Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

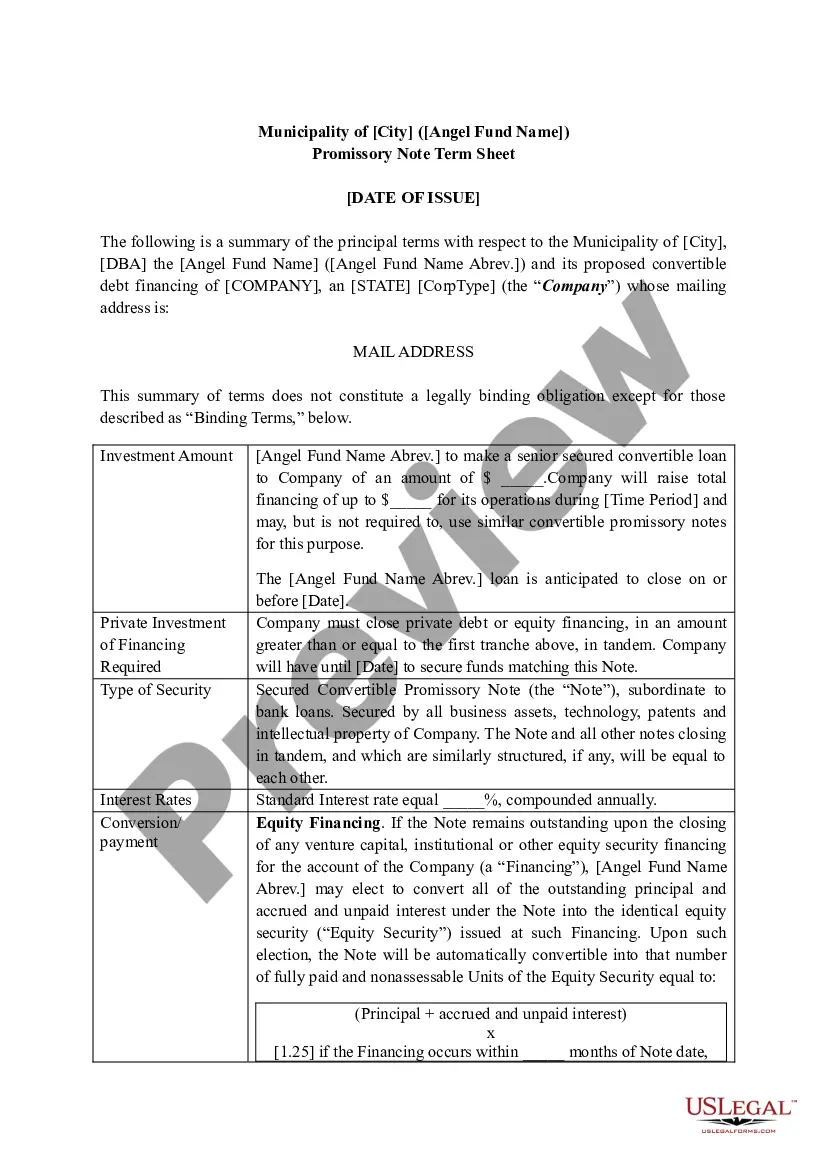

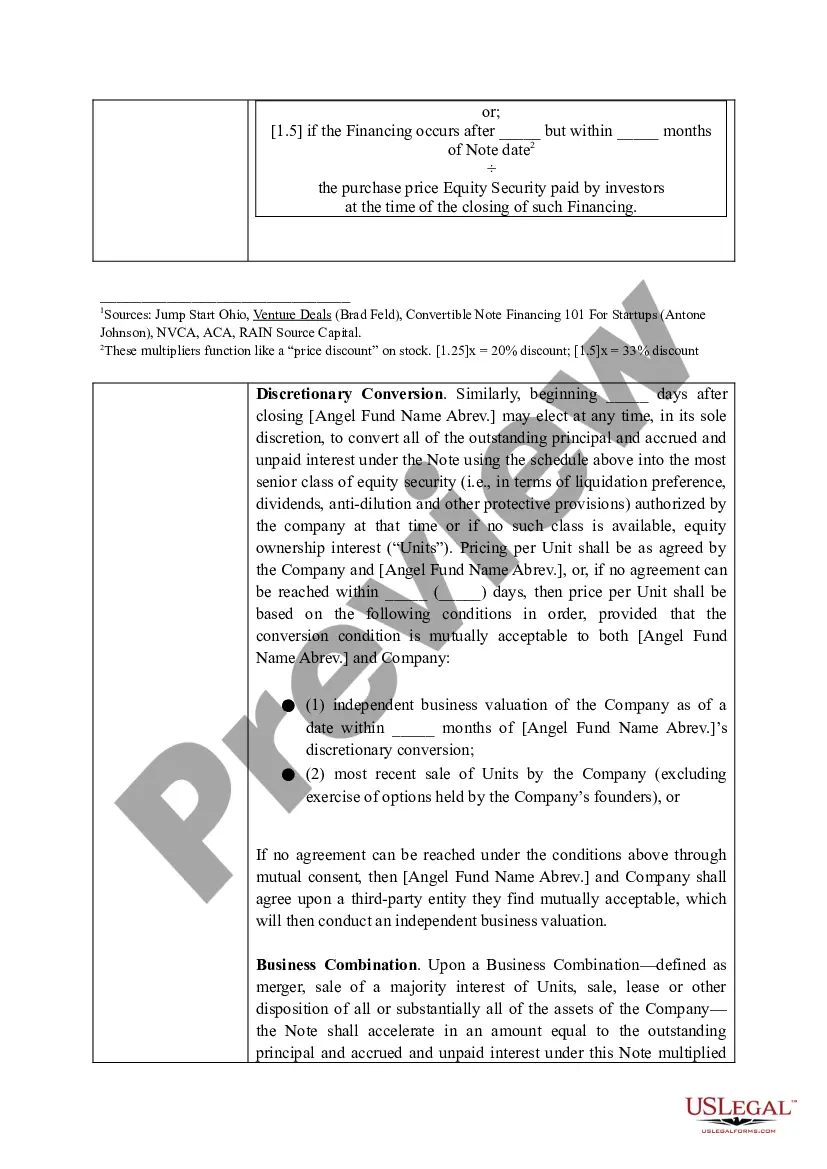

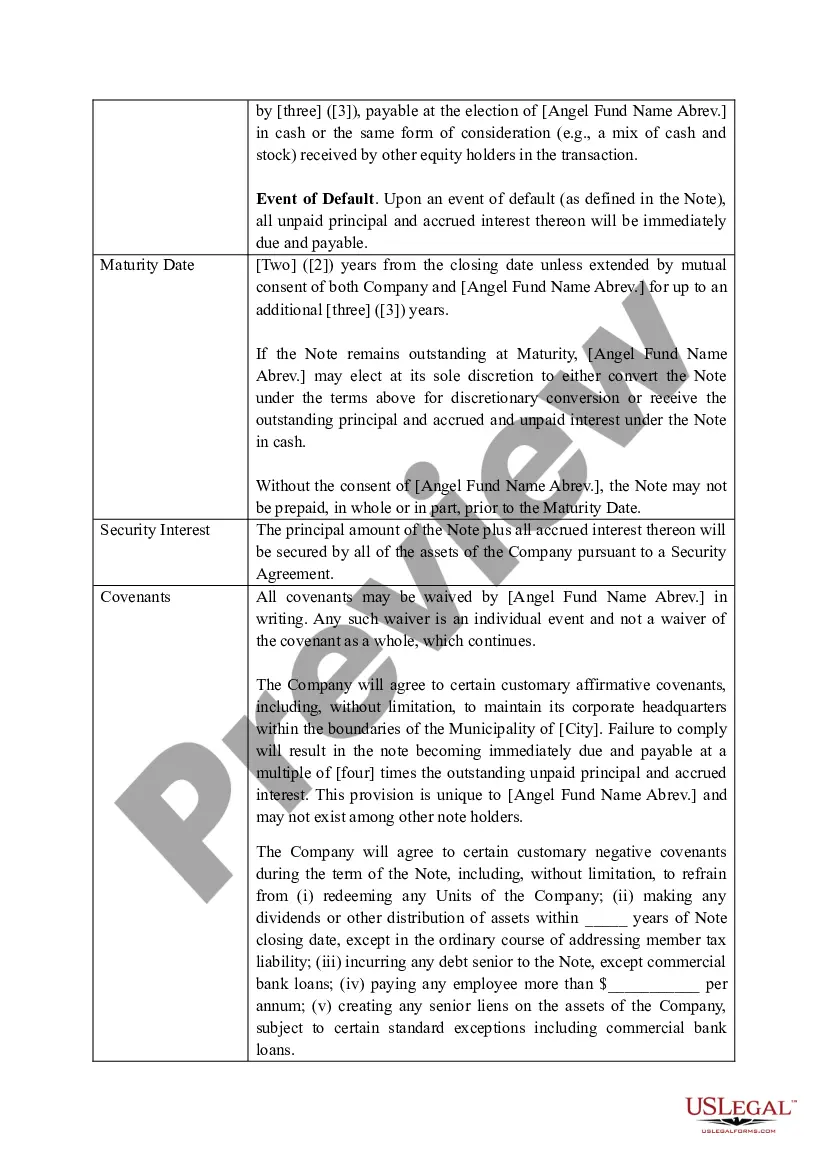

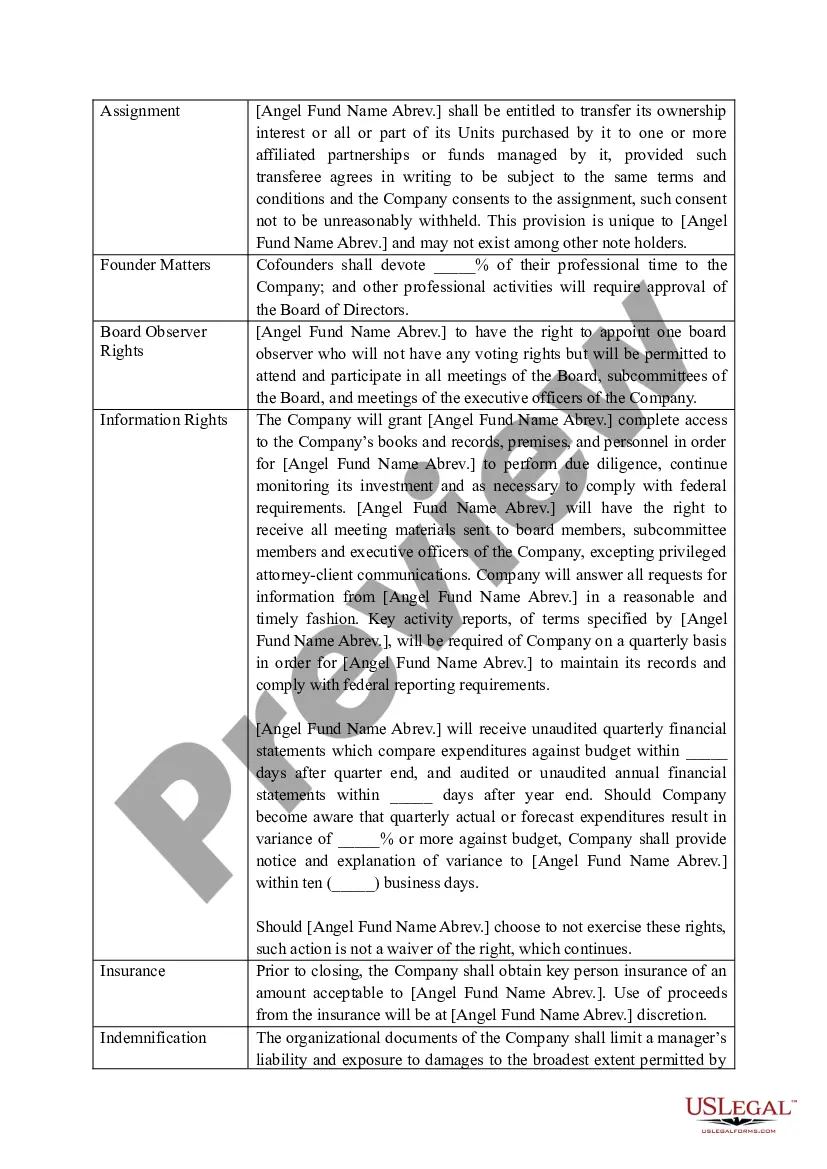

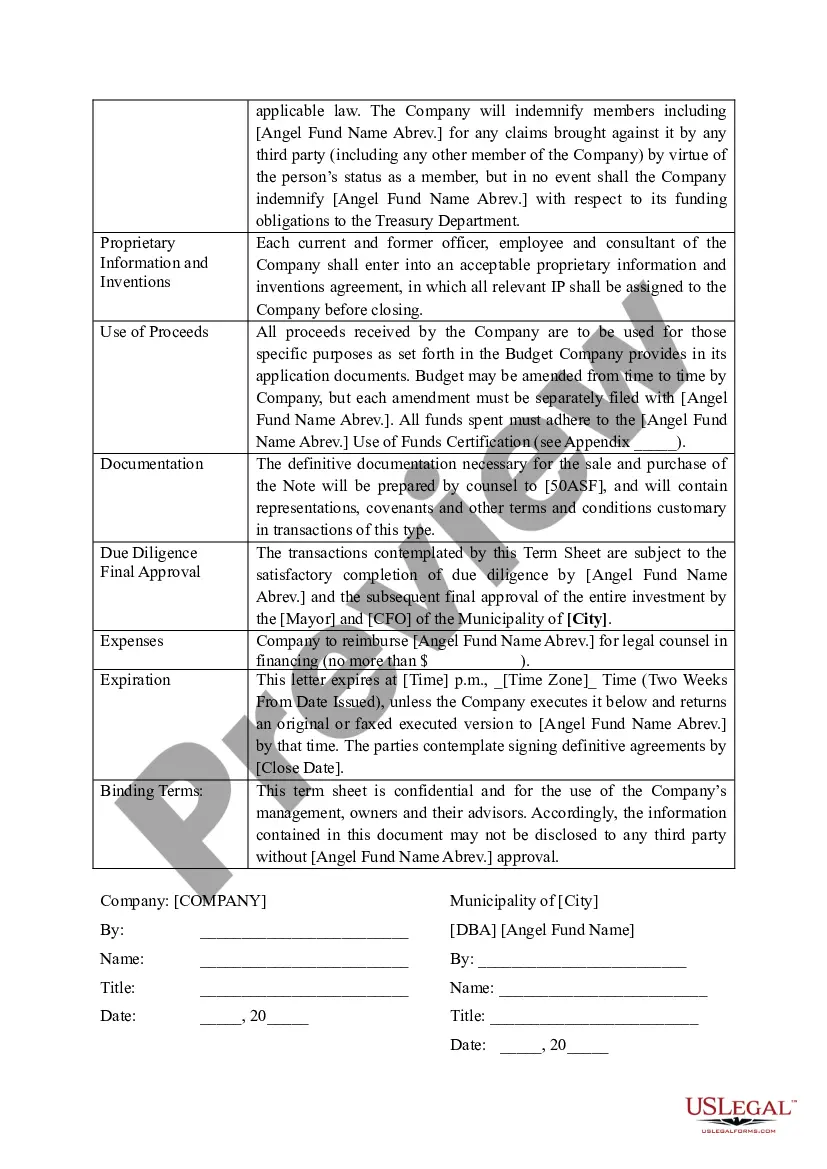

The Hawaii Angel Fund Promissory Note Term Sheet is a detailed document outlining the terms and conditions associated with the Hawaii Angel Fund's promissory note program. This term sheet serves as an agreement between the Hawaii Angel Fund and potential borrowers seeking funding for their business ventures or projects. It lays out the specific requirements, rights, and obligations of both parties involved in the lending process. The term sheet includes various essential elements such as the principal amount of the loan, interest rate, repayment terms, and other financial considerations. It highlights the key terms that borrowers must adhere to throughout the loan's lifespan, ensuring clarity and transparency in the lending process. The Hawaii Angel Fund Promissory Note Term Sheet helps to establish a mutual understanding between the lender and borrower, minimizing potential disputes or misunderstandings. By clearly outlining the terms, it allows borrowers to assess whether the funding aligns with their needs and financial capabilities. Different types of Hawaii Angel Fund Promissory Note Term Sheets may exist based on various factors, such as loan duration, interest rate structure, and associated fees. These variations may cater to specific borrower segments or industries, ensuring tailored financial solutions. Some possible types of term sheets include: 1. Short-term Promissory Note Term Sheet: This type of term sheet usually encompasses loans with a shorter repayment period, typically less than one year. It may be suitable for businesses or projects with immediate funding requirements or shorter-term cash flow projections. 2. Long-term Promissory Note Term Sheet: This term sheet outlines loans with longer repayment durations, typically extending beyond one year. It may be suitable for borrowers seeking substantial financing for long-term projects or capital-intensive ventures. 3. Fixed Interest Rate Promissory Note Term Sheet: This type of term sheet defines loans with a predetermined fixed interest rate throughout the loan's tenure. Borrowers benefit from predictable interest expenses, enabling better financial planning and budgeting. 4. Variable Interest Rate Promissory Note Term Sheet: This term sheet highlights loans with an interest rate tied to an external reference, such as the current market rate or an established financial index. The interest rate may fluctuate over time, potentially affecting the borrower's overall repayment obligations. 5. Secured Promissory Note Term Sheet: In certain cases, the Hawaii Angel Fund may require borrowers to provide collateral to secure the loan. This type of term sheet outlines the specific terms and conditions related to collateral use and management. Each Hawaii Angel Fund Promissory Note Term Sheet is carefully crafted to suit the unique needs of borrowers and maximize the effectiveness of the lending program. It provides a framework that fosters trust, accountability, and fair financial practices between the Hawaii Angel Fund and borrowers, promoting entrepreneurial growth and economic development in Hawaii.