Hawaii Letter of Transmittal

Description

How to fill out Letter Of Transmittal?

You may invest several hours online attempting to find the legal record design that meets the federal and state requirements you need. US Legal Forms provides a large number of legal varieties that happen to be evaluated by experts. You can actually download or print the Hawaii Letter of Transmittal from my services.

If you currently have a US Legal Forms bank account, it is possible to log in and click on the Download switch. Next, it is possible to complete, change, print, or signal the Hawaii Letter of Transmittal. Every legal record design you get is yours for a long time. To acquire another version of any purchased type, proceed to the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms website the first time, adhere to the easy instructions under:

- Initially, make certain you have chosen the proper record design for the region/town of your liking. Read the type outline to ensure you have selected the proper type. If readily available, utilize the Review switch to appear through the record design too.

- If you would like locate another model of the type, utilize the Look for area to discover the design that meets your needs and requirements.

- After you have discovered the design you need, click Get now to move forward.

- Find the costs plan you need, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your bank card or PayPal bank account to pay for the legal type.

- Find the file format of the record and download it to the system.

- Make changes to the record if necessary. You may complete, change and signal and print Hawaii Letter of Transmittal.

Download and print a large number of record web templates making use of the US Legal Forms web site, that offers the largest selection of legal varieties. Use professional and condition-particular web templates to take on your company or person needs.

Form popularity

FAQ

A partnership return shall be filed in the first year the partners formally agree to engage in joint operation, or in the absence of a formal agreement, the first taxable year in which the organization receives income or makes or incurs any expenditures treated as deductions for Hawaii income tax purposes.

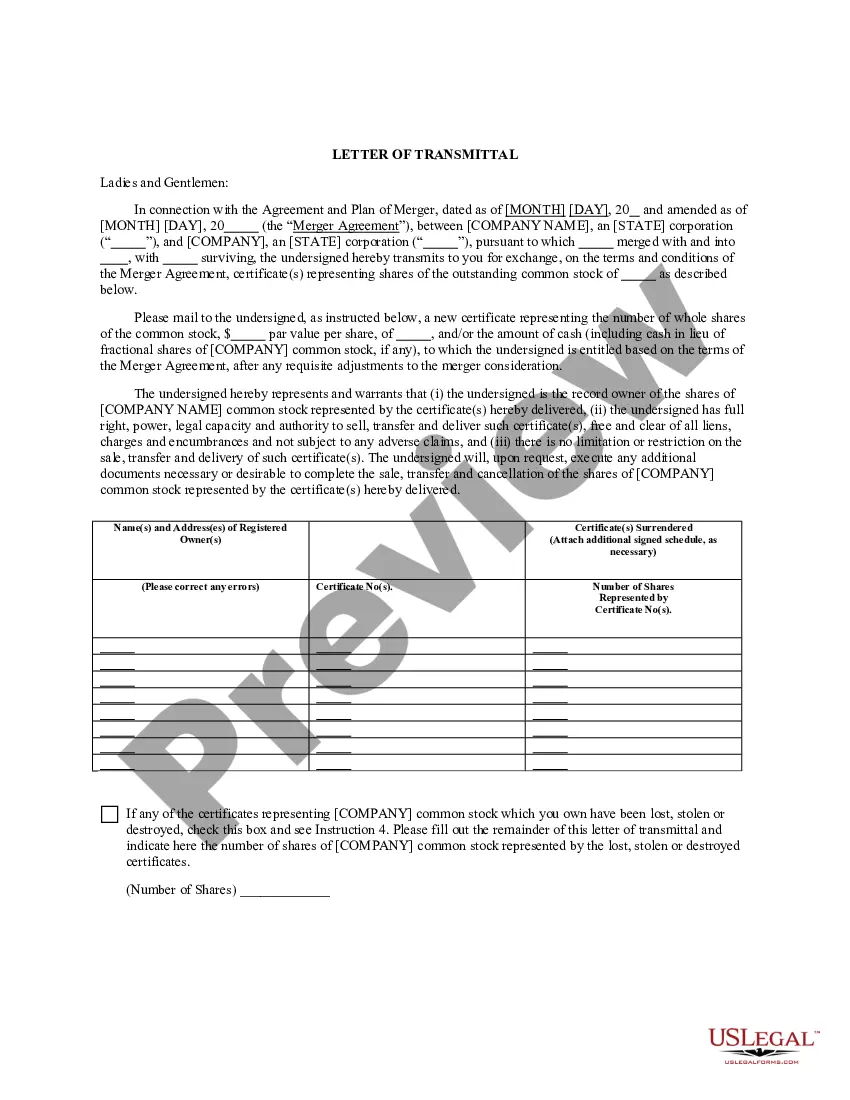

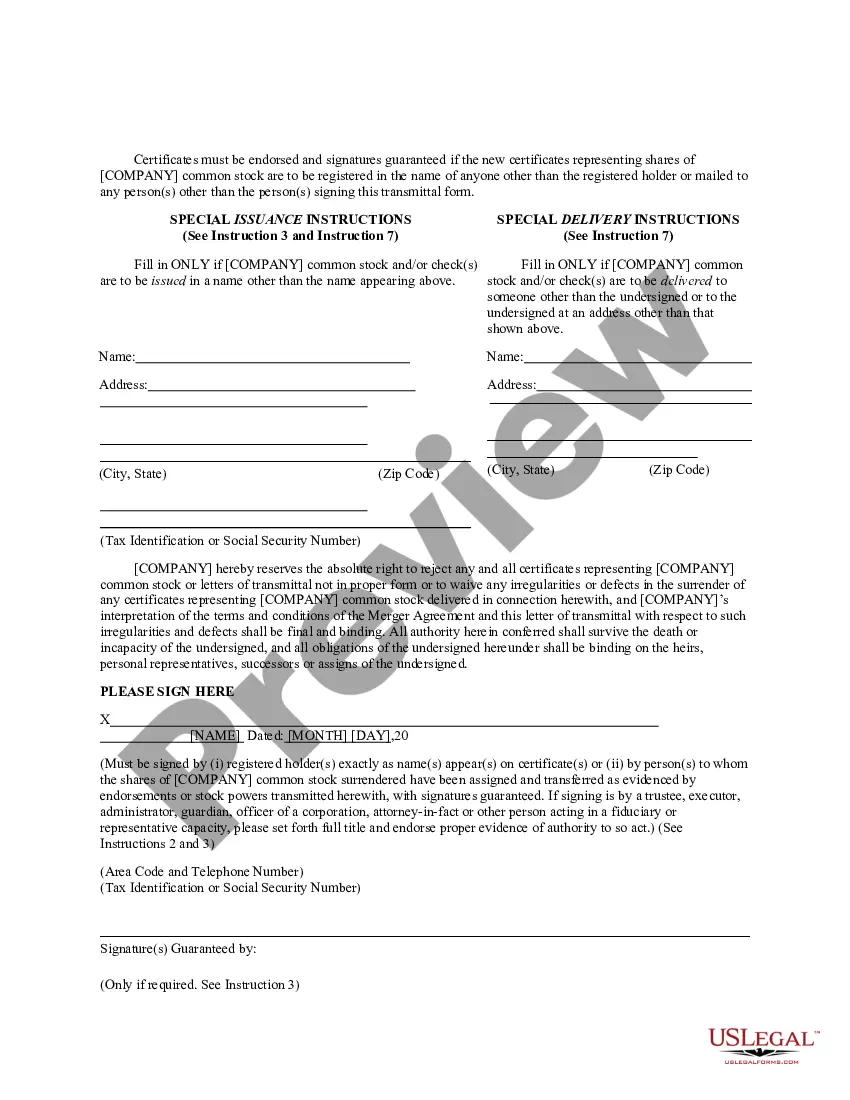

How to fill out a transmittal form: Begin by gathering all the necessary information and documents that are required for the transmittal form. ... Fill out the sender's information accurately and completely. ... Proceed to fill out the recipient's information, ensuring accuracy and completeness.

The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en- gaging in the business activity. The GET applies to nearly every form of business activity.

Where to File ? File Form N-196 and State copies of Forms 1099 with the Hawaii Department of Taxation, P.O. Box 3559, Honolulu, HI 96811-3559. Shipping and Mailing ? If you are sending a large number of forms, you may send them in conveniently sized packages. On each package, write your name and identifying number.

Any person who is in Hawai?i for a temporary or transient purpose and whose permanent residence is not Hawai?i is considered a Hawai?i nonresident. Each year, a nonresident who earns income from Hawai?i sources must file a State of Hawai?i tax return and will be taxed only on income from Hawai?i sources.

What is Form N-196? Form N-196 is an Annual Summary and Transmittal of Hawaii Information Returns used to report total number of 1099 forms and total amount reported.