Hawaii Pre Incorporation Agreement

Description

How to fill out Pre Incorporation Agreement?

If you want to full, download, or printing lawful file layouts, use US Legal Forms, the greatest collection of lawful kinds, that can be found on the Internet. Utilize the site`s easy and hassle-free look for to get the papers you want. Various layouts for business and person purposes are categorized by groups and claims, or keywords. Use US Legal Forms to get the Hawaii Pre Incorporation Agreement in a number of clicks.

When you are presently a US Legal Forms buyer, log in to the account and click the Obtain key to obtain the Hawaii Pre Incorporation Agreement. You can even gain access to kinds you previously acquired in the My Forms tab of your respective account.

If you use US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have chosen the form for the correct city/country.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Don`t neglect to learn the outline.

- Step 3. When you are not happy using the type, use the Search area near the top of the monitor to get other versions in the lawful type template.

- Step 4. When you have found the form you want, click on the Acquire now key. Select the rates program you favor and add your accreditations to register to have an account.

- Step 5. Process the transaction. You can use your Мisa or Ьastercard or PayPal account to accomplish the transaction.

- Step 6. Find the format in the lawful type and download it on your system.

- Step 7. Full, revise and printing or signal the Hawaii Pre Incorporation Agreement.

Each and every lawful file template you acquire is your own for a long time. You may have acces to every single type you acquired inside your acccount. Select the My Forms section and choose a type to printing or download once more.

Be competitive and download, and printing the Hawaii Pre Incorporation Agreement with US Legal Forms. There are many specialist and express-certain kinds you can utilize for your business or person requires.

Form popularity

FAQ

If someone is not in legal existence, then he cannot be a party to contract, and 'Privity to Contract' doctrine excludes company from the liability. In Kelner v Baxter, Phonogram Limited v Lane this position was confirmed. In pure common law sense, Pre-incorporation contract does not bind the company.

Before a company is incorporated, it cannot enter into commercial contracts. Consequently, nobody can sign a contract for that company as an agent. A contract entered into by a party on behalf of a company, where that company has not yet been formed, is called a pre-incorporation contract.

A shareholders' agreement is an instrument that sets out the limitation which the shareholders would want to control, as far as possible, in certain cases including but not limited to changes to the articles of association, alteration of share rights, increase or reduce the amount of share capital, etc.

Promoters are generally held personally liable for pre-incorporation contract. If a company does not ratify or adopt a pre-incorporation contract under the Specific Relief Act, then the common law principle would be applicable and the promoter will be liable for breach of contract.

Before a company is incorporated, it has no legal existence. ingly, it has no capacity to enter into a contract. The company cannot sue or be sued on a pre-incorporation contract. However, persons who conclude contracts for the unborn company can be held personally liable on such contracts.

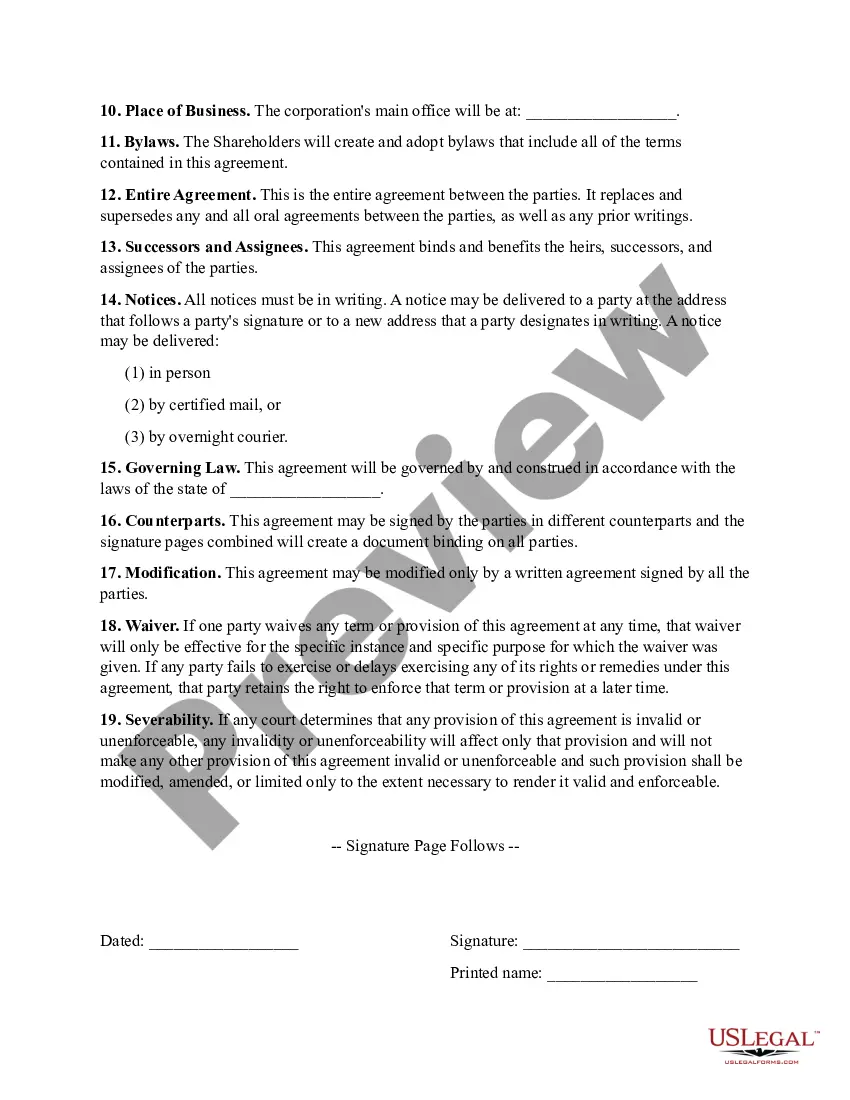

Pre-incorporation agreements, also known as promoters' agreements, outline a corporation's operations, responsibilities, and ownership before it is formally established. This type of agreement is usually made between the individuals (often referred to as promoters) involved in setting up the corporation.

An essential aspect of PICs under the Act would be that the contract would need to be ratified within three months after incorporation. Ratification simply means that the company elects to approve the terms and obligations of the agreement formally. This can either be fully, partially or conditionally.

There are various types of pre-incorporation contracts that can be made by a company ing to their need before incorporation, such as a lease agreement, employment agreement, founder's agreement, shareholder agreement, etc.