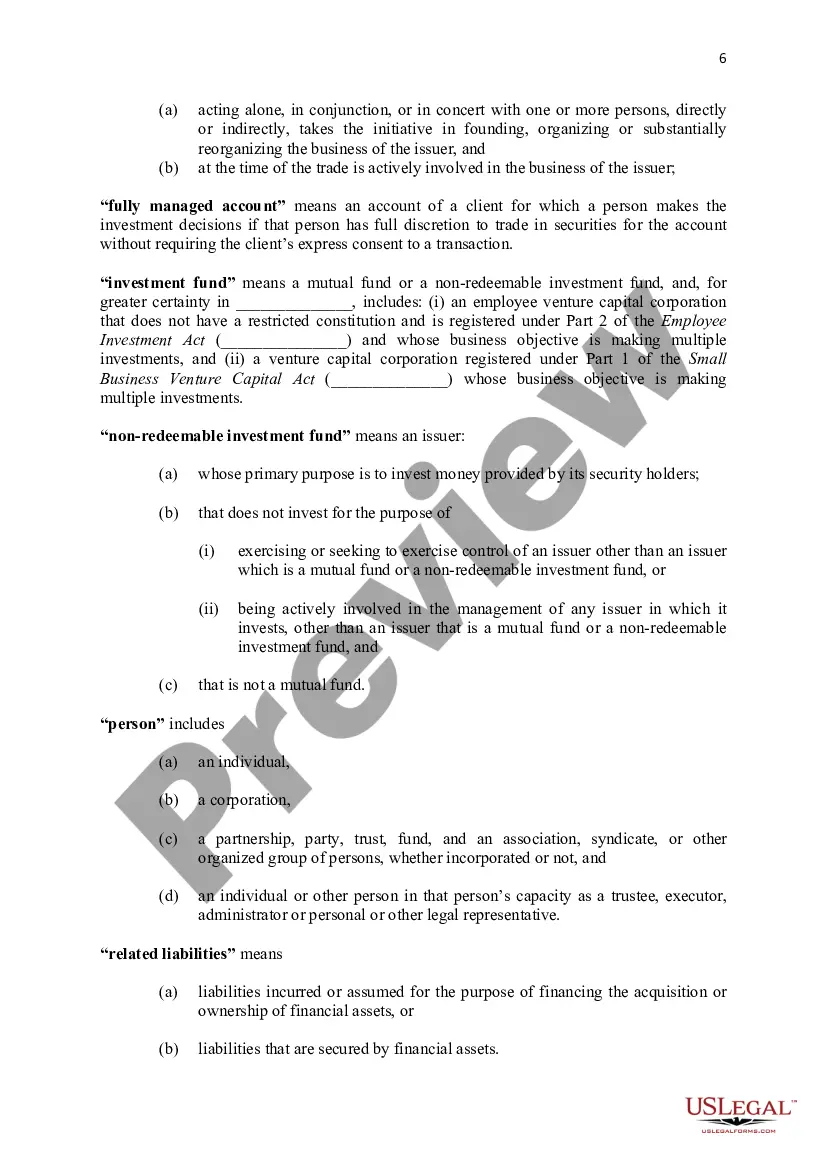

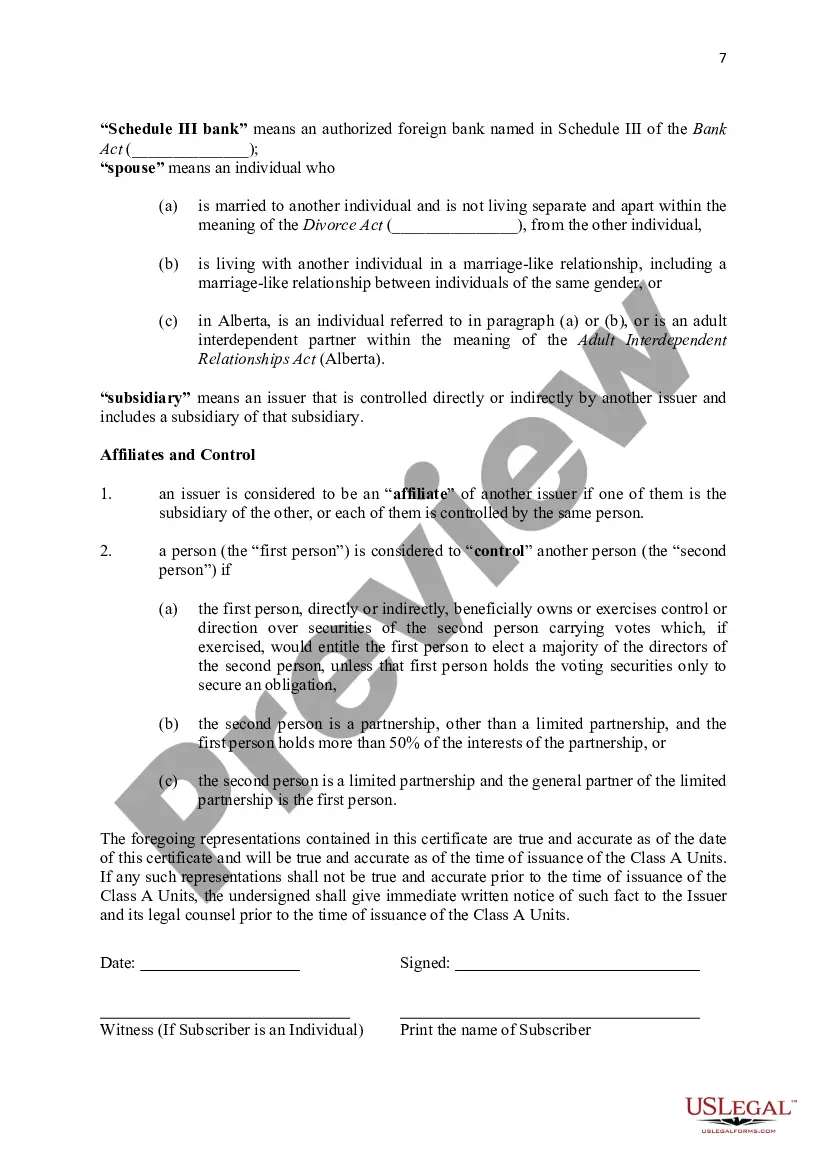

Hawaii Accredited Investor Status Certificate

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Status Certificate?

US Legal Forms - among the largest libraries of legal varieties in the USA - offers an array of legal document layouts it is possible to down load or produce. Using the internet site, you can get 1000s of varieties for business and person reasons, categorized by types, claims, or search phrases.You can find the most up-to-date models of varieties much like the Hawaii Accredited Investor Status Certificate within minutes.

If you currently have a monthly subscription, log in and down load Hawaii Accredited Investor Status Certificate from your US Legal Forms local library. The Obtain switch will appear on each and every form you see. You have access to all formerly delivered electronically varieties in the My Forms tab of your own profile.

In order to use US Legal Forms initially, here are simple recommendations to help you get started:

- Be sure to have picked the proper form to your town/state. Go through the Review switch to review the form`s content material. See the form explanation to ensure that you have selected the proper form.

- If the form does not suit your specifications, use the Research industry at the top of the screen to find the one which does.

- Should you be happy with the form, validate your option by visiting the Get now switch. Then, select the prices prepare you prefer and supply your credentials to register for an profile.

- Procedure the financial transaction. Utilize your credit card or PayPal profile to complete the financial transaction.

- Pick the format and down load the form on your system.

- Make adjustments. Fill up, edit and produce and indicator the delivered electronically Hawaii Accredited Investor Status Certificate.

Every template you added to your account lacks an expiry date and is also your own eternally. So, in order to down load or produce one more duplicate, just check out the My Forms portion and click around the form you require.

Obtain access to the Hawaii Accredited Investor Status Certificate with US Legal Forms, by far the most substantial local library of legal document layouts. Use 1000s of specialist and condition-certain layouts that meet your small business or person demands and specifications.

Form popularity

FAQ

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

The questionnaire may require various attachments: account information, financial statements, and a balance sheet to verify the qualification. The list of attachments can extend to tax returns, W-2 forms, salary slips, and even letters from reviews by CPAs, tax attorneys, investment brokers, or advisors.

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income.

For those seeking a career in investing, consider one of the following certifications: Chartered Financial Analyst (CFA), Certified Financial Planner (CFP), Chartered Alternative Investment Analyst (CAIA), or Financial Risk Manager (FRM). Each of these certifications can help one pursue a career in investing.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

Based on guidance from the SEC, your accreditation is valid for 5 years as long as you self-certify that you still retain your status as an accredited investor.

Net worth over $1 million, excluding primary residence (individually or with spouse or partner) Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

As an individual, you are considered an accredited investor if you have a net worth of over $1 million and an income over $200,000. Note that in this case, your primary residence isn't included in your net worth, and if you have a spouse your combined income must be over $300,000.