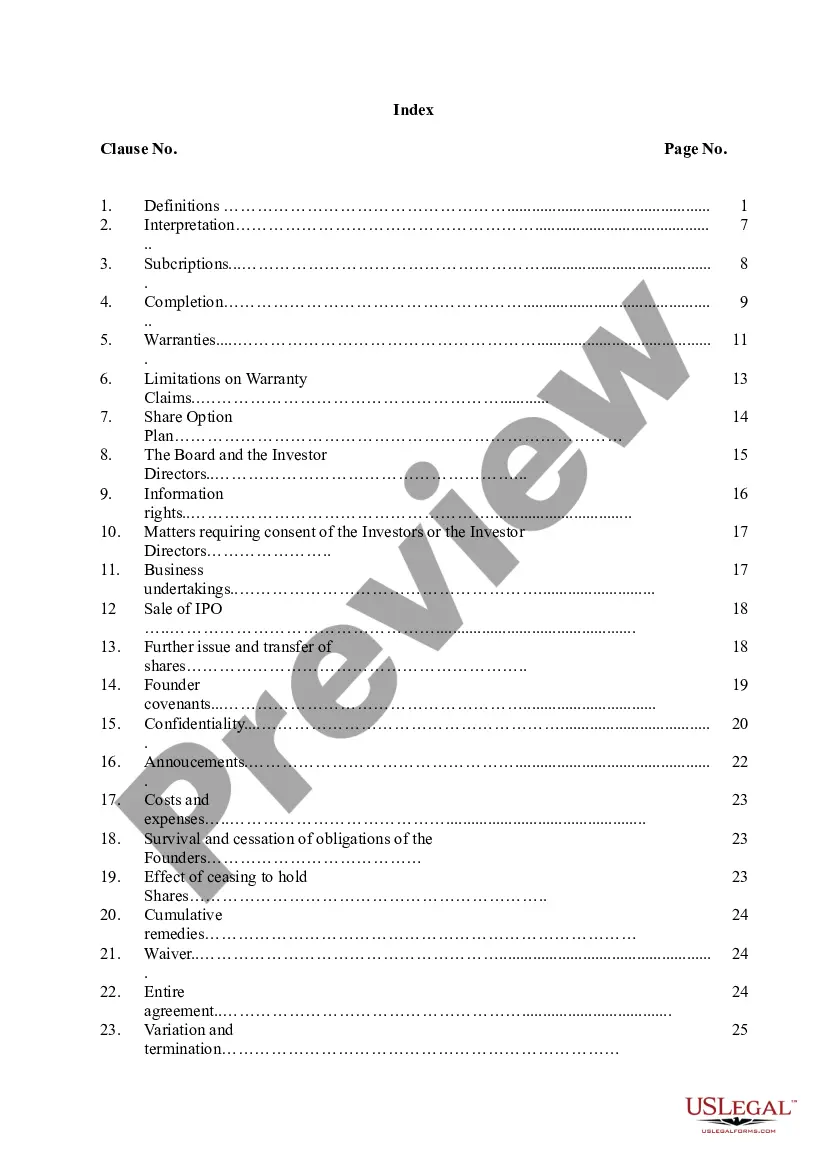

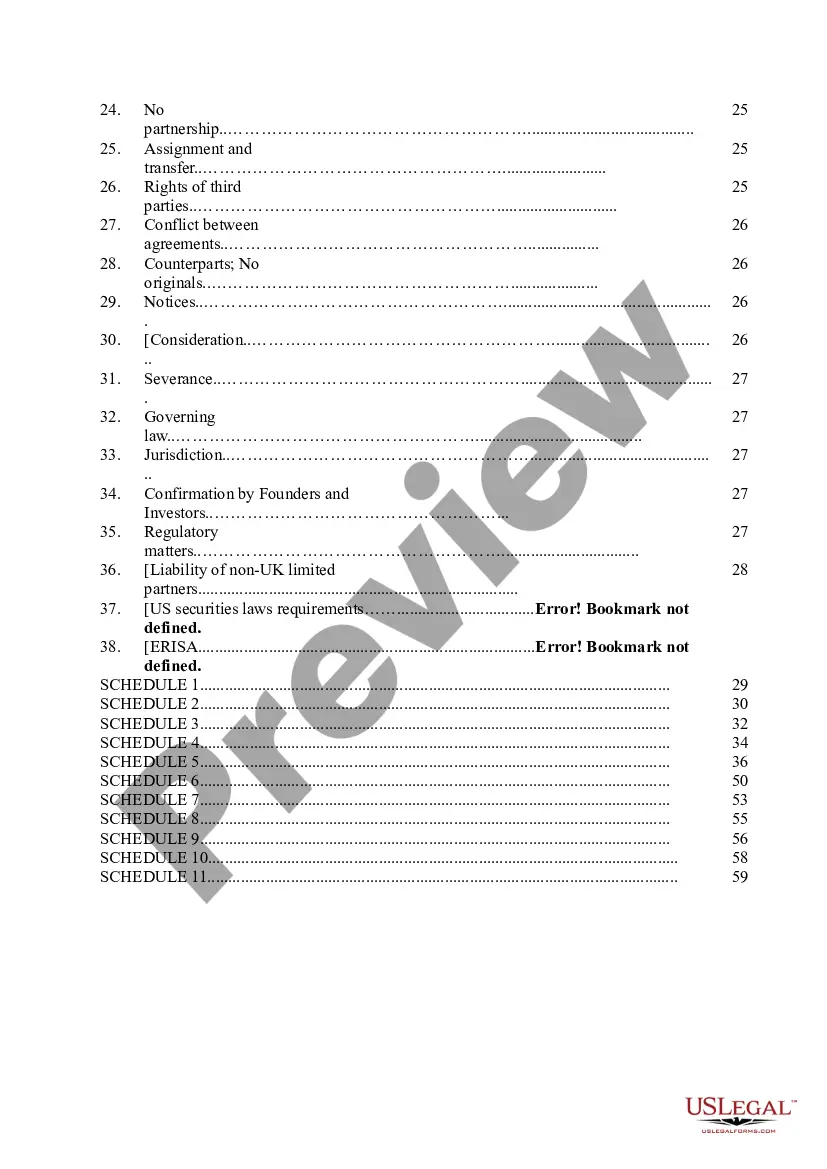

Hawaii Subscription Agreement and Shareholders' Agreement

Description

How to fill out Subscription Agreement And Shareholders' Agreement?

US Legal Forms - one of several largest libraries of legal types in America - provides a wide range of legal file layouts it is possible to obtain or printing. Utilizing the site, you may get a large number of types for company and personal purposes, categorized by groups, states, or search phrases.You can get the most recent types of types like the Hawaii Subscription Agreement and Shareholders' Agreement in seconds.

If you currently have a monthly subscription, log in and obtain Hawaii Subscription Agreement and Shareholders' Agreement through the US Legal Forms local library. The Acquire key will show up on each develop you see. You get access to all previously acquired types from the My Forms tab of your respective account.

If you want to use US Legal Forms the very first time, listed here are straightforward recommendations to help you get started out:

- Be sure to have picked the best develop for your metropolis/county. Select the Preview key to analyze the form`s content material. See the develop description to ensure that you have chosen the right develop.

- In the event the develop does not suit your needs, utilize the Lookup discipline towards the top of the monitor to find the the one that does.

- In case you are happy with the shape, validate your selection by simply clicking the Purchase now key. Then, opt for the pricing strategy you want and supply your credentials to sign up to have an account.

- Method the transaction. Utilize your charge card or PayPal account to accomplish the transaction.

- Choose the file format and obtain the shape on your product.

- Make alterations. Fill up, edit and printing and indication the acquired Hawaii Subscription Agreement and Shareholders' Agreement.

Each web template you added to your bank account does not have an expiry date and is yours eternally. So, if you would like obtain or printing yet another copy, just visit the My Forms section and then click on the develop you need.

Gain access to the Hawaii Subscription Agreement and Shareholders' Agreement with US Legal Forms, one of the most considerable local library of legal file layouts. Use a large number of specialist and express-particular layouts that meet your organization or personal requires and needs.

Form popularity

FAQ

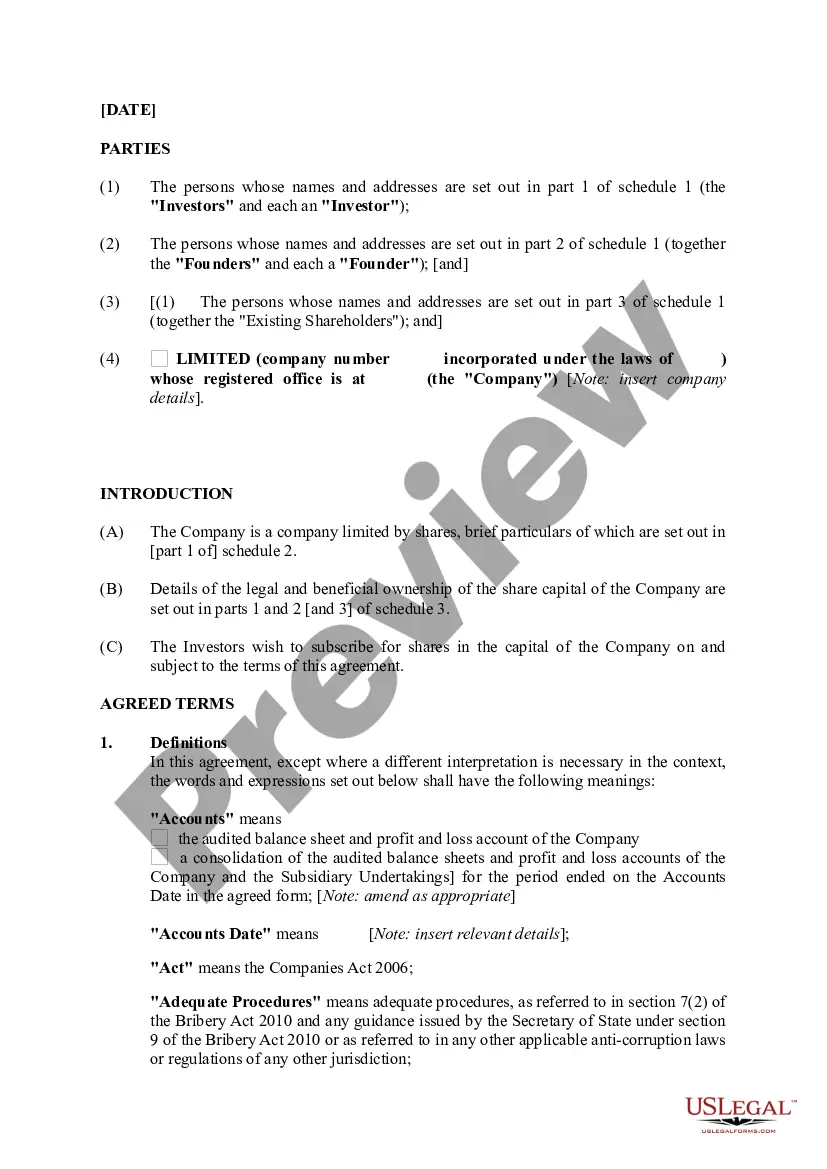

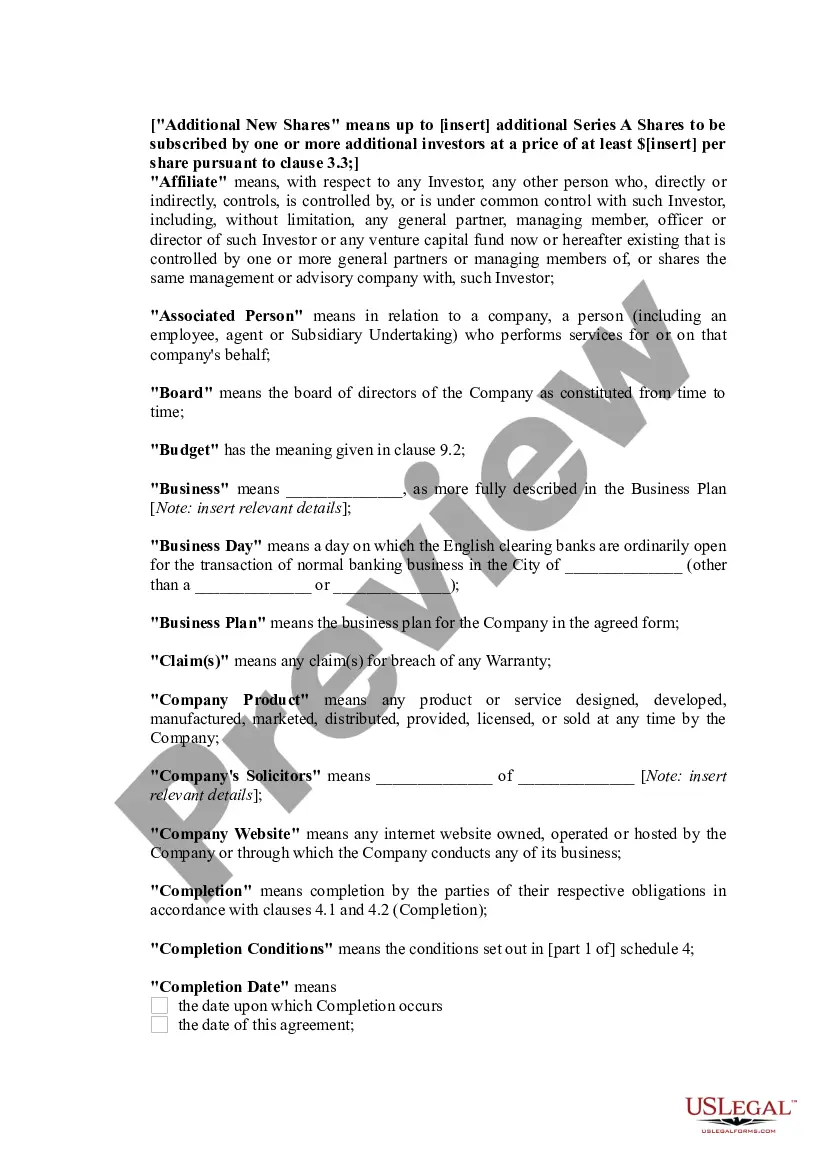

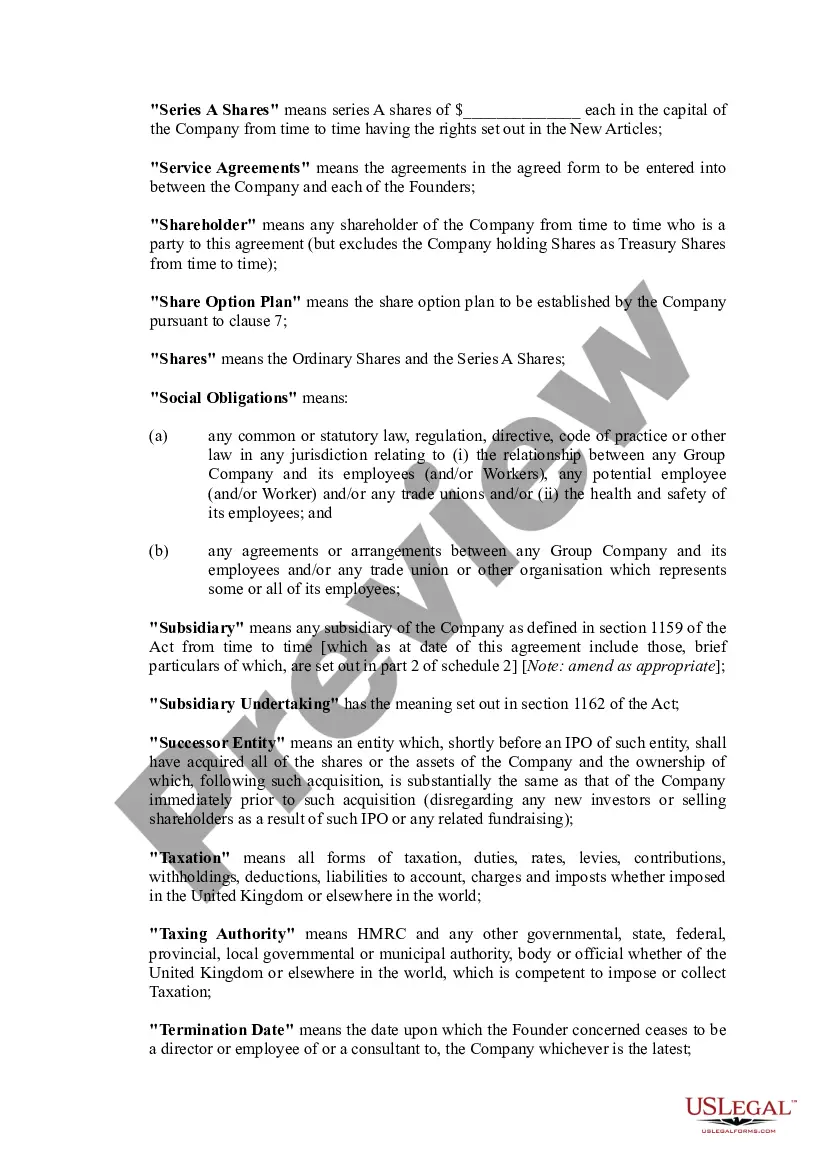

What is a Subscription Agreement? A master subscription agreement is a legal document that outlines the terms and conditions of a subscription-based relationship between a business and its users.

What is an LLC Subscription Agreement? An LLC subscription agreement is an investor's application to join a limited liability company (LLC). It is also a two-way guarantee between a company and a new shareholder (subscriber).

Depending on the requirements of each company, a share subscription agreement can vary widely, but some common clauses are confidentiality, fulfillment of a precondition, tranches, and guarantee and indemnity. A share purchase agreement is an agreement made between two parties.

Subscription agreement vs shareholders agreement? A share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.

A well organized and well-structured subscription agreement will include the details about the transaction, the number of shares being sold and the price per share, and any legally binding confidentiality agreements and clauses.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

What to Think about When You Begin Writing a Shareholder Agreement. ... Name Your Shareholders. ... Specify the Responsibilities of Shareholders. ... The Voting Rights of Your Shareholders. ... Decisions Your Corporation Might Face. ... Changing the Original Shareholder Agreement. ... Determine How Stock can be Sold or Transferred.