Hawaii Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust On A Mineral / Royalty Interest Sold By Grantor?

You are able to spend time on-line searching for the legitimate document template which fits the state and federal specifications you will need. US Legal Forms supplies thousands of legitimate kinds which can be examined by pros. It is simple to down load or print the Hawaii Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor from our service.

If you have a US Legal Forms accounts, you may log in and then click the Obtain switch. After that, you may full, change, print, or sign the Hawaii Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor. Every single legitimate document template you get is the one you have for a long time. To acquire one more copy associated with a obtained type, visit the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms internet site the very first time, stick to the straightforward instructions under:

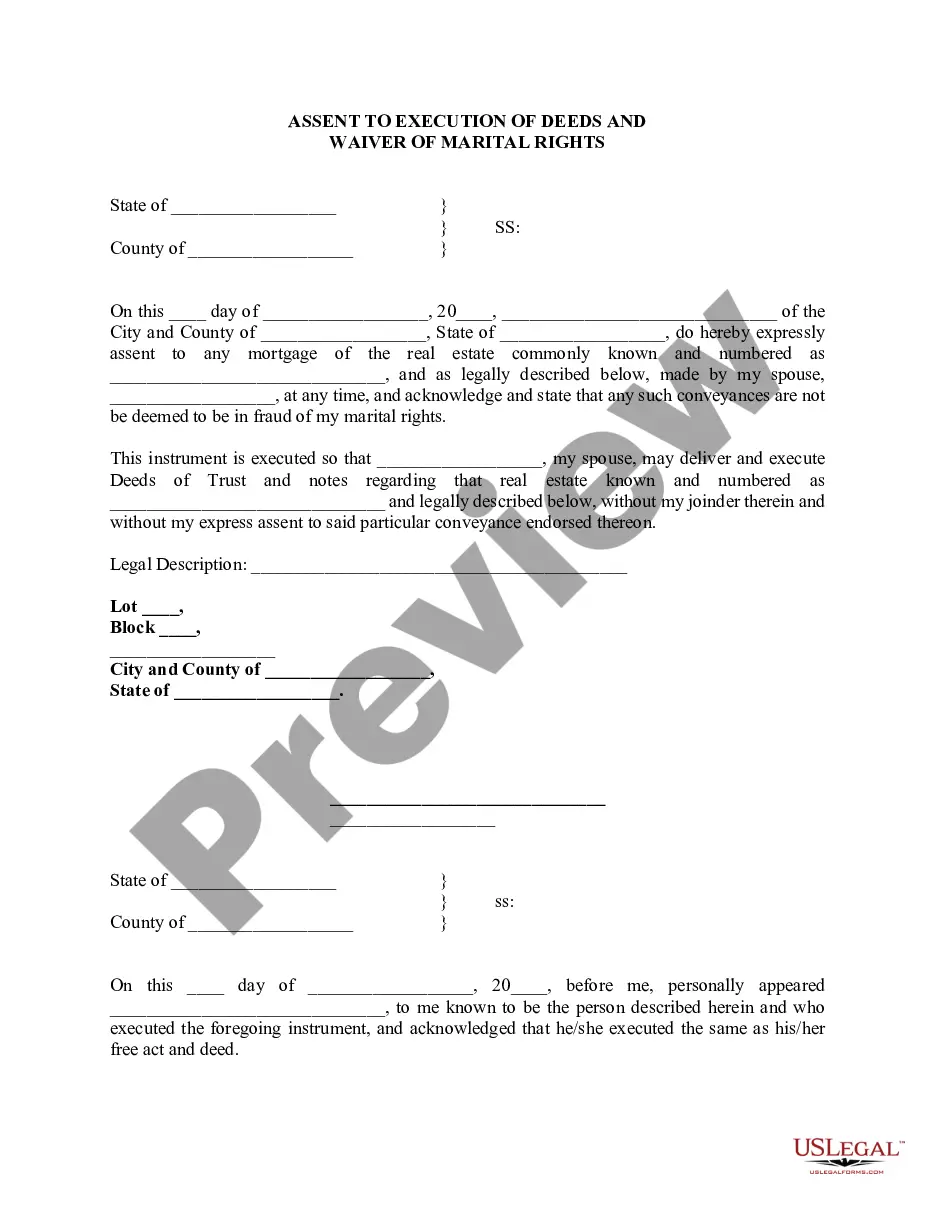

- Very first, make sure that you have selected the correct document template for that state/city that you pick. See the type explanation to make sure you have picked out the correct type. If readily available, use the Preview switch to appear through the document template too.

- If you would like discover one more edition of the type, use the Search field to obtain the template that meets your requirements and specifications.

- When you have discovered the template you need, just click Buy now to carry on.

- Choose the prices program you need, type your credentials, and sign up for a free account on US Legal Forms.

- Full the financial transaction. You should use your bank card or PayPal accounts to fund the legitimate type.

- Choose the file format of the document and down load it to the system.

- Make modifications to the document if required. You are able to full, change and sign and print Hawaii Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor.

Obtain and print thousands of document layouts while using US Legal Forms website, which offers the biggest selection of legitimate kinds. Use skilled and express-distinct layouts to handle your organization or person demands.

Form popularity

FAQ

A mortgage or deed of trust is an agreement in which a borrower puts up title to real estate as security (collateral) for a loan. People often refer to a home loan as a "mortgage." But a mortgage isn't a loan agreement. The promissory note promises to repay the amount you borrowed to buy a home.

Hawaii is a lien theory state and uses mortgages instead of deeds of trust.

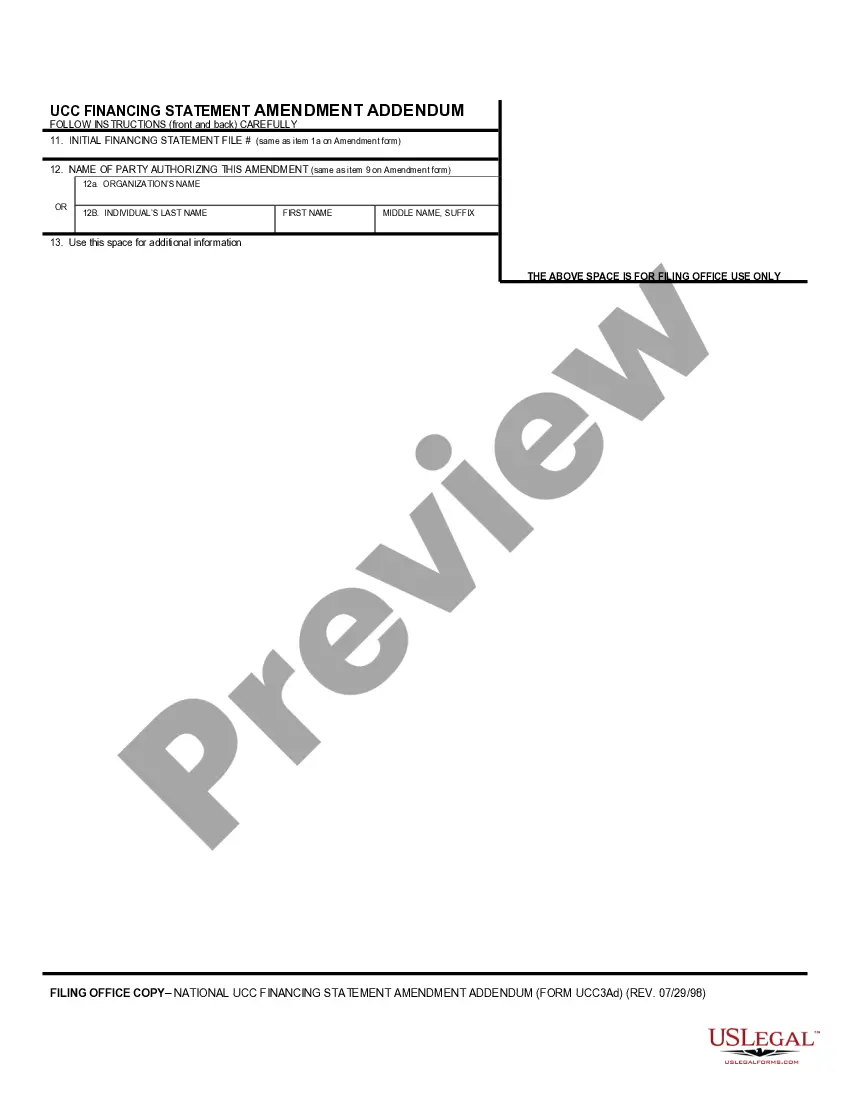

A standard form deed of release by which a lender releases some, but not all, of the mortgages and charges granted to it by a security provider under a security agreement.

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...