To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

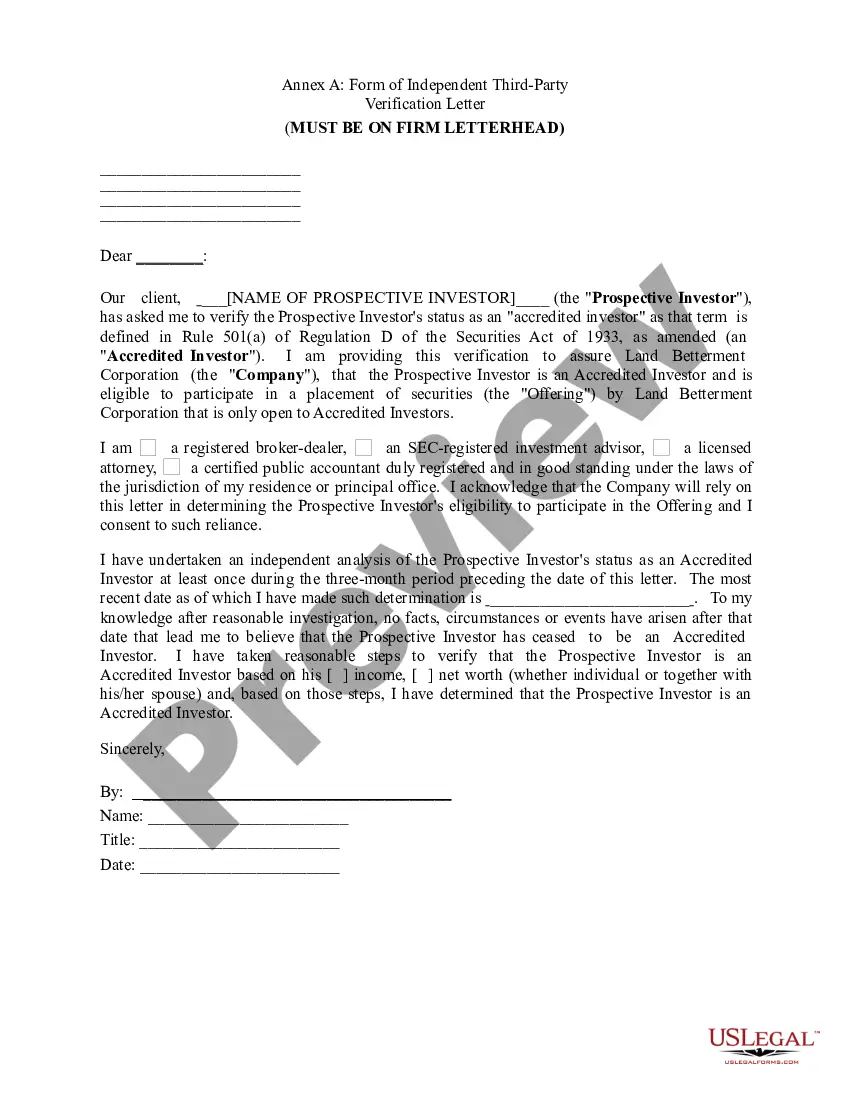

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

The Hawaii Accredited Investor Certification Letter is a document that certifies an individual or entity as an accredited investor according to the regulations set by the Hawaii Department of Commerce and Consumer Affairs. This certification letter is crucial for individuals or entities seeking investment opportunities that are only available to accredited investors. Being an accredited investor grants individuals or entities specific privileges in the investment world, such as access to certain investment opportunities that are not available to the public due to their complexity or risk. To obtain the Hawaii Accredited Investor Certification Letter, individuals or entities must meet certain criteria outlined by the Hawaii Department of Commerce and Consumer Affairs. These criteria typically include a minimum income or net worth threshold, investment experience, or holding specific professional credentials. It is important to note that there might be different types of Hawaii Accredited Investor Certification Letters, depending on the specific criteria met by the individual or entity seeking certification. These different types could include: 1. Income-Based Certification: This type of certification is granted to individuals who meet a specific income threshold set by the Hawaii Department of Commerce and Consumer Affairs. The income threshold is typically reviewed annually to account for inflation and other economic factors. Individuals with a high income are considered more capable of understanding and managing the risks associated with certain investment opportunities. 2. Net Worth-Based Certification: Individuals or entities with a high net worth may also qualify for the Hawaii Accredited Investor Certification Letter. The net worth criteria consider the total value of an individual's assets minus their liabilities. A specific net worth threshold is typically required to qualify for this type of certification. 3. Professional Credential-Based Certification: Some professional qualifications or credentials automatically qualify individuals for the Hawaii Accredited Investor Certification Letter. For example, individuals holding specific financial certifications such as CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant) may be eligible for this type of certification. These professional credentials demonstrate a high level of financial knowledge and expertise. It is important for individuals or entities interested in obtaining the Hawaii Accredited Investor Certification Letter to carefully review and understand the specific requirements set by the Hawaii Department of Commerce and Consumer Affairs. Obtaining this certification can open doors to a wider range of investment opportunities but should be approached with caution, as it also entails taking on higher risks associated with such investments.