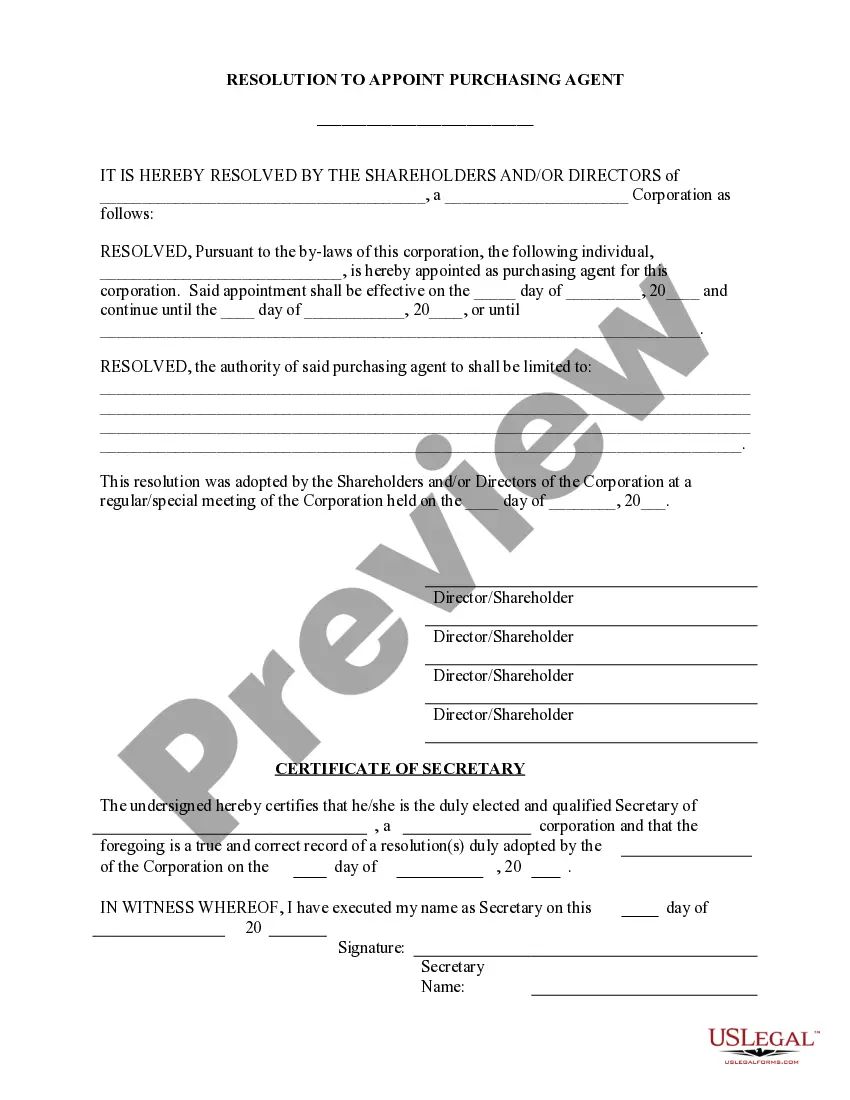

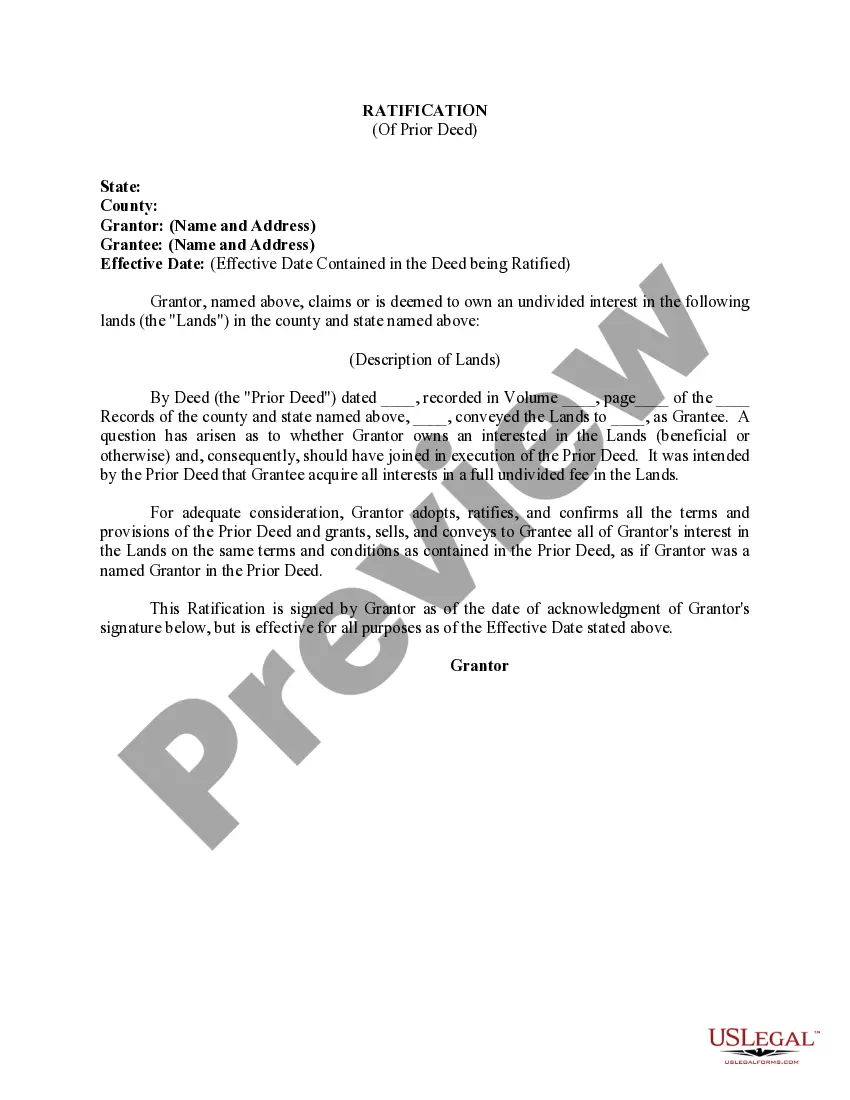

Hawaii Ratification of Prior Deed

Description

How to fill out Ratification Of Prior Deed?

US Legal Forms - one of the largest libraries of legal types in the United States - provides a variety of legal file layouts you are able to down load or printing. While using site, you will get a large number of types for organization and person uses, sorted by types, states, or key phrases.You can get the most up-to-date versions of types like the Hawaii Ratification of Prior Deed in seconds.

If you currently have a subscription, log in and down load Hawaii Ratification of Prior Deed from your US Legal Forms library. The Download option can look on each type you perspective. You have access to all in the past acquired types in the My Forms tab of your own account.

If you would like use US Legal Forms initially, here are easy guidelines to get you started:

- Ensure you have chosen the right type for the town/county. Select the Preview option to analyze the form`s information. Read the type description to actually have chosen the correct type.

- In the event the type doesn`t match your demands, make use of the Look for area on top of the display screen to discover the one which does.

- When you are satisfied with the form, confirm your decision by simply clicking the Purchase now option. Then, opt for the rates program you want and provide your accreditations to sign up for an account.

- Process the deal. Make use of charge card or PayPal account to finish the deal.

- Find the format and down load the form on the gadget.

- Make modifications. Complete, change and printing and indication the acquired Hawaii Ratification of Prior Deed.

Each design you put into your money lacks an expiration date and is yours for a long time. So, if you would like down load or printing yet another version, just check out the My Forms area and click on around the type you need.

Get access to the Hawaii Ratification of Prior Deed with US Legal Forms, by far the most substantial library of legal file layouts. Use a large number of skilled and status-specific layouts that meet your business or person demands and demands.

Form popularity

FAQ

Yes. The Hawaii Uniform Real Property Transfer on Death Act allows a single TOD deed to be signed by joint owners. The law sees a property owner who owns property with another owner with right of survivorship as a joint owner.

The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3). The ® standard purchase contract directs escrow to charge the conveyance tax to the seller.

The deed or assignment of lease must be signed (in black ink) by the current owner and the new owner before a notary public. The deed or assignment of lease must be recorded in the State of Hawaii Bureau of Conveyances or Land Court. A Conveyance Tax Certificate must be filed and any tax due must be paid.

Hawaii is a lien theory state and uses mortgages instead of deeds of trust.

Quitclaim Deeds are more often used when an ex-spouse is going off title. A Warranty Deed gives some guarantees to the Grantee, such as guarantying that the Grantor owns the property being conveyed and that the Grantor guarantees the title to the property, subject only to the encumbrances set forth in Exhibit ?A?.

Form P-64B is used to request an exemption from the conveyance tax. Depending on the type of transaction, Form P-64B must either be (1) submitted to the Department of Taxation, Technical Section for approval of the exemption, or (2) filed directly with the BOC.

A Hawaii quitclaim deed is a form of deed conveying interest in real property from a Seller (the ?Grantor?) to a Buyer (the ?Grantee?). Because it is a quit claim, the seller is transferring the property with no guarantee whatsoever that he or she has clean title to the property.

The fee to record a Hawaii deed depends on the system in which the deed is recorded. Land Court System deeds require a $36.00 recording fee?increased to $101.00 for deeds exceeding 50 pages. Regular System deeds require a $41.00 recording fee?increased to $106.00 for deeds exceeding 50 pages.