A Hawaii Subscription Agreement is a legal document that outlines the terms and conditions between a company or organization (issuer) and an investor, who is interested in purchasing equity or debt securities, to fund the issuer's operations or expansion. This agreement establishes the relationship and rights between the parties involved and typically includes important details related to investment amount, subscription price, payment terms, and any associated legal requirements specific to Hawaii. There are various types of Hawaii Subscription Agreements depending on the nature of the securities being offered: 1. Equity Subscription Agreement: This type of agreement is used when the issuer is offering equity securities, such as shares in a corporation or membership interests in a limited liability company. It establishes the number of shares being offered, purchase price per share, and any shareholder rights or restrictions associated with the investment. 2. Convertible Note Subscription Agreement: In cases where the issuer is offering convertible notes, which are debt securities that can be converted into equity in the future, this agreement outlines the terms and conditions of the note investment, including interest rates, maturity dates, and conversion terms. 3. Debt Subscription Agreement: This agreement is utilized when the issuer offers debt securities, such as corporate bonds or promissory notes, to investors. It specifies the principal amount of the debt, interest rates, payment schedules, and any covenants or guarantees associated with the debt repayment. 4. SAFE (Simple Agreement for Future Equity) Subscription Agreement: SAFE agreements are used in startup financing rounds and provide investors with the right to obtain future equity at a predetermined valuation. This type of subscription agreement establishes the investment amount, valuation cap, discount rate, and trigger events for converting the SAFE into equity. It is essential for both parties to carefully review and understand the terms mentioned in the Hawaii Subscription Agreement before entering into any investment commitments. Seeking legal counsel or professional advice is highly recommended ensuring compliance with applicable laws and regulations specific to Hawaii.

Hawaii Subscription Agreement

Description

How to fill out Subscription Agreement?

Finding the right authorized document web template could be a have a problem. Obviously, there are tons of templates available on the Internet, but how will you discover the authorized type you need? Use the US Legal Forms web site. The service gives a huge number of templates, like the Hawaii Subscription Agreement, which can be used for company and personal demands. All the kinds are inspected by pros and satisfy federal and state specifications.

When you are currently listed, log in in your accounts and click the Obtain option to obtain the Hawaii Subscription Agreement. Utilize your accounts to check from the authorized kinds you possess ordered earlier. Go to the My Forms tab of your accounts and get one more version in the document you need.

When you are a fresh consumer of US Legal Forms, allow me to share simple directions so that you can follow:

- Initial, make certain you have selected the appropriate type for the metropolis/region. You may check out the form using the Preview option and read the form explanation to make certain it will be the best for you.

- If the type does not satisfy your needs, use the Seach discipline to discover the correct type.

- Once you are certain the form is acceptable, click on the Acquire now option to obtain the type.

- Pick the rates plan you desire and enter in the required info. Create your accounts and purchase the transaction using your PayPal accounts or credit card.

- Choose the document file format and down load the authorized document web template in your gadget.

- Comprehensive, change and printing and signal the acquired Hawaii Subscription Agreement.

US Legal Forms is definitely the greatest local library of authorized kinds in which you can find various document templates. Use the company to down load expertly-manufactured files that follow state specifications.

Form popularity

FAQ

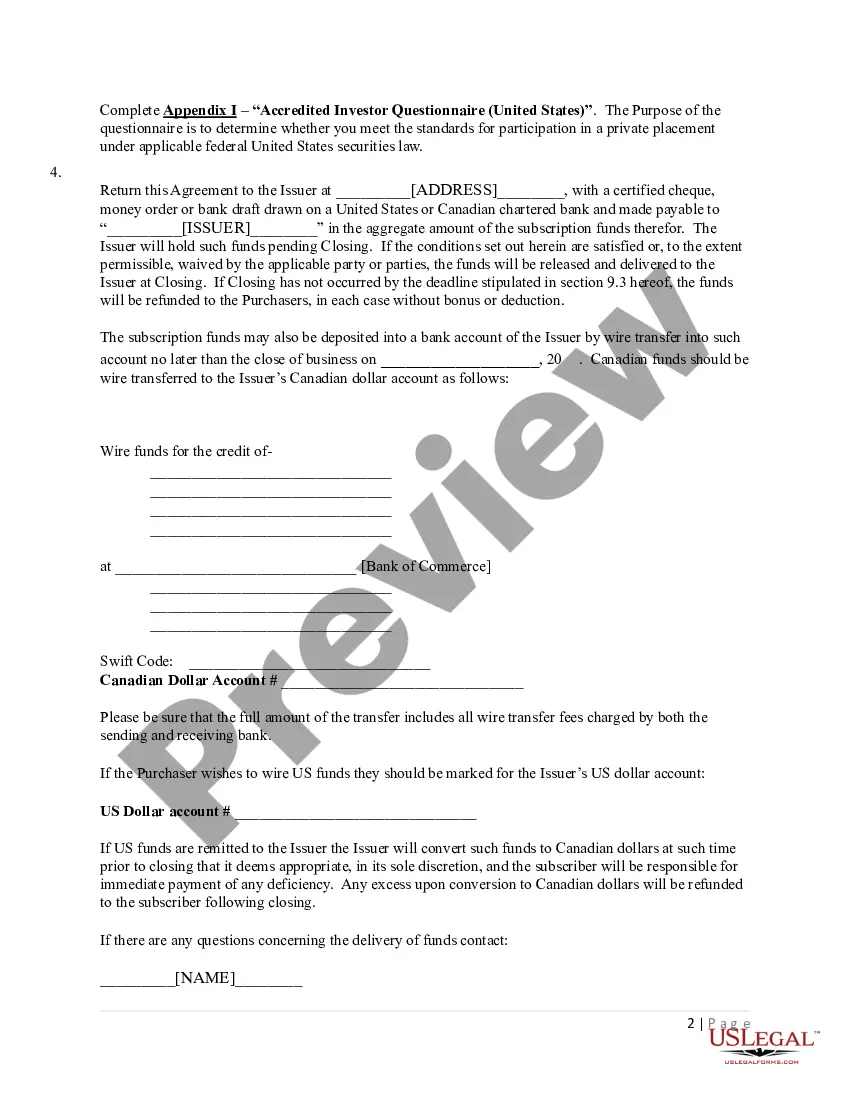

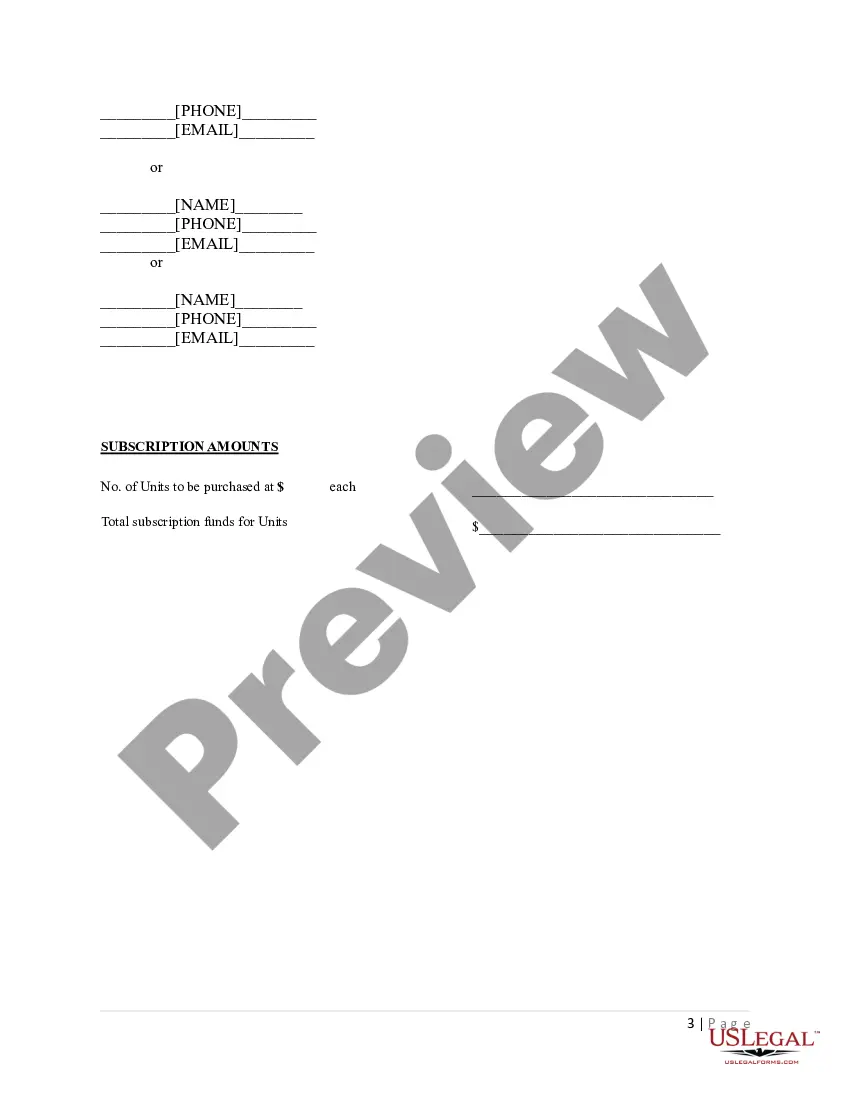

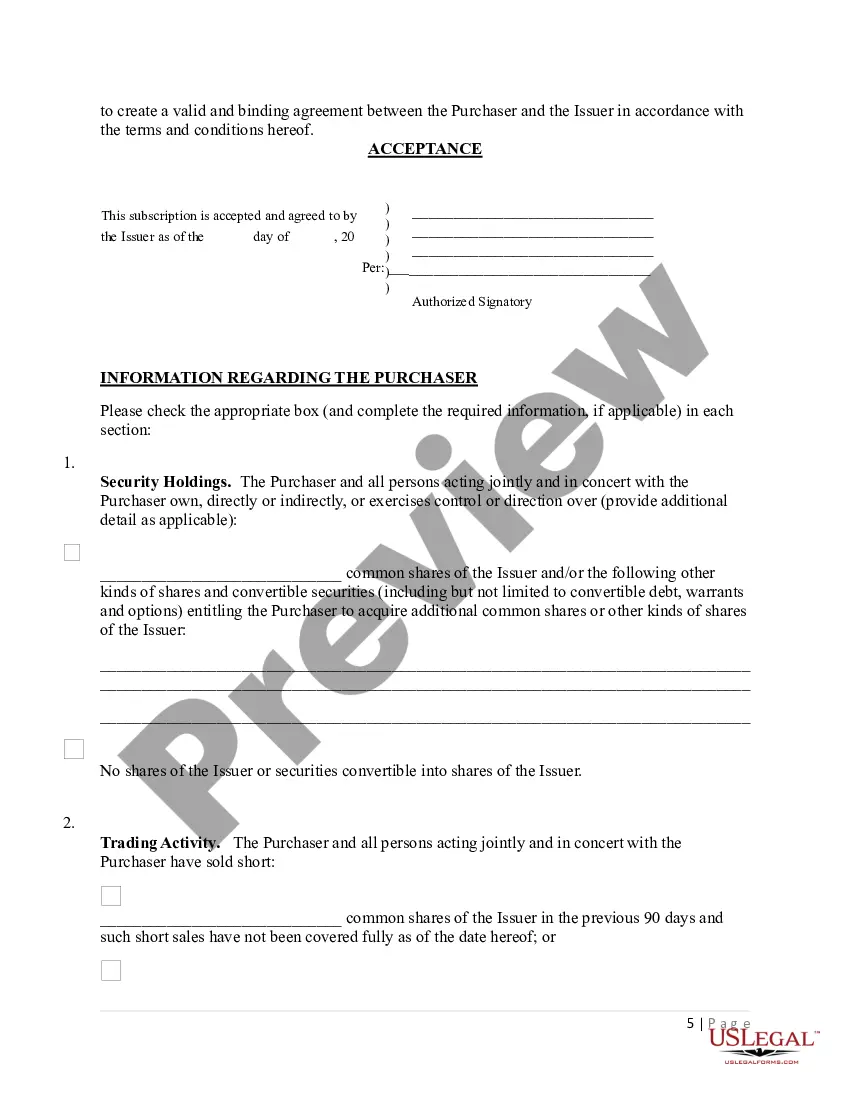

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

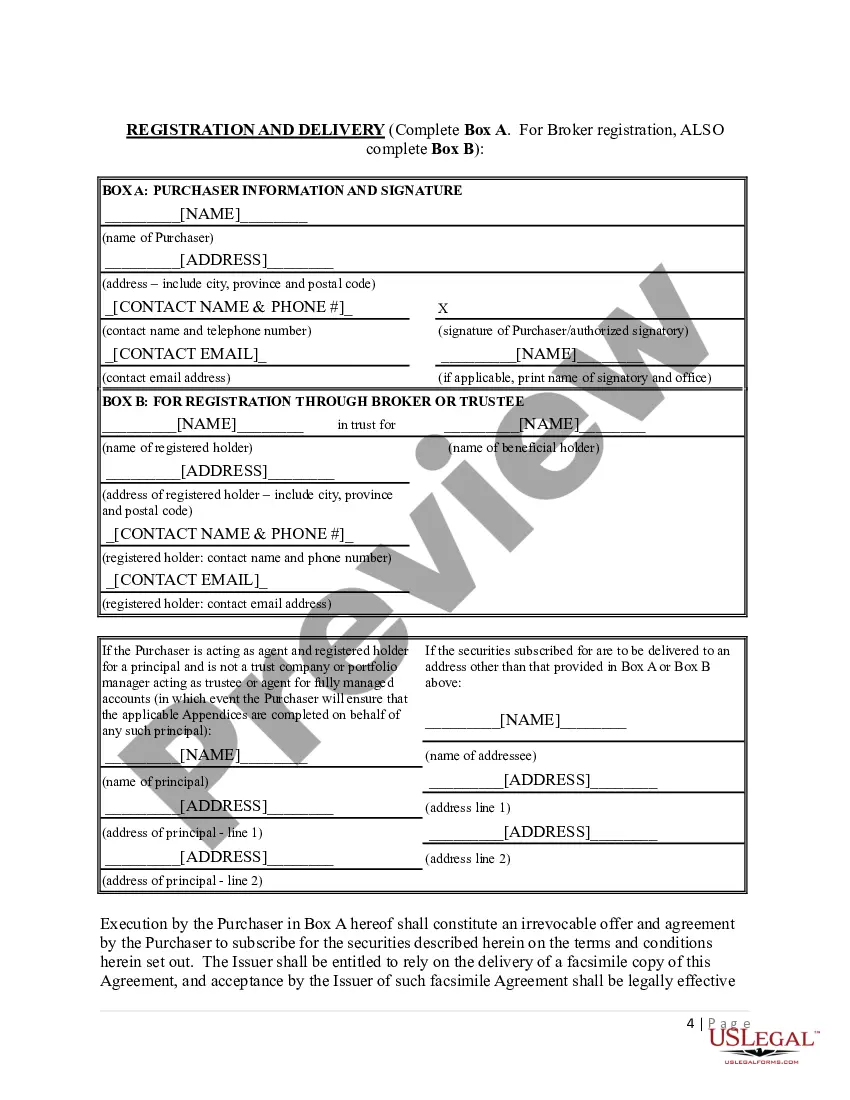

The Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.