Hawaii Due Diligence Field Review and Checklist

Description

How to fill out Due Diligence Field Review And Checklist?

You may devote hrs on the Internet attempting to find the authorized record template that fits the federal and state needs you will need. US Legal Forms gives thousands of authorized kinds which are reviewed by specialists. You can actually acquire or print the Hawaii Due Diligence Field Review and Checklist from my support.

If you currently have a US Legal Forms profile, you are able to log in and click on the Obtain switch. Next, you are able to full, revise, print, or indicator the Hawaii Due Diligence Field Review and Checklist. Every authorized record template you get is the one you have forever. To obtain one more copy associated with a purchased type, check out the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms site initially, keep to the straightforward directions beneath:

- Initial, ensure that you have chosen the correct record template for that area/metropolis of your liking. Read the type explanation to ensure you have chosen the proper type. If offered, make use of the Review switch to check throughout the record template as well.

- In order to discover one more model of your type, make use of the Search area to discover the template that suits you and needs.

- When you have discovered the template you desire, click Acquire now to carry on.

- Find the pricing program you desire, enter your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the deal. You may use your bank card or PayPal profile to pay for the authorized type.

- Find the structure of your record and acquire it to your gadget.

- Make adjustments to your record if possible. You may full, revise and indicator and print Hawaii Due Diligence Field Review and Checklist.

Obtain and print thousands of record templates making use of the US Legal Forms Internet site, that offers the most important collection of authorized kinds. Use specialist and status-distinct templates to tackle your company or individual requirements.

Form popularity

FAQ

Taxpayer's response 1 How long have you owned your business? 2 Do you have any documentation to substantiate your business? 3 Who maintains the business records for your business? 4 Do you have separate bank accounts for personal and business transactions?

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

A due diligence questionnaire is a formal assessment made up of questions designed to outline the way a business complies with industry standards, implements cybersecurity initiatives, and manages its network.

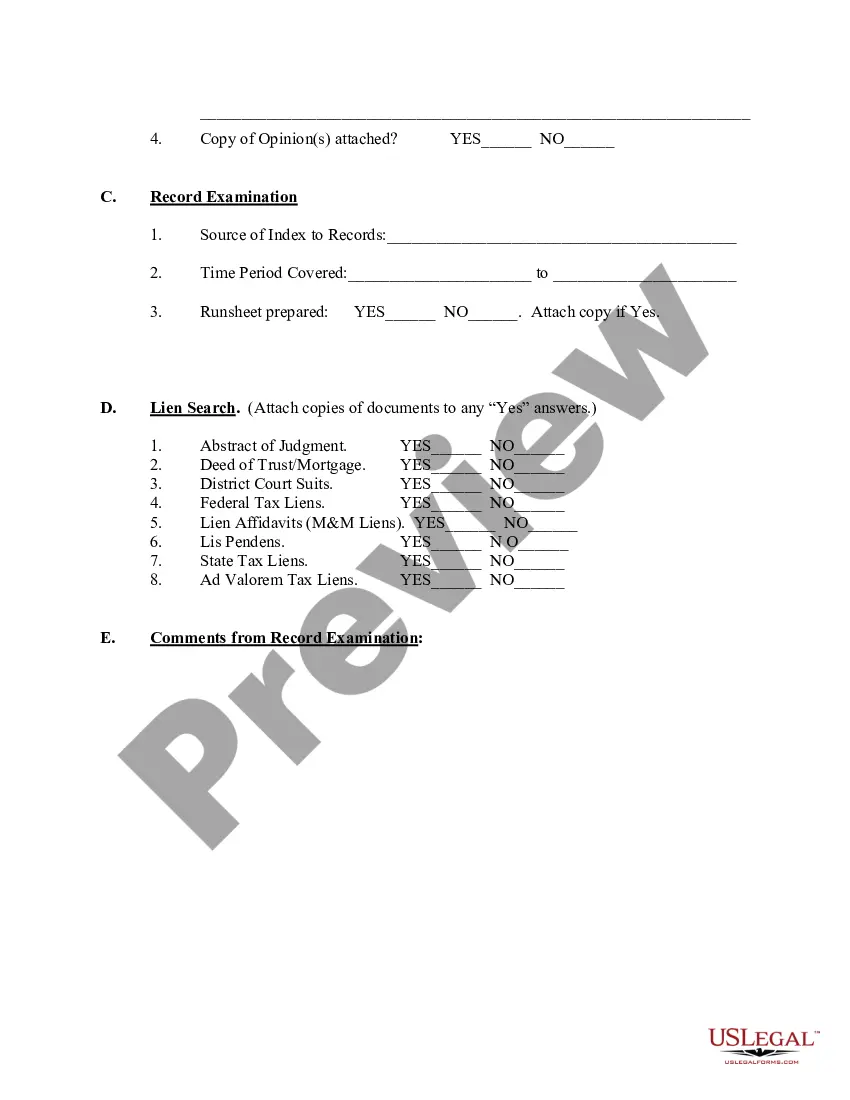

However, a standard due diligence report should include the following components: Executive summary. Company overview. Purpose and objective of the diligence. Financial due diligence. Legal due diligence. Operational due diligence. Market and commercial due diligence. Risk assessment.

Additionally, there are four due diligence requirements that paid tax preparers must meet when preparing returns for clients that claim certain tax benefits, which you can read more about on the IRS website.

The Four Due Diligence Requirements Complete and Submit Form 8867. (Treas. Reg. section 1.6695-2(b)(1)) ... Compute the Credits. (Treas. Reg. section 1.6695-2(b)(2)) ... Knowledge. (Treas. Reg. section 1.6695-2(b)(3)) ... Keep Records for Three Years.

How To Prepare For Due Diligence - kagaar Introduction. ... Understanding Due Diligence. ... Defining Objectives and Scope. ... Assembling a Due Diligence Team. ... Organizing Documentation and Information. ... Financial Analysis and Documentation. ... Legal Review and Compliance. ... Operational Assessment.

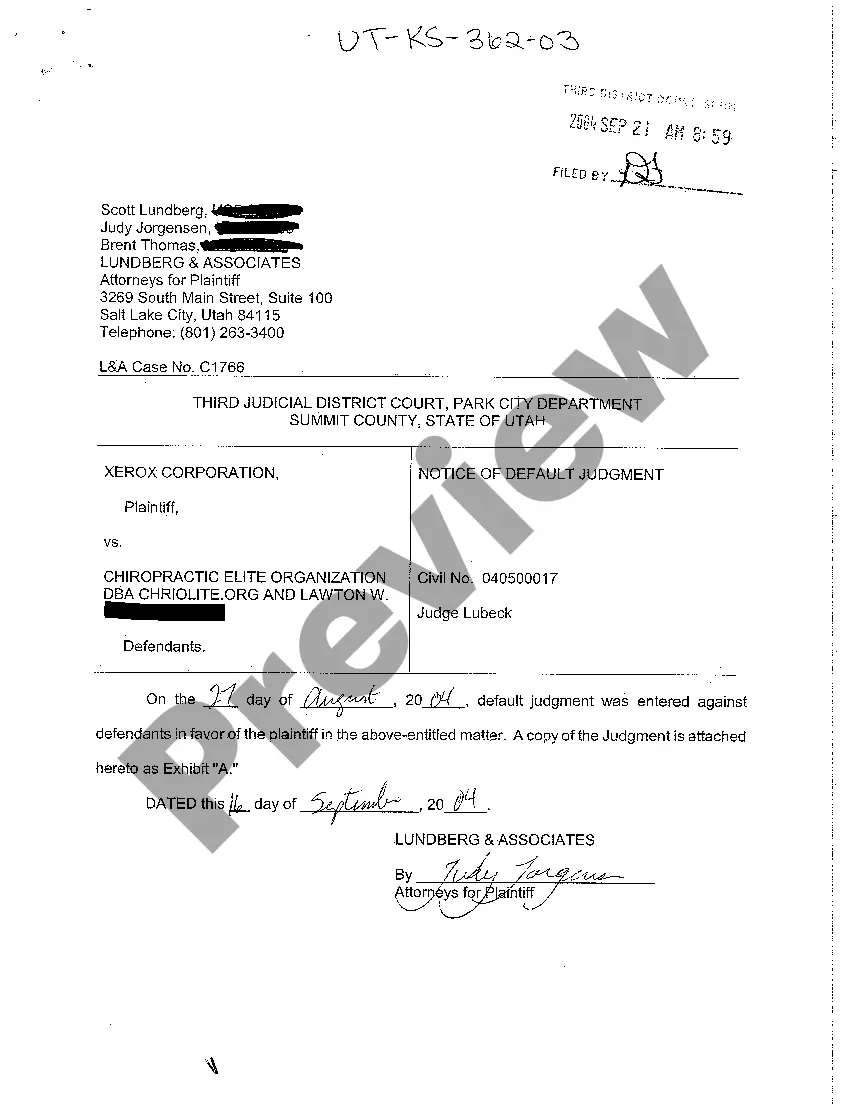

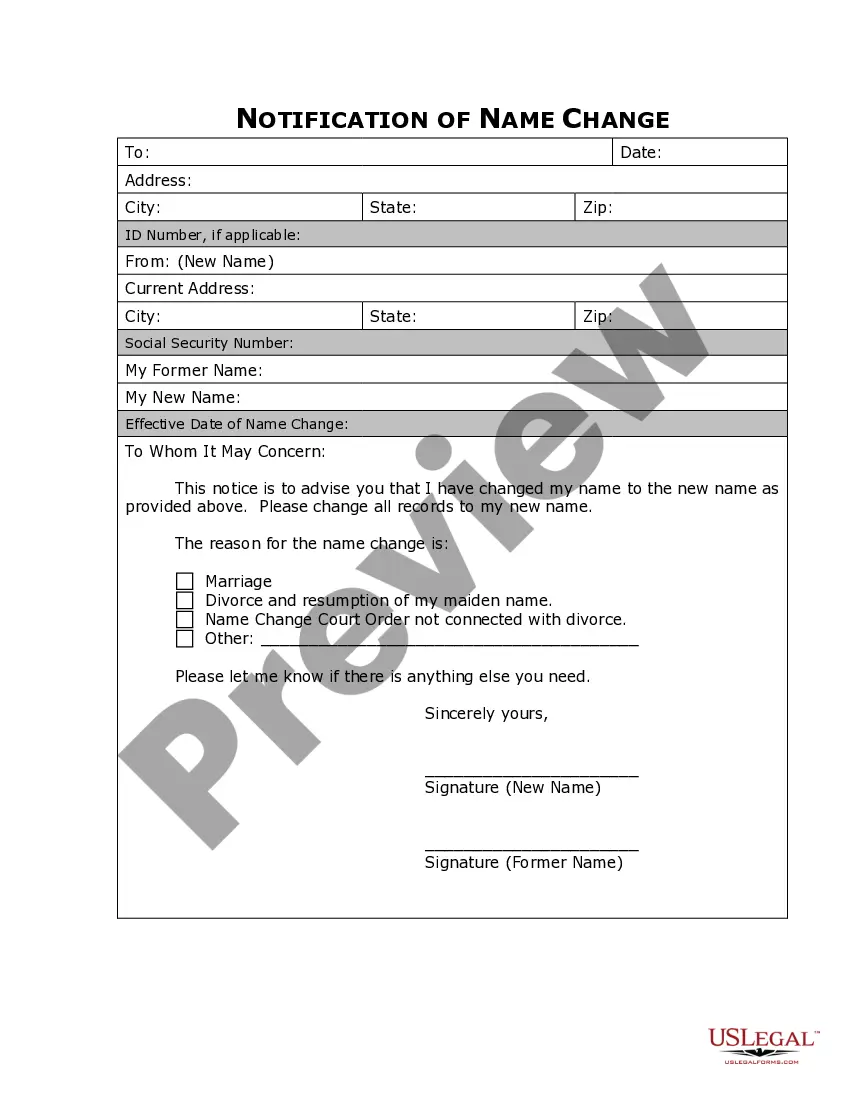

Complete Due Diligence Documents Checklist Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.