Hawaii Accredited Investor Veri?cation Letter - Individual Investor

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

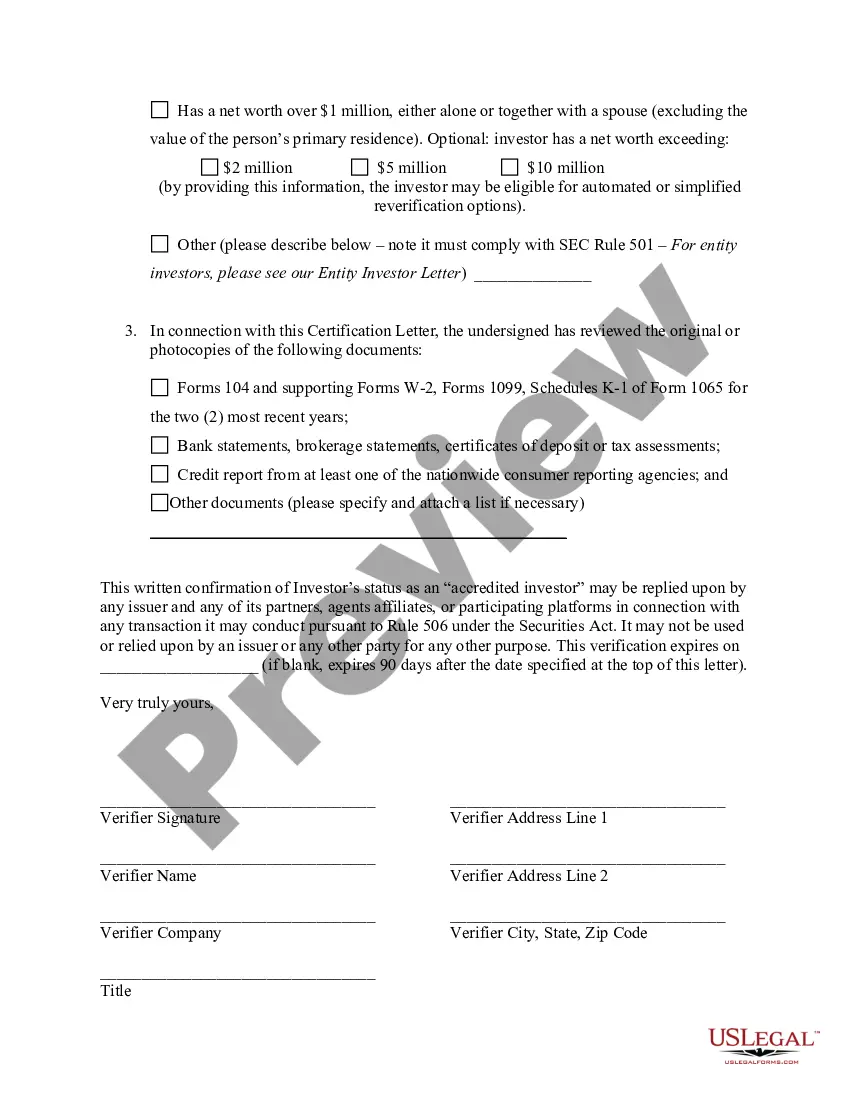

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Veri?cation Letter - Individual Investor?

You may devote hrs on the web searching for the lawful record design that meets the state and federal specifications you need. US Legal Forms supplies a huge number of lawful types that are reviewed by experts. You can actually acquire or print out the Hawaii Accredited Investor Veri?cation Letter - Individual Investor from your support.

If you already possess a US Legal Forms accounts, you are able to log in and click on the Acquire option. Afterward, you are able to total, edit, print out, or indication the Hawaii Accredited Investor Veri?cation Letter - Individual Investor. Each and every lawful record design you acquire is your own eternally. To have an additional duplicate associated with a acquired develop, visit the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms web site the first time, stick to the straightforward guidelines beneath:

- First, make sure that you have selected the right record design for your state/city of your choosing. Browse the develop description to ensure you have picked out the right develop. If offered, use the Review option to search from the record design also.

- If you wish to discover an additional model of the develop, use the Lookup industry to find the design that fits your needs and specifications.

- After you have located the design you need, click Acquire now to move forward.

- Find the rates plan you need, type your references, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You should use your charge card or PayPal accounts to pay for the lawful develop.

- Find the format of the record and acquire it in your system.

- Make adjustments in your record if required. You may total, edit and indication and print out Hawaii Accredited Investor Veri?cation Letter - Individual Investor.

Acquire and print out a huge number of record templates while using US Legal Forms web site, which offers the most important variety of lawful types. Use specialist and condition-particular templates to deal with your organization or personal needs.

Form popularity

FAQ

How can individuals qualify as accredited? Individuals (i.e., natural persons) may qualify as accredited investors based on wealth and income thresholds, as well as other measures of financial sophistication.

Can an LLC become an accredited investor? Yes, a Limited Liability Company (LLC) could potentially qualify as an accredited investor if it has total assets of at least $5,000,000 and the LLC was not created for the specific purpose of acquiring the securities.

Investors - How to Order Self-Verification With VerifyInvestor.com, you can obtain accredited investor self certification, submit accredited investor proof, get verification of accredited investor status, and get an eligible accredited investor certificate quickly, confidentially, and cost-effectively.

The questionnaire may require various attachments: account information, financial statements, and a balance sheet to verify the qualification. The list of attachments can extend to tax returns, W-2 forms, salary slips, and even letters from reviews by CPAs, tax attorneys, investment brokers, or advisors.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

In the U.S., an accredited investor is anyone who meets one of the below criteria: Individuals who have an income greater than $200,000 in each of the past two years or whose joint income with a spouse is greater than $300,000 for those years, and a reasonable expectation of the same income level in the current year.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant.

Verified Investor: How to Prove you are an Accredited Investor? Bank and brokerage statements. Evidence of an IRA. Credit report. A letter from a CPA, lawyer, registered broker-dealer, or registered investment advisor. Tax returns or W2 forms.