Hawaii Affidavit of Heirship for House

Description

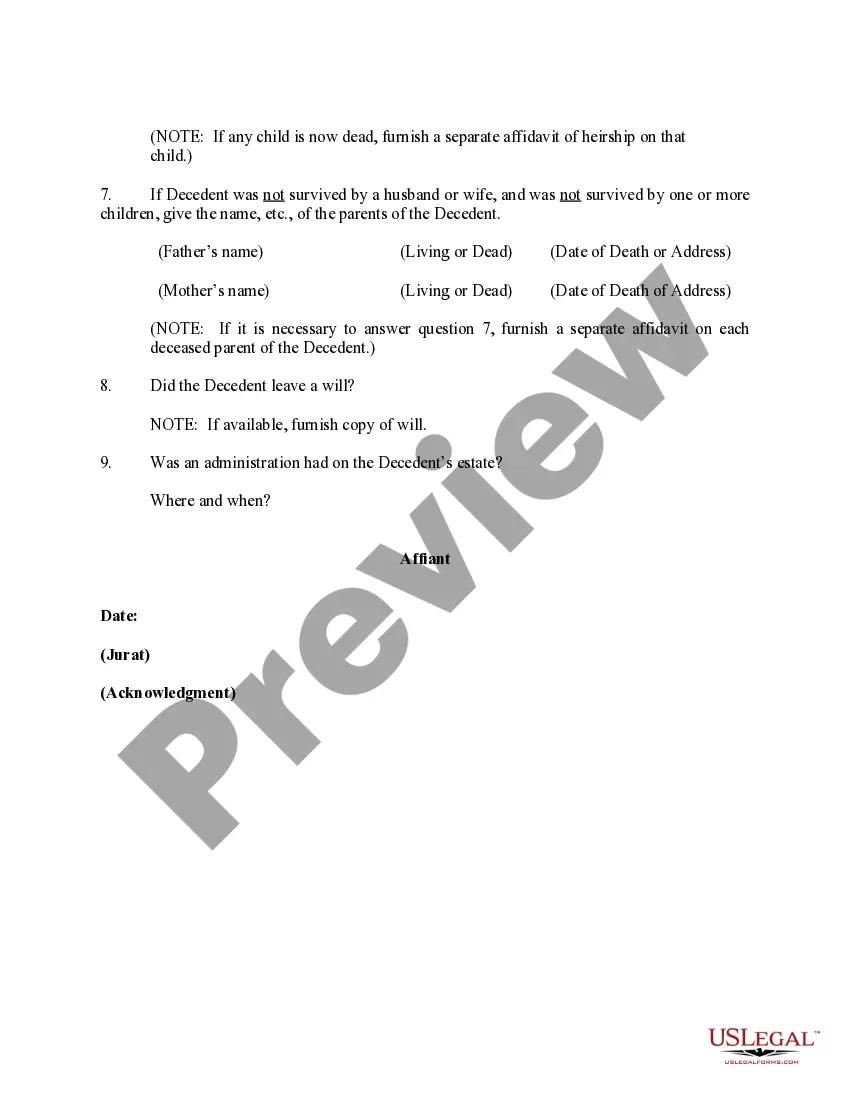

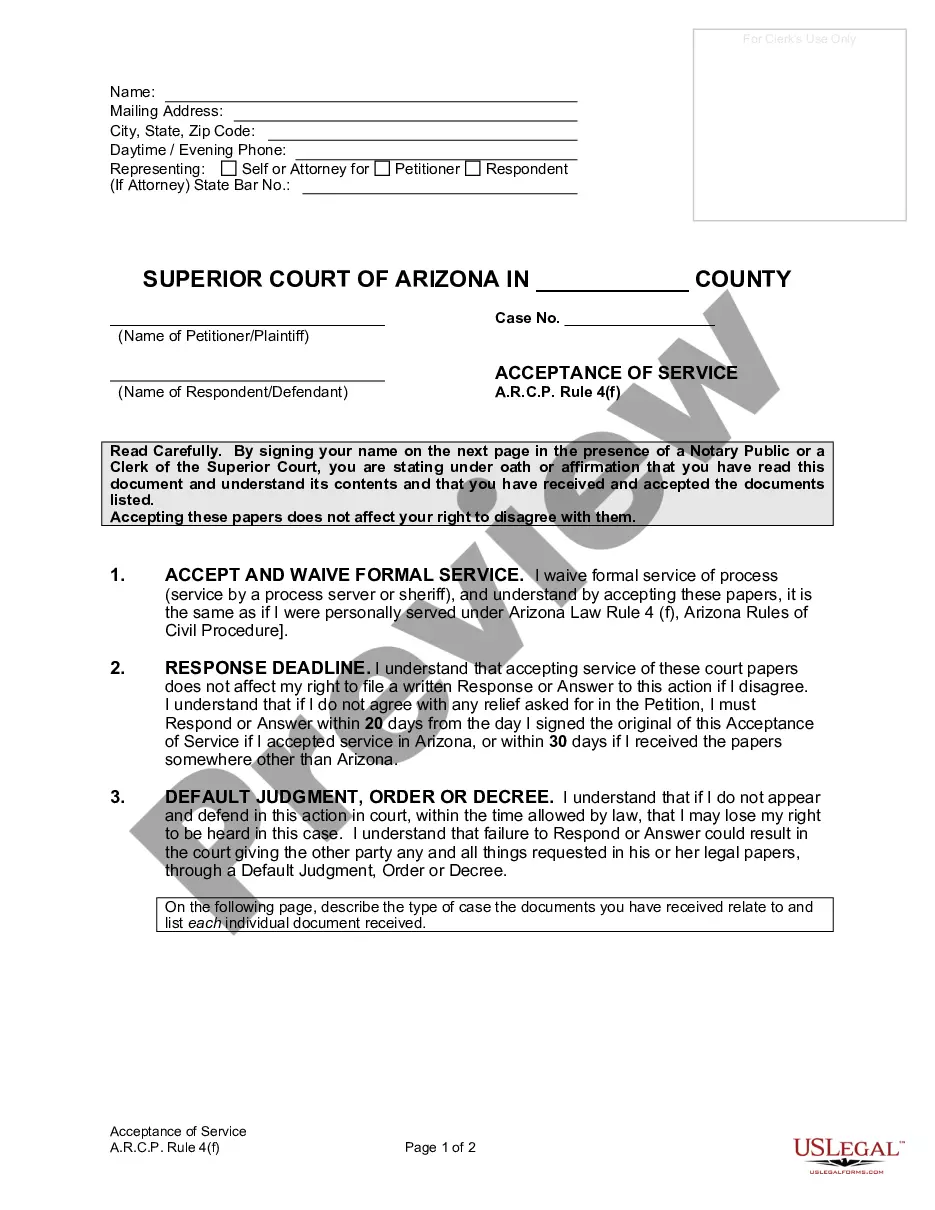

How to fill out Affidavit Of Heirship For House?

If you wish to complete, obtain, or printing legitimate papers templates, use US Legal Forms, the largest variety of legitimate varieties, which can be found on the web. Take advantage of the site`s simple and handy lookup to obtain the documents you need. Different templates for company and individual uses are categorized by classes and suggests, or keywords. Use US Legal Forms to obtain the Hawaii Affidavit of Heirship for House with a handful of click throughs.

Should you be presently a US Legal Forms customer, log in to your profile and click the Down load option to have the Hawaii Affidavit of Heirship for House. You can also entry varieties you formerly delivered electronically from the My Forms tab of your own profile.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have chosen the shape for your right area/nation.

- Step 2. Make use of the Preview option to examine the form`s content material. Don`t overlook to see the description.

- Step 3. Should you be unsatisfied with the develop, utilize the Research industry near the top of the screen to find other models in the legitimate develop format.

- Step 4. Once you have found the shape you need, select the Purchase now option. Select the pricing plan you like and add your accreditations to register on an profile.

- Step 5. Approach the transaction. You can use your charge card or PayPal profile to perform the transaction.

- Step 6. Find the formatting in the legitimate develop and obtain it on your own device.

- Step 7. Total, change and printing or sign the Hawaii Affidavit of Heirship for House.

Each and every legitimate papers format you get is your own for a long time. You possess acces to every single develop you delivered electronically inside your acccount. Select the My Forms area and decide on a develop to printing or obtain once more.

Compete and obtain, and printing the Hawaii Affidavit of Heirship for House with US Legal Forms. There are many skilled and express-specific varieties you can utilize for your personal company or individual requirements.

Form popularity

FAQ

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

What is Considered a Small Estate in Hawaii? Any estate that's below a certain threshold in Hawaii can avoid probate. Even if there's no Will, a simplified probate procedure known as ?a summary probate? is possible if any estate is valued at $100,000 or less.

In Hawaii, ?next of kin? for purposes of intestate succession (when someone dies without a will) generally include the closest relatives of the decedent, specifically the: Surviving spouse. Children. Parents.

In Hawaii, probate is only required under two circumstances: if the deceased owned any real estate in his or her name alone, no matter how small the value OR. if the total value of the deceased's personal property exceeds $100,000. How Probate Works in Hawaii & How to Avoid It - 3D Wealth Advisors 3dwealthadvisors.com ? blog ? what-happens-if-y... 3dwealthadvisors.com ? blog ? what-happens-if-y...

If the estate is worth £36,000 or less If the person who died didn't own any property or land, you should check if they had possessions worth more than £36,000. There is a special process for estates worth £36,000 or less. An estate of that value is called a 'small estate'. After death - dealing with an estate - Citizens Advice citizensadvice.org.uk ? death-and-wills ? aft... citizensadvice.org.uk ? death-and-wills ? aft...

Small Estate Affidavit If an Hawaii estate has a gross value <$100,000, you can use the small estate process to settle the estate with no court involvement. Probate for Small HI Estates - EstateExec EstateExec ? ... ? Small Estates EstateExec ? ... ? Small Estates

A trust can be a great mechanism to avoid probate and is the recommended method. While there are some upfront fees for creating a trust, the fees are typically much less than probate costs. Generally, you, as trustee, retain control of the assets held within the trust during your lifetime. 4 Ways to Avoid Probate in Hawaii - Law Office of Keoni Souza, LLC keonisouzalaw.com ? post ? 4-ways-to-avoi... keonisouzalaw.com ? post ? 4-ways-to-avoi...

An affidavit of heir is a written statement that allows an estate to move forward with an uncontested probate. The person who signs the affidavit is agreeing that they are the rightful owner of the assets and that they will transfer them to the appropriate parties as soon as the probate process is complete.