the explanation.

- Step 3. In case you are not happy using the kind, use the Search area at the top of the display screen to locate other models of your authorized kind template.

- Step 4. Once you have identified the form you will need, click on the Get now switch. Opt for the rates program you like and include your references to register for an bank account.

- Step 5. Approach the deal. You should use your charge card or PayPal bank account to perform the deal.

- Step 6. Choose the structure of your authorized kind and obtain it on your product.

- Step 7. Full, edit and produce or signal the Hawaii Term Sheet - Series A Preferred Stock Financing of a Company.

Every single authorized document template you acquire is the one you have eternally. You might have acces to each and every kind you downloaded within your acccount. Select the My Forms section and decide on a kind to produce or obtain yet again.

Be competitive and obtain, and produce the Hawaii Term Sheet - Series A Preferred Stock Financing of a Company with US Legal Forms. There are thousands of specialist and condition-certain forms you can use to your company or person needs.