Hawaii Election of 'S' Corporation Status and Instructions - IRS 2553

Description

How to fill out Hawaii Election Of 'S' Corporation Status And Instructions - IRS 2553?

Are you currently in the place the place you need to have files for possibly organization or personal reasons virtually every working day? There are a lot of lawful document themes available online, but finding ones you can rely isn`t easy. US Legal Forms delivers thousands of type themes, much like the Hawaii Election of 'S' Corporation Status and Instructions - IRS 2553, which are published to meet federal and state specifications.

In case you are already informed about US Legal Forms site and have a free account, simply log in. Following that, it is possible to download the Hawaii Election of 'S' Corporation Status and Instructions - IRS 2553 template.

If you do not provide an account and wish to begin using US Legal Forms, follow these steps:

- Obtain the type you will need and make sure it is for that correct town/region.

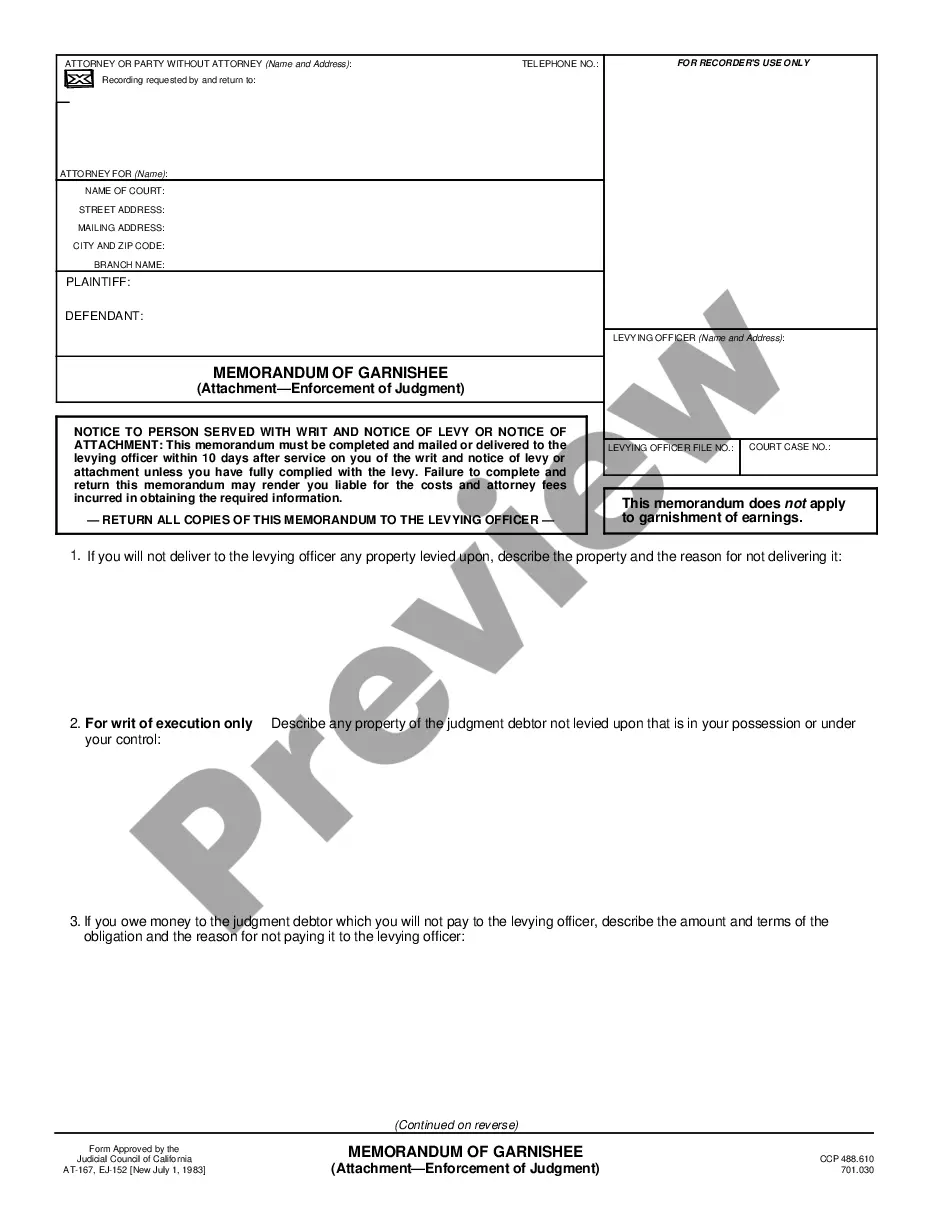

- Use the Preview key to examine the form.

- Read the information to ensure that you have chosen the correct type.

- In case the type isn`t what you`re trying to find, make use of the Search area to find the type that suits you and specifications.

- Whenever you obtain the correct type, just click Acquire now.

- Opt for the pricing prepare you desire, submit the required info to produce your bank account, and purchase your order utilizing your PayPal or bank card.

- Select a handy file structure and download your backup.

Discover all the document themes you have purchased in the My Forms menu. You can get a additional backup of Hawaii Election of 'S' Corporation Status and Instructions - IRS 2553 any time, if possible. Just click on the necessary type to download or produce the document template.

Use US Legal Forms, the most considerable collection of lawful forms, to save lots of time and prevent errors. The assistance delivers appropriately produced lawful document themes that you can use for an array of reasons. Create a free account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders. See the Instructions for Form 2553PDF for all required information and to determine where to file the form.

Guidance for taxpayers who have not timely filed their election request to be treated as an S Corporation. If the Form 2553 has not been timely filed, the corporation may obtain relief for certain late S elections by following the procedures in Rev. Proc. Filing Requirements for Filing Status Change | Internal Revenue Service irs.gov ? businesses ? corporations ? filing-r... irs.gov ? businesses ? corporations ? filing-r...

If you want your LLC to be taxed as an S corp., you need to file IRS Form 2553, Election by a Small Business Corporation. If you file Form 2553, you do not need to file Form 8832, Entity Classification Election, as you would for a C corp. Business taxes 101: Can an LLC be taxed as an S Corp? | .com ? articles ? can-an-llc-be-tax... .com ? articles ? can-an-llc-be-tax...

Part IV: Late corporate classification election representations. Another section that most businesses can skip, Part IV only applies to you if you're an LLC and you're filing Form 2553 after the form deadline. Again, if that doesn't apply to you, skip this section.

If you're an existing business You must file Form 2553 within two months and 15 days of the beginning of the tax year that you want your S corp tax treatment to start. For example, if you want your existing LLC to be taxed as an S corp in 2023, you need to file Form 2553 by March 15, 2023.

Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation on the corporate income. S Corporations | Internal Revenue Service irs.gov ? small-businesses-self-employed ? s... irs.gov ? small-businesses-self-employed ? s...

After filing Form 2553, the IRS will send either an acceptance or denial letter to the business within 60 days of filing. If the election is accepted, the letter will show the effective date. If you don't receive a letter within 60 days of filing Form 2553, then you should contact the IRS at 1-800-829-4933. Form 2553 late filing: Making up for lost time on S Corp elections blockadvisors.com ? small-business-services blockadvisors.com ? small-business-services

Form 2553, Election by a Small Business Corporation, can't be filed electronically. The form instructions state that the corporation needs to mail or fax the original copy of the form to the IRS. Refer to the IRS Instructions for Form 2553 for more information.