Hawaii First Meeting Minutes of Sole Director

Description

How to fill out First Meeting Minutes Of Sole Director?

US Legal Forms - one of the biggest libraries of authorized types in America - delivers a wide range of authorized file layouts you may acquire or print out. Utilizing the internet site, you will get 1000s of types for enterprise and person uses, categorized by classes, suggests, or keywords and phrases.You can find the latest types of types just like the Hawaii First Meeting Minutes of Sole Director in seconds.

If you have a membership, log in and acquire Hawaii First Meeting Minutes of Sole Director from your US Legal Forms catalogue. The Download option will show up on every single develop you view. You get access to all earlier acquired types inside the My Forms tab of the profile.

In order to use US Legal Forms for the first time, listed below are basic directions to obtain began:

- Ensure you have picked out the proper develop to your metropolis/state. Select the Review option to review the form`s articles. See the develop explanation to ensure that you have chosen the proper develop.

- In the event the develop doesn`t satisfy your requirements, take advantage of the Research industry on top of the screen to find the one who does.

- In case you are satisfied with the shape, affirm your choice by simply clicking the Acquire now option. Then, select the rates program you prefer and offer your qualifications to register for the profile.

- Approach the deal. Make use of your charge card or PayPal profile to finish the deal.

- Choose the structure and acquire the shape in your product.

- Make adjustments. Fill up, edit and print out and indicator the acquired Hawaii First Meeting Minutes of Sole Director.

Each web template you added to your account lacks an expiry particular date which is yours for a long time. So, if you would like acquire or print out yet another duplicate, just check out the My Forms portion and then click in the develop you want.

Obtain access to the Hawaii First Meeting Minutes of Sole Director with US Legal Forms, one of the most substantial catalogue of authorized file layouts. Use 1000s of specialist and status-distinct layouts that meet your company or person demands and requirements.

Form popularity

FAQ

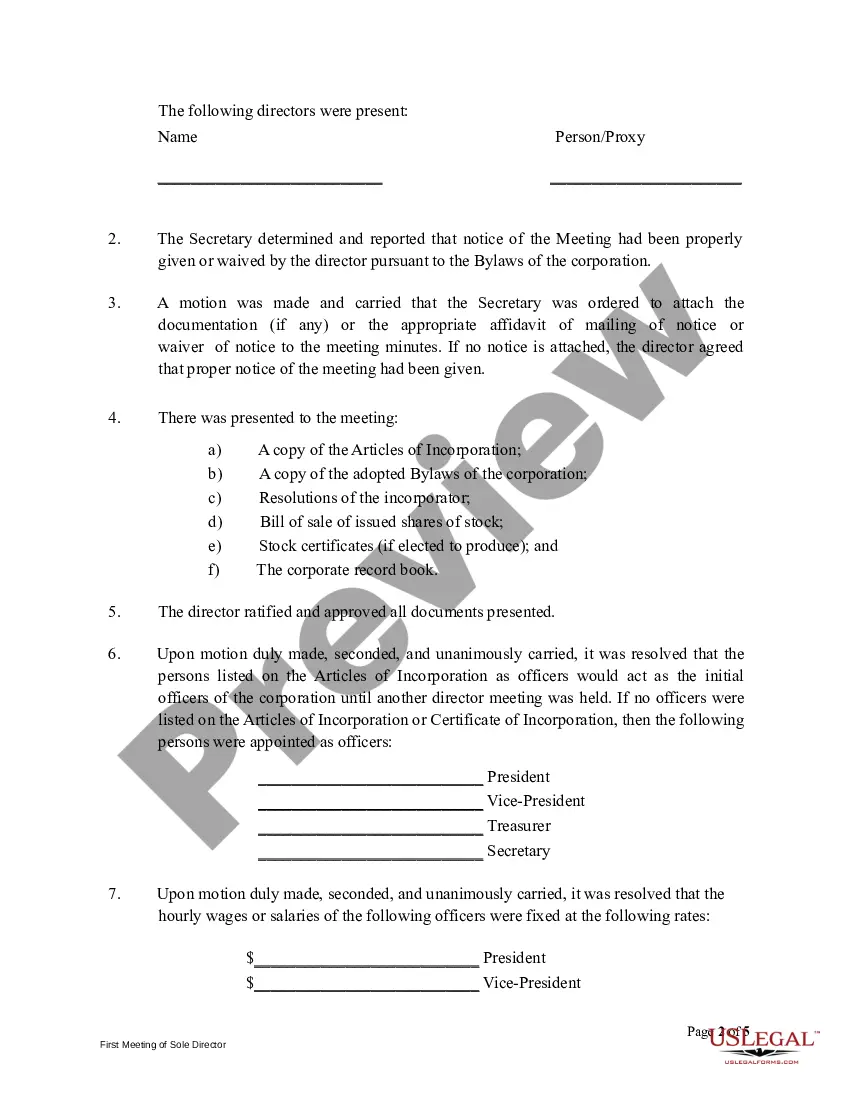

Generally, the following details should be included in the minutes of board meetings, including the first board meeting of the directors: date, time, and location of the meeting. names of all directors present and those who were unable to attend. names and roles of anyone else in attendance.

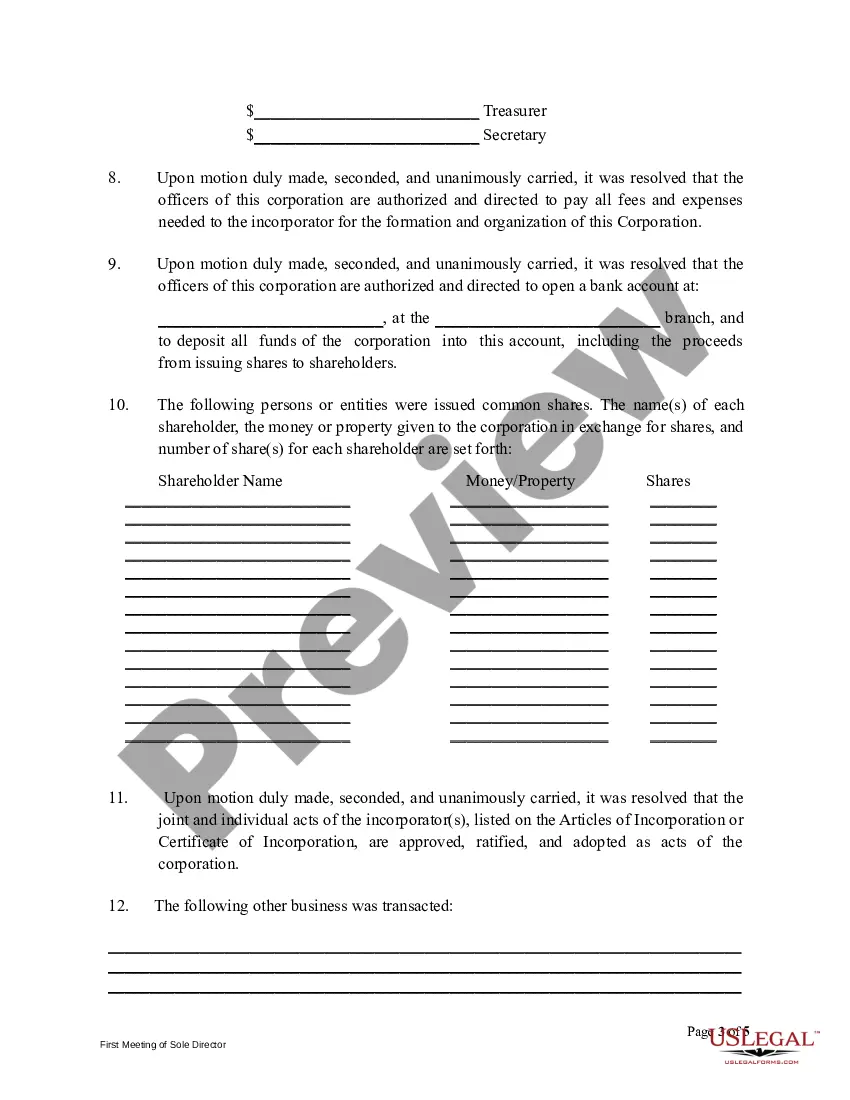

What should board of directors first meeting minutes include? Your corporation's first directors meeting typically focuses on initial organizational tasks, including electing officers, setting their salaries, resolving to open a bank account, and ratifying bylaws and actions of the incorporators.

The first board meeting of the company (private limited or public limited) is to be held within 30 days of incorporation of the company. In the first board meeting of the company, various transactions take place and the items are mentioned in the minutes of the first board meeting.

The first shareholder meeting is an organizational meeting where shareholders ratify and approve the actions of the incorporators. Shareholders also approve shares values, appoint directors and officers if needed, and wrap up other initial tasks.

An Incorporators' Organizational Meeting is an initial meeting of the incorporators of a company where the initial resolutions to organize the company are recorded. This occurs after Articles of Incorporation are filed and a certificate of incorporation is received from the Secretary of State.

The first board of directors meeting typically covers much of the same information as the first shareholder meeting (some corporations even combine these meetings or hold them back to back). In this meeting, directors approve initial corporate documents and ensure officer roles are filled.

How to write meeting minutes reports Make an outline. Prior to the meeting, create an outline by picking or designing a template. ... Include factual information. ... Write down the purpose. ... Record decisions made. ... Add details for the next meeting. ... Be concise. ... Consider recording. ... Edit and proofread.

The first meeting of the sole director ratifies the actions of the incorporator, appoints the officers, gives authority to open a bank account, and allows for any other initial director tasks needed. Meeting minutes ensure that all these actions are documented in the corporate record.

The first board of directors meeting typically covers much of the same information as the first shareholder meeting (some corporations even combine these meetings or hold them back to back). In this meeting, directors approve initial corporate documents and ensure officer roles are filled.

Resolution of Sole Director (Minutes) - CO. CF. 11 Section 248 does not specifically refer to the situation that applies to sole directors as usually a meeting consists of more than one person. However it is considered best practice for a sole director to record their decisions.